A bank teller resume should highlight your ability to execute transactions promptly and accurately for clients. Today’s bank tellers may also need to collaborate with other departments, cross-sell financial products, and work in both personal and business banking. Find out how to write a resume that conveys your qualifications and accomplishments with this guide.

“Bank teller resumes should reflect accuracy, cash handling, and customer service. Show how you support financial transactions with integrity.”

— Carolyn Kleiman, Resume and Career Advisor

Most Popular Bank Teller Resumes

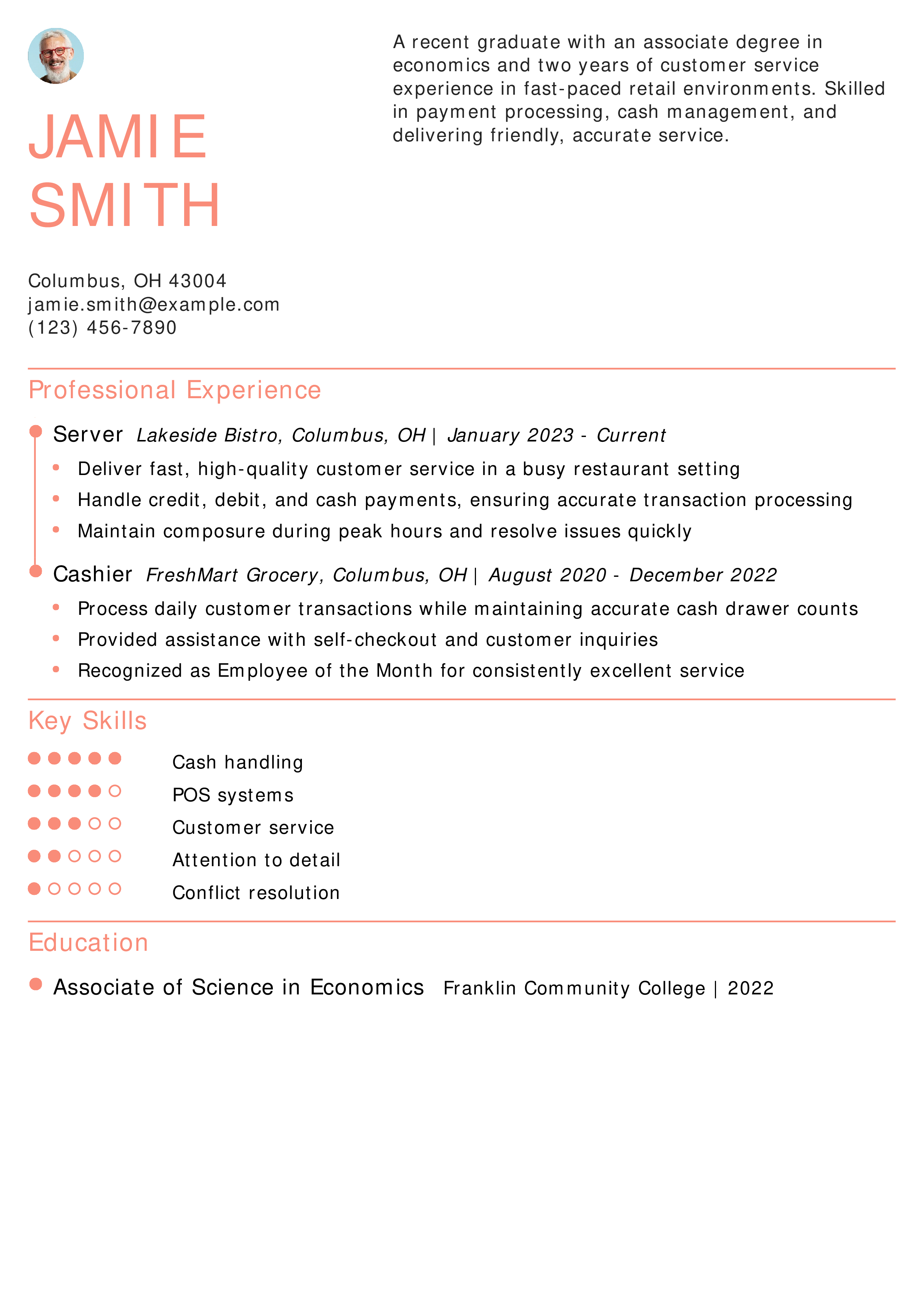

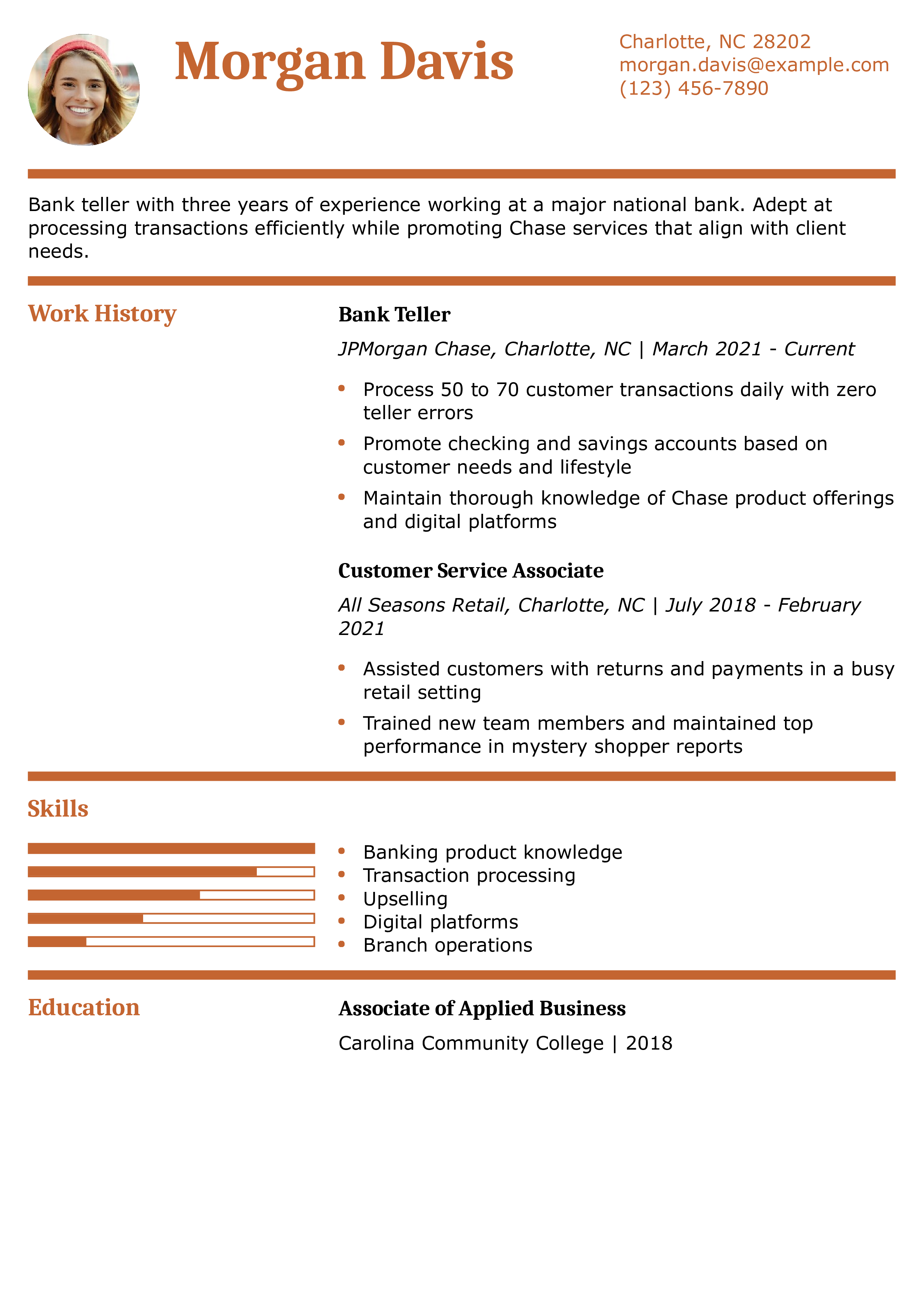

Entry-Level Bank Teller Resume Example

Why this resume example is strong

This resume highlights transferable skills from retail and food service to banking. It emphasizes reliability and attention to detail — both essential for entry-level tellers. Learn how to build a resume from scratch in this complete guide.

Bank Teller Experience Resume Example

Why this resume example is strong

This resume clearly documents relevant bank teller experience and achievements in customer service and upselling. It’s structured to show growth and reliability. To improve your own format, check out best resume formats.

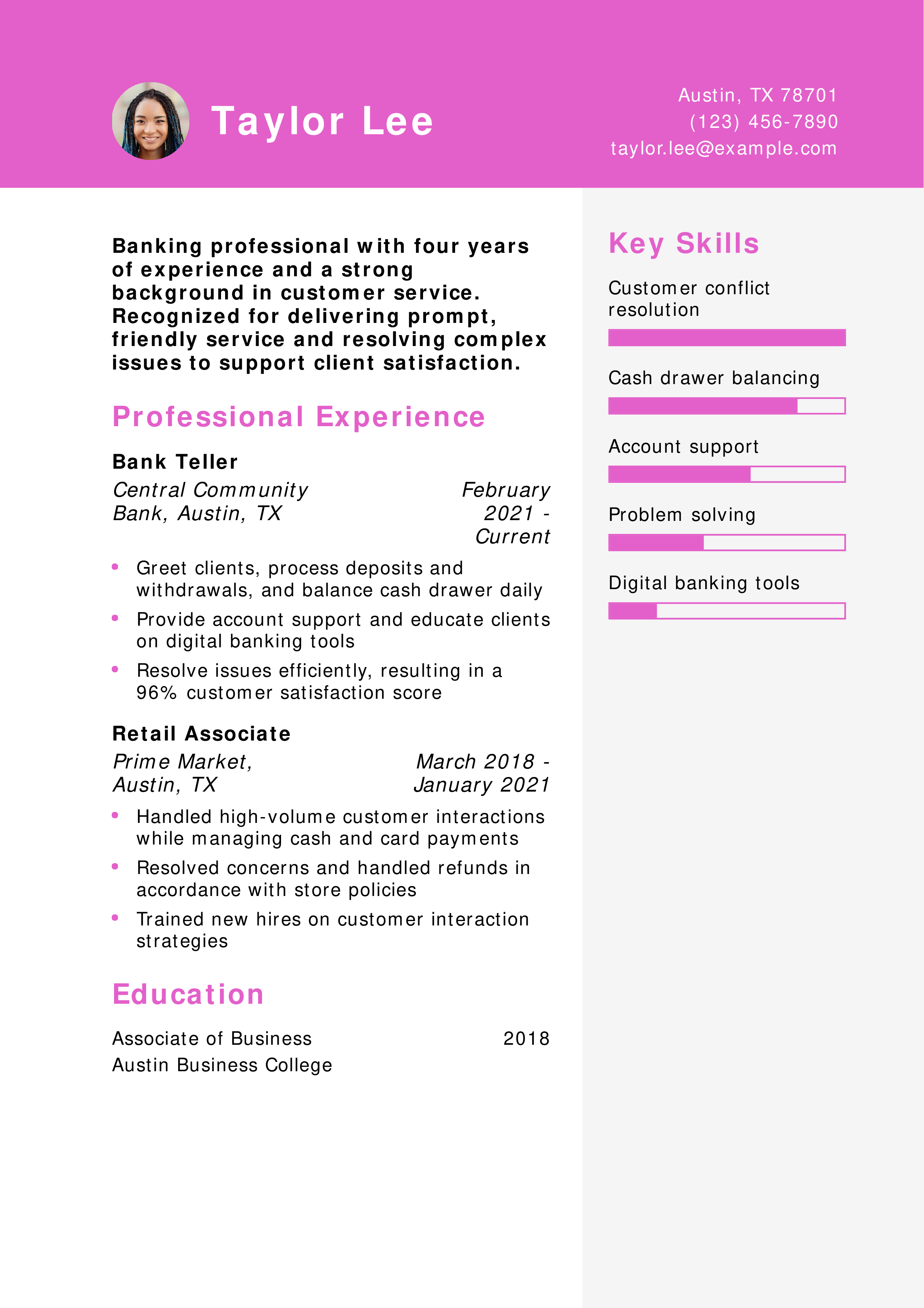

Bank Teller Customer Service Resume Example

Why this resume example is strong

This resume emphasizes the customer service component of the teller role, showing how retail experience translates to banking. For more advice on how to highlight service-related skills, check out customer service skills for a resume.

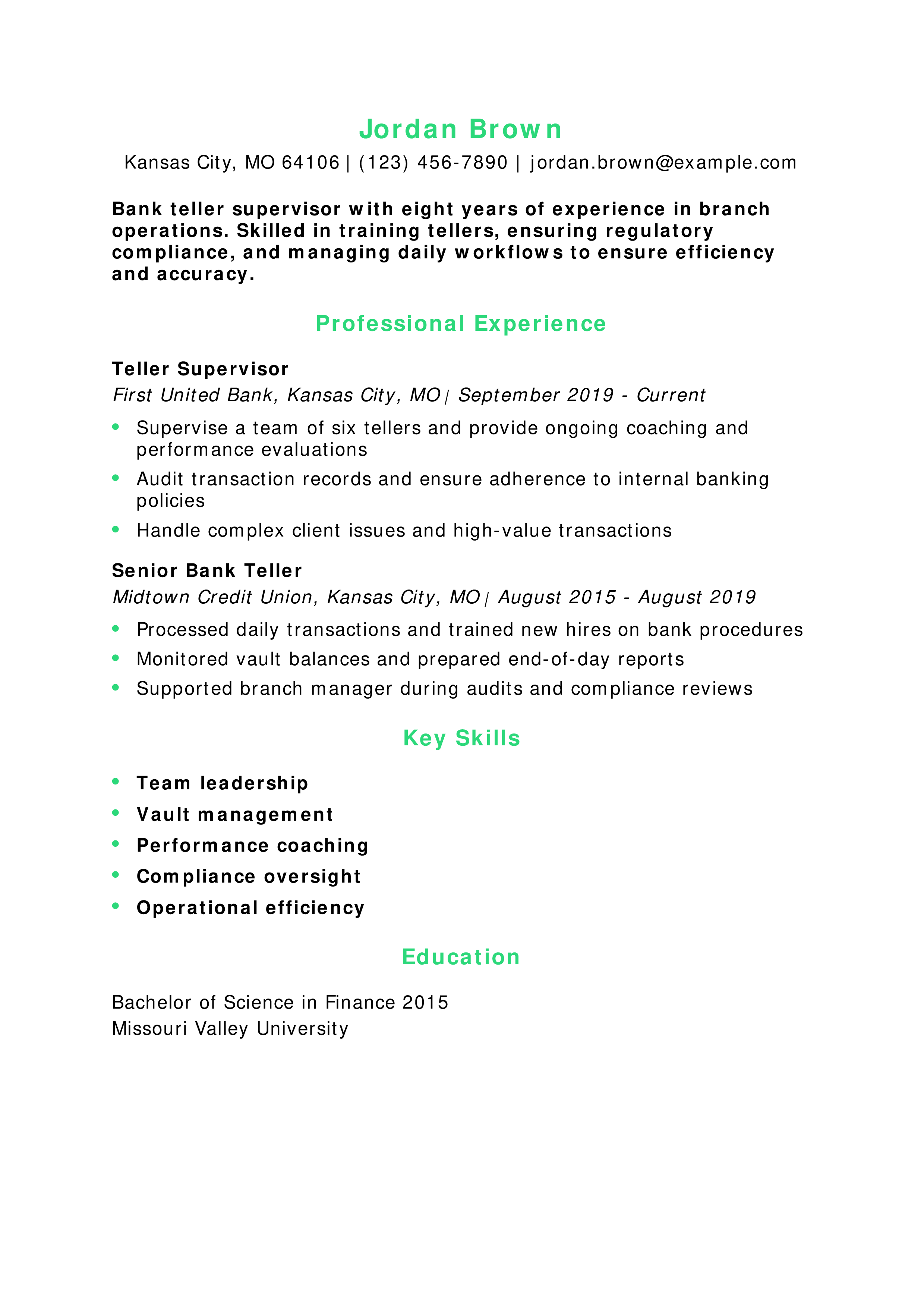

Bank Teller Supervisor Resume Example

Why this resume example is strong

This resume clearly shows career progression and leadership experience. It outlines technical and interpersonal strengths that are essential for supervisory roles. Learn how to highlight your career path in resume outline examples.

Chase Bank Teller Resume Example

Why this resume example is strong

This resume highlights experience with a recognized bank brand and showcases an understanding of retail banking services. To explore how to tailor content to specific employers, visit what to put on a resume.

Head Bank Teller Resume Example

Why this resume example is strong

This resume focuses on leadership, accountability, and accuracy — three must-have skills for head tellers. For tips on highlighting similar accomplishments, check out resume summary examples.

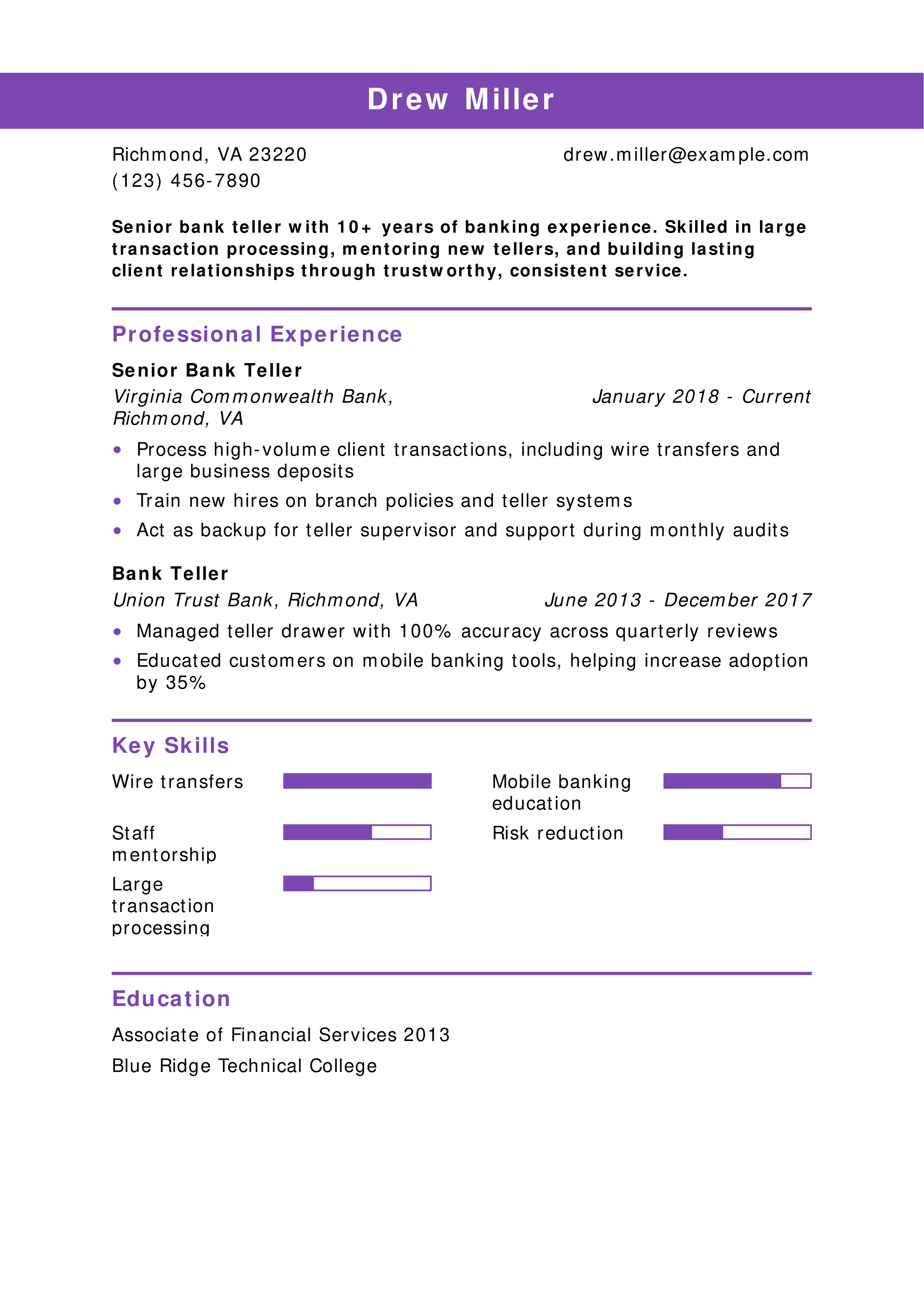

Senior Bank Teller Resume Example

Why this resume example is strong

This resume uses quantifiable achievements and training experience to demonstrate senior-level capability. Learn how to show career progression and how far back a resume should go.

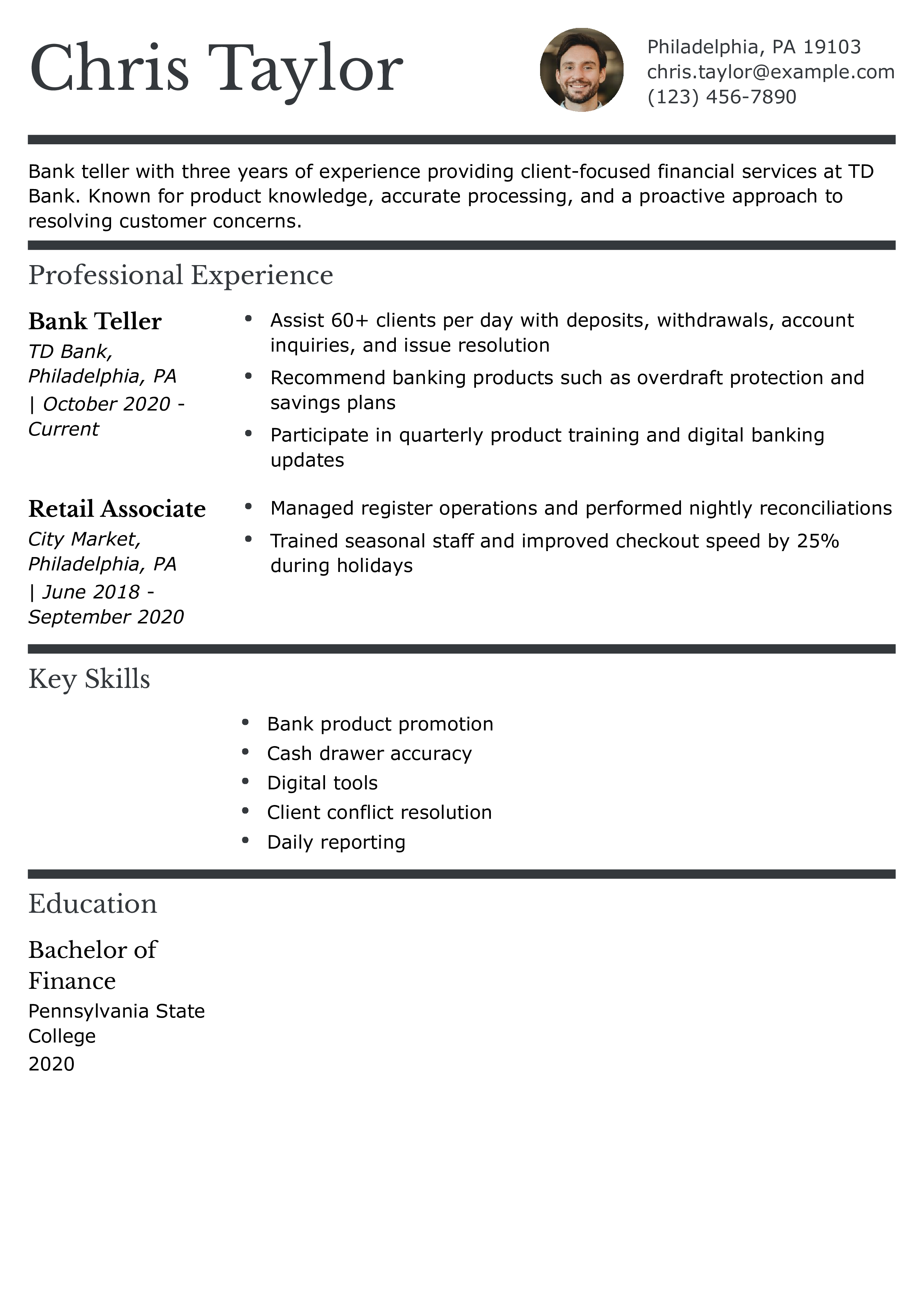

TD Bank Teller Resume Example

Why this resume example is strong

This resume connects banking knowledge to customer outcomes and includes brand-specific experience, which adds credibility. For guidance on presenting education clearly, read how to list your education on a resume.

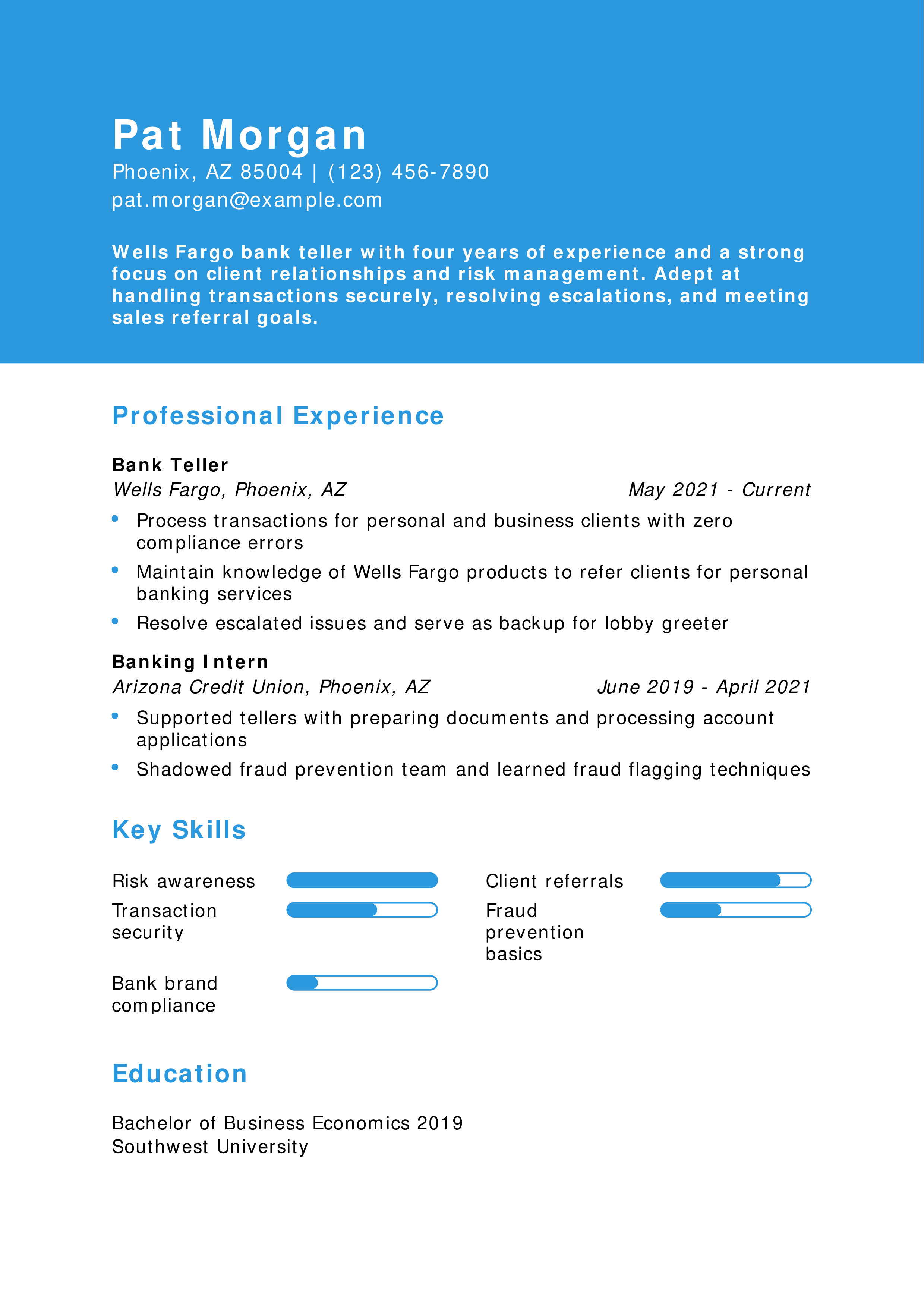

Wells Fargo Bank Teller Resume Example

Why this resume example is strong

This resume leverages brand experience and introduces compliance and fraud prevention — key differentiators in teller roles. Learn how to include similar insights in your resume at resume skills.

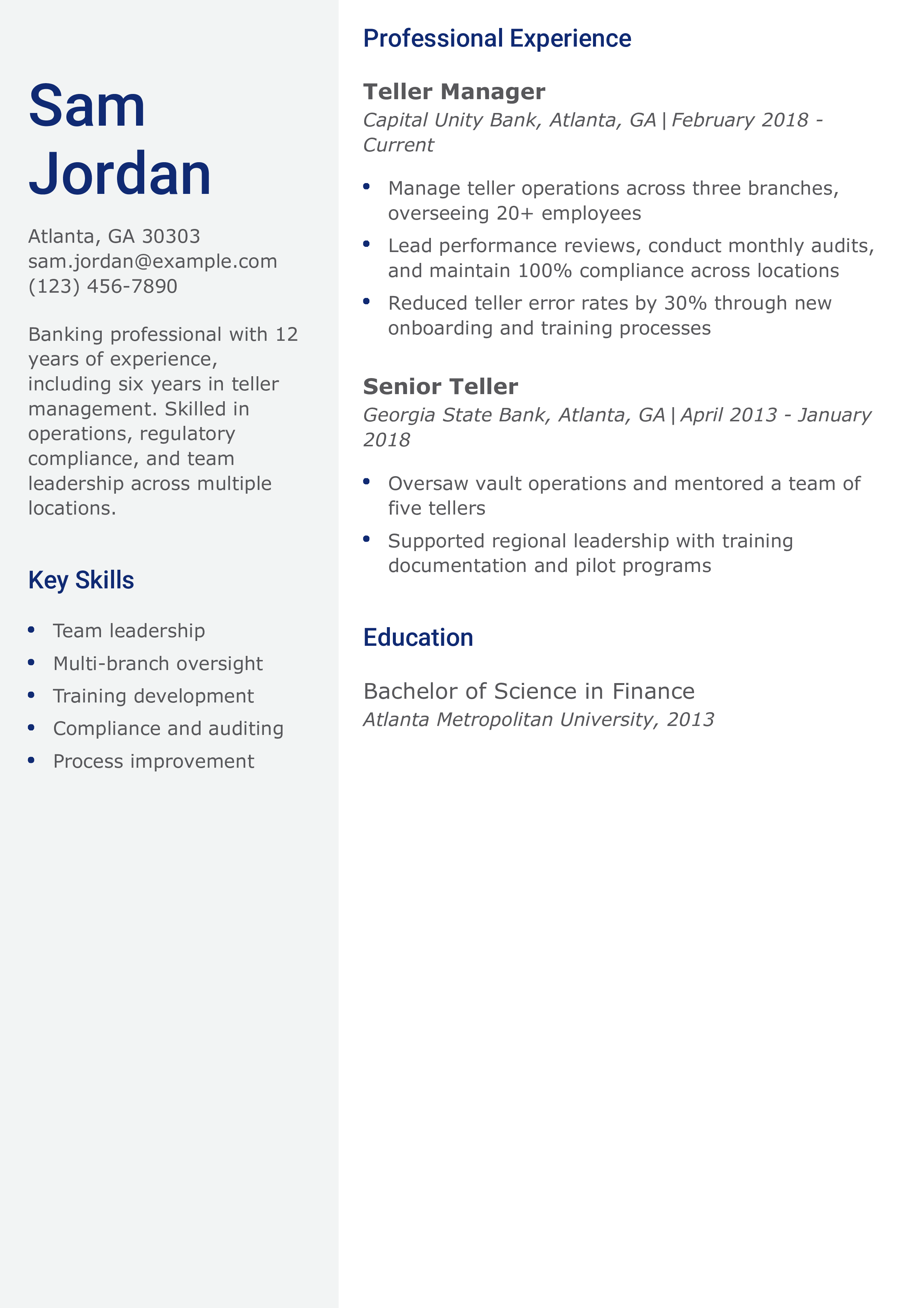

Bank Teller Manager Resume Example

Why this resume example is strong

This resume highlights strategic leadership and a clear record of process improvement. It's a strong model for mid- or senior-level professionals. For tips on emphasizing leadership roles, check out resume objective examples.

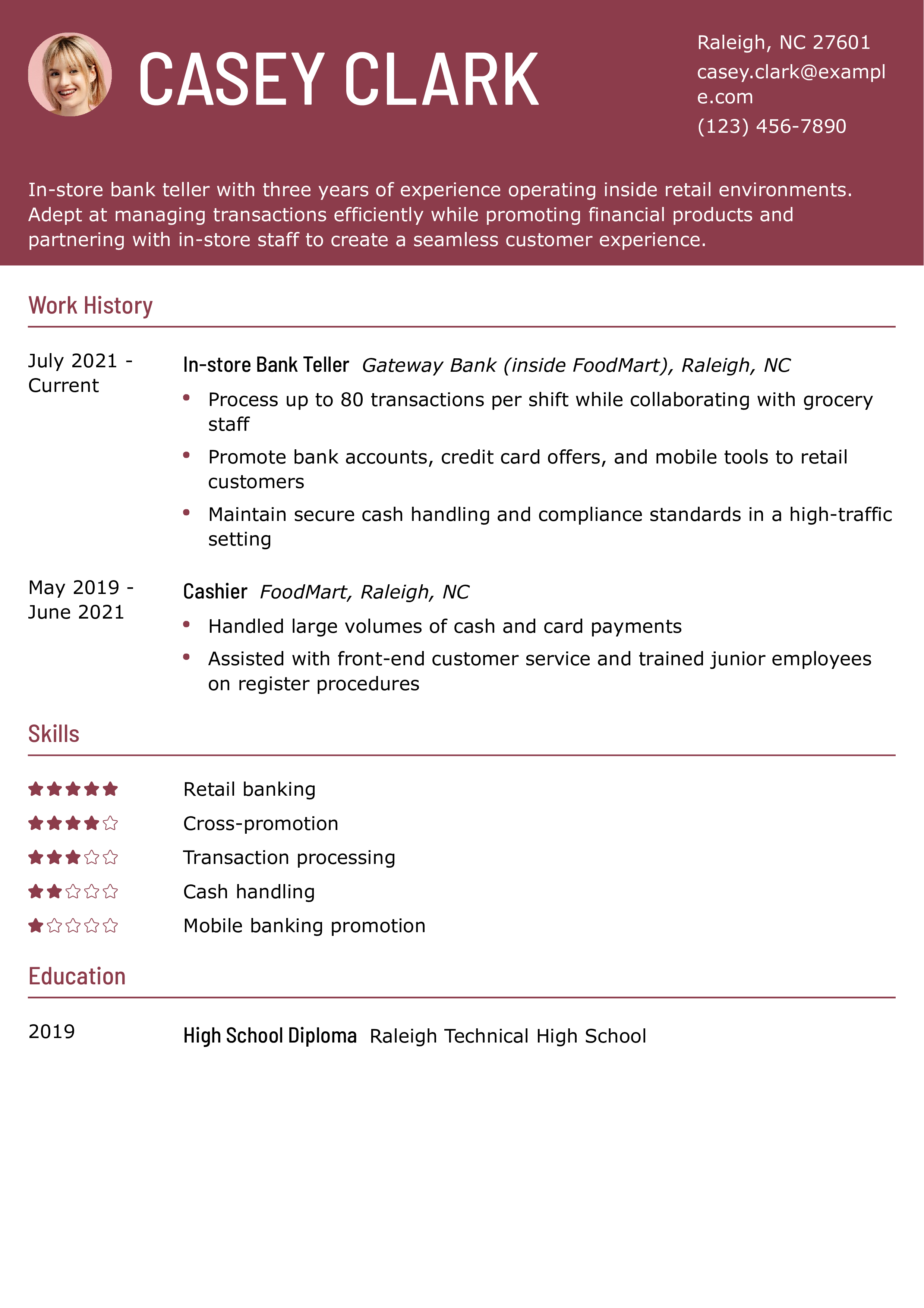

In-Store Bank Teller Resume Example

Why this resume example is strong

This resume effectively shows how banking and retail skills intersect. It demonstrates flexibility and product knowledge in fast-paced, public-facing settings. Learn how to present hybrid roles in resume interests section.

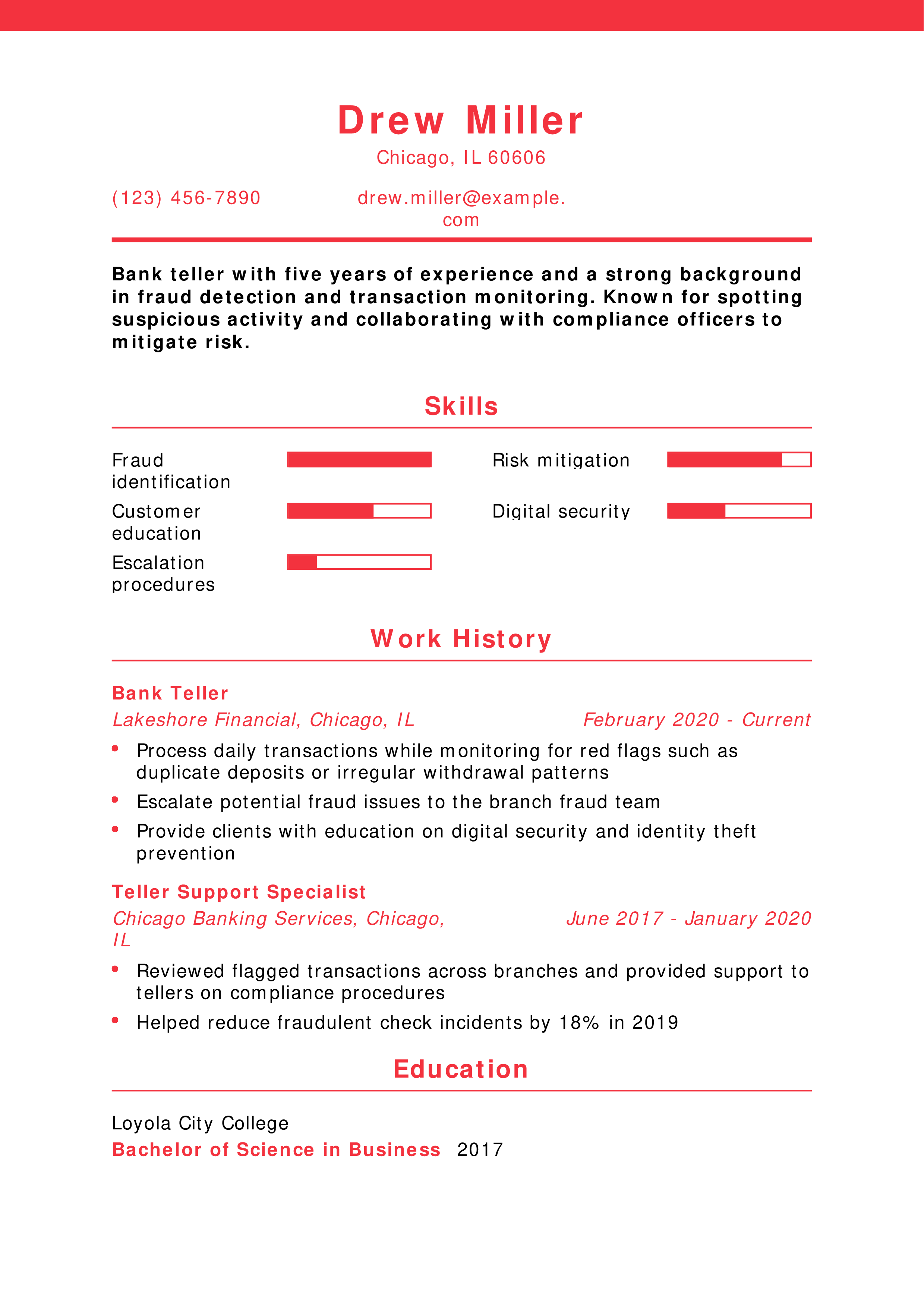

Bank Teller Fraud Prevention Resume Example

Why this resume example is strong

This resume demonstrates specialized knowledge in fraud prevention, a growing priority in modern banking. It blends front-line service with back-end risk awareness. To boost your resume’s technical depth, read technical skills for a resume.

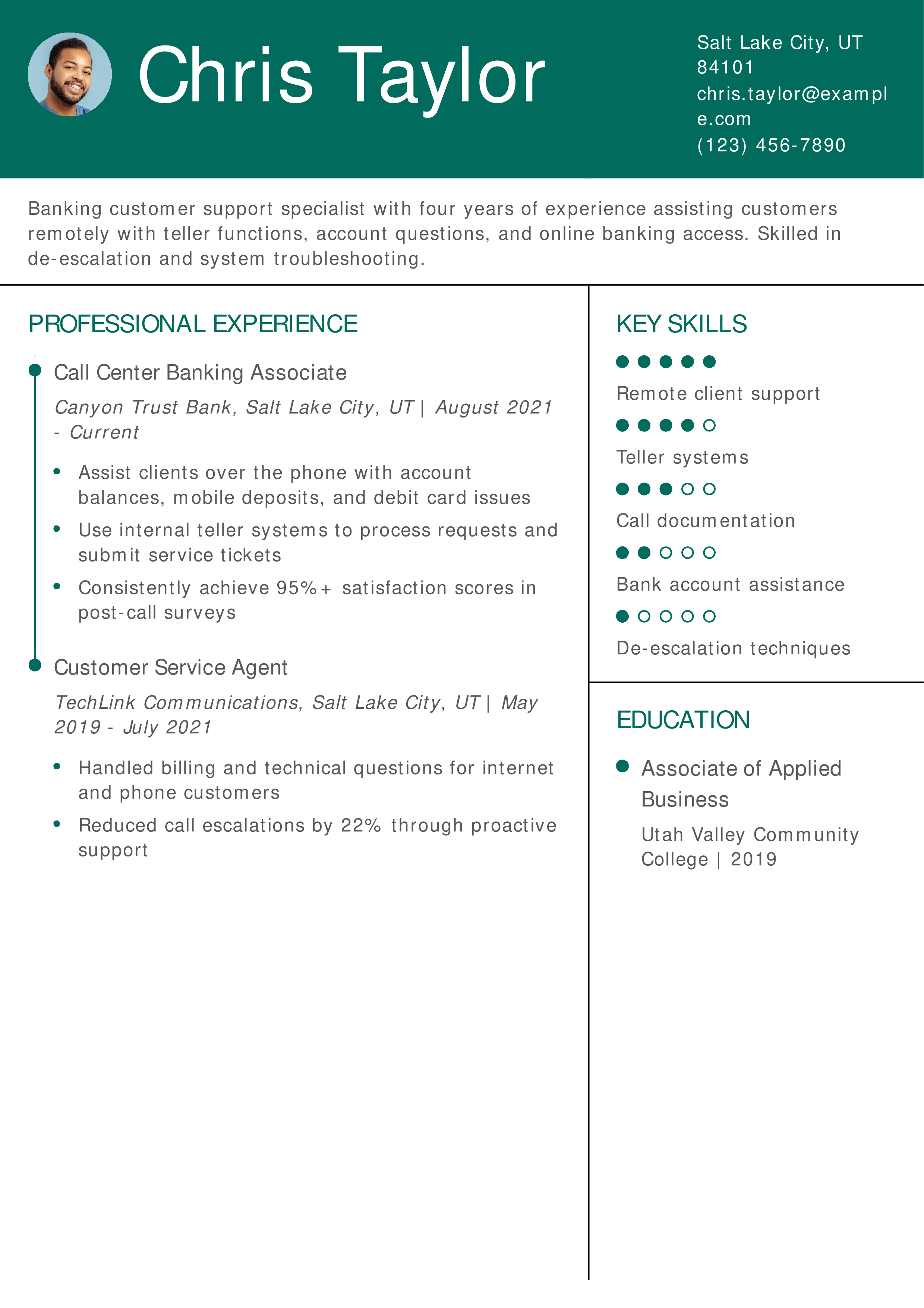

Bank Teller Call Center Support Resume Example

Why this resume example is strong

This resume shows how virtual teller and support roles are increasingly relevant. It emphasizes remote communication and system use. For tips on showcasing this balance, explore soft skills for resume.

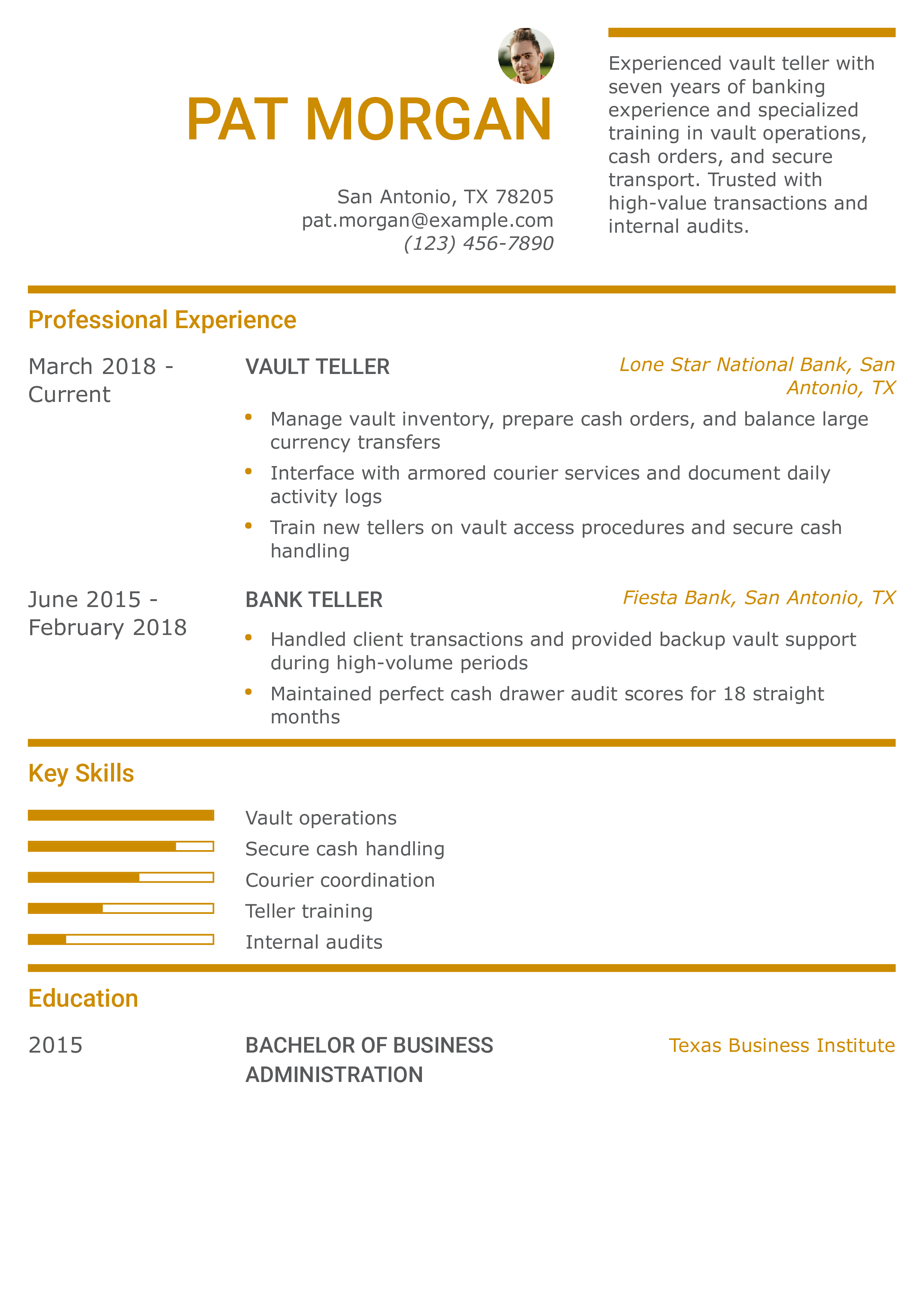

Vault Teller Resume Example

Why this resume example is strong

This resume is tailored for high-security, back-end banking roles. It emphasizes trust, detail, and audit-readiness. To highlight similar credentials, review how to list certifications on resume.

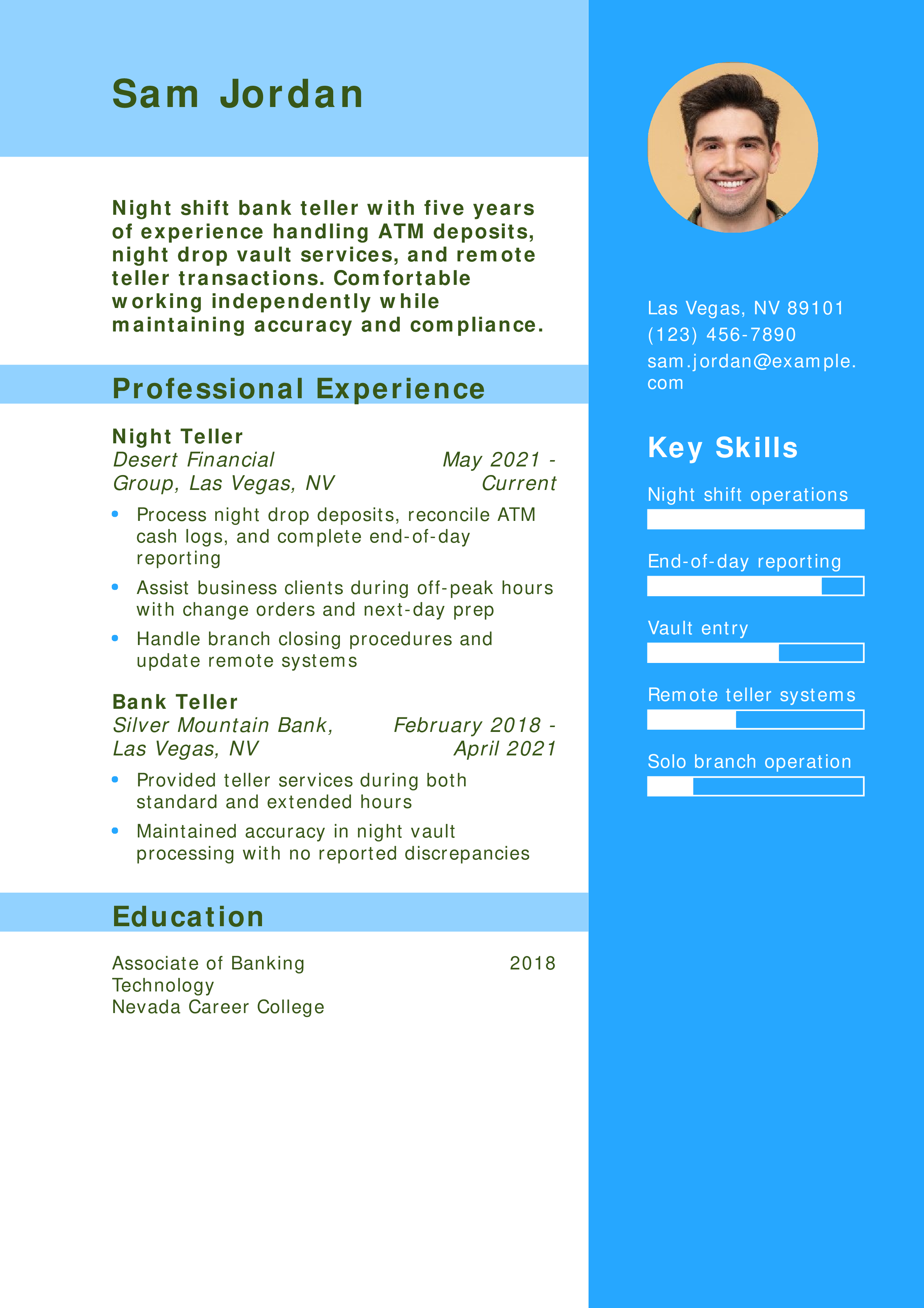

Night Shift Bank Teller Resume Example

Why this resume example is strong

This resume is ideal for after-hours roles, highlighting reliability, self-direction, and compliance. For guidance on resume length and focus, read should a resume be one page.

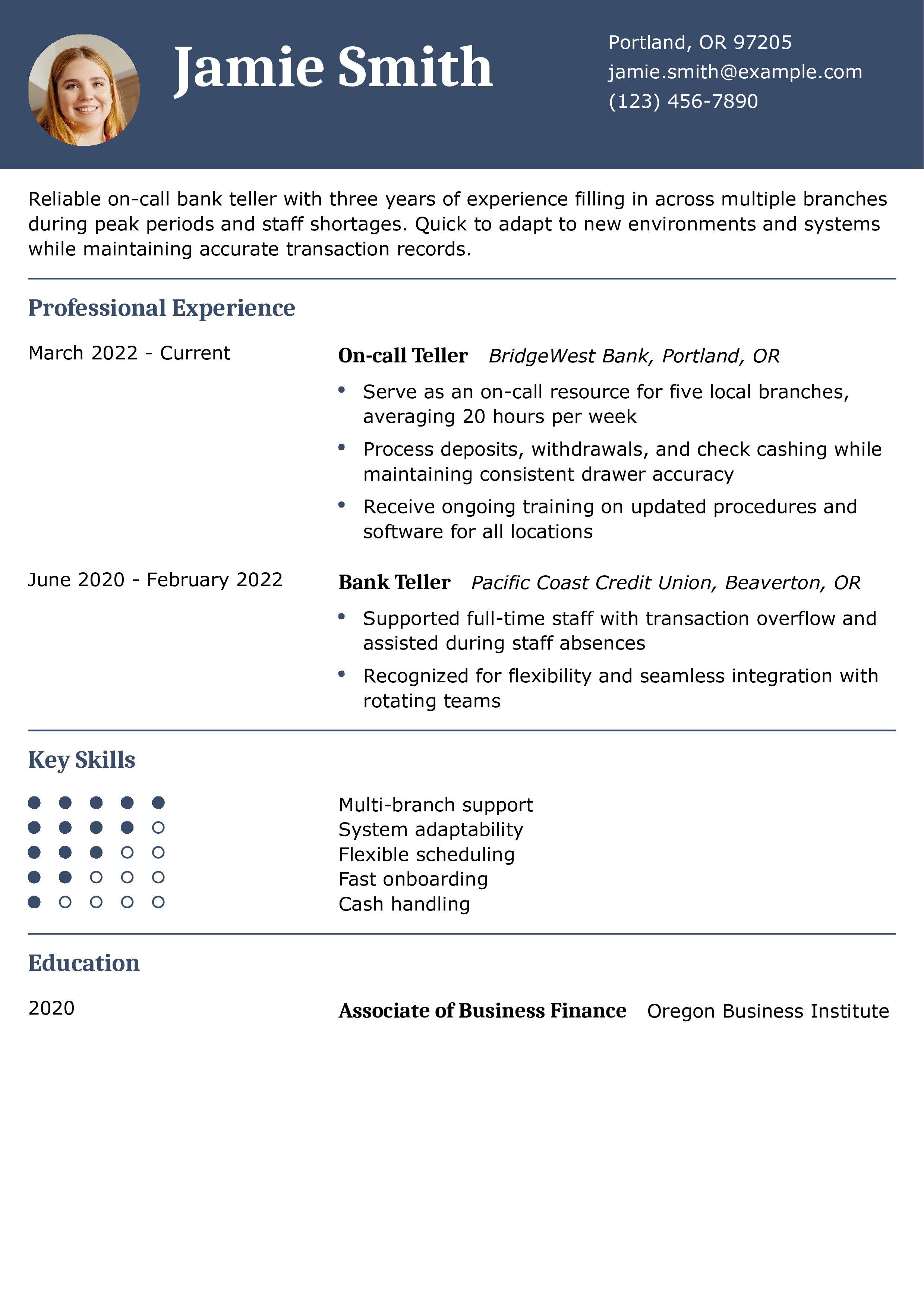

On-Call Bank Teller Resume Example

Why this resume example is strong

This resume focuses on flexibility and quick adaptability — must-have traits for an on-call or float role. It shows consistency even with changing environments. Learn how to format a flexible job history in how to make a resume.

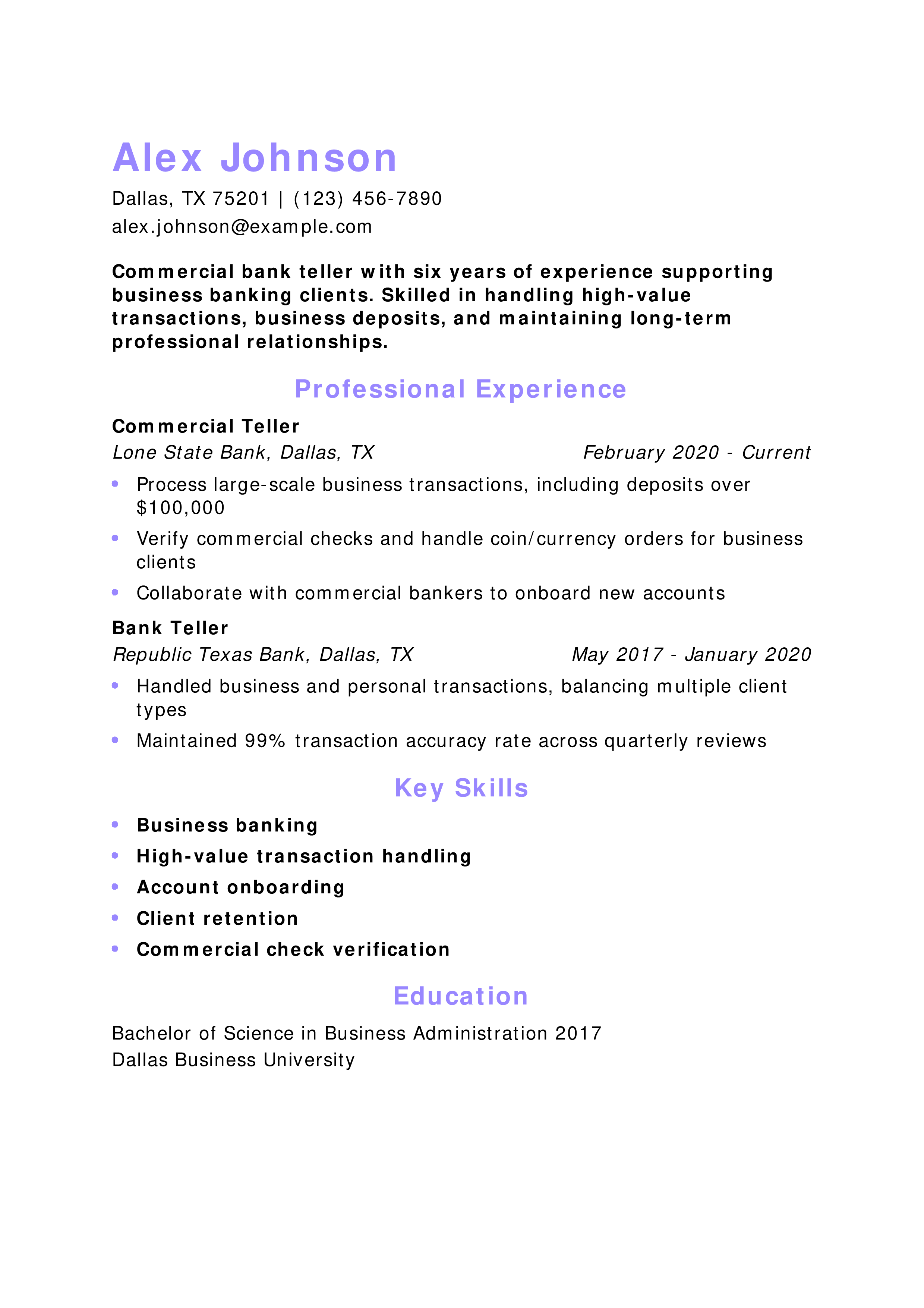

Commercial Bank Teller Resume Example

Why this resume example is strong

This resume clearly targets a specialized area — commercial banking — and demonstrates the trust and skill needed to handle high-value accounts. For tips on what to include in specialized resumes, explore what to put on a resume.

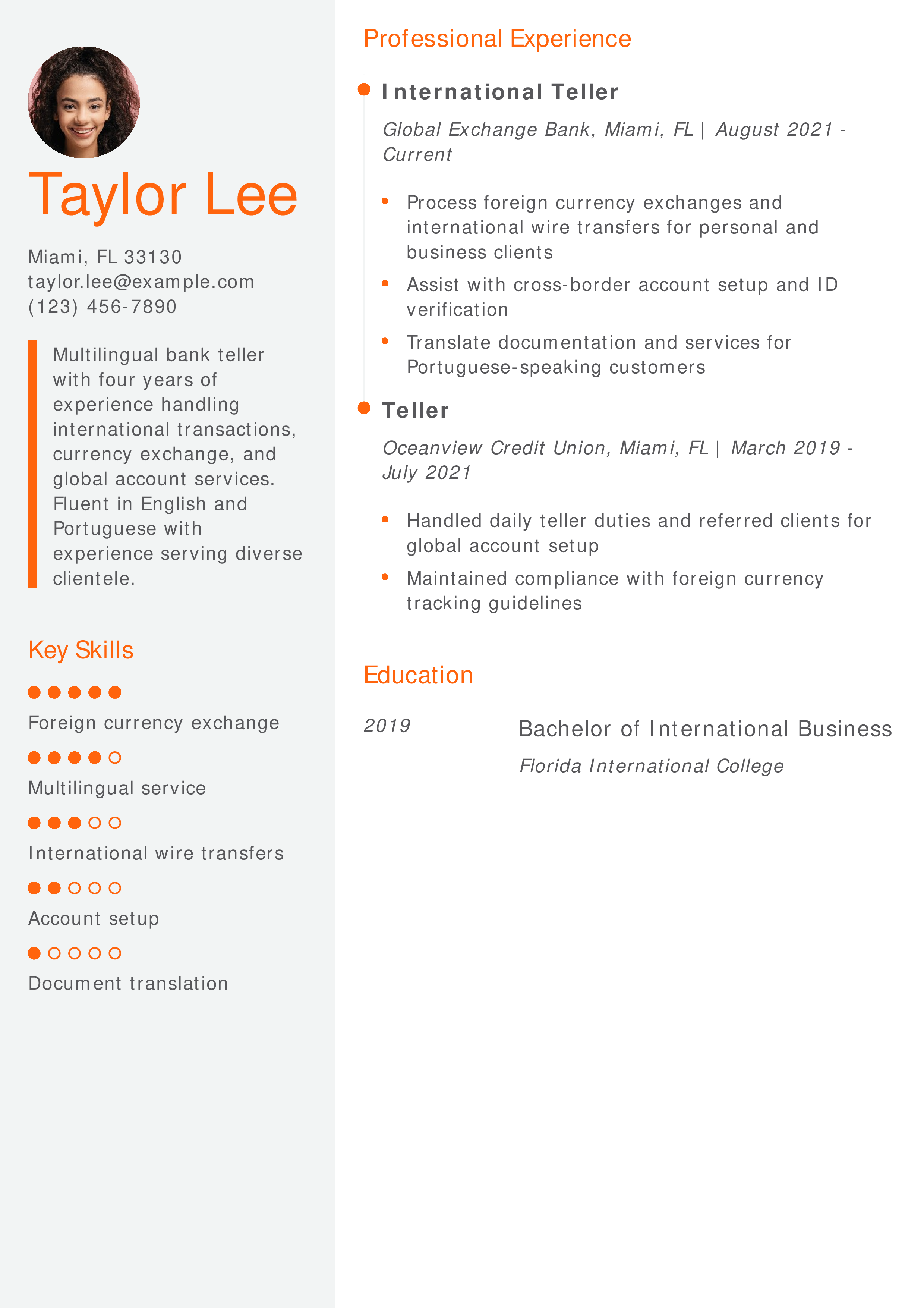

International Bank Teller Resume Example

Why this resume example is strong

This resume highlights global banking knowledge and multilingual service, great assets for international-focused branches. For help including languages on your resume, visit resume language skills.

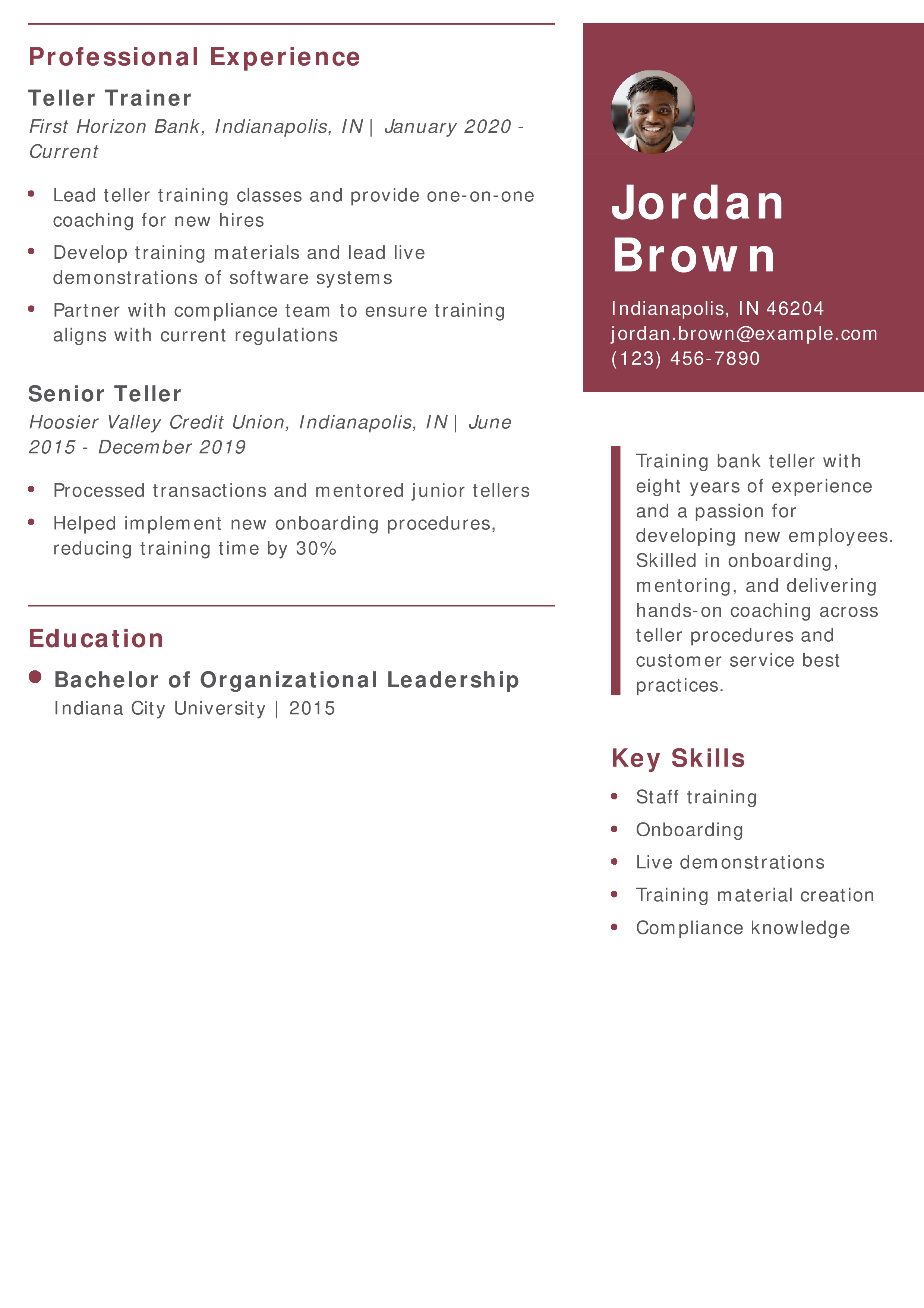

Training Bank Teller Resume Example

Why this resume example is strong

This resume centers on leadership and teaching skills critical for training roles. It shows initiative and measurable impact. To improve your own instructional language, see resume objective examples.

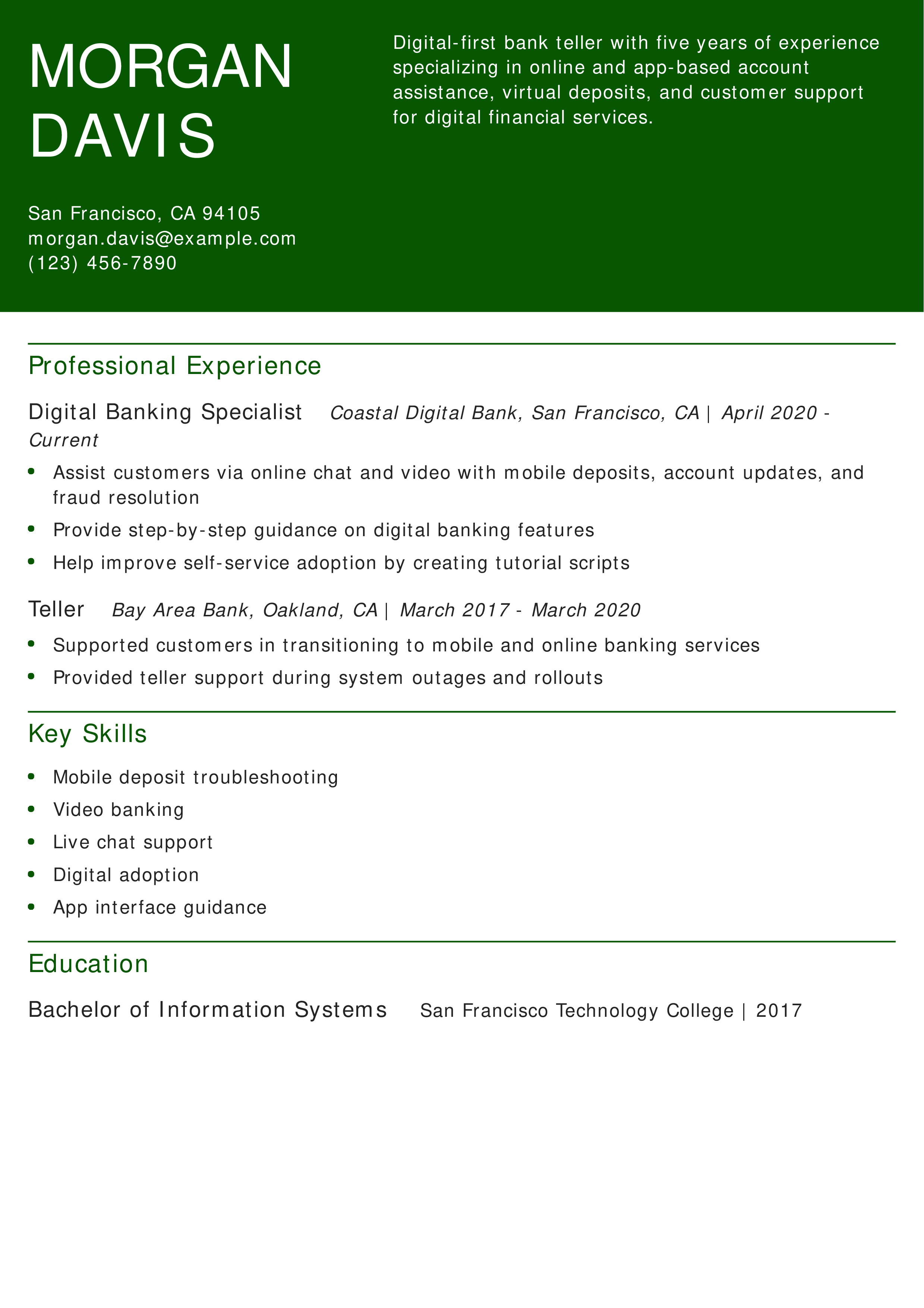

Digital Bank Teller Resume Example

Why this resume example is strong

This resume stands out by focusing on digital skills and remote banking experience. It’s perfect for roles in modern, tech-forward banks. To present similar skills, explore how to email a resume.

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Bank Teller Text-Only Resume Templates and Examples

How To Write a Bank Teller Resume

1. Write a dynamic profile summarizing your bank teller qualifications

In just a few sentences, your profile needs to cover how many years you’ve worked in banking and the related skills you’ve gained along the way. Highlight your strengths in cash management, teller operations, and sales, and show how you’ve used them to uphold a bank’s service standards. Also include any credentials that set you apart in your field, such as an advanced degree, certification, or software proficiency.

Senior-Level Profile Example

A banking professional with over 10 years of experience, specializing in bank telling, team management, personal banking, and corporate banking. A strong history of identifying ideal banking solutions for customers and building client relationships.

Entry-Level Profile Example

A recent business graduate with an associate degree in economics, specializing in customer service, cash management, and client relations. Adept at managing cash transactions and providing quality service to diverse clientele.

2. Add your bank teller experience with compelling examples

Much of a bank teller’s job revolves around executing transactions for clients. But your professional experience bullet points should go beyond “make deposits and withdrawals” or “serve clients.” Pair basic job duties with relevant results and metrics to impress a hiring manager.

For instance, if you want to highlight your ability to cross-sell financial products, you could write, “Educated clients on high-interest rate accounts, resulting in a 25% increase in new accounts.” This helps the hiring manager understand the impact of your skills.

Senior-Level Professional Experience Example

Bank Teller, Cleveland Municipal Bank, Cleveland, OH June 2012 – Present

- Interface with bank customers to identify banking needs, recommend financial solutions, and identify ideal products to achieve client goals

- Manage customer requests quickly and efficiently, including cashing checks and money orders, depositing and withdrawing cash, checking account balances, and providing account information

- Provide financial advice using advanced knowledge of bank practices, accounts, credit cards, and loan payments

- Educate clients on additional banking products available, including certificates of deposit and personal loans

- Partner with personal bankers to refer clients in need of credit cards, loans, and other financial tools

Entry-Level Professional Experience Example

Server, Littleberg Restaurant, Cleveland, OH January 2020 – Present

- Provide quality customer service to guests, manage food and drink orders, provide recommendations on menu items, and ensure a pleasant dining experience for patrons

- Expedite orders in the kitchen to ensure prompt delivery to tables

- Manage payment transactions, including both cash and credit card payments, and provide customer refunds as needed

3. Include bank teller-related education and certifications

Entry-level bank teller positions often require a high school diploma, but some banks may prioritize candidates with an associate degree. A bachelor’s degree can help you move into supervisory positions or other banking roles, such as loan officer.

List your highest level of education on your resume, along with any relevant certifications you have. If your degree is in finance or a banking-related field, specify that as well.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Associate of Applied Business

- Cuyahoga Community College, Cleveland, OH | 2009

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Certified Bank Teller, American Bankers Association, 2011

4. Include a list of skills and proficiencies related to bank tellers

Being a bank teller requires an aptitude for math, sales, and customer service. The job duties of a bank teller often differ between banks, so look through the job posting to see what the hiring manager is looking for. Once you have this information, create a list of your skills that overlap.

Use similar language to help applicant tracking systems (ATS) identify your resume as a good match. For example, if the job posting refers to “business banking” instead of “commercial banking,” change this on your resume. Common skills for bank tellers are listed below:

| Key Skills and Proficiencies | |

|---|---|

| Account management | Banking software |

| Bank telling | Cash management |

| Client relations | Commercial banking |

| Corporate banking | Customer service |

| Financial analysis | Financial services |

| Financial software | Microsoft Office suite |

| Money handling | Personal banking |

| Personal loans | Retail banking |

| Sales | Teller operations |

How To Pick the Best Bank Teller Resume Template

The design of your bank teller resume should look professional, so find a template that mainly uses black text on a white background. Due to the banking industry still being fairly traditional, use a standard font like Times New Roman or Arial. It can be tempting to choose something with bold colors or fancy flourishes, but these distract from your qualifications and can come across as too casual.

Frequently Asked Questions: Bank Teller Resume Examples and Advice

How do I ensure my Bank Teller resume example is ATS-friendly?-

To make your Bank Teller resume example ATS-friendly, focus on including relevant keywords from the job description and avoid using complex formatting like images or non-standard fonts. Keep the document simple and ensure each section is clearly labeled (e.g., Education, Professional Experience, Skills). The use of action verbs and proper section headings will also help your resume get noticed by both ATS and hiring managers.

What are common action verbs for bank teller resumes?-

Common action verbs for bank teller resumes relate to conducting transactions, serving customers, and contributing to efficient banking operations. When you’re writing bullet points, start each one with a strong action verb, such as an option from the list below. These verbs accurately describe your responsibilities while still providing an engaging read for the hiring manager.

Get ideas by reading through the job posting. If the hiring manager is looking for a candidate who can “balance a cash drawer” and “process transactions,” use “balanced” and “processed” in your resume where possible.

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Collaborated | Communicated |

| Conducted | Coordinated |

| Created | Delivered |

| Deposited | Evaluated |

| Executed | Identified |

| Implemented | Improved |

| Led | Maintained |

| Managed | Oversaw |

| Performed | Provided |

| Resolved | Reviewed |

| Supported | |

How do you align your resume with a job posting?-

The rise of online banking and virtual banks has created a challenging job market for tellers. For open teller jobs, the Bureau of Labor Statistics expects a 15% decline through 2032. This means you could be up against many other applicants.

Give your resume an edge by spending a few minutes customizing it to the job posting. Look for ways to reflect language, such as changing “banking software” to Oracle or BankPoint if you’re versed in those programs, and they appear in the job description. Make sure anything listed as a must-have qualification is included in your profile or in the top half of your resume.

What is the best bank teller resume format?-

Hiring managers are looking for bank tellers with a strong background in handling client transactions accurately and efficiently. The reverse chronological format is the best option to demonstrate this, as it places your most recent and relevant experience towards the top of your document. At the entry level, you can highlight transferable skills from prior jobs, especially if any of the roles were customer-facing.

What’s the recommended length for a bank teller resume?-

The recommended length for a bank teller resume is one page, especially for professionals with under 10 years of experience. A two-page resume can work for those with substantial accomplishments or a longer career, but only if it’s concise and highly relevant to the role. Tailoring your resume to the job and highlighting your strongest qualifications are key to success.

Stick to listing work experience from the last 10 to 15 years, as this period is most relevant to employers. Summarize or omit older positions unless they’re crucial for your application. A focused and streamlined resume will help capture the hiring manager’s attention.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Send in a cover letter to support your resume and give you another opportunity to engage with the hiring manager. The cover letter can include more details on your teller experience, including a few key accomplishments, or explain why you’re an excellent fit for this bank. Check out these bank teller cover letter examples and templates for ideas on formatting, content, and language.