How To Write a Banking Resume

An effective banking resume should demonstrate a thorough understanding of financial regulations and services, as well as customer service ability. Whether you’re new to the banking industry or taking the next step in your career, a solid resume that highlights your skills and achievements can help land your next job.

- Entry-Level

- Mid-Career

- Senior-Level

1. Write a dynamic profile summarizing your banking qualifications

The first section of your resume is one of the most important because it’s what hooks the hiring manager and makes them interested enough to keep reading. The profile summary section goes at the top of your resume after the header with your name and contact information. It is designed to give a reviewer an overall idea of who you are and what you can offer. Draw attention to your most valuable qualities, such as extensive experience or the ability to speak more than one language.

Senior-Level Profile Example

Commercial banking associate with over 10 years of experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Entry-Level Profile Example

Commercial banking professional with over two years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

2. Outline your banking experience in a compelling list

The professional experience section of your resume should explain what your duties and responsibilities have been in previous positions. Also, it must be a soft sales pitch about the value you can bring to your next position. It can be helpful to separate each job listing into sections: one for your job duties and one to highlight achievements. What’s worth mentioning depends on the position you’re applying for, but most banking positions rely on customer satisfaction and efficiency, so these are good places to start.

Senior-Level Professional Experience Example

Commercial Banking Associate

Bank of San Francisco, San Francisco, CA | November 2017 – present

- Lead and performance-manage a team of 12 associates

- Help customers open new bank accounts and access online services

Highlights:

- Consistently earned 98% and higher client satisfaction rating

- Drove a 45% increase in customer use of online services

- Trained and mentored seven new hires in 2021

Entry-Level Professional Experience Example

Commercial Banking Officer

Commercial Bank of California, Los Angeles, CA | November 2018 – January 2021

- Opened and closed over 50 accounts per week

- Helped clients analyze risks and set appropriate banking plans

- Attended and contributed to industry conferences and panel discussions

- Led and managed a five-person team

3. Include banking-related education and certifications

A degree in finance or business or accounting-related certifications can put you ahead of the pack when applying for a job in the banking industry. Some jobs may require a certain educational background, such as being a certified financial planner. Customer-facing positions like tellers may focus more on cash-handling experience and sales skills. List your education and any relevant credentials or certifications clearly on your resume so the hiring manager can determine if you have the necessary qualifications.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] – [Graduation Month and Year]

Example

- Bachelor of Science in Finance

- California State University, Northridge, CA – July 2012

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Certified Chartered Financial Analyst, CFA Institute, 2013

4. List your banking-related skills and proficiencies

The objective of your resume is to show the person reviewing it you’re a good fit for the position and that you will add value once you’re hired. Make it easy to see your skills and proficiencies. A bulleted list works well for this and can be divided into two sections: technical and banking-related skills and general professional skills.

| Action Verbs | |

|---|---|

| Client relationship management | Compliance with banking regulations |

| Credit risk assessment | Cross-selling abilities |

| Customer service skills | Data-driven decision making |

| Financial statement analysis | Fraud detection and prevention |

| Investment portfolio management | Loan underwriting |

| Regulatory reporting | Retail banking operations |

| Risk management | Sales skills |

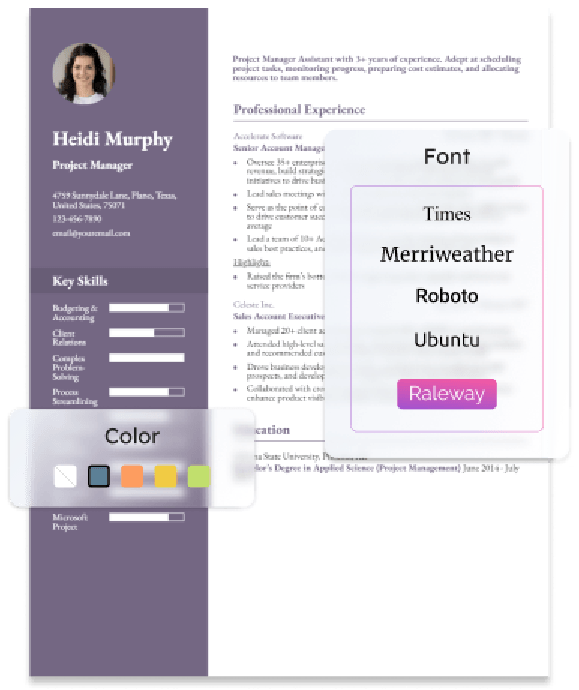

How To Pick the Best Banking Resume Template

Using a banking resume template lets you spend more time crafting compelling copy that positions you as a top candidate and less time messing with spacing and bolding. But all templates aren’t created equal. Look for non-fussy designs that prioritize readability and organization. Your resume is a professional document, and a hiring manager must quickly and easily determine if you’re a match for the position. Use headings, bullets, and lines for easier skimming.

Banking Text-Only Resume Templates and Examples

- Entry-Level

- Mid-Career

- Senior-Level

Jerry Jones

(738) 274-2648 | [email protected] | 91 Riverside Avenue, Los Angeles, California, 90001

Profile

High achieving and analytical investment banker with seven years of experience in the banking industry. Proven ability to work alongside a wide variety of clients to provide useful investment insights and outline any potential risks. Possesses a bachelor’s degree in finance from California State University and a master’s degree from Claremont McKenna College. Excellent communication skills, in-depth knowledge of the current trends in the investment banking industry, and success-orientated attitude.

Professional Experience

Investment Banker, 1st Capital Bank, Los Angeles, CA

June 2017 – March 2021

- Oversaw and managed the relationship-banking team, which resulted in a 15% increase in revenue and increased profitability

- Prepared and organized the execution of equity transactions

- Successfully achieved the 2020 target of $15M

- Participated in industry conferences and panel discussions

Investment Associate, American First National Bank, Los Angeles, CA

November 2014 – June 2017

- Helped to increase the yearly revenue by 6% via regular client-orientated sales events

- Performed company equity research

- Contributed to the preparation of fact-based growth opportunity reports

Education

Master of Finance

Claremont McKenna College, Claremont, CA, September 2012 – July 2013

Bachelor of Science in Finance

California State University, Northridge, CA, September 2009 – July 2012

Key Skills

- Tax audits

- Risk management and compliance

- Wealth management

- Knowledge of commercial and private banking

- Team leadership

- Exceptional communication skills

- Impressive ability to build and maintain working relationships

Certifications:

- CFA Institute certified Chartered Financial Analyst (CFA), August 2013

Frequently Asked Questions: Banking Resume Examples and Advice

What are common action verbs for banking resumes?-

Action verbs take your bullets from bland descriptions of your job duties to compelling marketing materials for yourself as an applicant. It’s important to use various action verbs to avoid repetition and keep your resume as engaging as possible. If you’re getting stuck while writing this section, try these options that work well for banking positions. Another useful technique is to quickly read through the job description and identify any matching phrasing for the job responsibilities.

| Action Verbs | |

|---|---|

| Analyzed | Assisted |

| Documented | Educated |

| Highlighted | Informed |

| Liaised | Prepared |

| Presented | Proposed |

| Qualified | Trained |

| Underwrote | Valued |

How do you align your resume with a job description?-

Targeting your resume to a specific job description can increase the chances that a hiring manager identifies you as a good fit. Look for keywords, qualifications, skills, and other must-haves listed in the job description and use these when creating your resume. Consider including a specific software in your list of key skills or adding a bullet point in your work experience section that highlights your knowledge of loans and other related products. This is especially important for those applying for competitive positions, such as loan officers, who are expected to experience just average growth, and tellers, who are expected to see a 12% decline through 2031.

What is the best banking resume format?-

The right format for a banking resume depends on how much experience you have, what kind of position you’re applying for, and the company, but you can’t go wrong with a reverse chronological format in this industry. This traditional design will be what most hiring managers expect and lets you list your work history, skills, and education in an organized, easy-to-read manner. You can also play around with this format, such as listing key skills first or using a double-column design to make more use of white space.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Including a cover letter with your resume shows you're serious about the position and willing to put in extra effort. It provides an additional opportunity to describe your achievements and qualifications. If you need help writing a banking cover letter, this guide provides tips and examples.