Whether you’d like to work with companies, nonprofits, or individual clients, you can write a great accountant resume by showing your skill at building financial success and stability. The following tips and examples will assist you in exploring this topic and creating compelling content for each section of your accounting job resume.

“Accountant resumes should reflect financial reporting, compliance, GAAP, and problem-solving. Let your resume show how you bring clarity and insight to the numbers.”

Most Popular Accountant Resumes

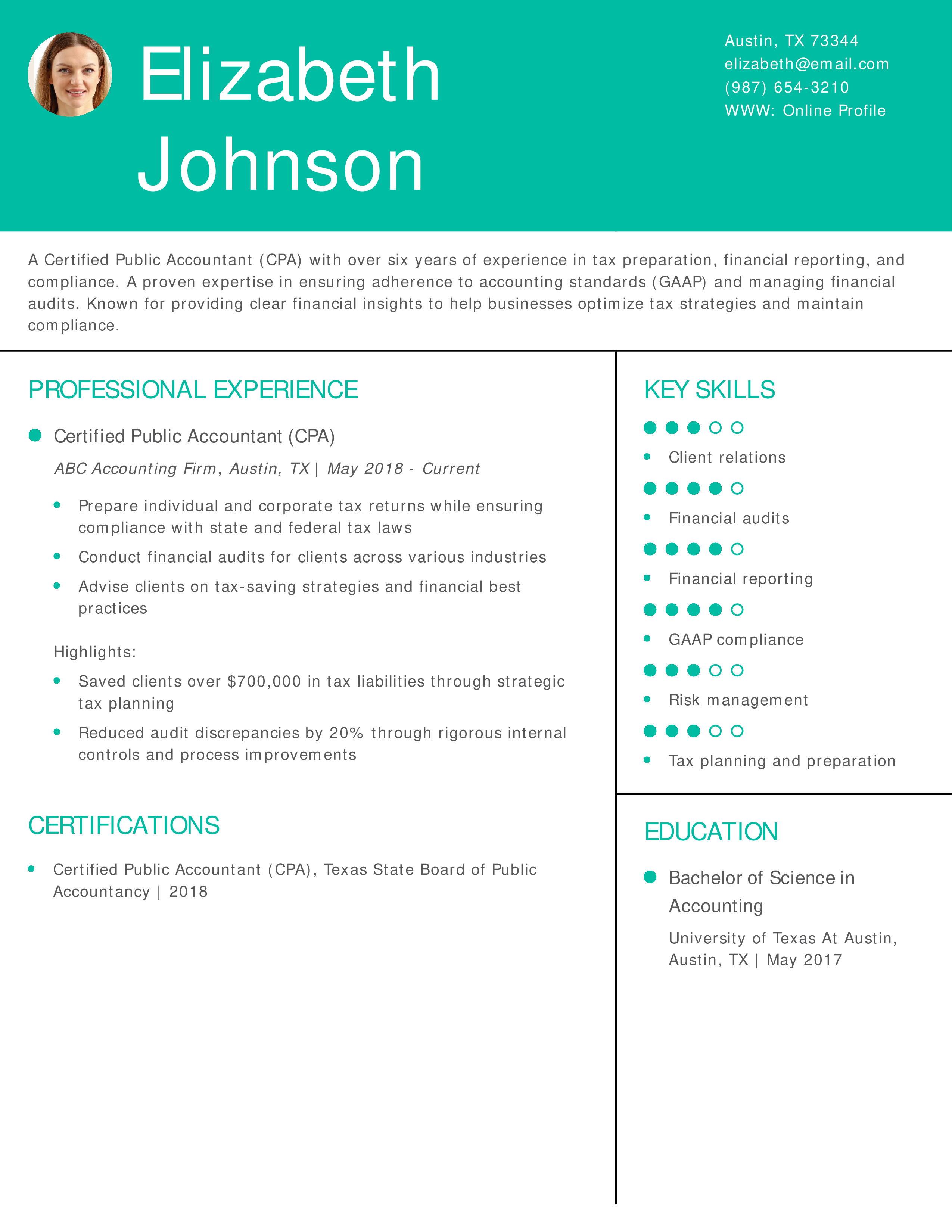

Accountant Resume Example

Why This CPA Resume Works

This resume effectively highlights the candidate’s technical expertise as a CPA, including tax planning and audit management. The measurable accomplishments in saving clients money and reducing discrepancies display the candidate’s value and expertise in accounting. Learn more about writing a CPA resume here.

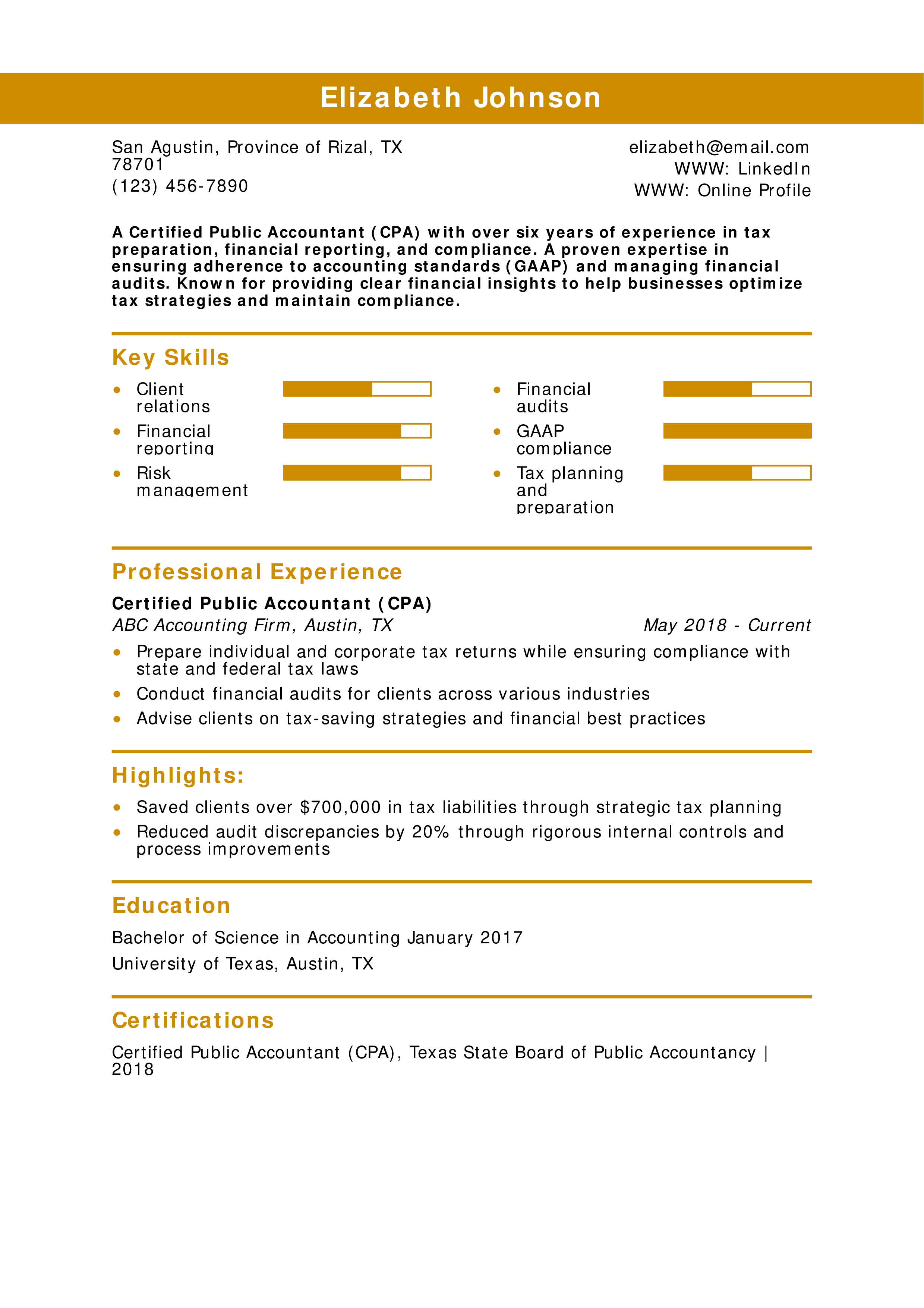

Public Accounting Resume

Why This Public Accounting Resume Works

This resume demonstrates expertise in public accounting with a strong focus on financial audits and tax preparation. The quantifiable achievements in tax liability reduction and efficiency improvements highlight the candidate’s value. Explore more on creating a public accounting resume here.

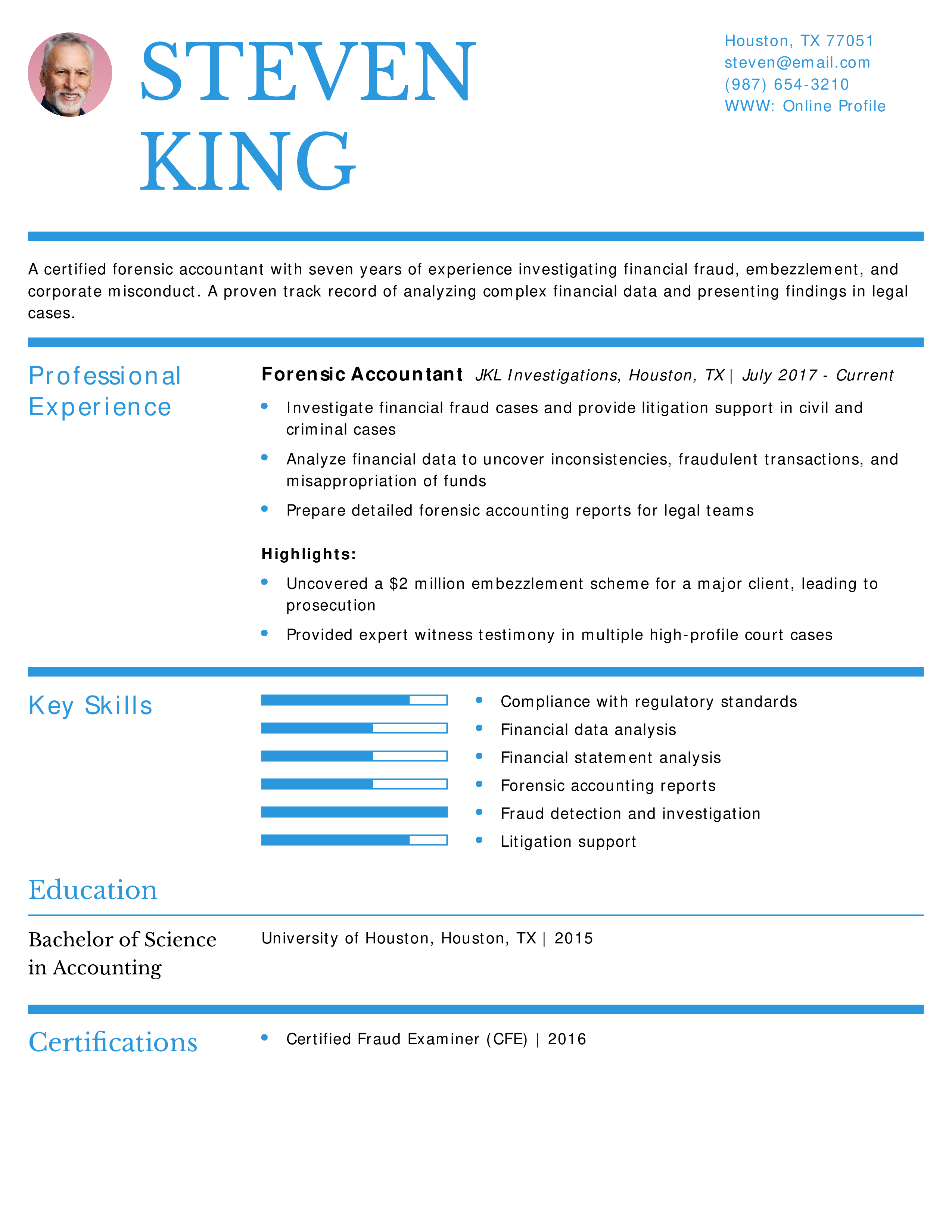

Forensic Accountant Resume

Why This Forensic Accountant Resume Works

This resume emphasizes the candidate’s specialized expertise in investigating financial fraud and providing litigation support. The significant accomplishments in uncovering embezzlement and offering expert testimony further validate the candidate’s qualifications. Read more tips for forensic accounting resumes here.

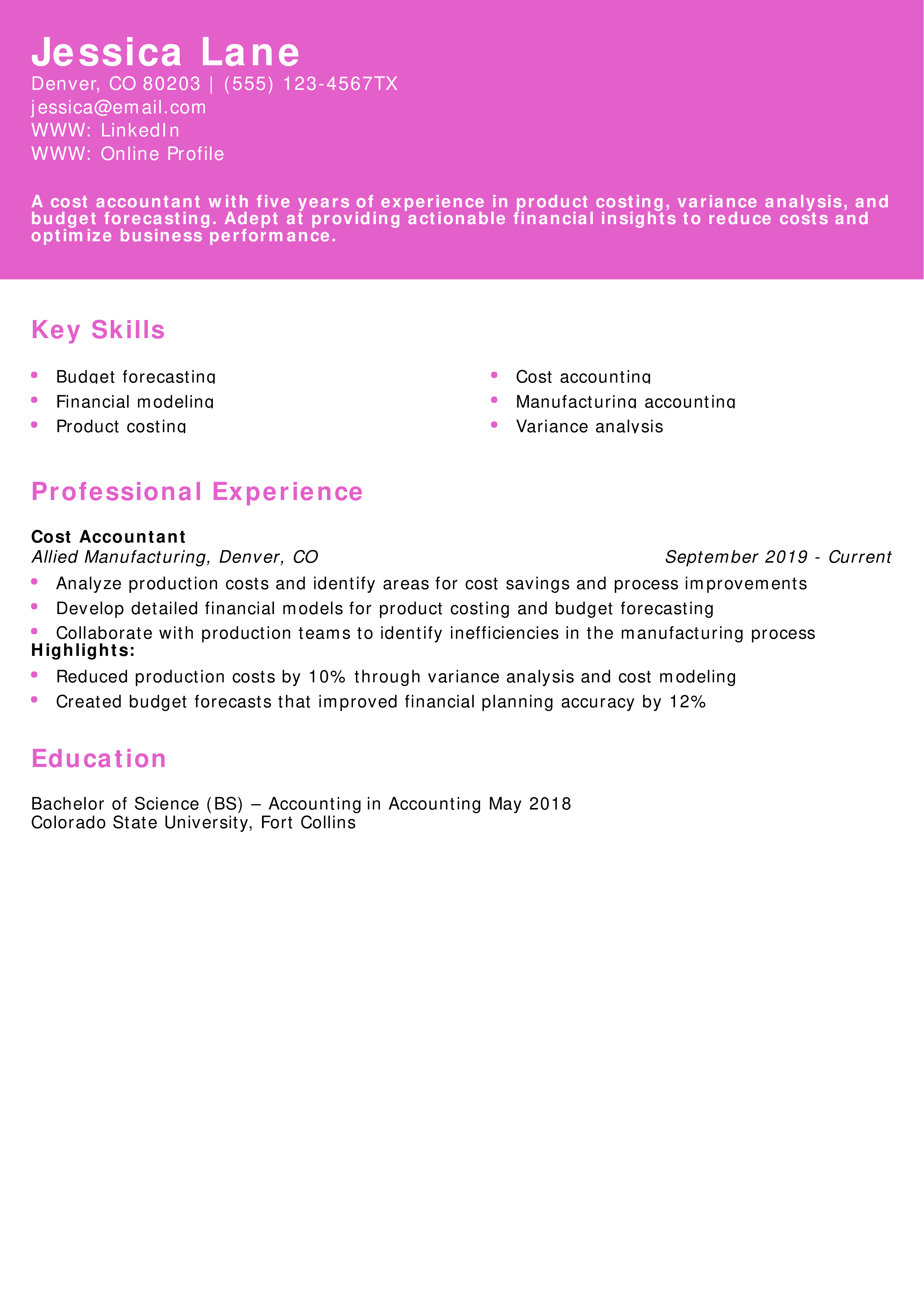

Cost Accountant Resume

Why This Cost Accountant Resume Works

This resume highlights the candidate’s ability to drive business results through cost optimization. The quantifiable achievements in reducing production costs and improving financial planning make the candidate stand out. Learn more about writing cost accountant resumes here.

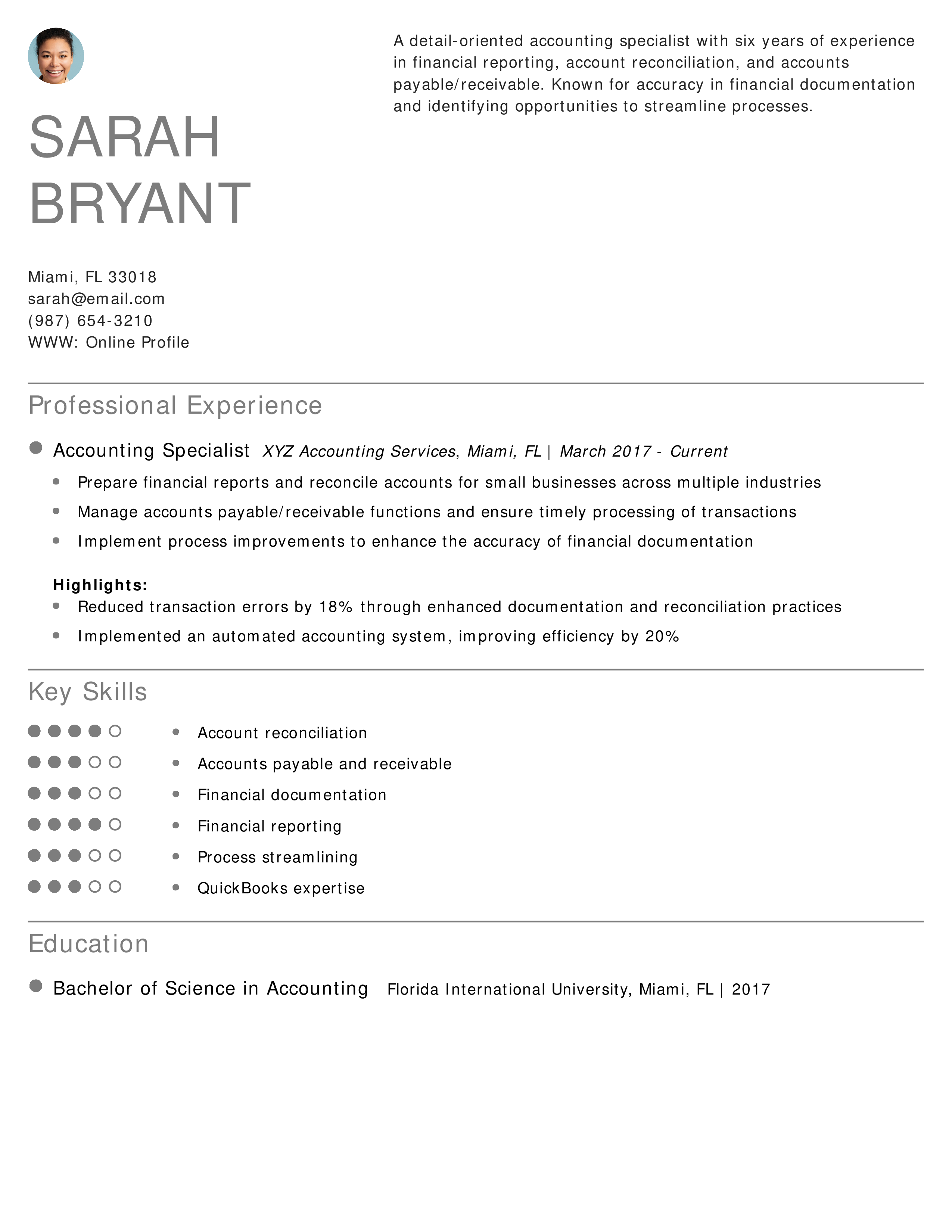

Accounting Specialist Resume

Why This Accounting Specialist Resume Works

This resume demonstrates the candidate’s ability to streamline processes and maintain accurate financial records. The accomplishments in reducing errors and implementing automation enhance the applicant’s appeal to hiring managers. Discover more tips for accounting specialist resumes here.

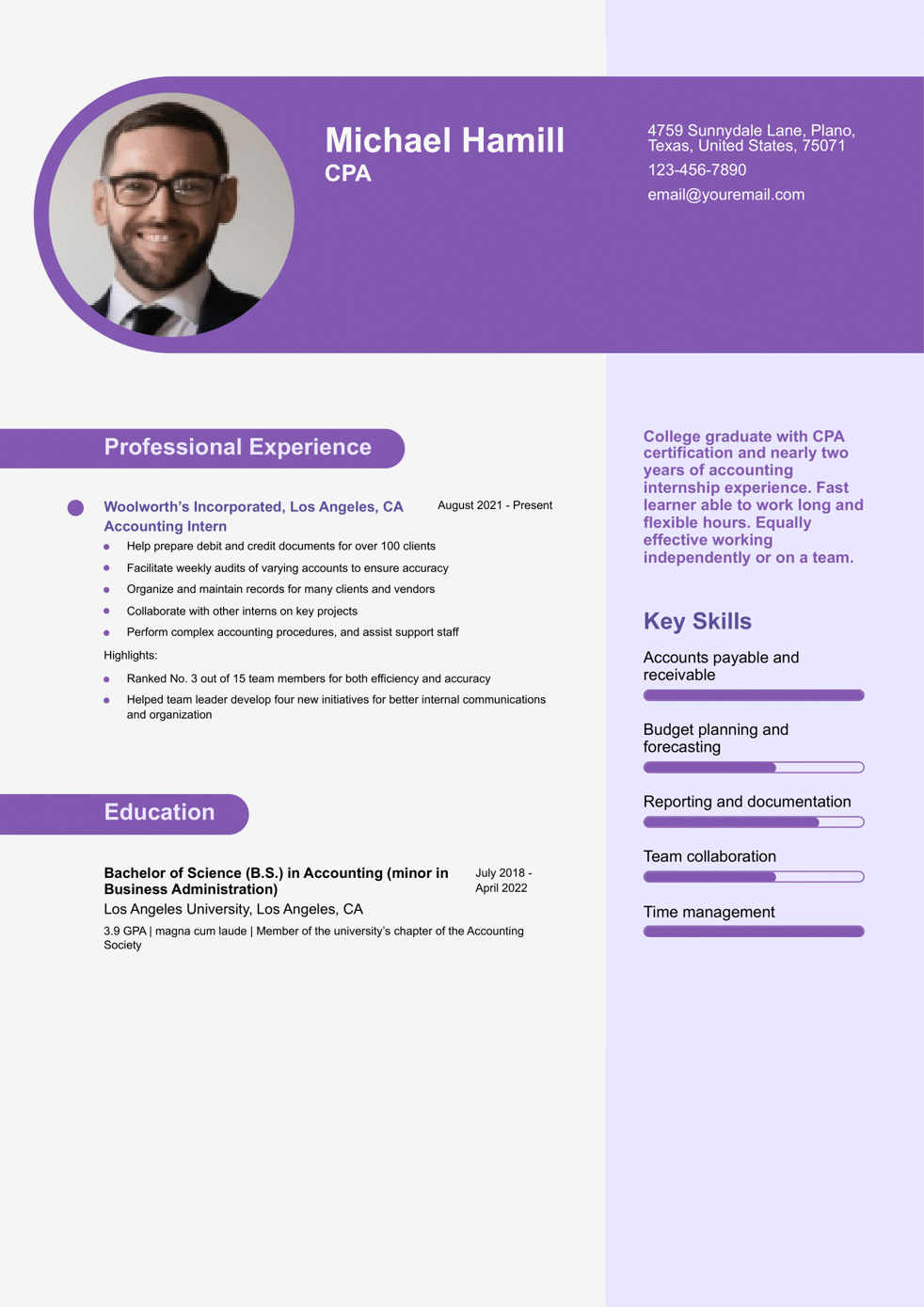

Entry-Level Accountant Resume

Why This Entry-Level Accountant Resume Works

This resume highlights the candidate’s relevant academic achievements and internship experience, showcasing their technical skills and strong attention to detail. Quantifiable achievements, such as ranking in the top 3 for accuracy, demonstrate potential. Learn more about crafting an entry-level accountant resume here.

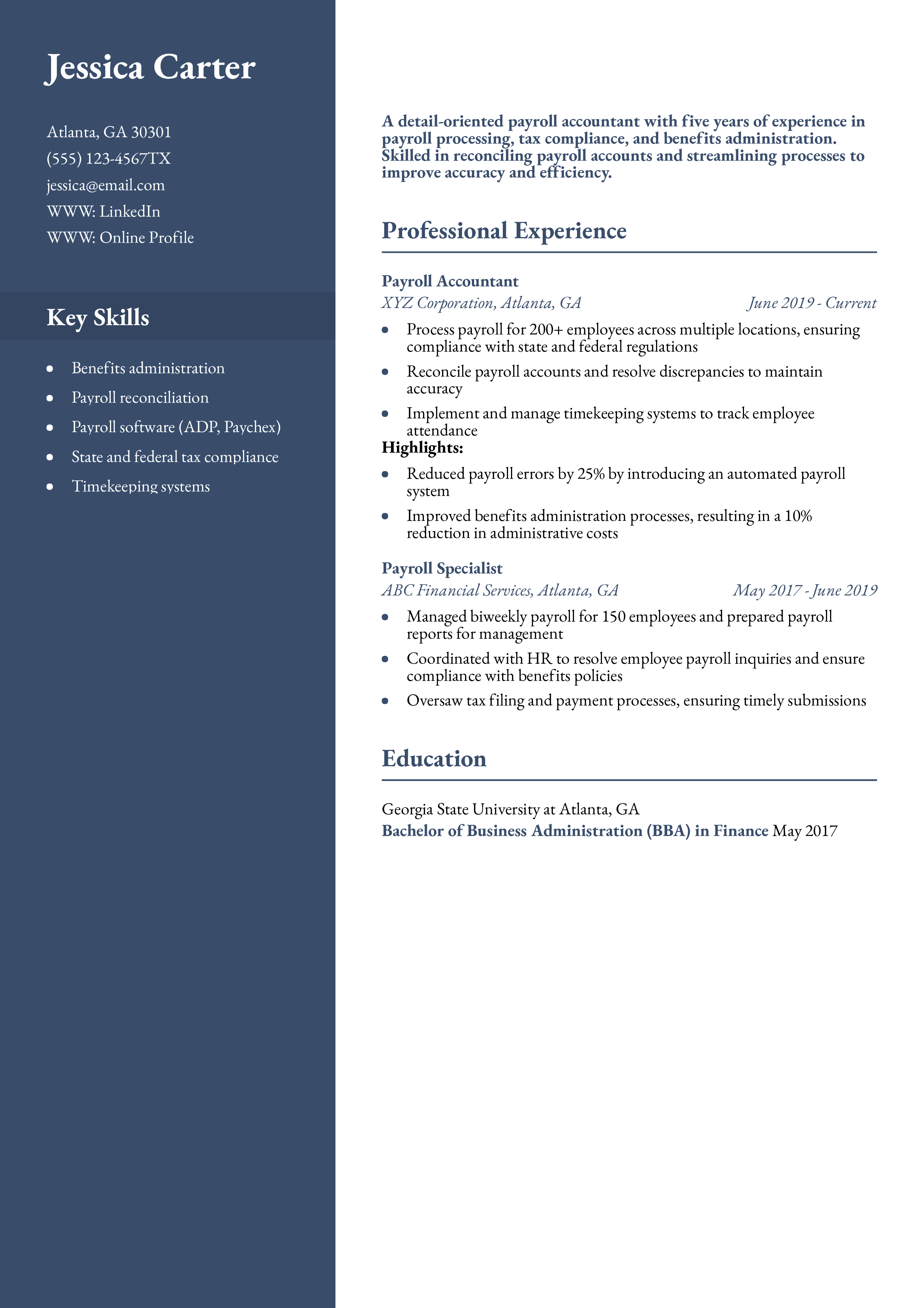

Payroll Accountant Resume

Why This Payroll Accountant Resume Works

This resume effectively showcases the candidate’s hands-on payroll expertise, emphasizing quantifiable achievements such as reducing errors and improving administrative processes. The technical skills and ability to manage large payroll functions make this a strong example. Explore tips for payroll accountant resumes here.

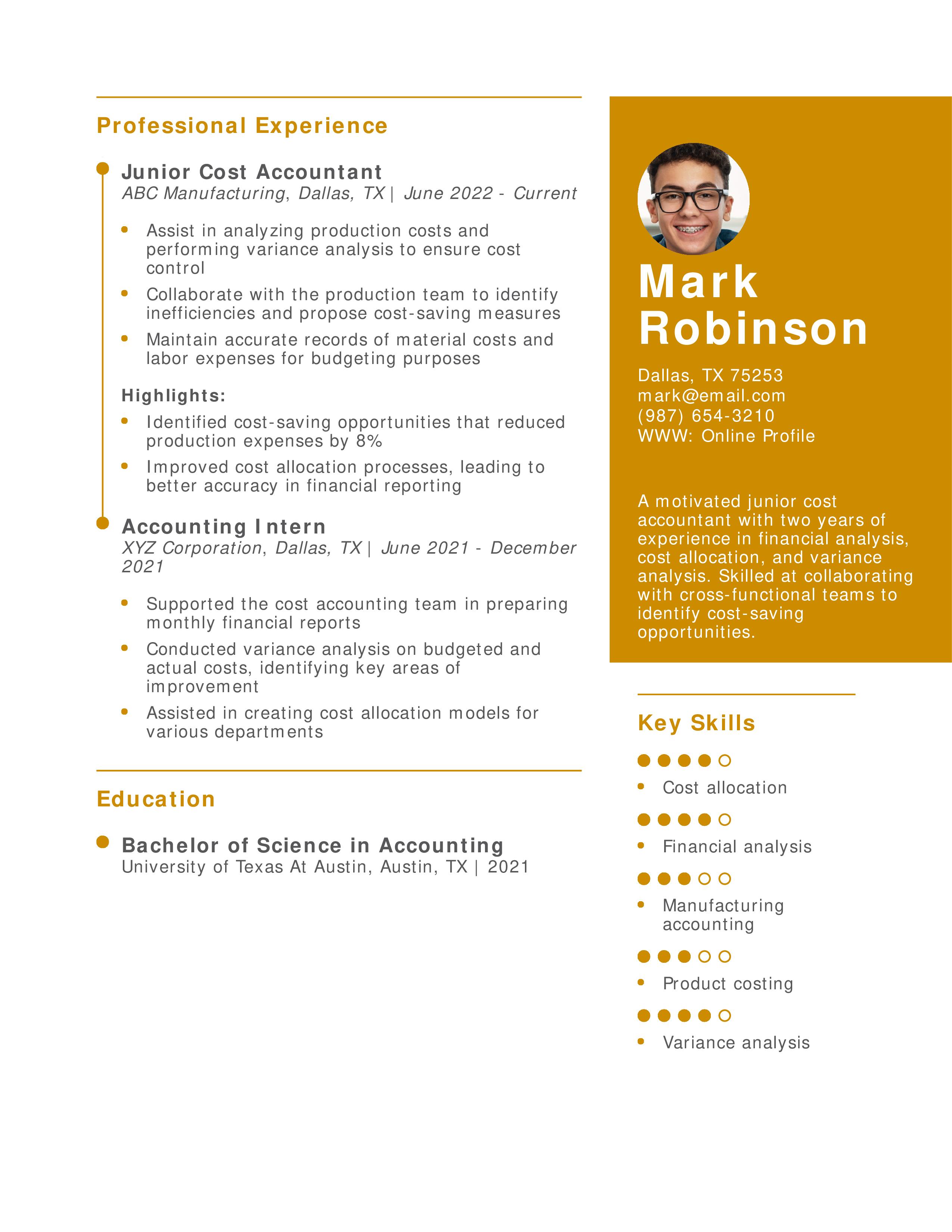

Junior Cost Accountant Resume

Why This Junior Cost Accountant Resume Works

This resume demonstrates the candidate’s ability to analyze production costs and improve financial reporting accuracy. The quantifiable reduction in production expenses makes the applicant stand out as a valuable hire. Learn more about writing cost accountant resumes here.

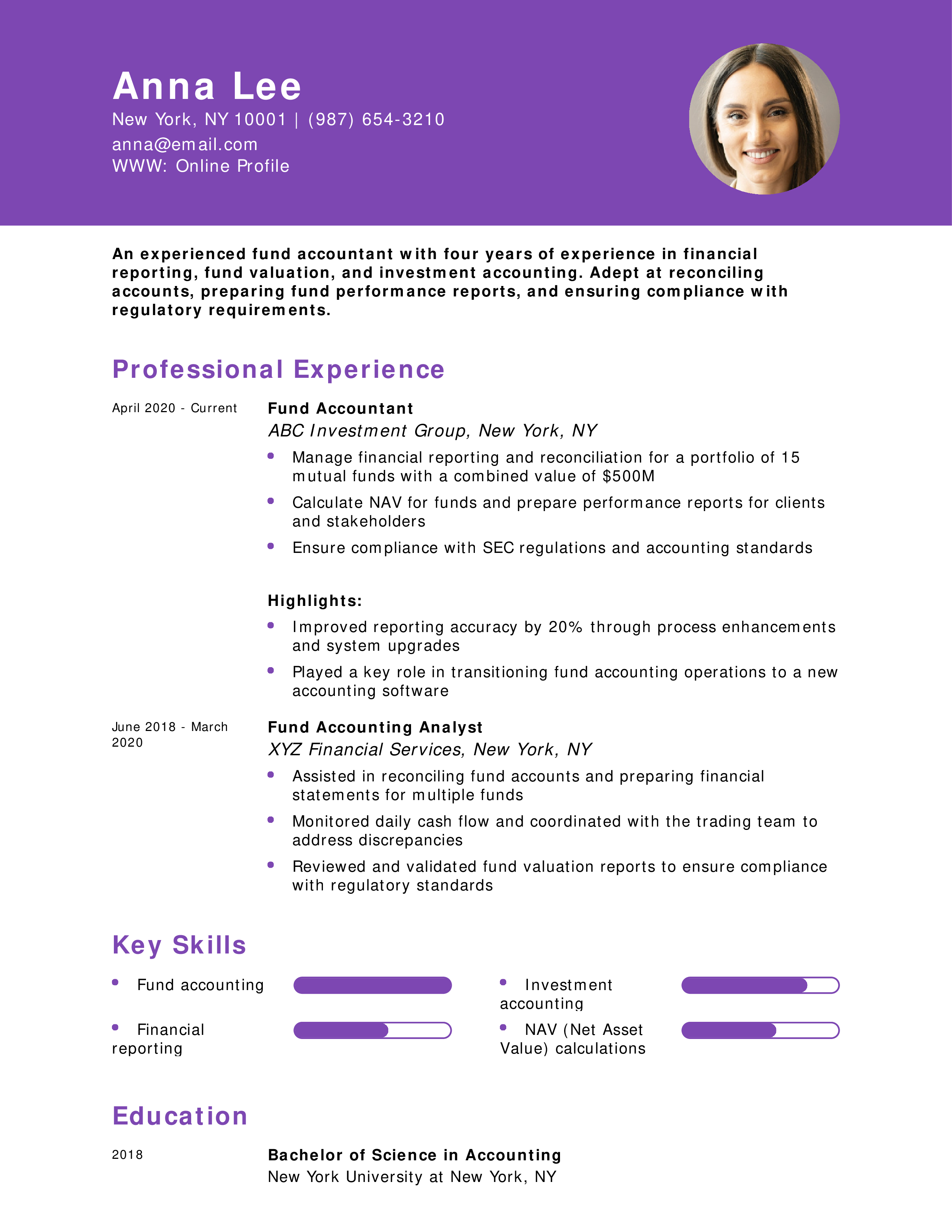

Fund Accountant Resume

Why This Fund Accountant Resume Works

This resume highlights the candidate’s fund accounting expertise, emphasizing their ability to manage large portfolios and ensure compliance with regulatory standards. The improvements in reporting accuracy and contributions to software transitions demonstrate their value. Explore more tips for fund accountant resumes here.

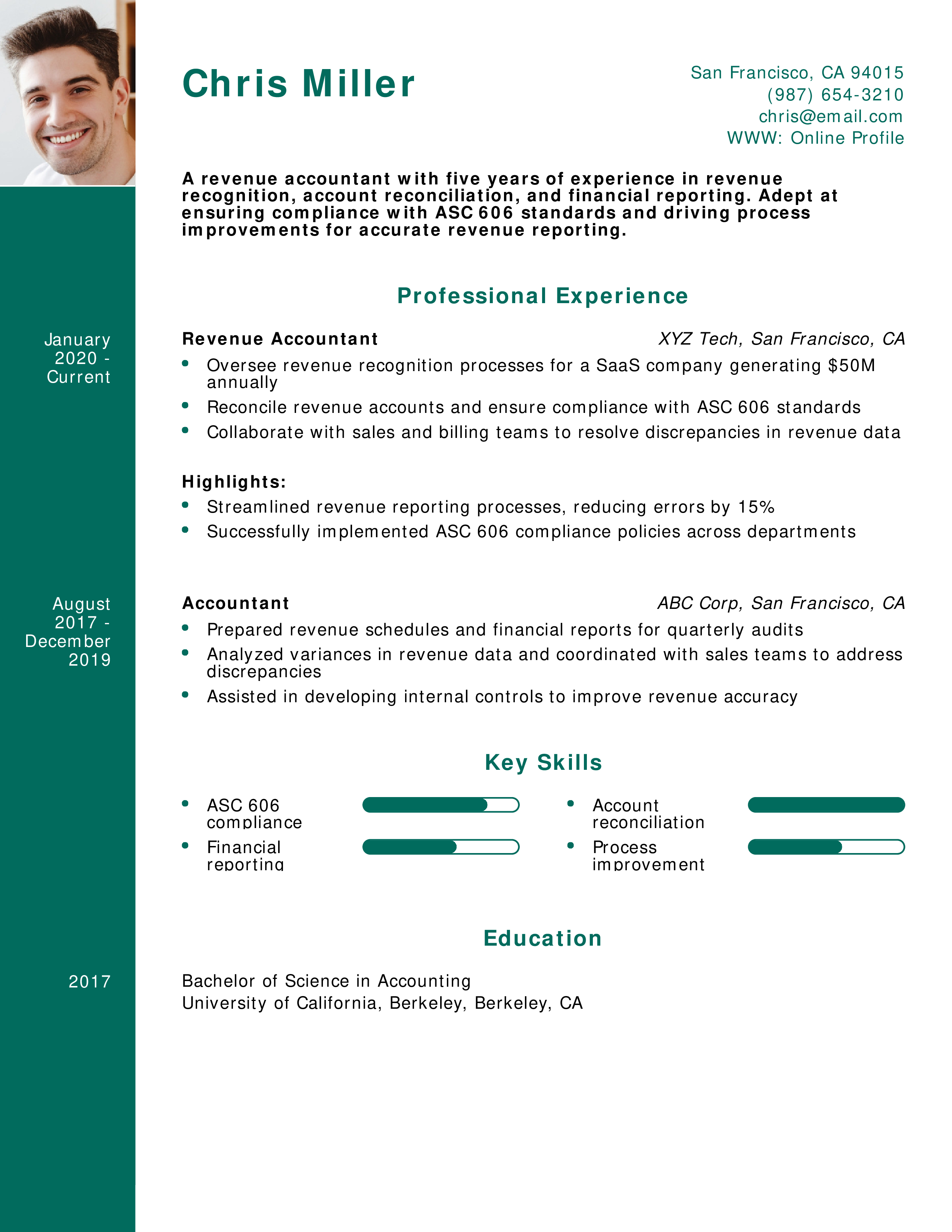

Revenue Accountant Resume

Why This Revenue Accountant Resume Works

This resume effectively emphasizes the candidate’s expertise in revenue recognition and compliance with ASC 606. The quantifiable reduction in reporting errors demonstrates their ability to drive process improvements. Learn more about revenue accountant resumes here.

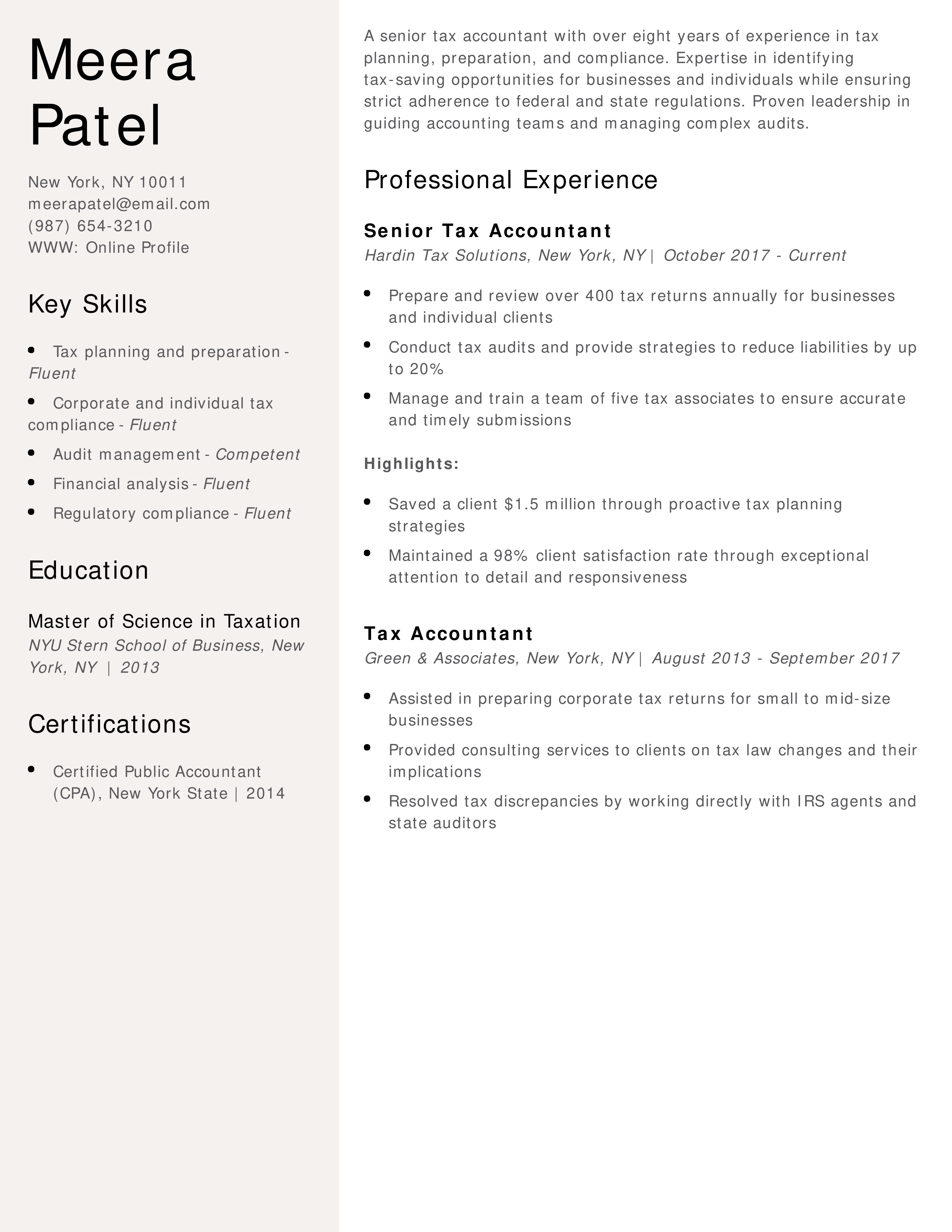

Senior Tax Accountant Resume

Why This Senior Tax Accountant Resume Works

This resume emphasizes the candidate’s ability to manage complex tax issues, lead a team, and save clients significant money through expert planning. The combination of technical skills, leadership, and measurable results makes this resume stand out. Read more about writing tax resumes here.

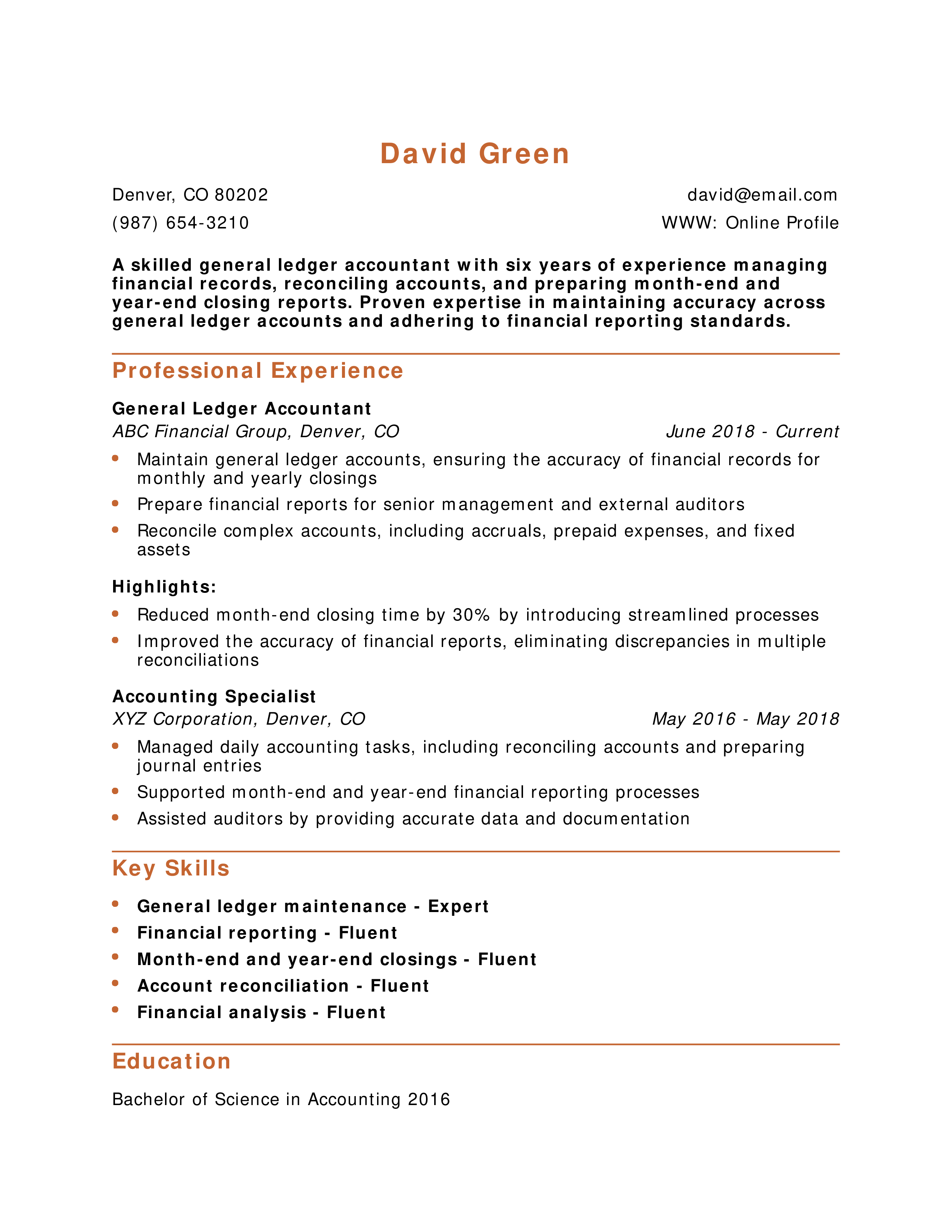

General Ledger Accountant Resume

Why This General Ledger Accountant Resume Works

This resume effectively showcases the candidate’s experience managing general ledger accounts and improving financial reporting efficiency. The quantifiable reduction in closing time and focus on reconciliation accuracy stand out to employers. Learn more about writing accounting resumes here.

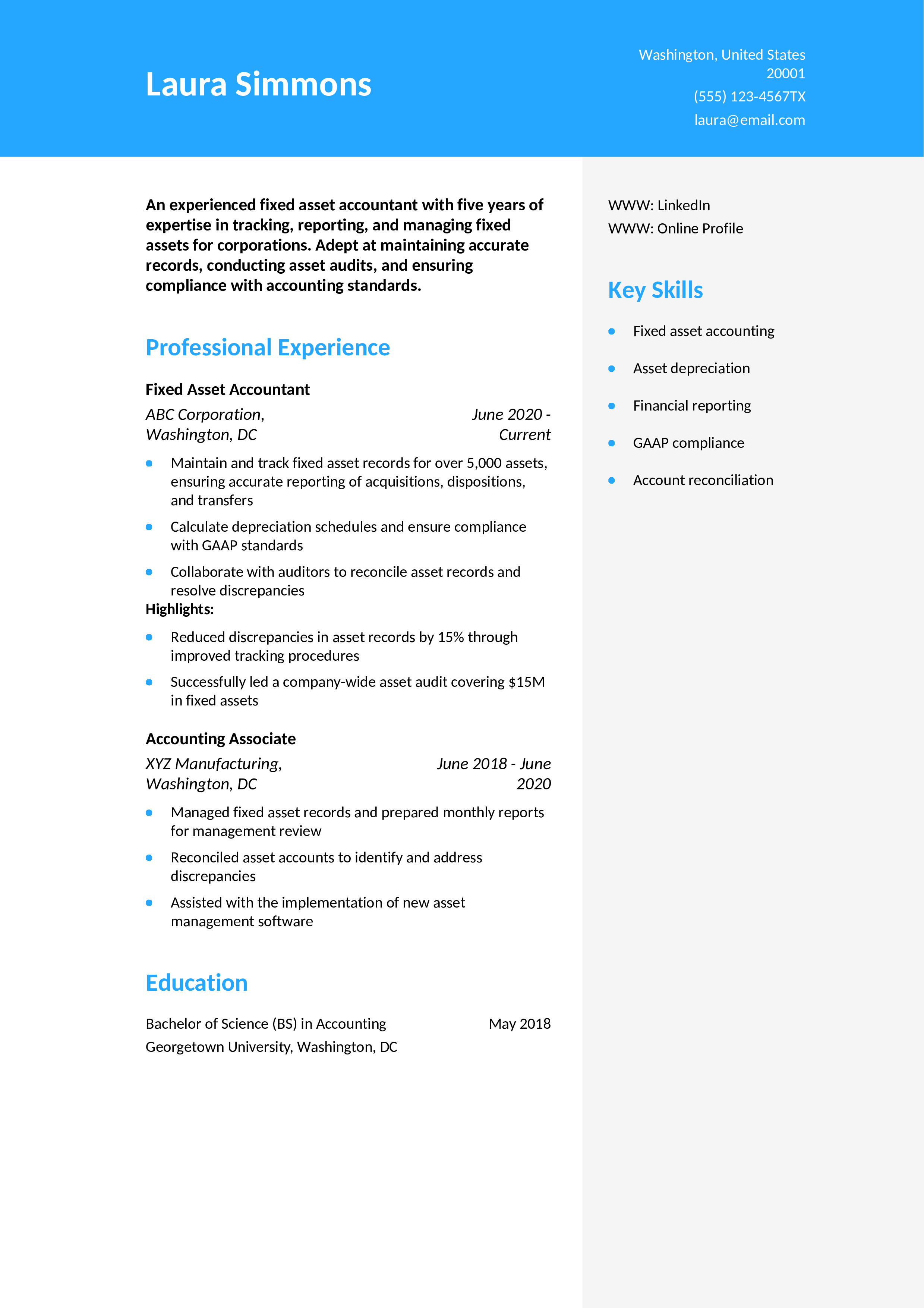

Fixed Asset Accountant Resume

Why This Fixed Asset Accountant Resume Works

This resume highlights the candidate’s specialized expertise in fixed asset management and GAAP compliance. The measurable achievements in reducing discrepancies and managing audits demonstrate their value. Explore more on accounting resumes here.

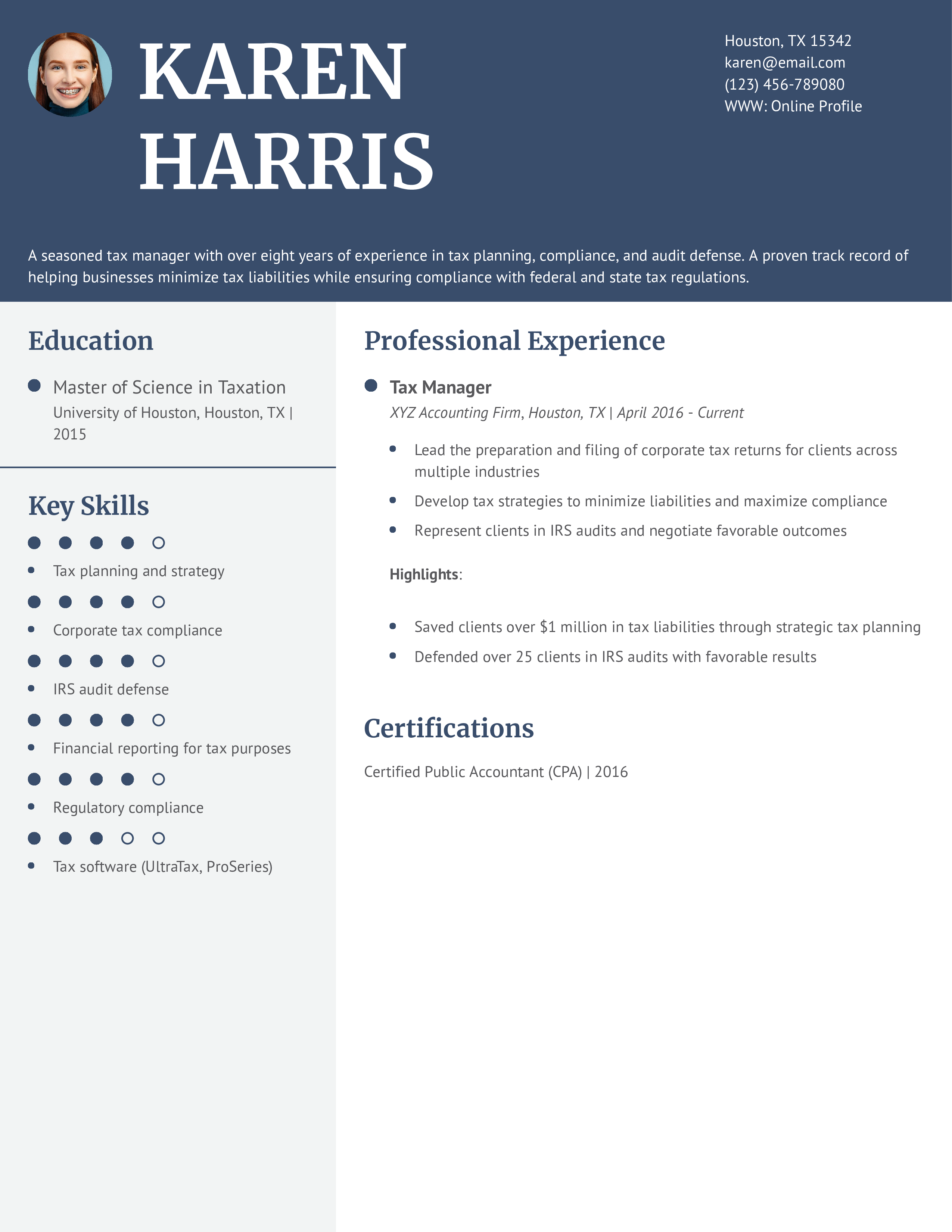

Tax Manager Example

Why This Tax Manager Resume Works

This resume effectively highlights the candidate’s leadership experience and ability to deliver significant cost savings through tax strategies. The accomplishments in IRS audit defense and mentoring teams make this resume stand out for senior-level positions. Read more about tax management resumes here.

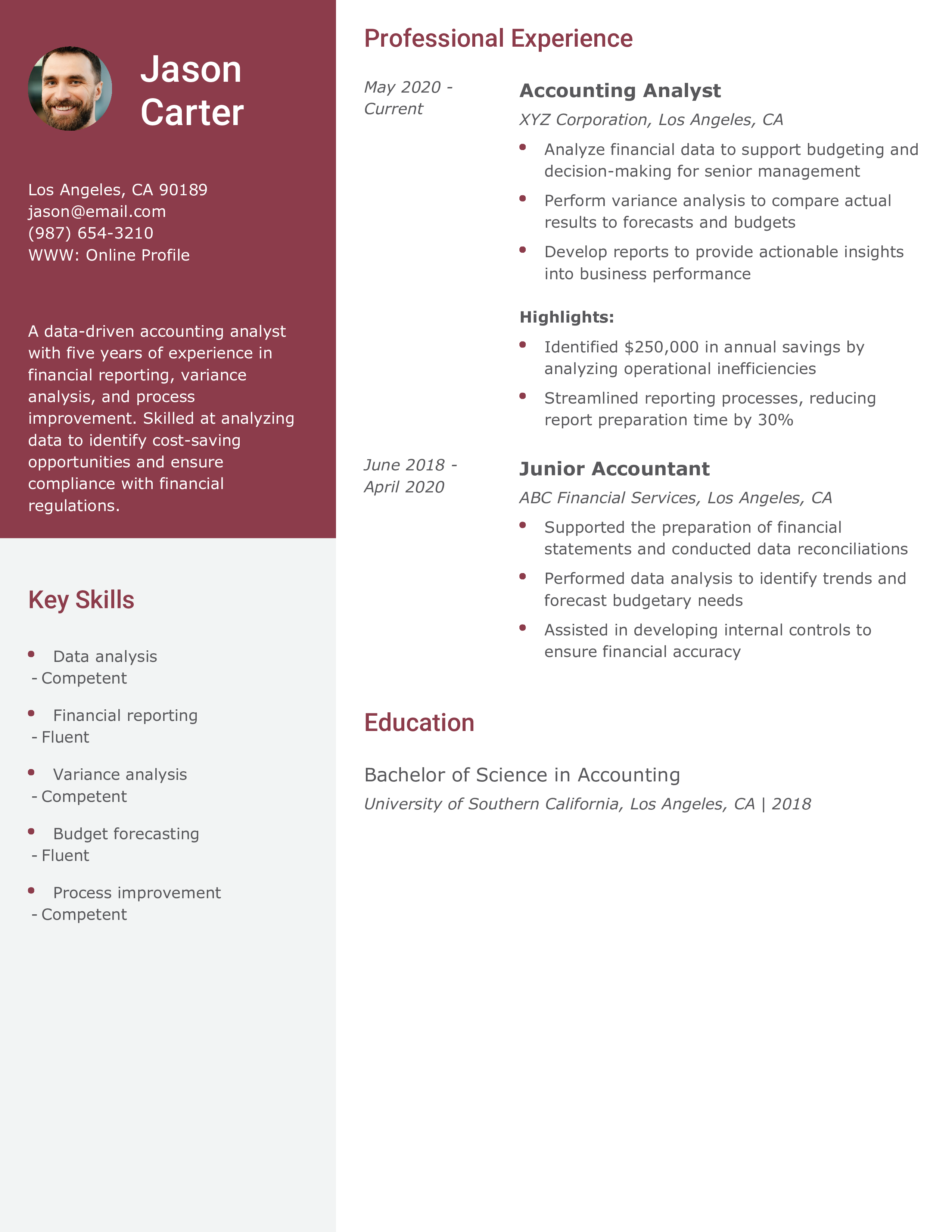

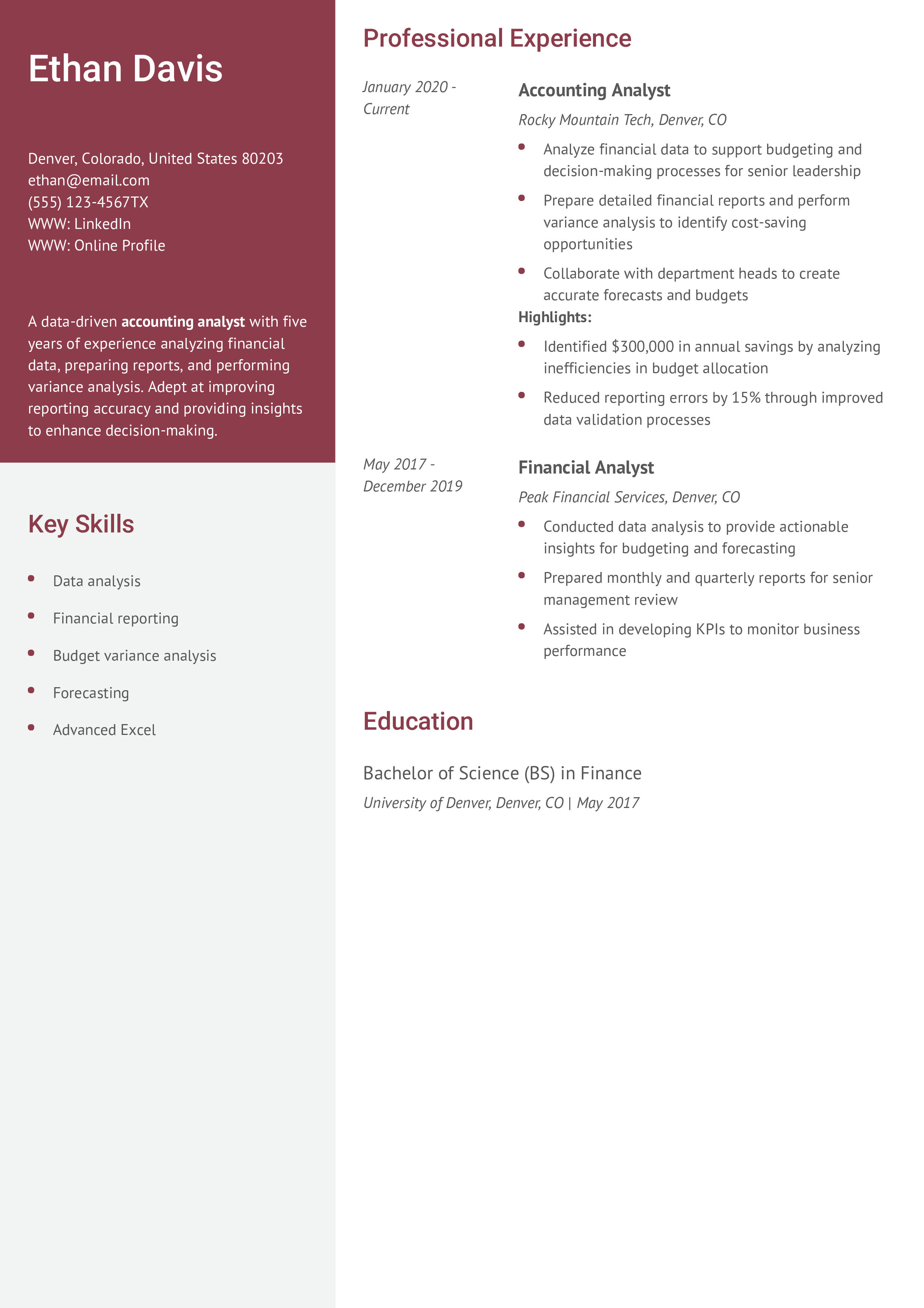

Accounting Analyst Resume

Why This Accounting Analyst Resume Works

This resume emphasizes the candidate’s ability to use data-driven analysis to improve financial performance and identify cost-saving opportunities. The quantifiable accomplishments in reducing costs and improving reporting efficiency set this resume apart. Learn more about accounting analyst resumes here.

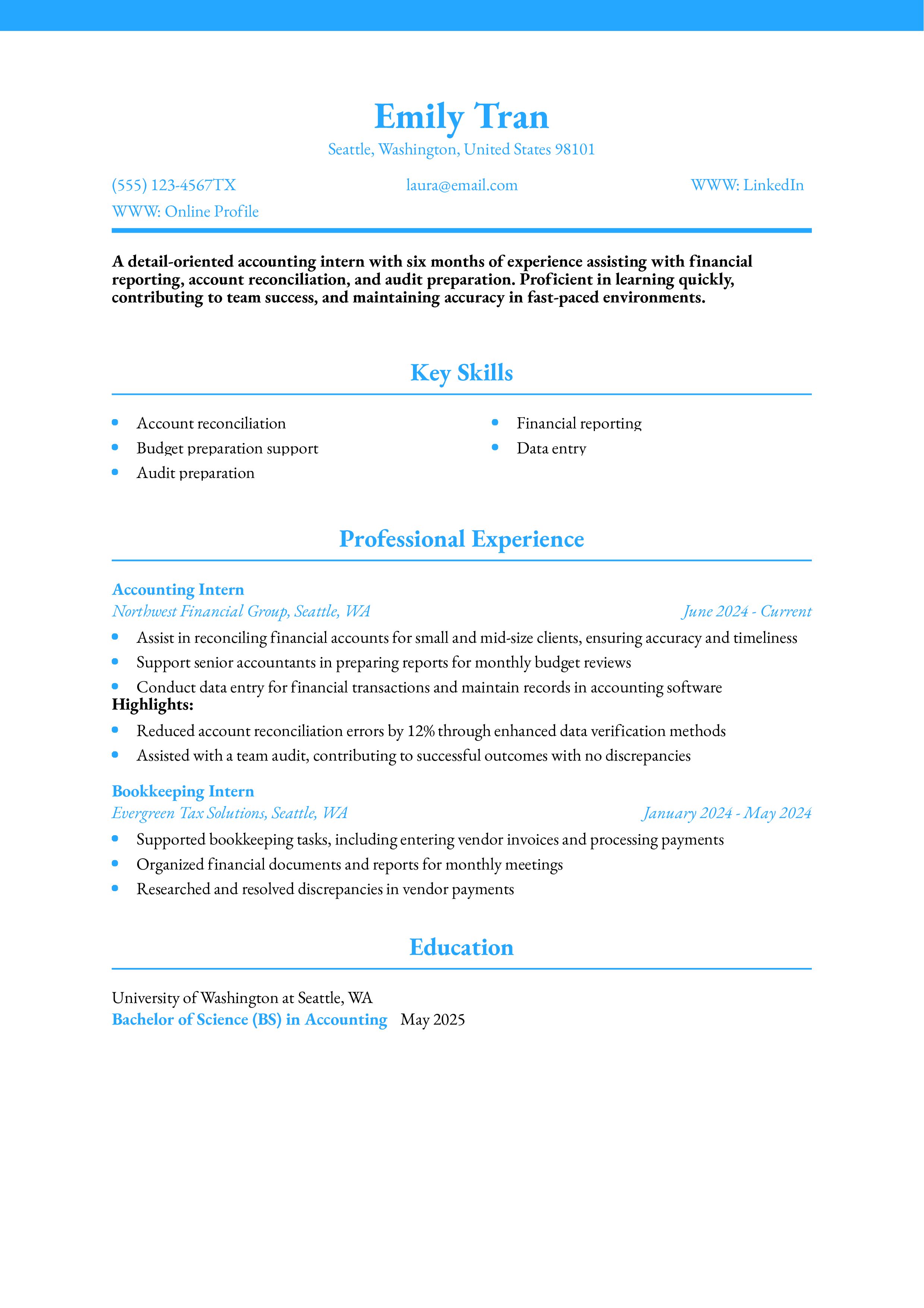

Accounting Intern Resume

Why This Accounting Intern Resume Works

This resume effectively highlights the candidate's internship experiences and quantifiable achievements, such as reducing reconciliation errors. It’s a strong starting point for a career in accounting. Learn more about crafting accounting intern resumes here.

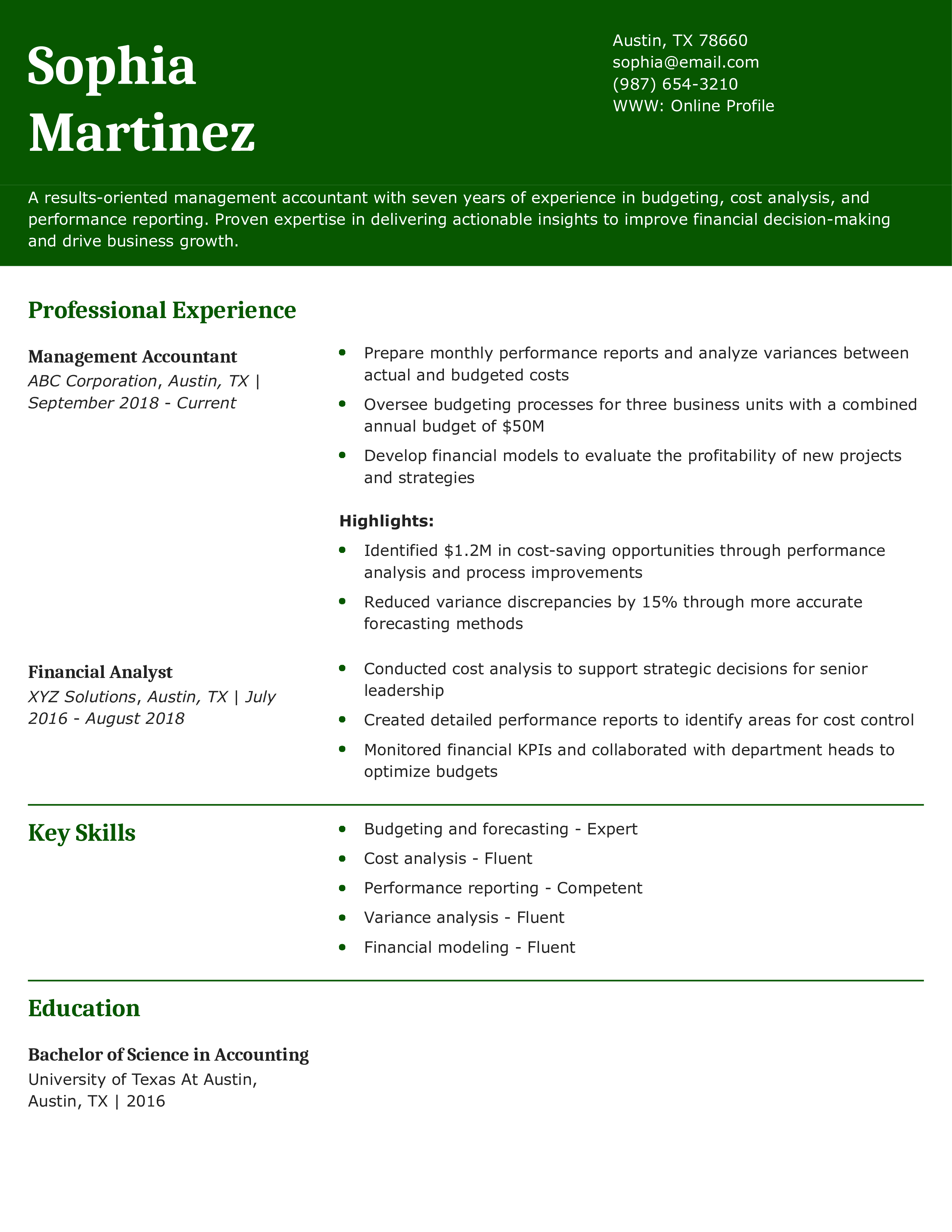

Management Accountant Resume

Why This Management Accountant Resume Works

This resume highlights the candidate’s ability to analyze financial performance and implement cost-saving measures. The focus on actionable insights and measurable results demonstrates value to employers. Read more about management accountant resumes here.

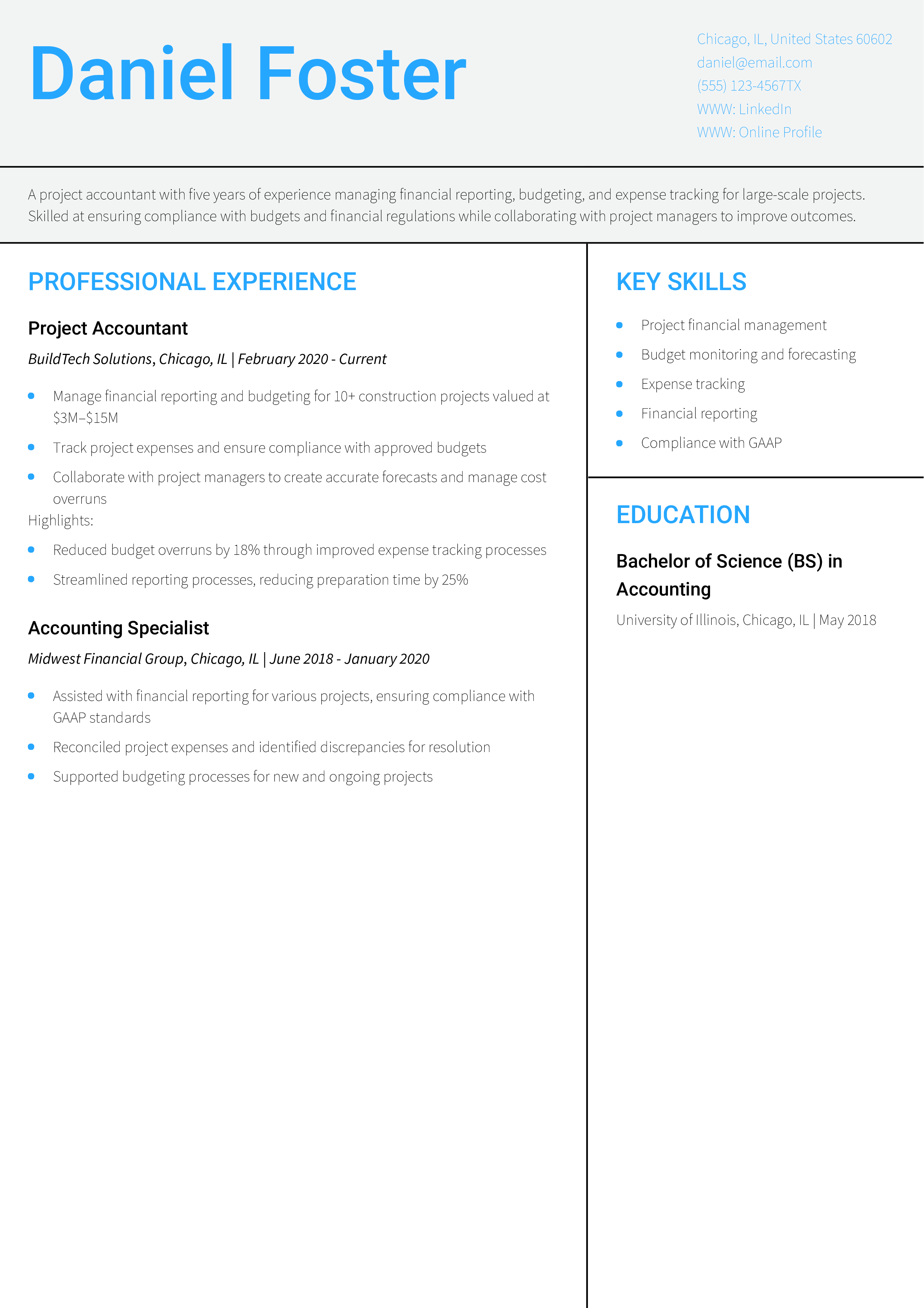

Project Accountant Resume

Why This Project Accountant Resume Works

This resume showcases the candidate’s expertise in managing project finances and collaborating with key stakeholders. The measurable improvements in budget compliance and reporting efficiency highlight their value. Learn more about project accountant resumes here.

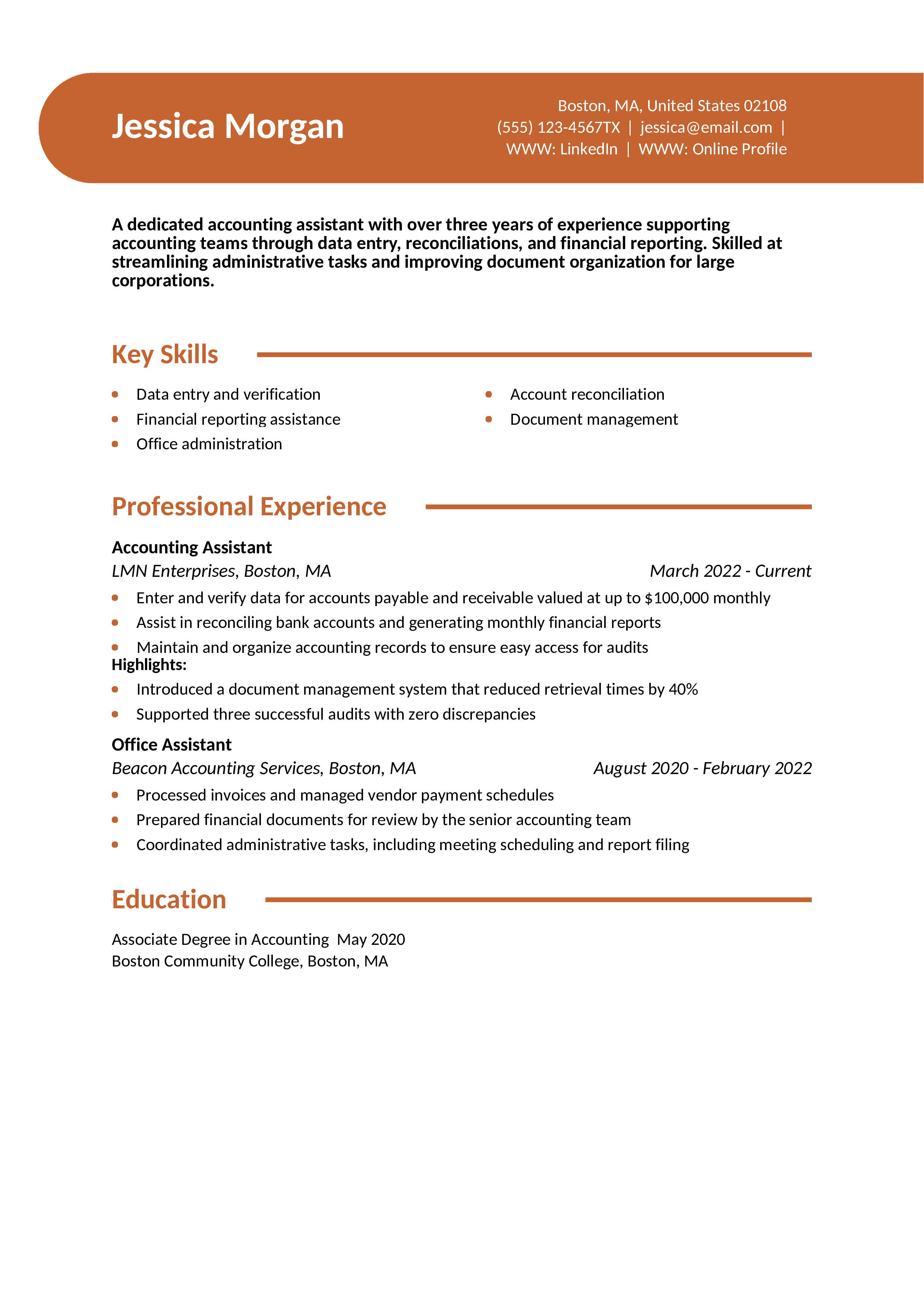

Accounting Assistant Resume

Why This Accounting Assistant Resume Works

This resume emphasizes the candidate’s support role in accounting teams and highlights their contributions to organizational efficiency. The measurable improvements in document management and audit success demonstrate attention to detail. Learn more about accounting assistant resumes here.

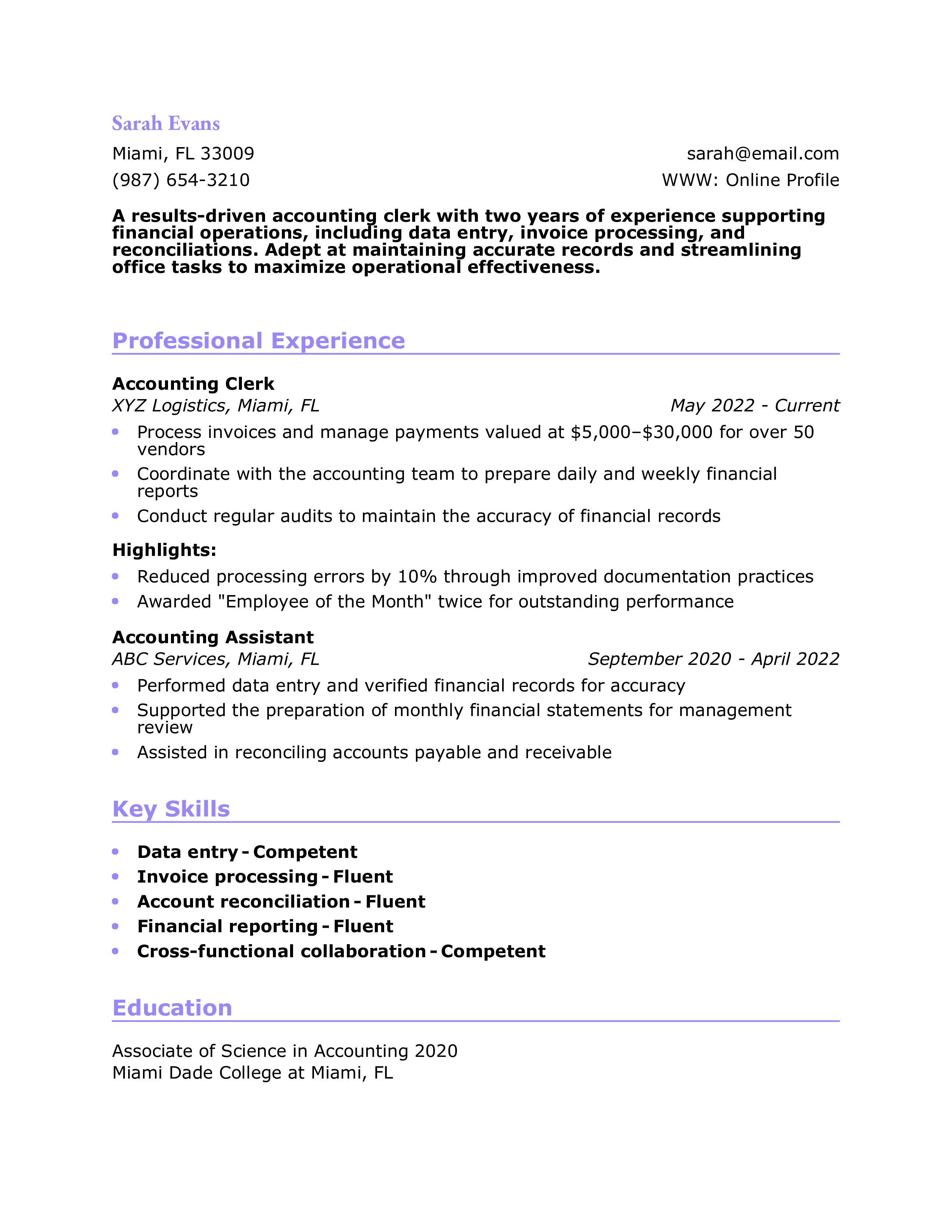

Accounting Clerk Resume

Why This Accounting Clerk Resume Works

This resume displays the candidate’s comprehensive knowledge of financial reporting and invoice processing. The concise bullet points effectively demonstrate their ability to reduce errors and maintain accurate records. Learn more about accounting clerk resumes here.

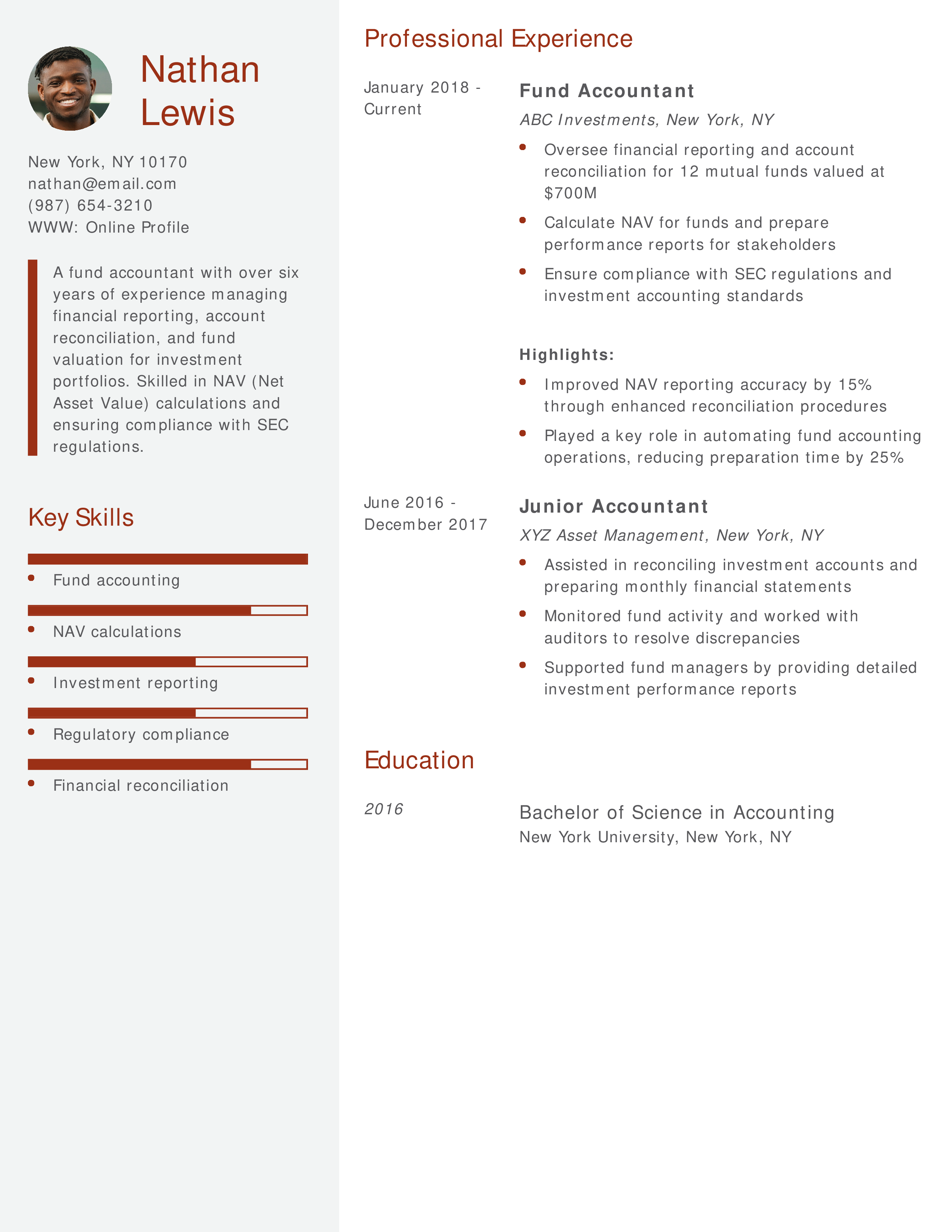

Fund Accountant Resume

Why This Fund Accountant Resume Works

This resume highlights the candidate’s expertise in fund accounting and regulatory compliance. Measurable achievements, such as improving reporting accuracy and automating processes, demonstrate their ability to deliver results. Explore tips for fund accountant resumes here.

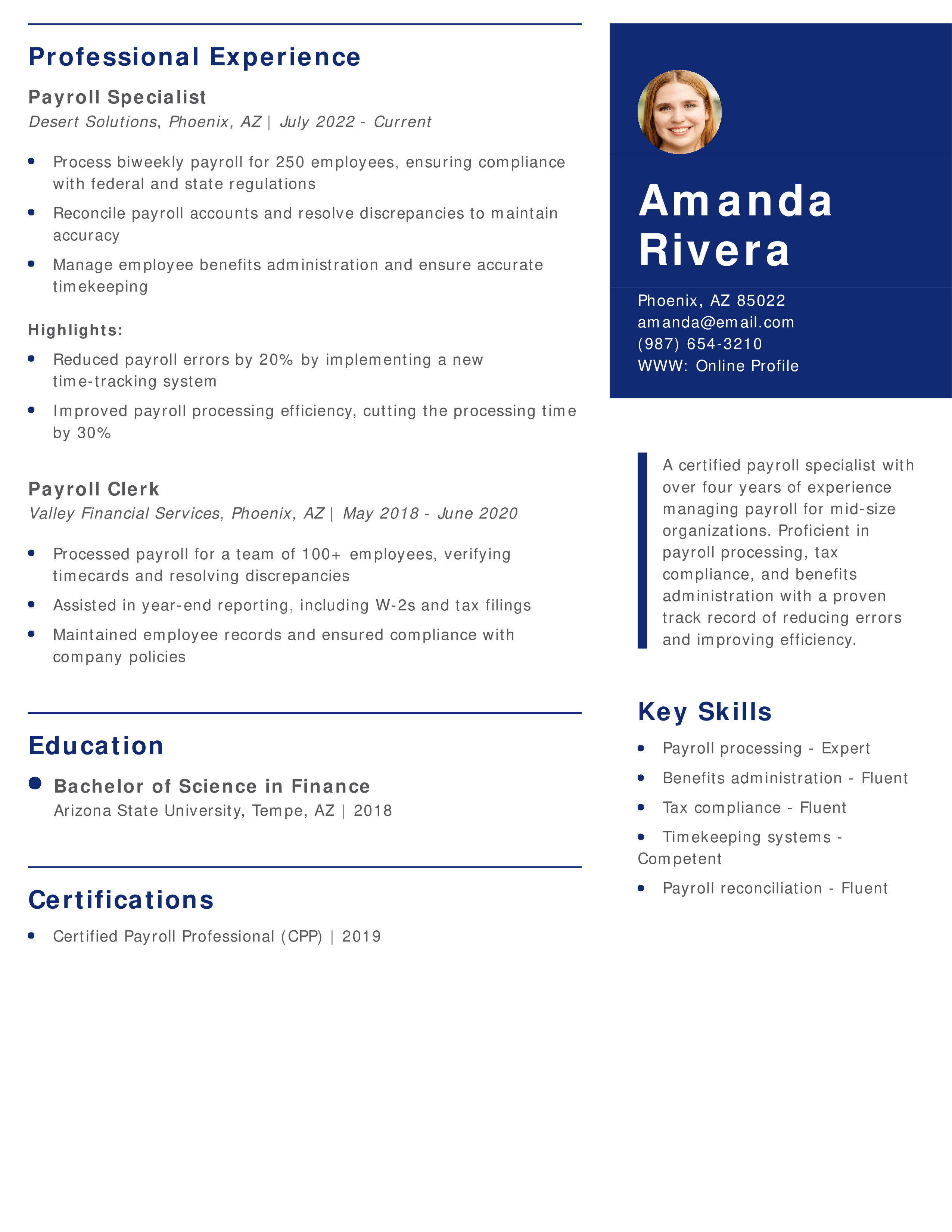

Payroll Specialist Resume

Why This Payroll Specialist Resume Works

This resume showcases the candidate’s ability to handle complex payroll functions while improving accuracy and efficiency. Quantifiable achievements such as reducing errors and streamlining processes strengthen this example. Learn more about payroll specialist resumes here.

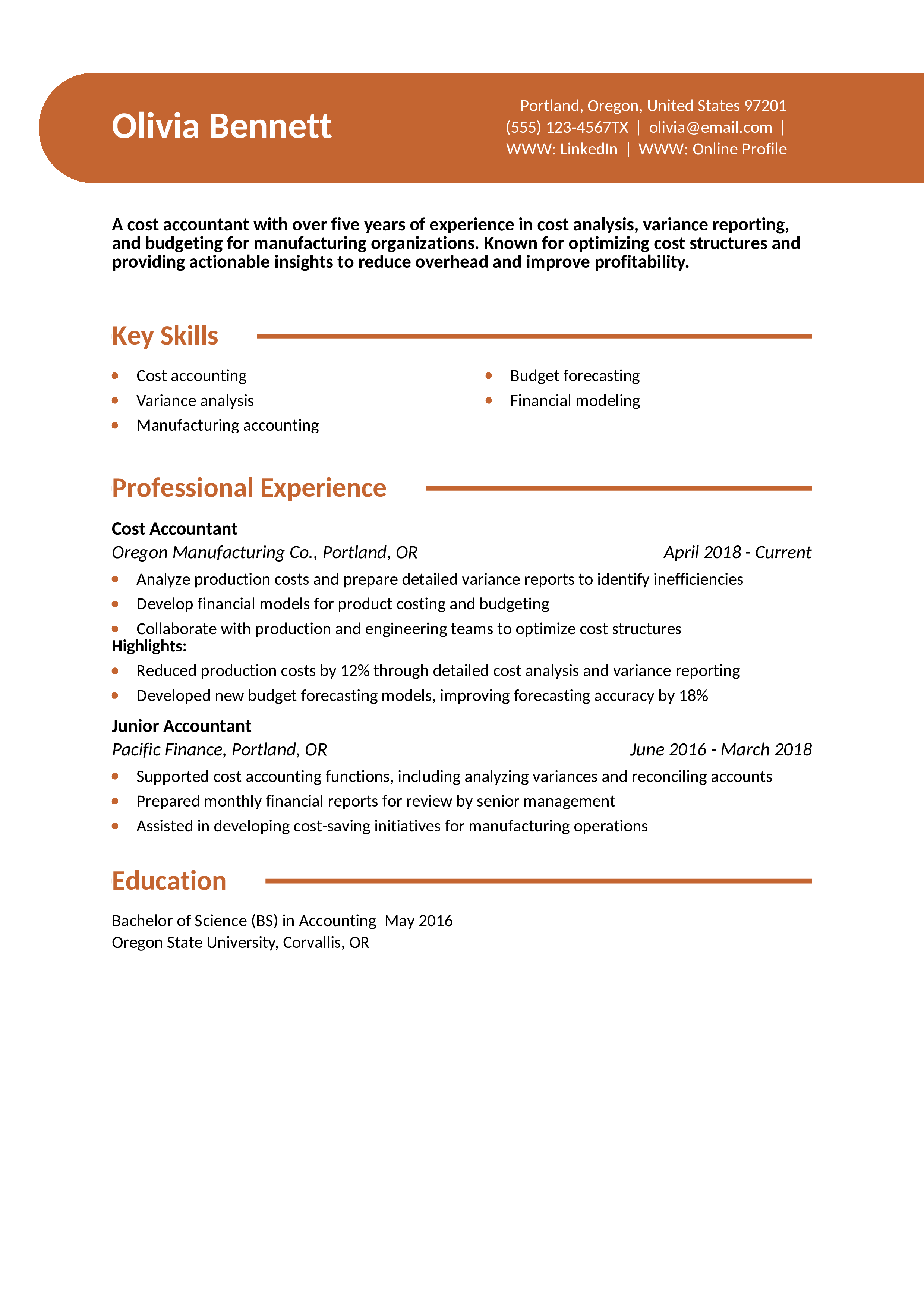

Cost Accountant Resume

Why This Cost Accountant Resume Works

This resume effectively highlights the candidate’s experience in manufacturing accounting and their ability to deliver actionable cost-saving recommendations. The quantifiable impact on production costs demonstrates their value to employers. Learn more about writing cost accountant resumes here.

Accounting Analyst Resume

Why This Accounting Analyst Resume Works

This resume emphasizes the candidate’s ability to deliver insights through data analysis and improve reporting accuracy. The quantifiable savings and reduced errors highlight the applicant’s ability to drive business performance. Explore more accounting analyst resume tips here.

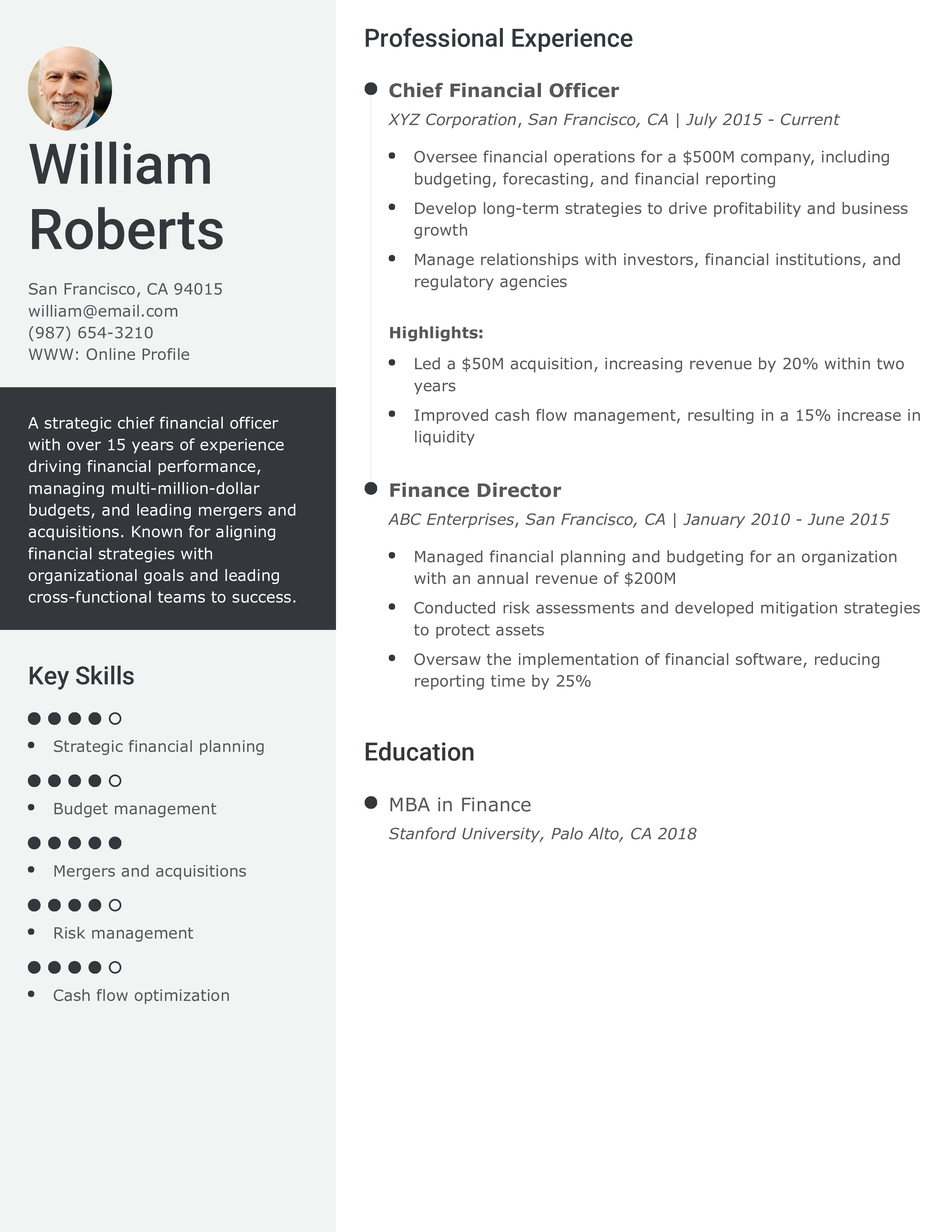

Chief Financial Officer (CFO) Resume

Why This CFO Resume Works

This resume highlights the candidate’s extensive leadership experience and their ability to deliver measurable business results. The accomplishments in mergers and acquisitions and cash flow optimization demonstrate strong financial leadership. Learn more about CFO resumes here.

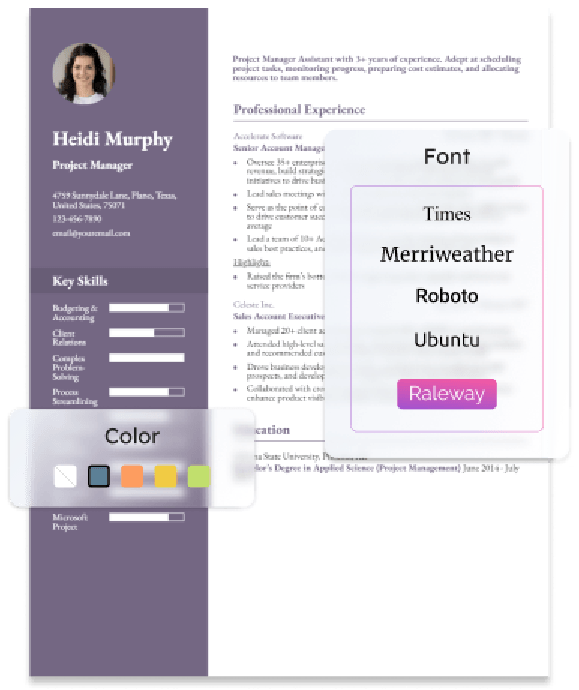

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Accountant Text-Only Resume Templates and Examples

How To Write an Accountant Resume

Accountant resumes that skip scale make it hard to understand your experience. Tell me the size of books, number of entities, or audit results. Context turns generic bullets into convincing ones.

1. Craft an outstanding profile with a summary of your accountant qualifications

In a brief paragraph at the top of your resume, the Profile should name three to five key reasons why you deliver strong accounting oversight and support. By showcasing your top qualifications this way, you can assure target employers you’re a fit for the accountant role they want to fill.

For example, maybe you have a reputation for helping businesses find and remove unnecessary costs. Or perhaps you’ve worked on successful initiatives for better legal compliance. Alternatively, you may have years of experience with startup budgets, and that’s a key focus of the accounting jobs you’re now after. You can also cite reasons outside your accounting work experience – for instance, a recently finished master’s degree or advanced certification that sets you apart.

Mid-Career Profile Example

Organized accounting professional with a record of success helping clients decrease costs, balance books, and reconcile accounts. Naturally curious and committed to gaining and applying new expertise. Bilingual: Fluent in English and Spanish.

Senior-Level Profile Example

Certified public accountant (CPA) dedicated to raising companies’ bottom lines. Skilled at preparing financial reports, reconciling accounts, collecting money owed, and completing special projects. Adapt readily to new work challenges and industry conditions.

2. Add a compelling section featuring your accountant experience

Under each past accounting job, give quantified examples of your helping people or organizations improve their financial position. For example, you may have developed cost analyses that enabled your organization to improve its bottom line. Perhaps you designed a system to prepare your taxes faster and more accurately. Or you depleted a backlog of late payments. Examples like these show hiring managers you can generate similar fiscal solutions for their company.

For any non-accounting jobs in your recent work history, focus your description on the transferable skills you gained. Say you worked as a receptionist – you could use this job description to emphasize client relations, careful documentation, or any other skill areas you expect to use in your next accounting job.

Entry-Level Experience Example

Accounting intern, Woolworth’s Incorporated, Los Angeles, CA | August 2021 to present

- Help prepare debit and credit documents for over 100 clients

- Facilitate weekly audit of varying accounts to ensure accuracy

- Organize and maintain records for many clients and vendors

- Collaborate with other interns on key projects

- Perform complex accounting procedures and assist support staff

Highlights:

- Ranked No. 3 out of 15 team members for both efficiency and accuracy

- Helped team leader develop four new initiatives for better internal communications and organization

Mid-Career Experience Example

Accounting Specialist, XYZ Accountants, Sacramento, CA | January 2012 to present

- Ensure accuracy of all transactions with clients, vendors, and employees

- Collaborative role working closely with managers and other staff members

Highlights:

- Identified and averted over $250,000 in lost revenue from bank errors

- Won “Accounting Expert of the Month” five times for outstanding diligence and accuracy

- Enhanced client relationships by actively addressing and resolving late payments

3. Include accountant-related education and certifications

View the Education and Certifications sections as another chance to show your expertise in supporting clients’ or employers’ financial health. Give at least the basic details on your highest degree in finance or accounting and any other postsecondary degrees you’ve earned. Also, share details on your CPA or other accounting-related certifications. With these credentials on your resume, you can assure hiring managers you’ll draw on a solid knowledge base when offering financial analysis and solutions.

Below are templates and examples to help you format your education and certification details. Note that optional template items appear in [brackets].

Education

Template

- Degree Name — [Concentration], School Name, City, ST | [Year]

- [#.# GPA] | [academic honors or awards]

Example

- Bachelor of Science (BS) — Accounting (minor in Business Administration), Los Angeles University, Los Angeles, CA | 2022

Certification

Template

- Certification Name or Title, [Awarding Organization] | [Year]

Example

- CPA, Association of Certified Public Accountants

4. Outline your most useful accountant skills and proficiencies

Include a “Key Skills” section on your resume to show the various ways you help build and ensure financial success. For most accountants, this section should cover expense reduction, financial reporting, and complex problem-solving. You may also want to name the specific technical programs or accounting software you’ve used, like advanced Excel or QuickBooks (but if you have five or more, consider making them their own “Technical Skills” section). Below are some common accounting skills you may add to your “Key Skills” section:

| Key Skills and Proficiencies | |

|---|---|

| Accounting software (QuickBooks, Quicken) | Account reconciliation |

| Accounts payable and receivable | Advanced mathematics |

| Budget planning and forecasting | Client relations |

| Complex problem-solving | Cost reduction and elimination |

| Data gathering and analysis | Efficiency improvement |

| Financial report preparation | General ledger accounting |

| Generally Accepted Accounting Principles (GAAP) | Microsoft Office Suite |

| Process streamlining | Project management |

| Regulatory and corporate compliance | Reporting and documentation |

| Risk management and mitigation | Spreadsheets |

| Tax return preparation | Team collaboration |

| Time management | |

How To Pick the Best Accountant Resume Template

As with most vocations, accountants should use a resume template that’s clear and straightforward. Opt for a visual design that lets the hiring manager quickly review your most impressive career details. Use a simple resume font, and avoid any template that has an overly colorful or elaborate design.

Frequently Asked Questions: Accountant Resume Examples and Advice

What are common action verbs for accountant resumes?-

One of the best ways to enhance your resume is by using a good mix of action verbs in your Experience section. Strong verbs for accountants include “secure,” “reconcile,” and “reinforce.” The following list will help you brainstorm and write about the various ways you’ve made an impact in your accounting career so far:

| Action Verbs | |

|---|---|

| Acquire | Audit |

| Avert | Avoid |

| Create | Develop |

| Distribute | Earn |

| Enhance | Estimate |

| Evaluate | Examine |

| Forecast | Garner |

| Generate | Improve |

| Invoice | Manage |

| Organize | Prepare |

| Prevent | Produce |

| Reconcile | Reinforce |

| Report | Schedule |

| Secure | Stabilize |

| Strengthen | Update |

| Verify | |

How do you align your accountant resume with a job posting?-

The Bureau of Labor Statistics forecasts that jobs for accountants will increase by about 6% between 2021 and 2031. This growth rate is roughly the same as the average for all U.S. vocations.

You can get more interviews in this growing field if you tailor your resume to each application. For example, if the job post calls for someone with a collaborative streak, you may want to emphasize that aspect of your experience in your Profile and Key Skills sections. Or say the company has many non-English speaking clients or business partners. In that case, highlight your foreign language skills both in your Profile and as a separate section farther down the document. With adjustments like these, you can make your resume more relevant to each opportunity in your job search.

What is the best accountant resume format?-

In nearly all cases, use a Combination (or Hybrid) resume because it’s easiest for hiring managers to learn about your relevant skills and experience. It’s also simplest for you to modify based on your job goals. With the Combination format, you highlight your most relevant skills and background in your Experience or Work History section and an intro section. (This combination of work history and intro content is where the format gets its name.) Your resume intro usually should include a Profile summary and Key Skills section, but you may also include an Awards or Career Highlights section.

Should my accountant resume be one or two pages?-

Your accountant resume should ideally be one page, especially if you have fewer than 10 years of experience. A two-page resume can be effective for seasoned professionals with a longer track record if it highlights accomplishments and skills directly relevant to the job. Every detail should add value and strengthen your candidacy.

Limit your work experience to the past 10 to 15 years, unless earlier positions are highly relevant. Keeping your resume concise and targeted will make a strong and memorable impression on potential employers.

To increase your chances of an interview, write a strong cover letter. The key to an effective letter is customizing it based on each job opening. Read our accountant cover letter guide to learn how. For other related examples, see our bookkeeper and finance cover letter guides.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!