Demonstrate your technical experience in evaluating vehicle damage, interfacing with customers, and driving positive business outcomes to build a winning auto insurance claims adjuster resume. Emphasize your comprehensive knowledge of insurance policies and auto repair technology to brand yourself as a subject matter expert within your space. This guide provides a variety of expert tips and advice to help you craft an accomplishment-driven resume that captures the nuances of your professional career.

“Auto insurance claims adjuster resumes should highlight investigative skills, customer communication, and knowledge of policy and liability. Accuracy and empathy matter. ”

Most Popular Auto Insurance Claims Adjuster Resumes

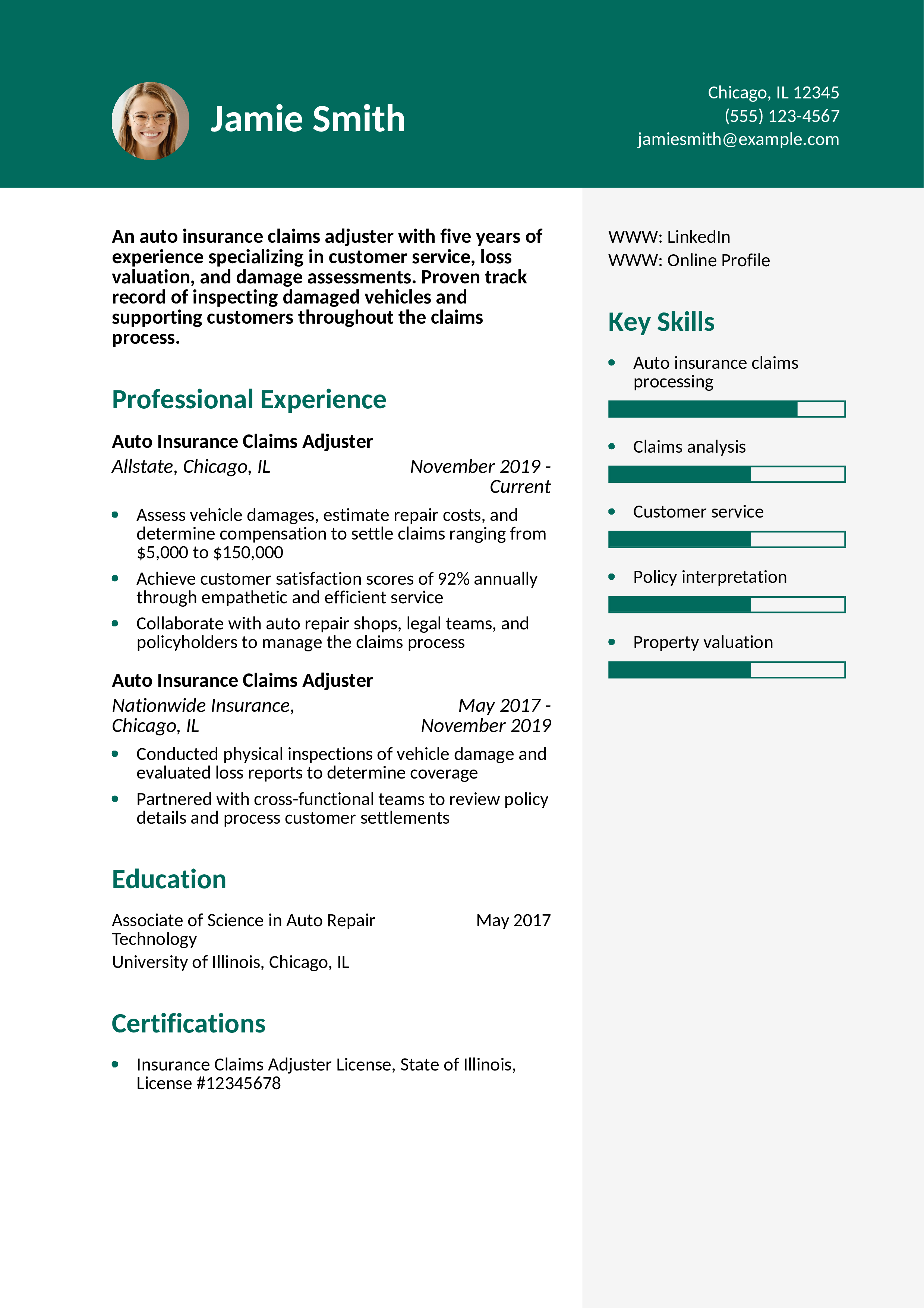

Auto Insurance Claims Adjuster Resume

Why This Resume Is a Great Example

This resume clearly presents years of hands-on experience and focuses on measurable results, like the 92% customer satisfaction rate. The layout is clean and easy to scan. This candidate uses action-oriented language and shows a balance between technical knowledge and client-focused service.

Key Tips

Using specific data like claim values adds credibility to your experience. Not sure what to include in your resume summary? Learn more from this resume summary examples guide.

Liability Claims Adjuster Resume

Why This Resume Is a Great Example

This resume highlights specialized experience in liability claims, showcasing a strong investigative background and legal coordination. The faster-than-average settlement time demonstrates measurable impact.

Key Tips

Including unique qualifications like legal research or personal injury knowledge can differentiate your resume. Learn more about how to list certifications on your resume.

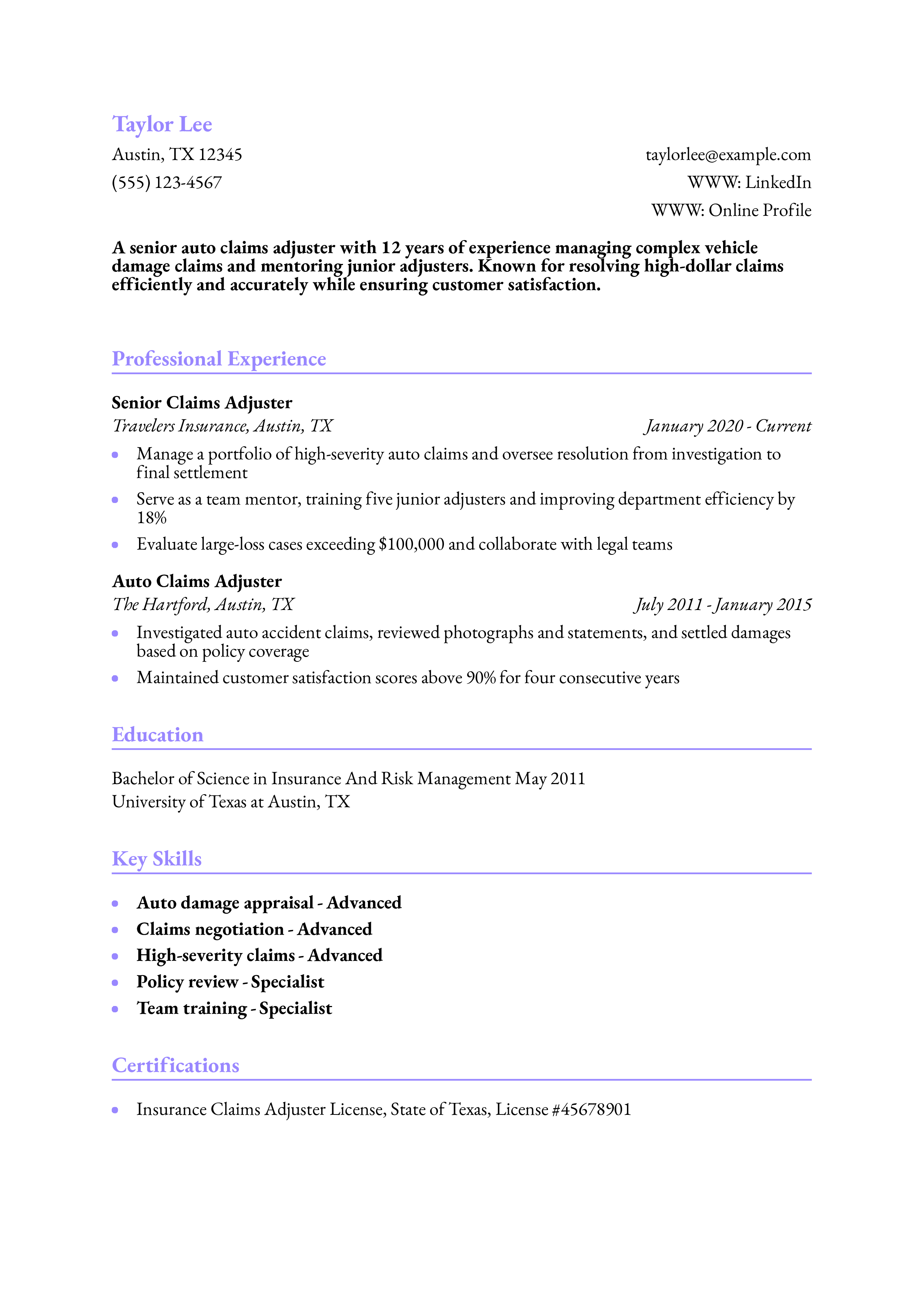

Senior Auto Claims Adjuster Resume

Why This Resume Is a Great Example

This resume demonstrates long-term industry experience and leadership. The ability to handle high-dollar claims while mentoring new staff adds value to potential employers.

Key Tips

When you have leadership responsibilities, include mentorship or team training roles. Learn more in our resume outline examples.

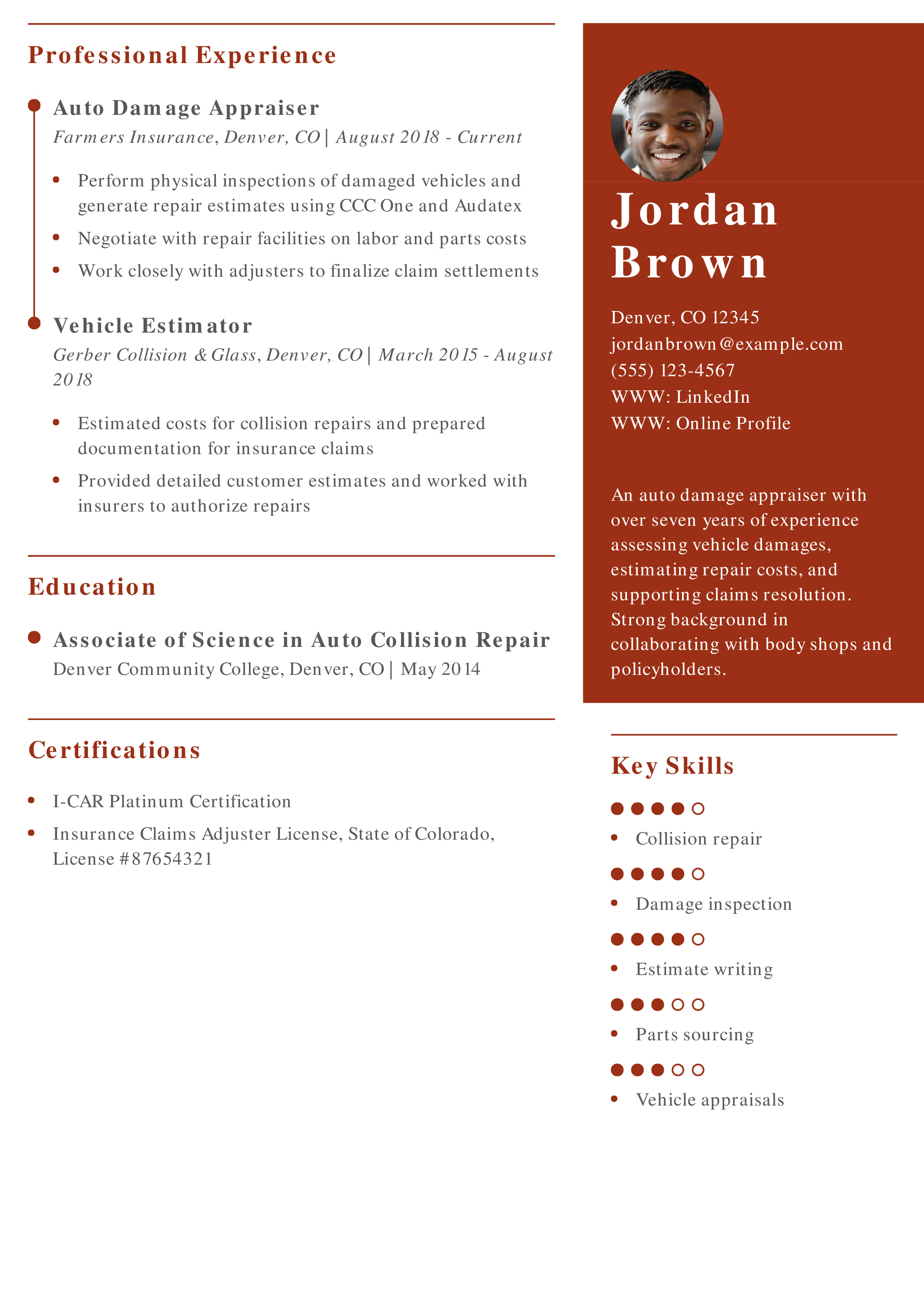

Auto Damage Appraiser Resume

Why This Resume Is a Great Example

This resume effectively outlines technical skills and tools used in the appraisal process, with clear progression and industry-specific knowledge.

Key Tips

When using industry-specific tools, be sure to name them. It helps hiring managers understand your capabilities. Need help formatting your resume? Check out our guide on the best resume formats.

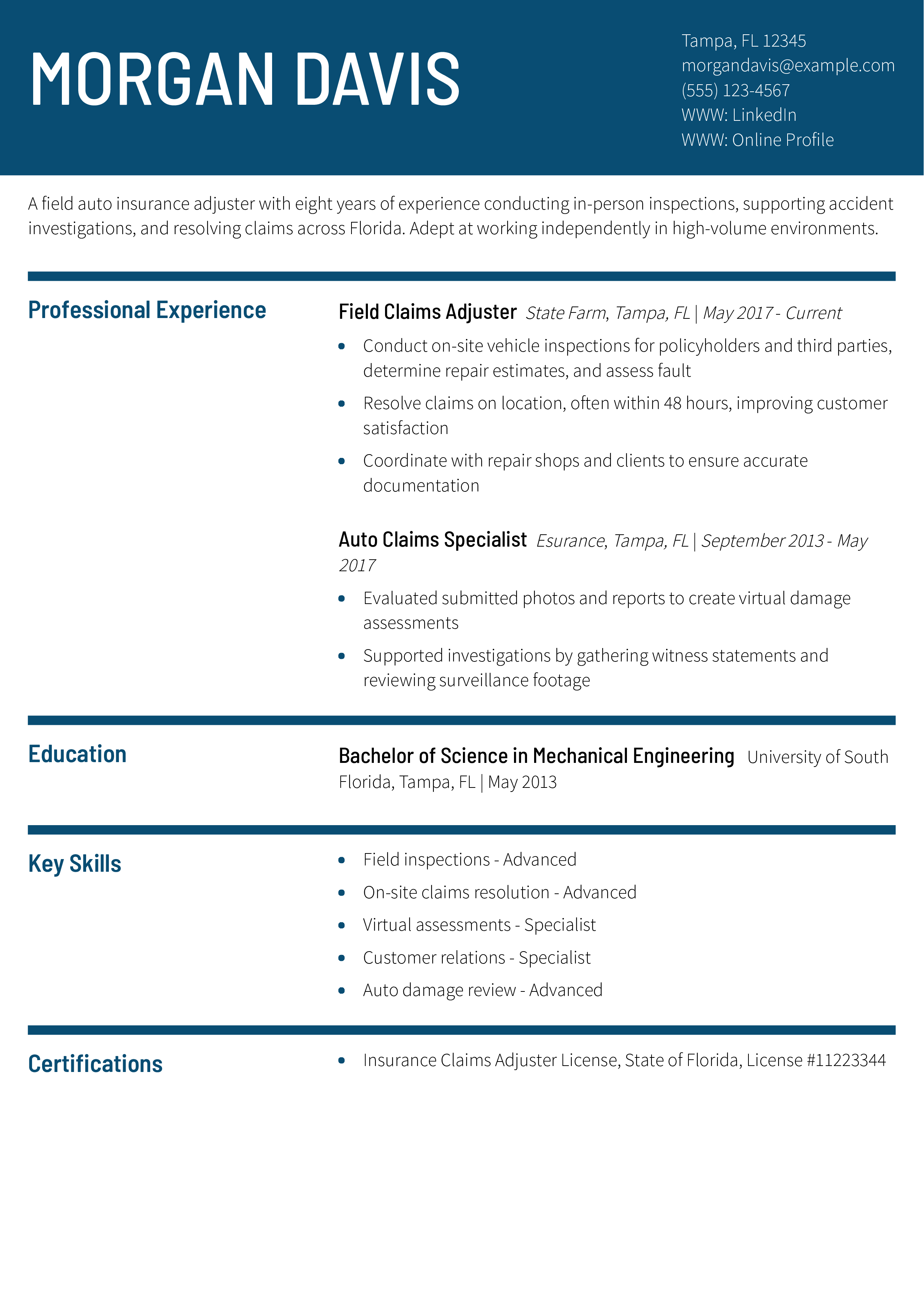

Auto Insurance Field Adjuster Resume

Why This Resume Is a Great Example

This resume focuses on fieldwork and independence, highlighting quick resolution rates and strong technical inspection capabilities.

Key Tips

Emphasize roles where you had autonomy and handled decisions in the field. For more tips, explore how to make a resume.

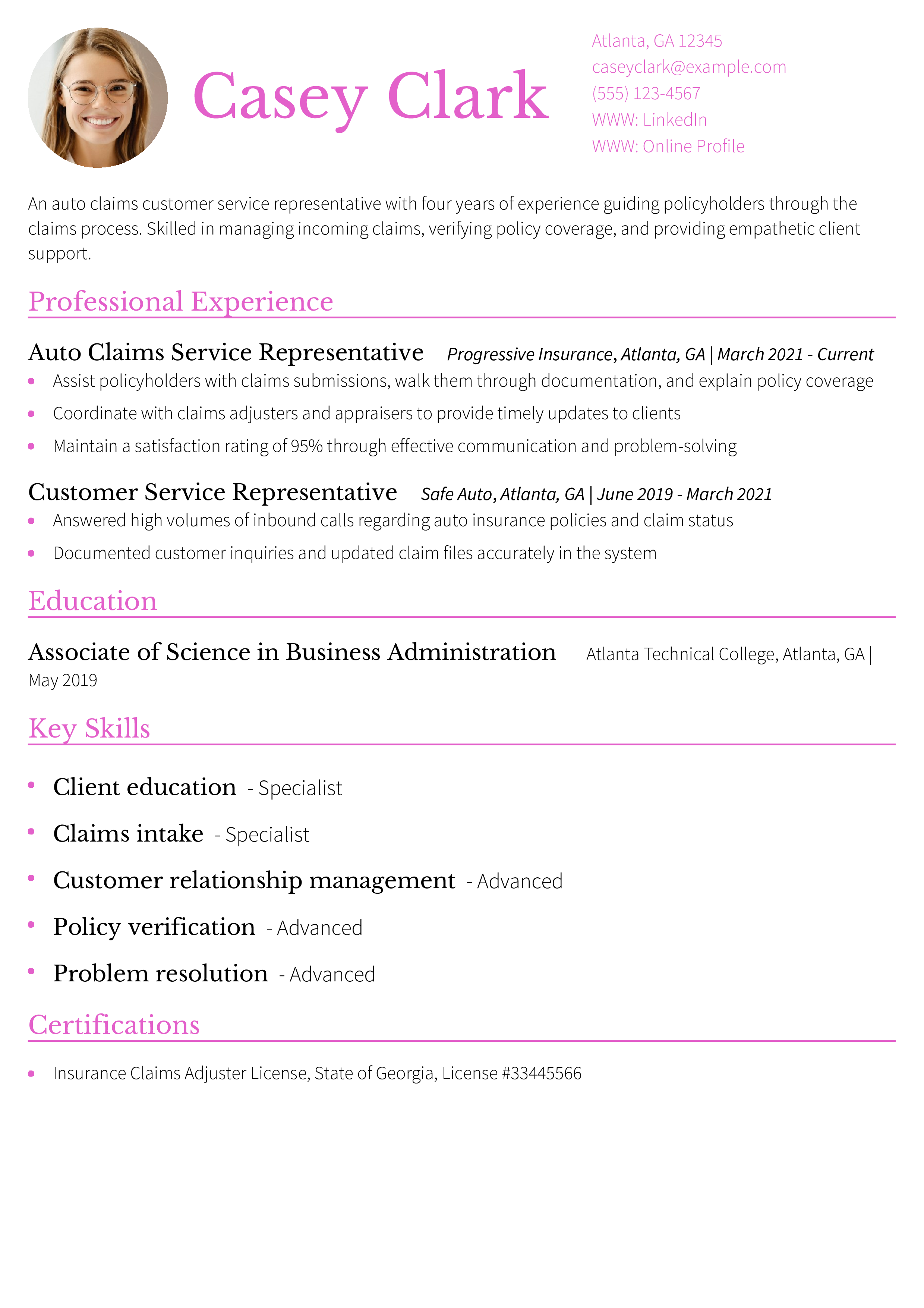

Auto Claims Customer Service Representative Resume

Why This Resume Is a Great Example

This resume prioritizes customer service, which is essential in auto claims roles. It also clearly shows progression and increasing responsibility.

Key Tips

Tailor your resume to highlight customer-facing skills if you're in a support-heavy role. For guidance, see this article on customer service skills for resumes.

Auto Insurance Subrogation Specialist Resume

Why This Resume Is a Great Example

This resume emphasizes niche skills in subrogation, demonstrating financial impact through recovery statistics. It's clearly focused and shows subject matter expertise.

Key Tips

If you specialize in a technical claims area like subrogation, highlight your recovery success. Learn more about what to put on a resume.

Auto Claims Estimator Resume

Why This Resume Is a Great Example

This resume shows a strong technical foundation in auto damage estimating and connects that skill set directly to insurance claims resolution.

Key Tips

Including the tools you use, such as CCC One or Audatex, makes your resume more relevant. For more advice, check out the best font and layout tips for resumes.

Auto Insurance Bodily Injury Adjuster Resume

Why This Resume Is a Great Example

This resume presents specialized experience with bodily injury claims and legal coordination. The candidate's ability to manage sensitive claims is clearly demonstrated.

Key Tips

Use industry language (like “caseload” or “settlement negotiation”) when appropriate. Need help with your education section? Learn how to list your education on a resume.

Auto Total Loss Adjuster Resume

Why This Resume Is a Great Example

This resume highlights the unique responsibilities and challenges of handling total loss claims, including working with vendors and providing client education.

Key Tips

For niche claims roles, describe the lifecycle of a claim from start to finish. Learn more in this guide on how far back your resume should go.

Auto Insurance Quality Assurance Specialist Resume

Why This Resume Is a Great Example

This resume shows a clear transition from frontline adjuster to QA, emphasizing analytical and regulatory skills. It highlights the impact of quality work in claims handling.

Key Tips

When transitioning roles, make sure to show transferable skills and new responsibilities. Check out how to list relevant coursework on a resume for more ways to showcase niche knowledge.

Auto Claims Litigation Specialist Resume

Why This Resume Is a Great Example

This resume effectively showcases legal expertise within a claims environment and demonstrates responsibility for high-risk litigation matters.

Key Tips

Litigation roles require showing you can handle complexity and detail. Learn more in this resume skills guide.

Auto Insurance Catastrophe Adjuster Resume

Why This Resume Is a Great Example

This resume captures the urgency and scale of catastrophe claims work while emphasizing efficiency and field readiness.

Key Tips

If you’ve worked on disaster events, highlight volume and deployment timelines. See our resume interests section guide to learn how to include availability or field-readiness traits.

Auto Insurance Claims Investigator Resume

Why This Resume Is a Great Example

This resume shows a career focus on investigation and fraud prevention, which is essential in protecting insurers from loss.

Key Tips

If you're in a fraud-focused role, emphasize how your work helps prevent company losses. Read this guide on how to list certifications for more examples.

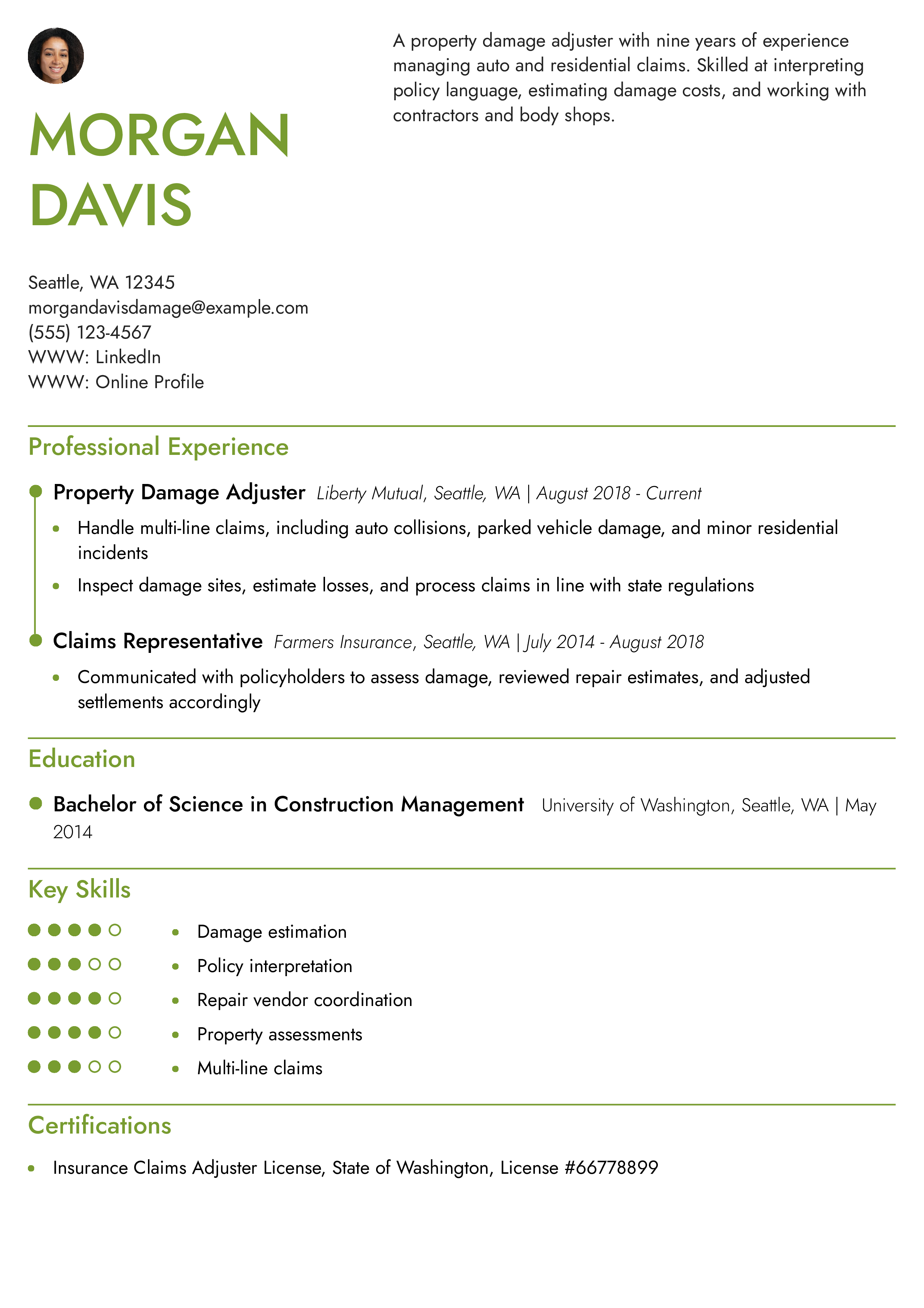

Auto Property Damage Adjuster Resume

Why This Resume Is a Great Example

This resume effectively combines auto and property damage experience, showing flexibility and strong estimation skills.

Key Tips

Including multi-line claims experience adds versatility to your resume. Learn how to better position your experience with this resume objective examples guide.

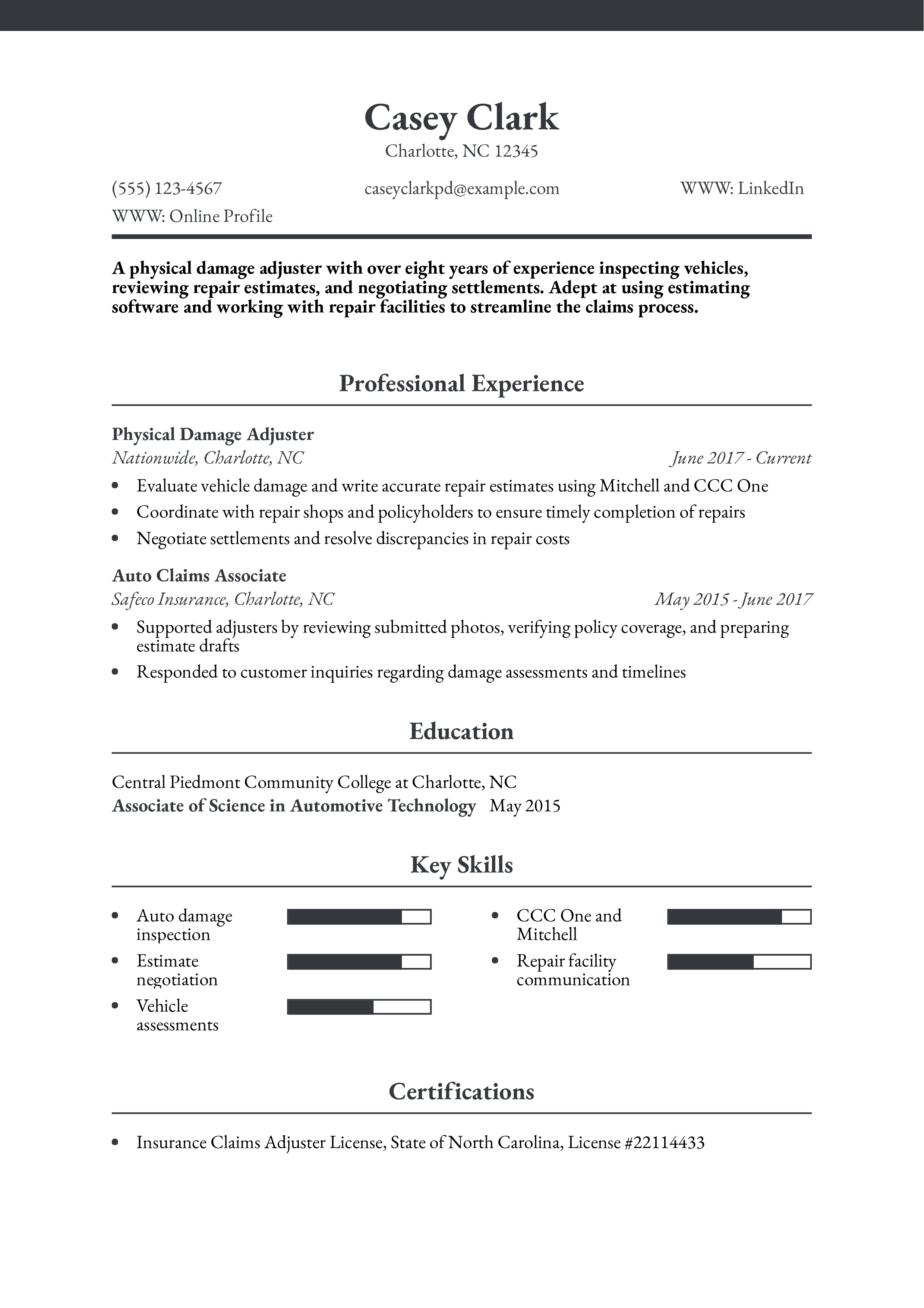

Auto Physical Damage Adjuster Resume

Why This Resume Is a Great Example

This resume highlights practical experience with estimating tools and emphasizes the adjuster's ability to coordinate between shops and clients.

Key Tips

When you're skilled in specialized tools like Mitchell or CCC, list them under skills. Learn more about presenting technical abilities in this technical skills for resumes guide.

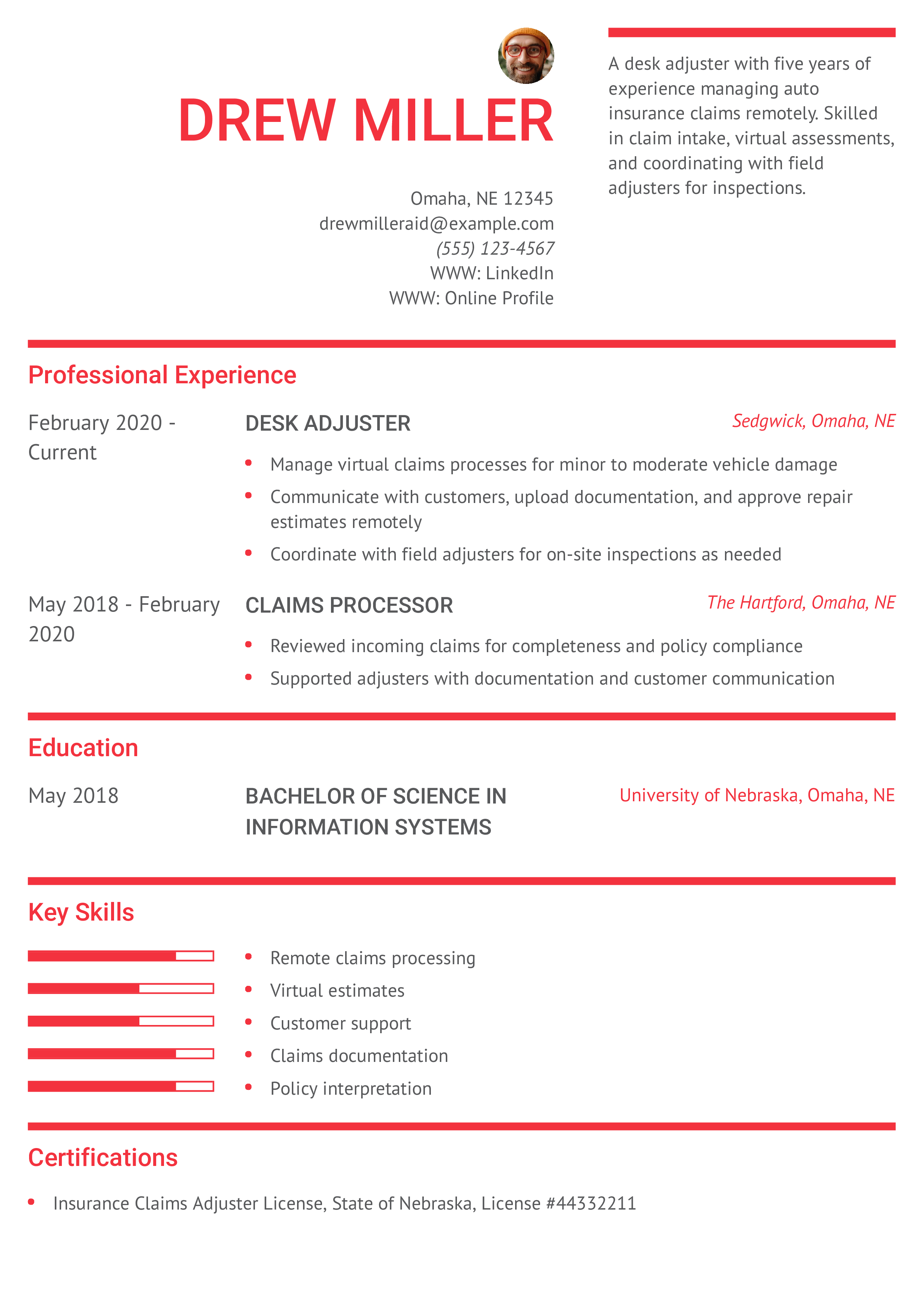

Auto Insurance Desk Adjuster Resume

Why This Resume Is a Great Example

This resume demonstrates a strong command of remote tools and workflows, which is essential for modern claims teams.

Key Tips

Remote roles should highlight communication and tech fluency. Learn more about document structure in our resume outline examples guide.

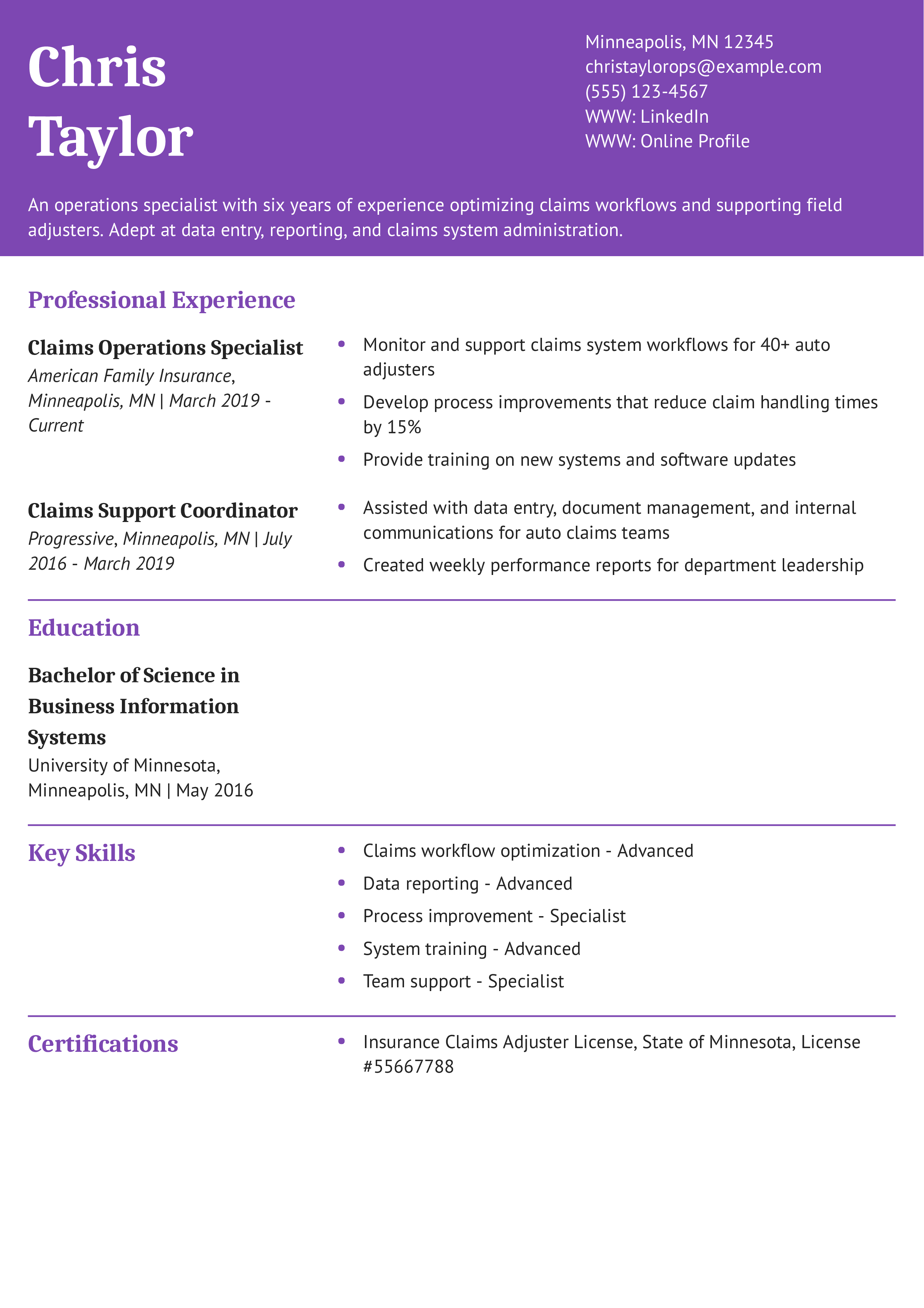

Auto Claims Operations Specialist Resume

Why This Resume Is a Great Example

This resume focuses on behind-the-scenes roles that keep claims departments running efficiently. It shows value even without direct claim handling.

Key Tips

Highlight process improvements and reporting responsibilities. See how to structure content like this in our best resume formats guide.

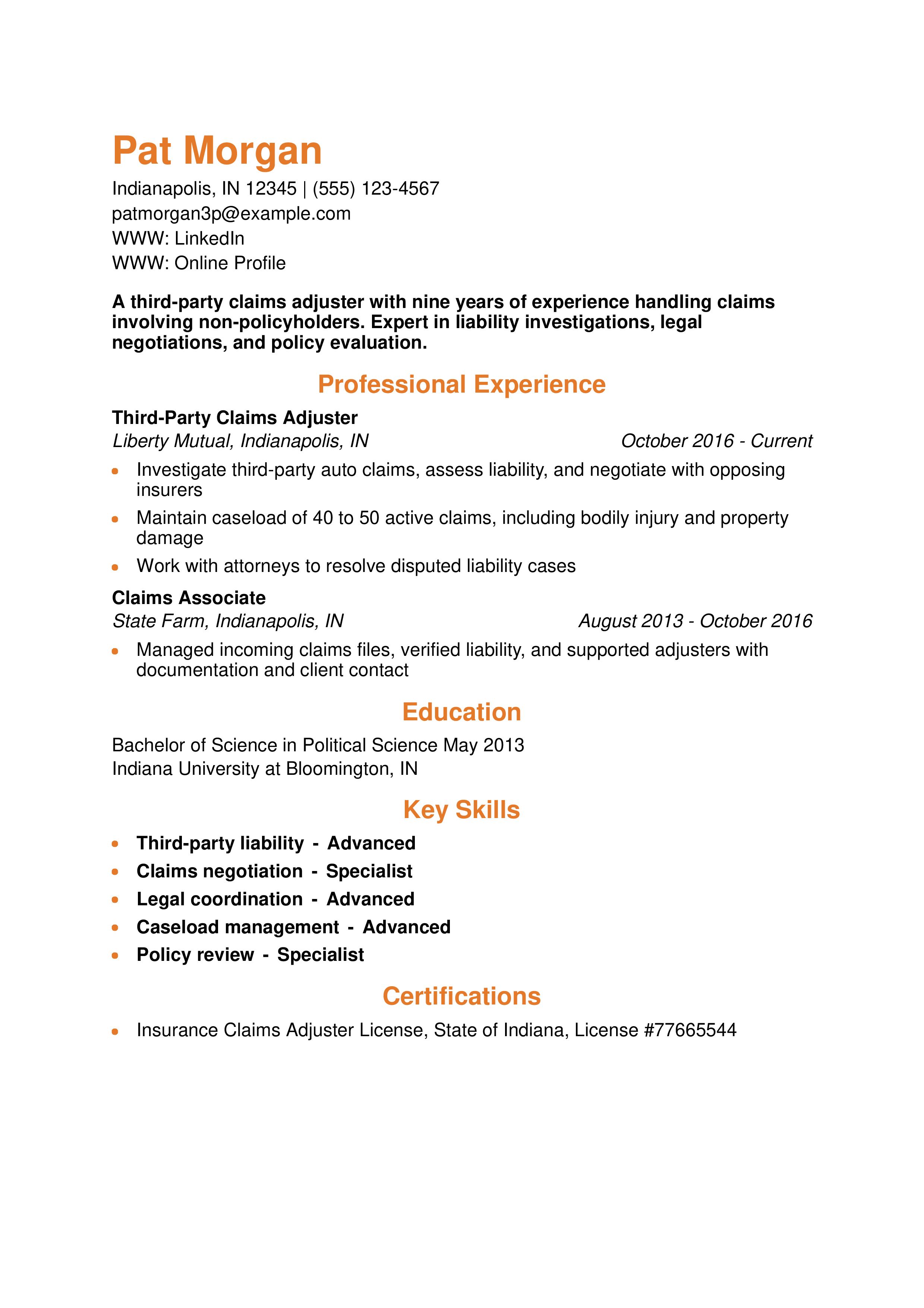

Auto Third-Party Claims Adjuster Resume

Why This Resume Is a Great Example

This resume shows deep experience in managing non-policyholder claims, which require additional investigation and communication skills.

Key Tips

Highlighting who you serve — policyholders or third parties—can clarify your niche. Learn more about what hiring managers expect in this how to make a resume guide.

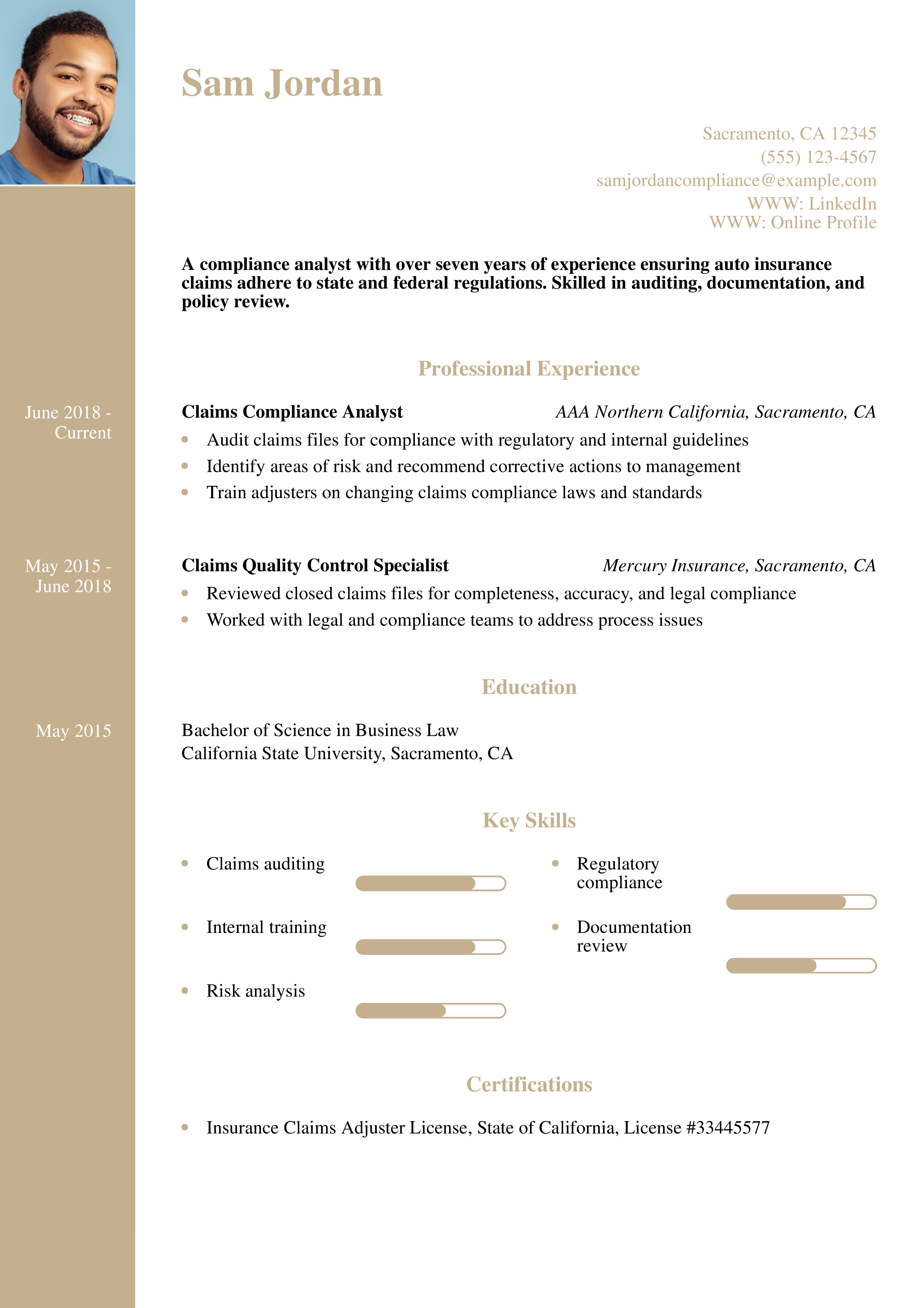

Auto Claims Compliance Analyst Resume

Why This Resume Is a Great Example

This resume highlights compliance expertise, which is a critical support function for insurance carriers. The candidate’s ability to lead training adds even more value.

Key Tips

If you're in a regulatory or legal support role, focus on accuracy and compliance. Need help with formatting? Explore our resume language skills guide.

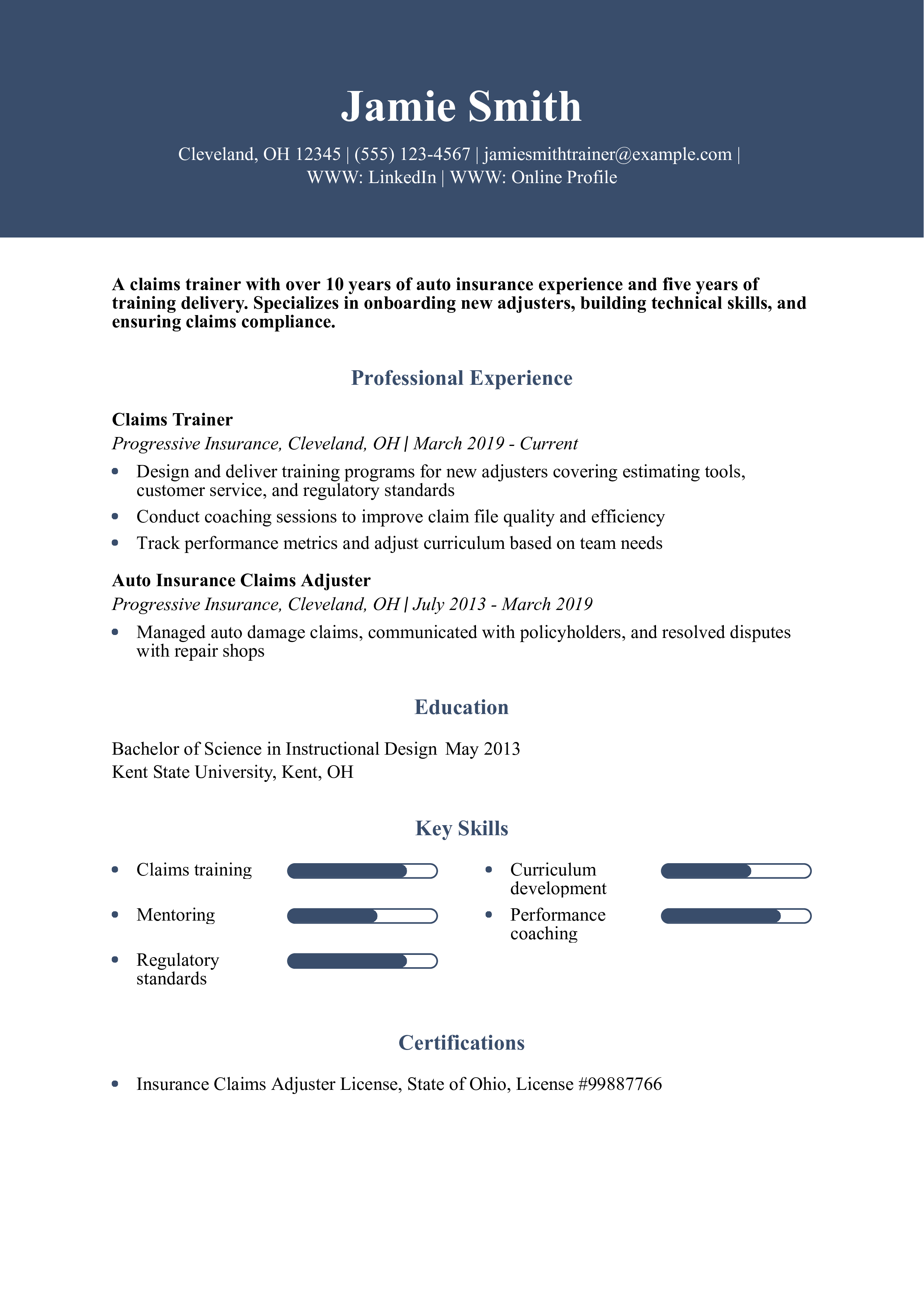

Auto Insurance Claims Trainer Resume

Why This Resume Is a Great Example

This resume combines technical claims knowledge with instructional experience, showing the candidate’s ability to build teams and improve performance.

Key Tips

When you’ve trained others, highlight curriculum creation and measurable learning outcomes. Learn how to structure this section in our how to list certifications guide.

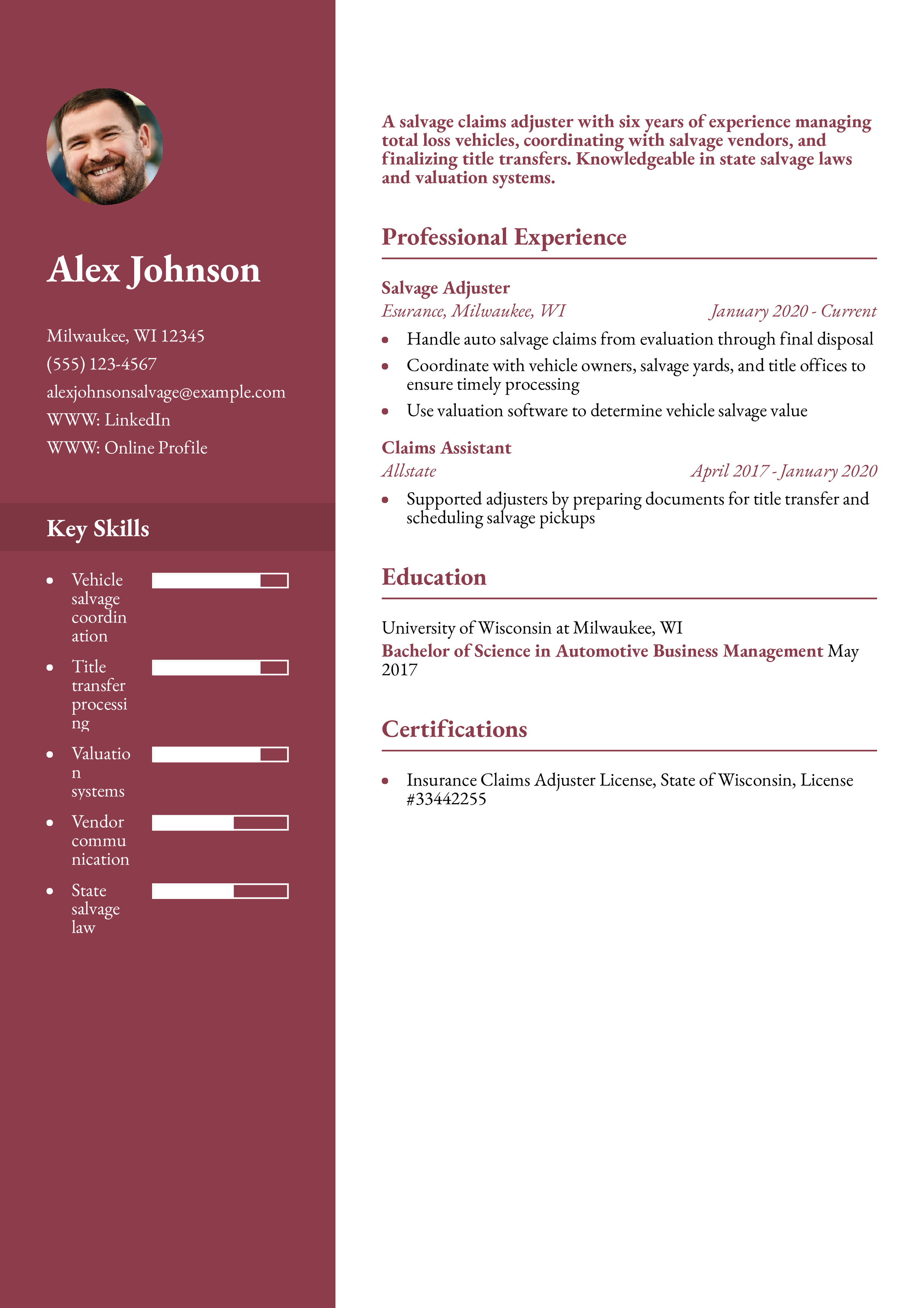

Auto Salvage Claims Adjuster Resume

Why This Resume Is a Great Example

This resume demonstrates expertise in a specific, often overlooked part of the auto claims process — salvage handling. It showcases administrative and technical skills clearly.

Key Tips

Specialty claims roles like salvage benefit from showing procedural knowledge. Learn how to position this info using our resume objective examples guide.

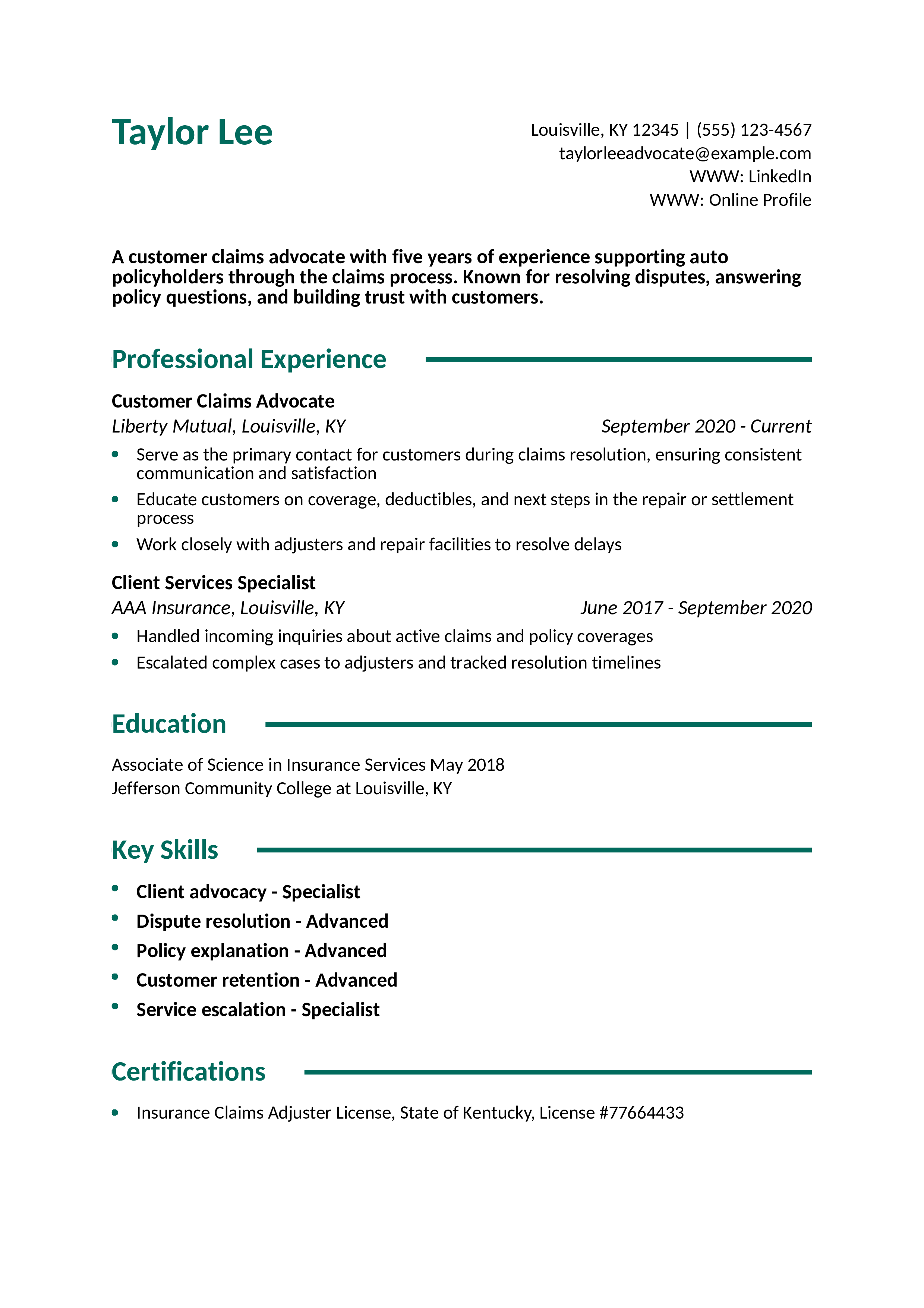

Auto Insurance Customer Claims Advocate Resume

Why This Resume Is a Great Example

This resume stands out for its focus on client experience and clear examples of proactive problem-solving in claims support.

Key Tips

If your strength is communication, frame your experience around building customer trust. For more advice, check out our soft skills for resumes guide.

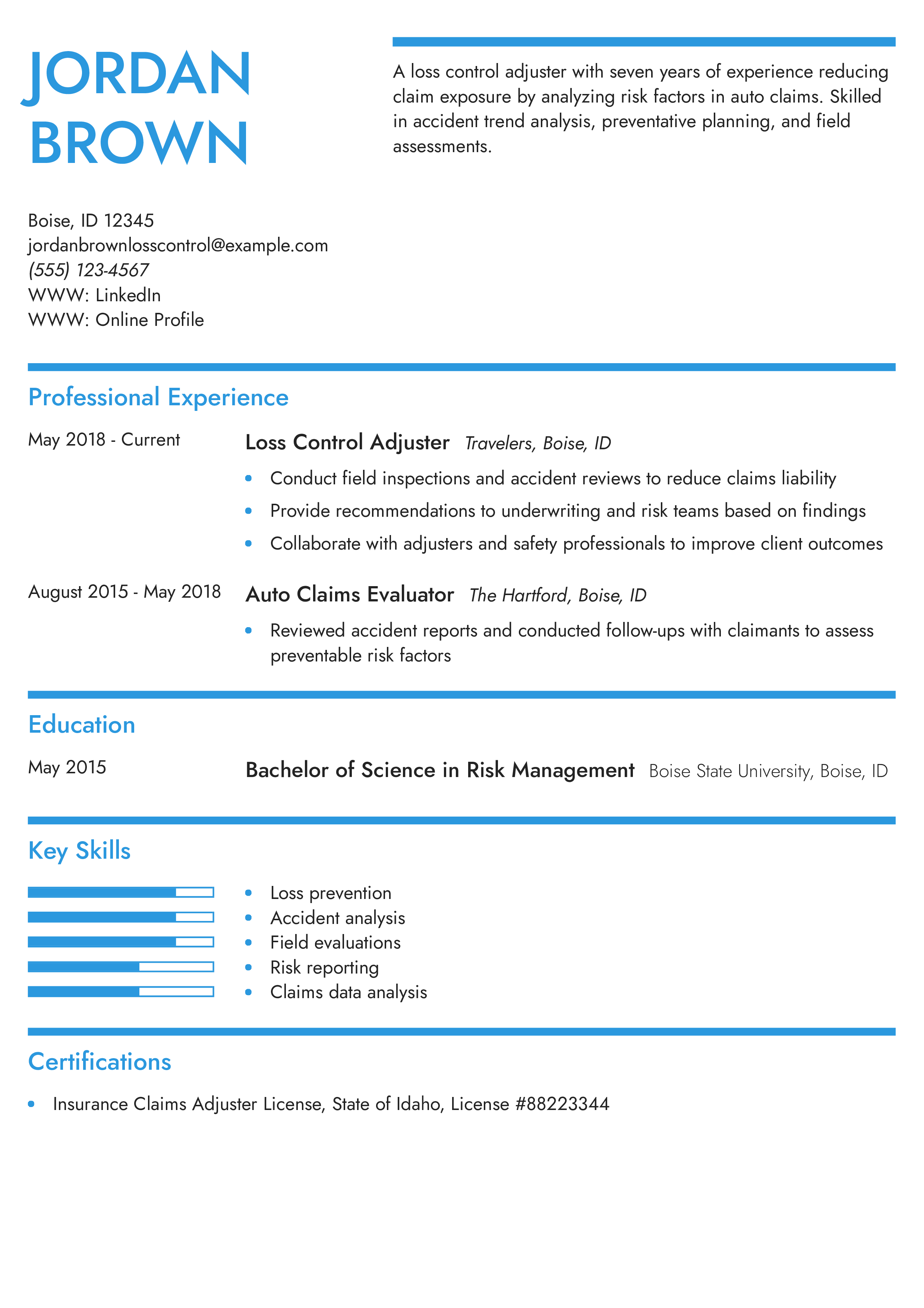

Auto Insurance Loss Control Adjuster Resume

Why This Resume Is a Great Example

This resume highlights the role of prevention in the claims process — a unique angle that emphasizes long-term thinking and impact.

Key Tips

If you’ve worked in a proactive claims role, highlight data analysis and recommendations. Learn how to strengthen this section with our what to put on a resume guide.

Auto Claims Support Specialist Resume

Why This Resume Is a Great Example

This resume focuses on attention to detail and organizational impact, showing how essential support roles are in claims departments.

Key Tips

Highlight behind-the-scenes responsibilities that keep operations running smoothly. Need help emailing your resume? Check out this guide on how to email a resume.

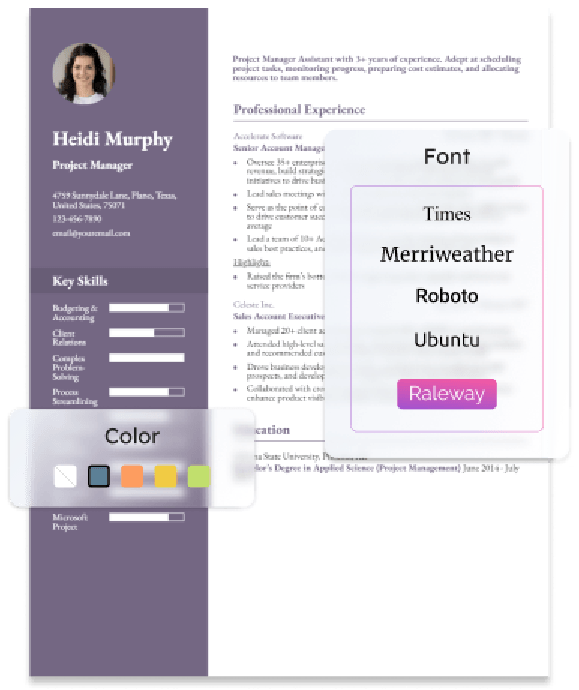

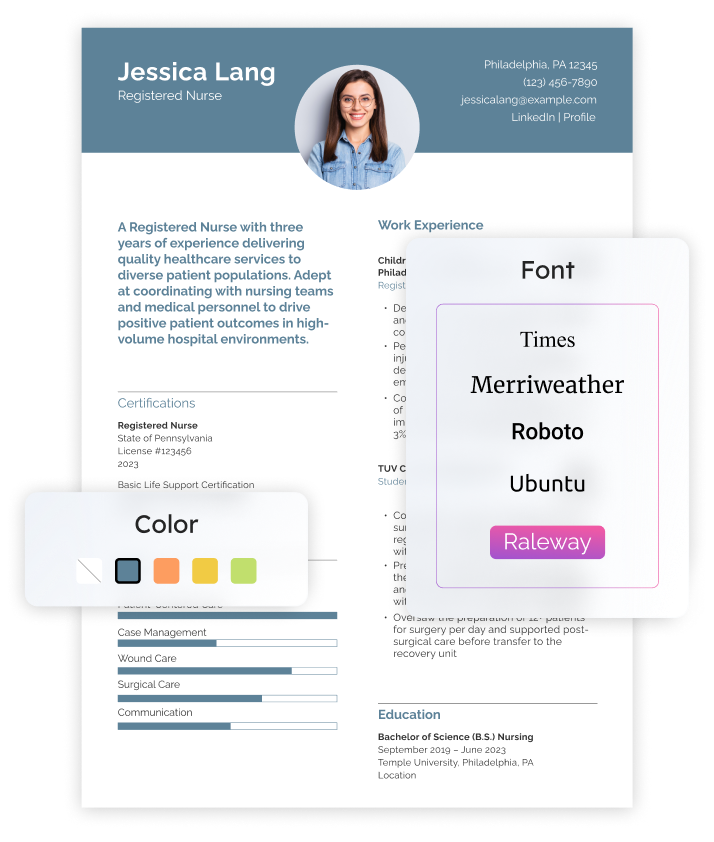

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Auto Insurance Claims Adjuster Text-Only Resume Templates and Examples

How To Write an Auto Insurance Claims Adjuster Resume

Quantify claims handled, faster resolution cycles, and strong estimate accuracy. Meeting resolution targets while keeping reopen rates low reflects balanced judgment.

1. Create a dynamic profile summarizing your auto insurance claims adjuster qualifications

Use this section to succinctly outline your experience, including how many years you’ve worked with vehicles or in the insurance industry. Highlight capabilities that make you a valuable candidate for this role, such as negotiation skills, vehicle knowledge, and proficiency with relevant claim or estimation software.

The profile summary should be short. Keep it to four sentences or fewer, and make every word count. Consider peppering in some action verbs or relevant skills with phrases such as “appraised property values” or “analyzed claims exposure” to demonstrate your experience and segue into the rest of your resume.

Senior-Level Profile Example

An Auto Insurance Claims Adjuster with 10+ years of experience specializing in auto repair, insurance claims analysis, policy interpretation, and damage assessment. A proven track record of serving as an SME for auto insurance claims, liability, and property valuations.

Entry-Level Profile Example

An Auto Insurance Claims Adjuster with five years of professional experience specializing in customer service, loss valuation, and damage assessments. A proven track record of performing inspections on damaged vehicles and supporting customers throughout the claims process.

2. Add a compelling section featuring your auto insurance claims adjuster experience

List recent and past work experience in this section, paying close attention to how you can describe accomplishments and duties in a way that’s likely to resonate with hiring managers. Stay away from cliched intros, such as “Responsible for.” Instead, break this section up with bullet points that include engaging action verbs and metrics.

For example, writing “performed in-person assessments of vehicle damage and increased policy-holder satisfaction by 10%” is stronger resume copy than “responsibilities including vehicle assessments.”

Be sure to also feature examples of you working effectively with clients, insurance companies, and auto repair services throughout your career. Customers who are beginning the claims process for their vehicle following an accident are typically not in the best state of mind. These types of experiences are often traumatic, and employers need candidates who can communicate with clients empathetically throughout the claims process.

Senior-Level Professional Experience Example

Auto Insurance Claims Adjuster, Liberty Mutual, San Diego, CA

November 2016 – Present

- Serve as the subject matter expert for commercial auto and liability claims, conduct physical and remote inspections on vehicles, perform damage assessments, and interpret insurance policies to ensure ideal business outcomes for the company and customer

- Coordinate with cross-functional teams to perform investigations, determine policy applicability, and evaluate appropriate compensation and adjustments

- Ensure compliance with state regulations, quality standards, and insurance policies throughout the claims process and settlement

Entry-Level Professional Experience Example

Auto Insurance Claims Adjuster, Allstate, New York, NY

November 2019 – Present

- Deliver high-quality service to customers to assess vehicle repair needs, damages, and compensation, communicate with empathy and understanding throughout the claims process and achieve customer satisfaction scores of 92% annually

- Perform physical inspections of vehicle damages, create estimates and valuations, and conduct negotiations for settlements totaling $5K-$150K

- Serve as liaison between customers, auto repair companies, and Allstate to review insurance claims, repair costs, and adjustments

3. Include education and certifications relevant to auto insurance claims adjusters

College degrees and certifications can help you stand out as a candidate. They also help qualify your experience, ensuring hiring managers are confident in the knowledge and skills you claim to have. A variety of degrees are relevant to work as an auto insurance adjuster. Associate degrees in auto repair, finance, or business all demonstrate experience that may be helpful on the job.

Certifications may be even more specialized and indicate you made an effort to master skills related to estimating damage, handling complex insurance processes, or investigating accidents.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Associate of Science (A.S.) Auto Repair Technology

- University of Syracuse, New York, NY | 2017

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Universal Claims Certification, Claims and Litigation Management Alliance | 2022

4. List auto insurance claims adjuster-related skills and proficiencies

As you create each section of your resume, consider how you can insert relevant key skills that may catch the eye of hiring managers. This verbiage can also help your resume make it through applicant tracking systems (ATS), which are designed only to pass through resumes with enough relevance.

One of the best ways to load your resume with relevant skills is to include at least one in each bullet point in your professional experience section. For example, “Leveraged knowledge of auto repair technology to support accurate damage assessments” includes two key skills.

| Key Skills and Proficiencies | |

|---|---|

| Auto insurance claims adjustments | Auto insurance claims analysis |

| Auto repair technology | Claims exposure |

| Claims processing | Client relations |

| Communication | Customer service |

| Damage assessment | Denial processes |

| Insurance claims analysis | Insurance claims investigations |

| Liability | Loss valuation |

| Policy interpretation | Property valuation |

| Regulatory compliance | Vehicle inspections |

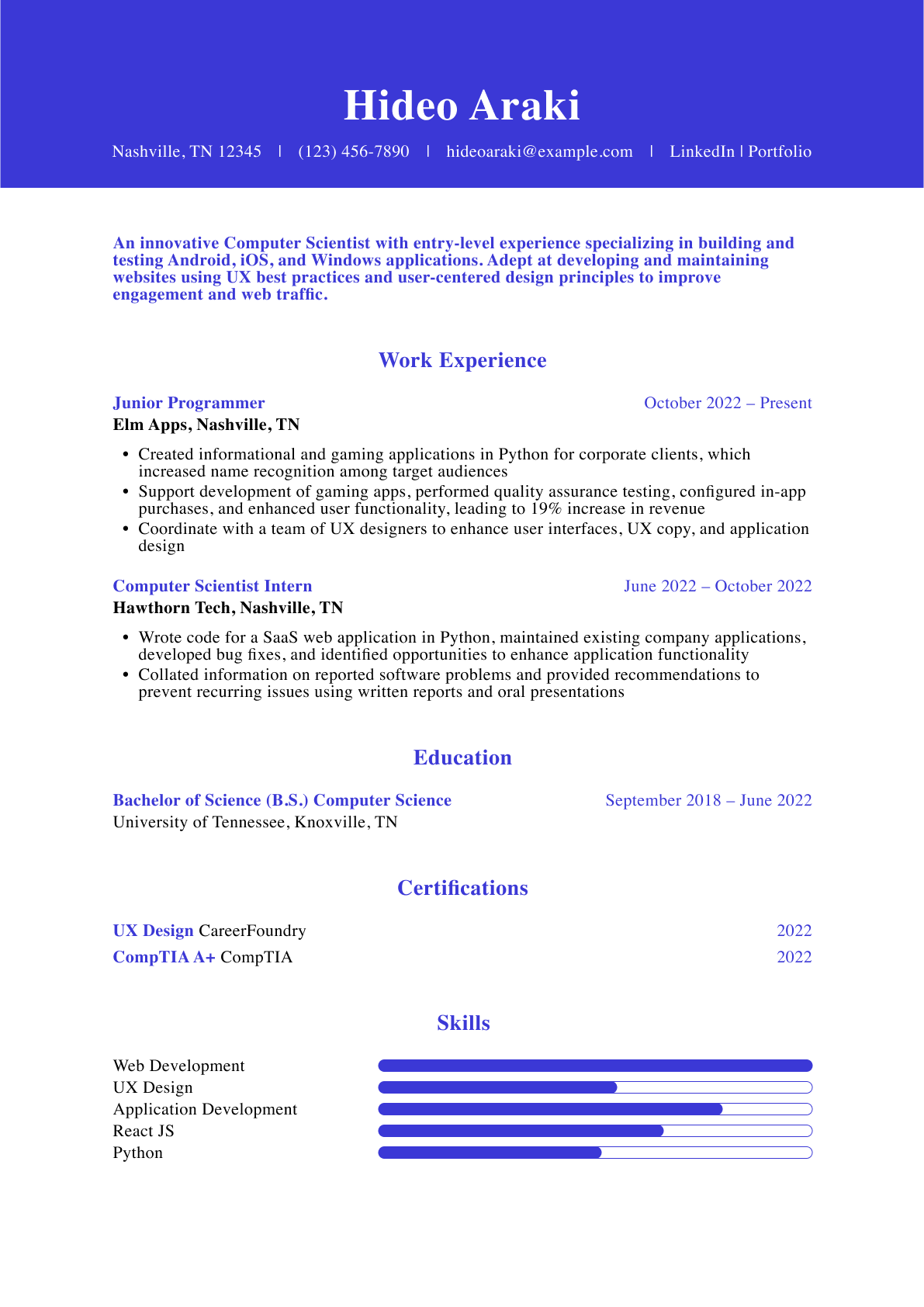

How To Pick the Best Auto Insurance Claims Adjuster Resume Template

Choose a template with visually appealing elements, such as a standout header with your name and contact information and subheadings that identify each section. Steer away from templates with overly decorative fonts and design elements that might make your page look cluttered.

An auto insurance claims adjuster must be able to communicate complex information in a concise, clear manner. When in doubt, opt for a simple, elegant template that supports your content and qualifications.

Frequently Asked Questions: Auto Insurance Claims Adjuster Resume Examples and Advice

What is the best way to highlight my experience in my Auto Insurance Claims Adjuster CV?-

The best way to highlight your experience in your Auto Insurance Claims Adjuster CV is by emphasizing specific achievements in each role. Use bullet points to make your experience scannable and focus on results-driven accomplishments, such as improving processes or saving costs. Include quantifiable data like percentage increases or revenue growth to reinforce the impact of your work.

What are common action verbs for auto insurance claims adjuster resumes?-

Adding action verbs to your resume makes it more dynamic and easier to read. When you start sentences and bullet points with relevant verbs, you drive straight to the important points, and that helps you pack more punch in just a one-page document.

Consider ways you can use various action verbs to discuss your previous work, such as incorporating words like adjusted, appraised, and estimated into bullet points. When you start with a relevant action verb and end with a positive result, you can impress hiring managers with your proactive approach to challenges.

| Action Verbs | |

|---|---|

| Adjusted | Analyzed |

| Appraised | Assessed |

| Communicated | Compiled |

| Documented | Educated |

| Evaluated | Examined |

| Inspected | Interviewed |

| Investigated | Managed |

| Negotiated | Oversaw |

| Processed | Resolved |

| Reviewed | Supported |

How do you align your resume with a job description?-

The job market for insurance claims adjusters, appraisers, examiners, and investigators is expected to decline by 3% through 2032, according to data published by the Bureau of Labor Statistics (BLS). Fortunately, there are still plenty of organizations across the nation that need auto insurance claims adjusters.

For example, suppose an organization is looking for a candidate with exceptional customer service skills. In that case, you can go further than simply listing this as a skill on your document. Instead, you could highlight your integrity and commitment to driving positive outcomes for customers throughout the claims process. Remember, a resume is more than just a document stuffed with keywords; it’s a summarization of your career on paper. By illustrating your own unique experiences that match the job description, you’ll significantly increase your chances of success during the job search.

What is the best auto insurance claims adjuster resume format?-

For auto insurance claims adjusters, the reverse chronological resume format is typically best. This format places your most recent and relevant work experience towards the top of your document.

This order of presentation lets employers understand the progression of your career. By placing your most recent work on top, the format tends to ensure employers read your most relevant or impressive accomplishments first. This can help you capture the hiring manager's attention, ensuring they read through the rest of your resume.

What’s the ideal length for an auto insurance claims adjuster resume?-

A one-page resume is ideal for most auto insurance claims adjuster positions, especially if you have less than 10 years of experience. For experienced professionals, a two-page resume may be appropriate, but only if it includes valuable, job-relevant content. Focus on showcasing your key achievements, certifications, and skills that align with the job description.

Aim to include work experience from the last 10 to 15 years. Older roles can be summarized or omitted unless they add significant value. Keeping your resume concise and relevant will leave a strong impression on hiring managers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

A cover letter is another opportunity to tailor your application package to the specific job. Use it to align yourself culturally with an organization, or make sure hiring managers note your most important qualifications.

Instead of writing a single cover letter to slap on every resume, tweak this document for each application. Start with our finance resume cover letter examples for some ideas before writing a cover letter that is uniquely yours.