Accounts Receivable Resume Templates and Examples (Download in App)

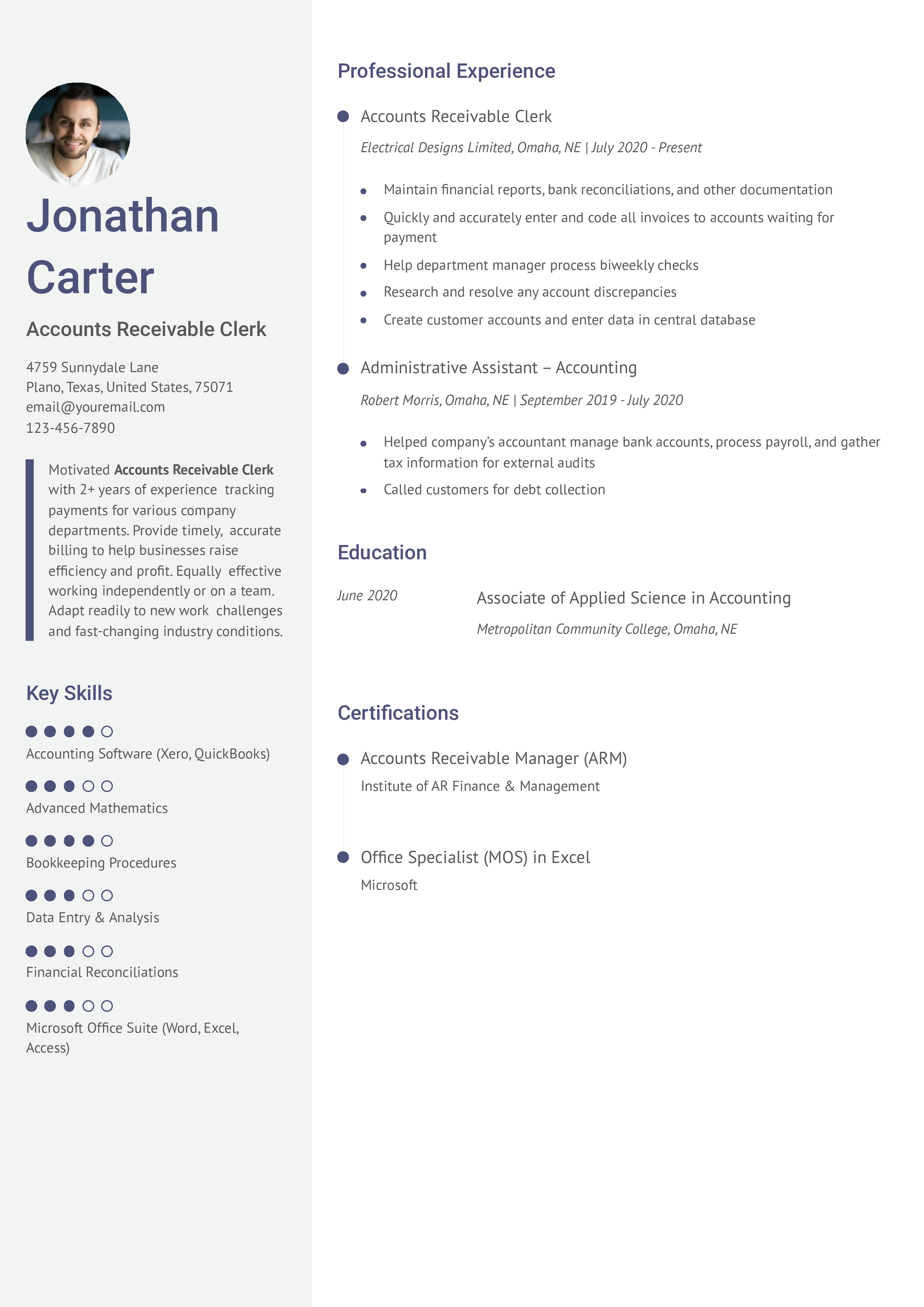

- Entry-level

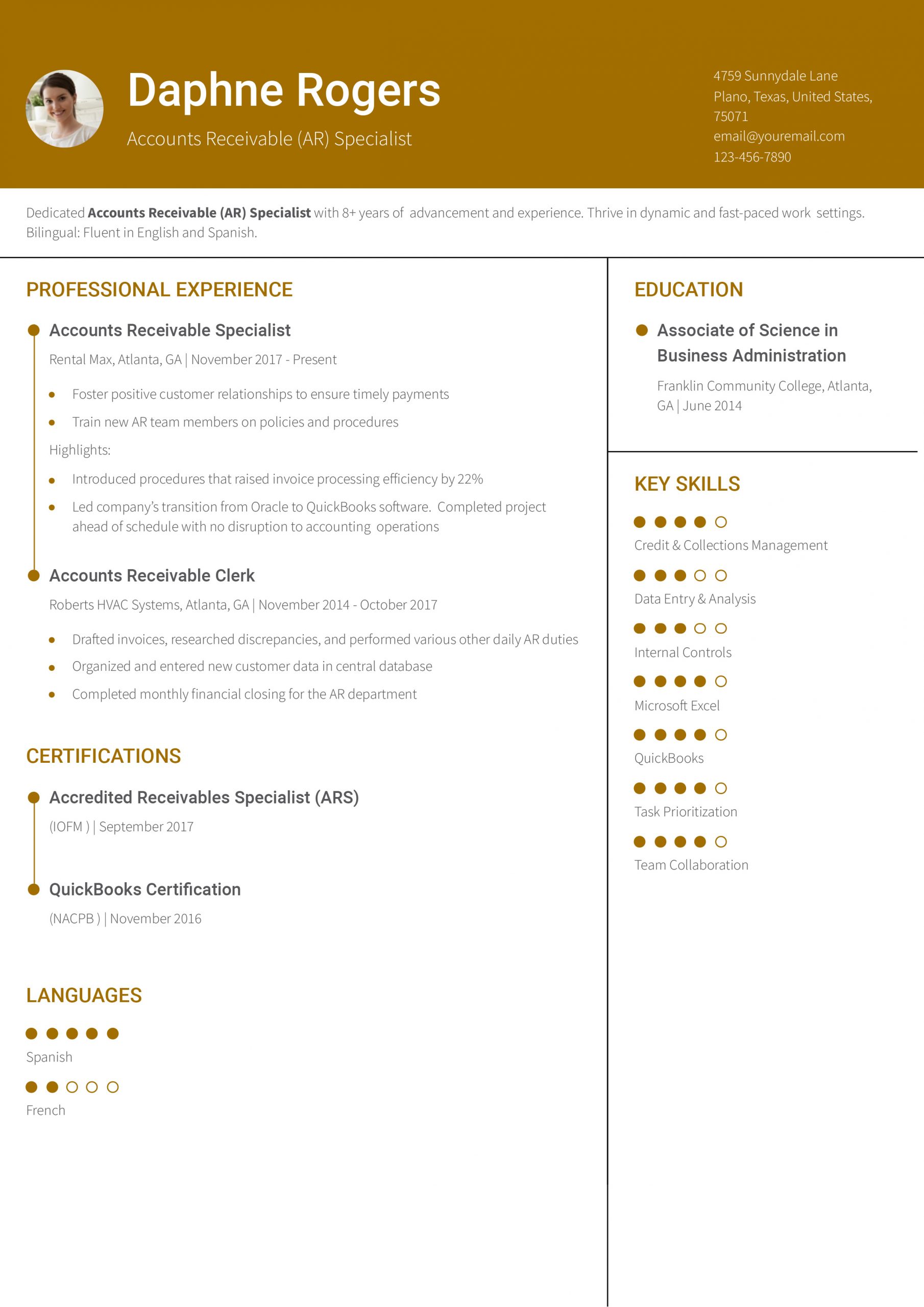

- Mid-career

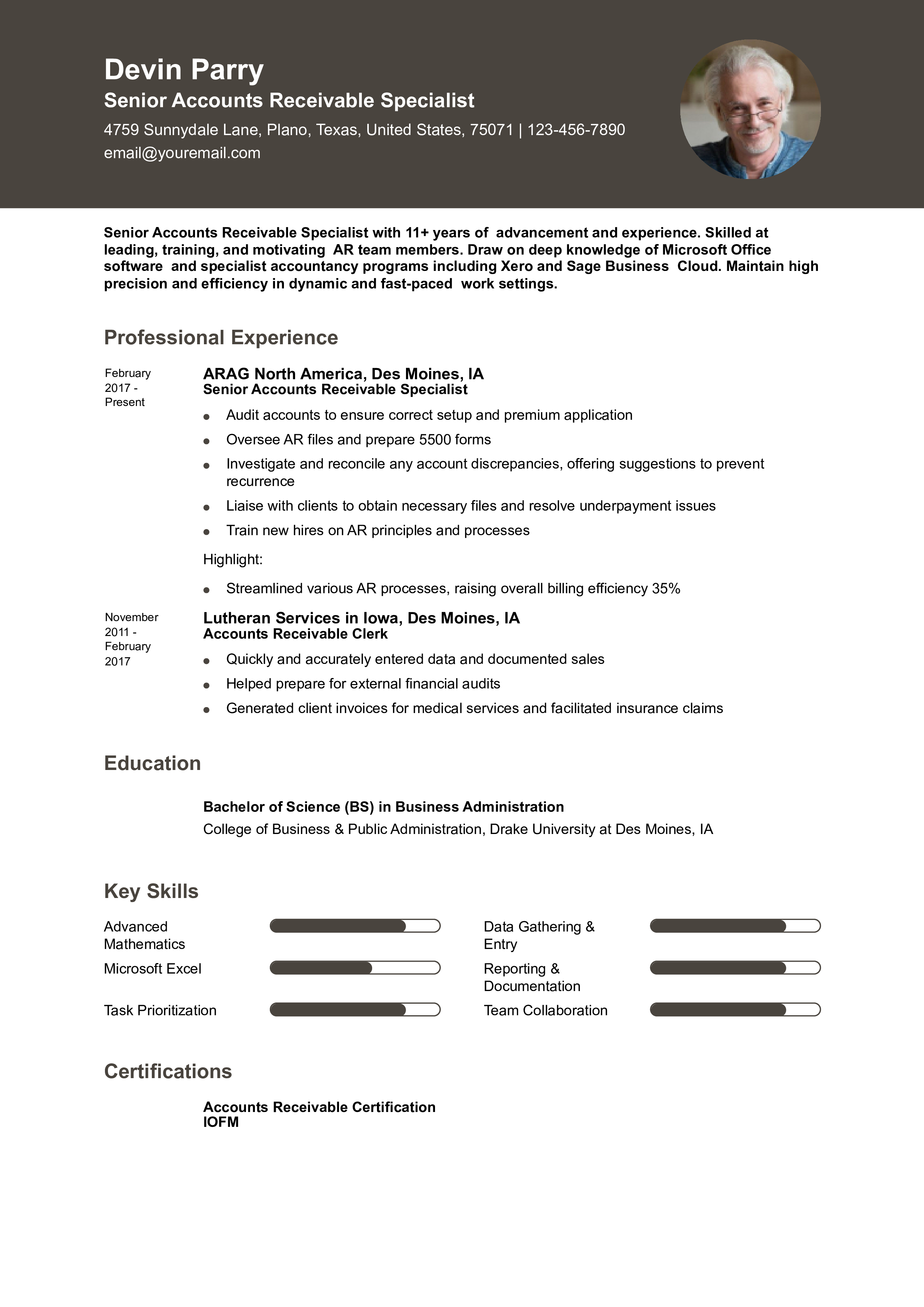

- Senior-level

Most Popular Accounts Receivable Resumes

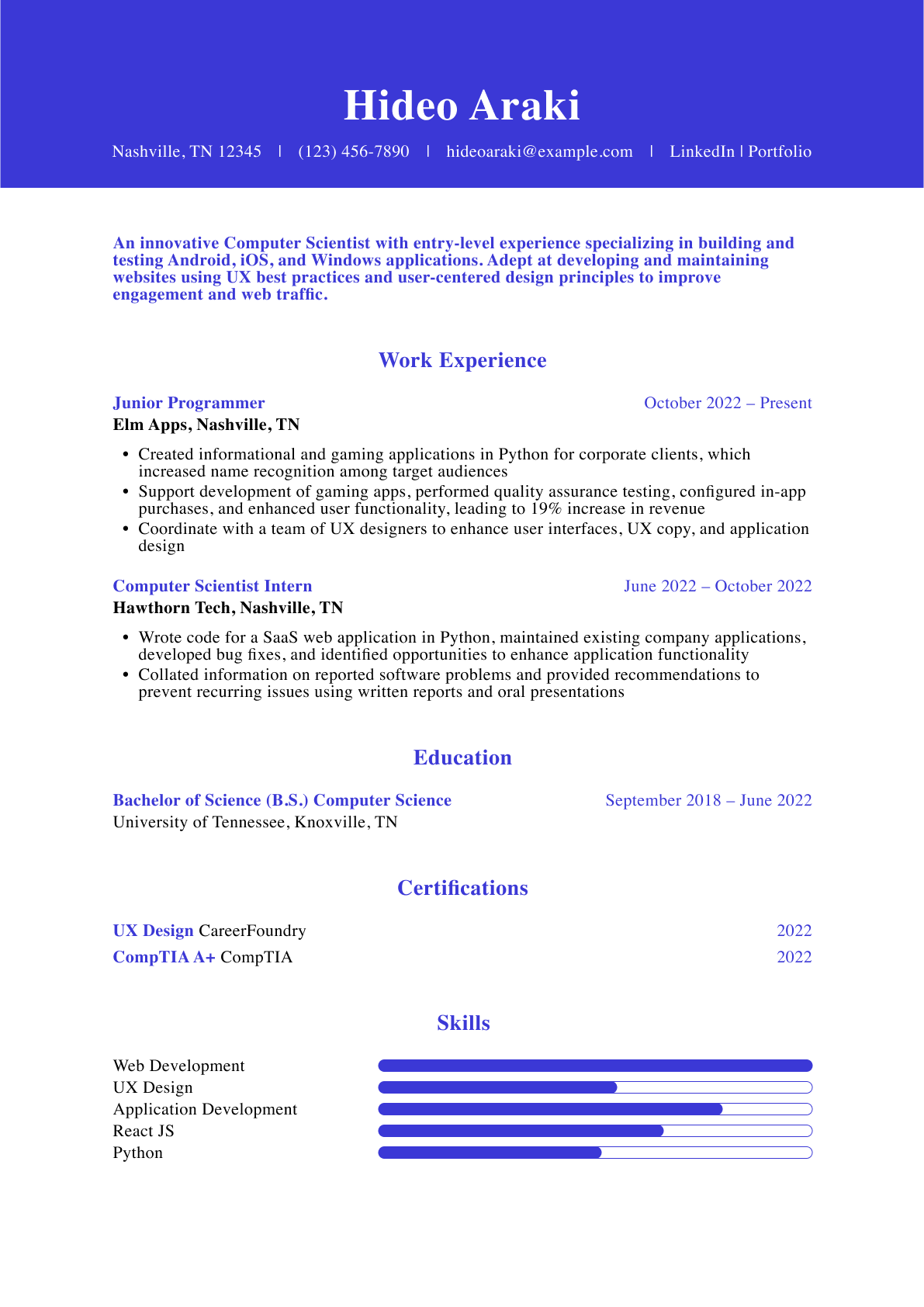

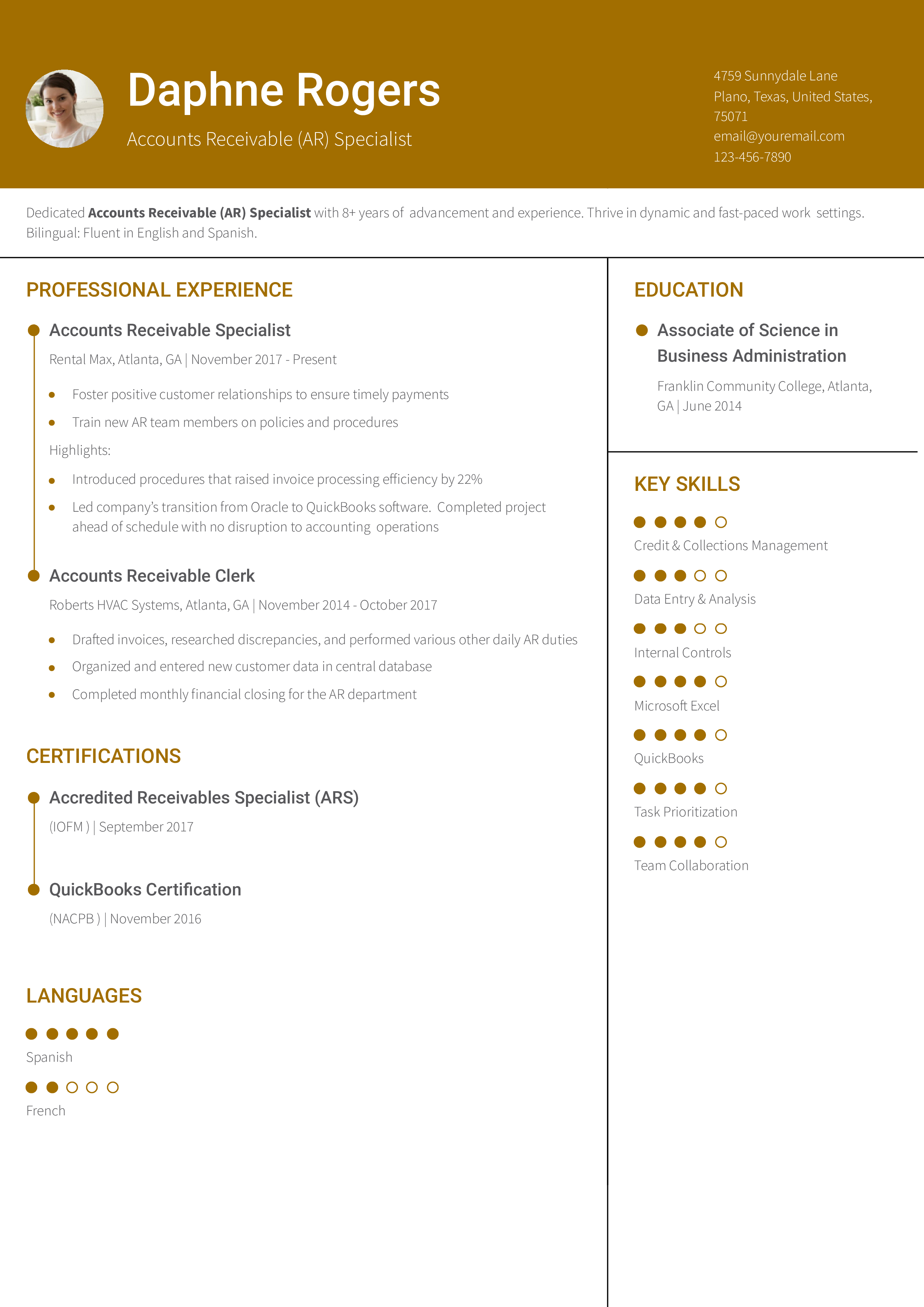

Accounts Receivable Resume Example

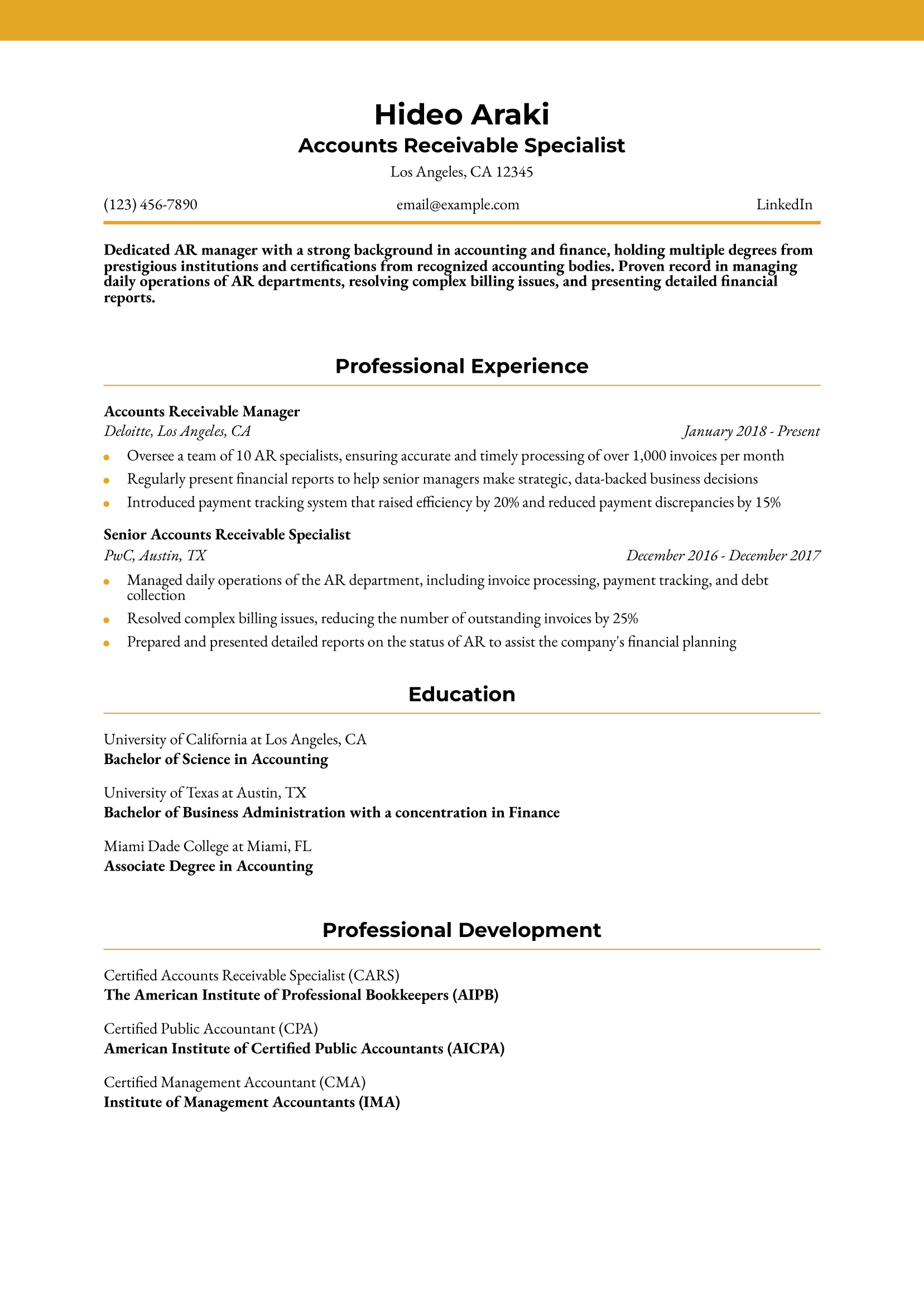

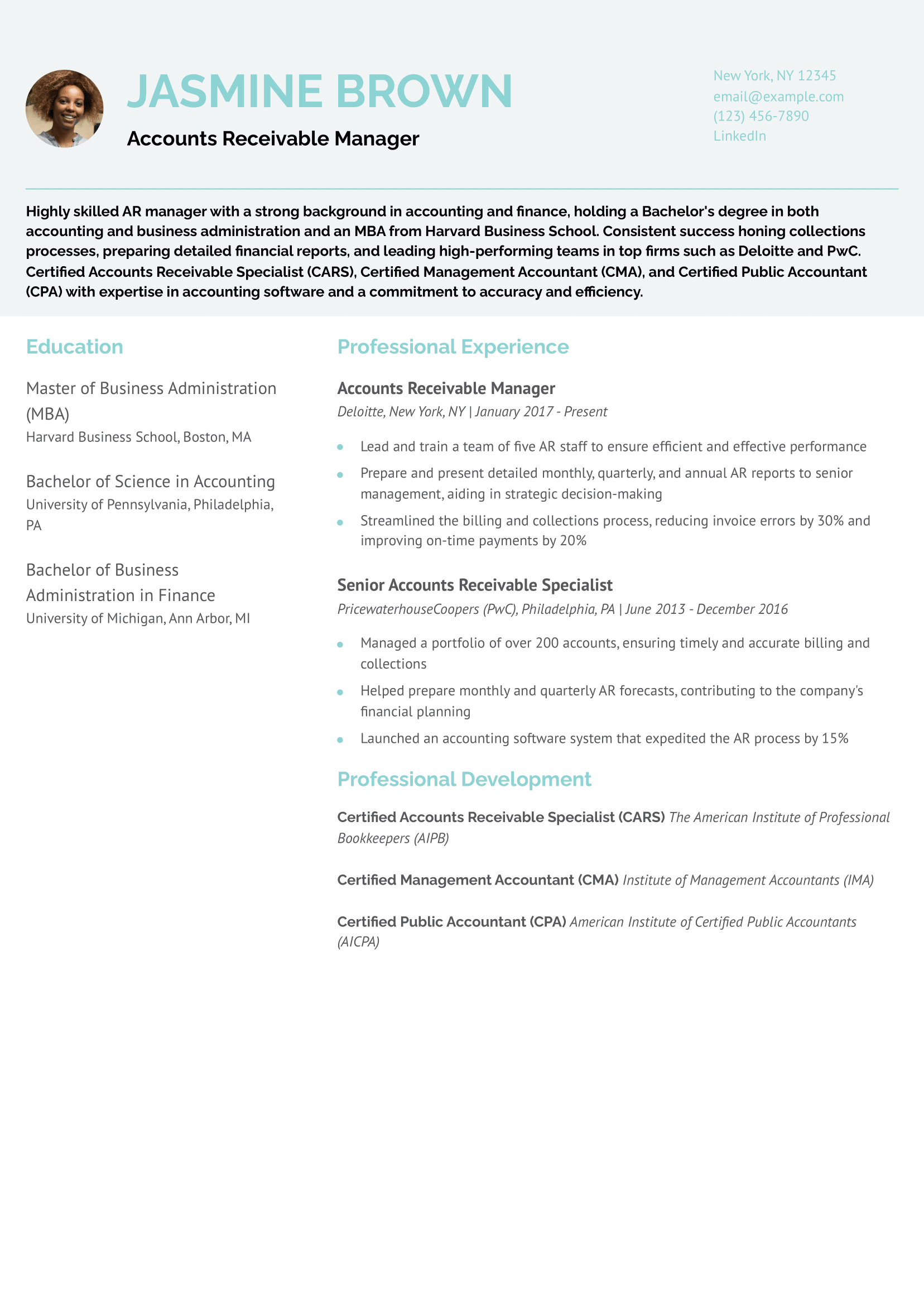

Accounts Receivable Manager Resume Example

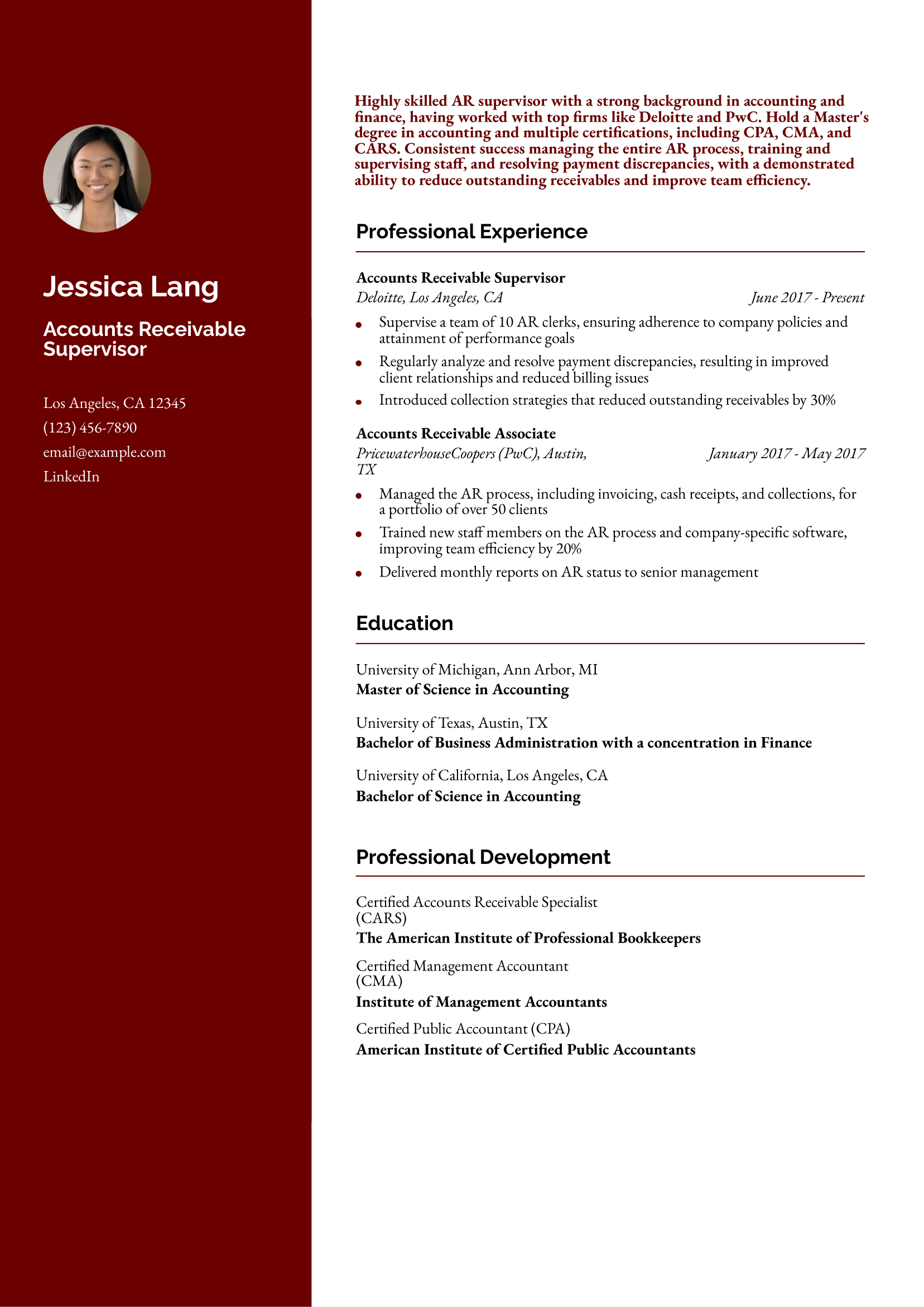

Accounts Receivable Supervisor Resume Example

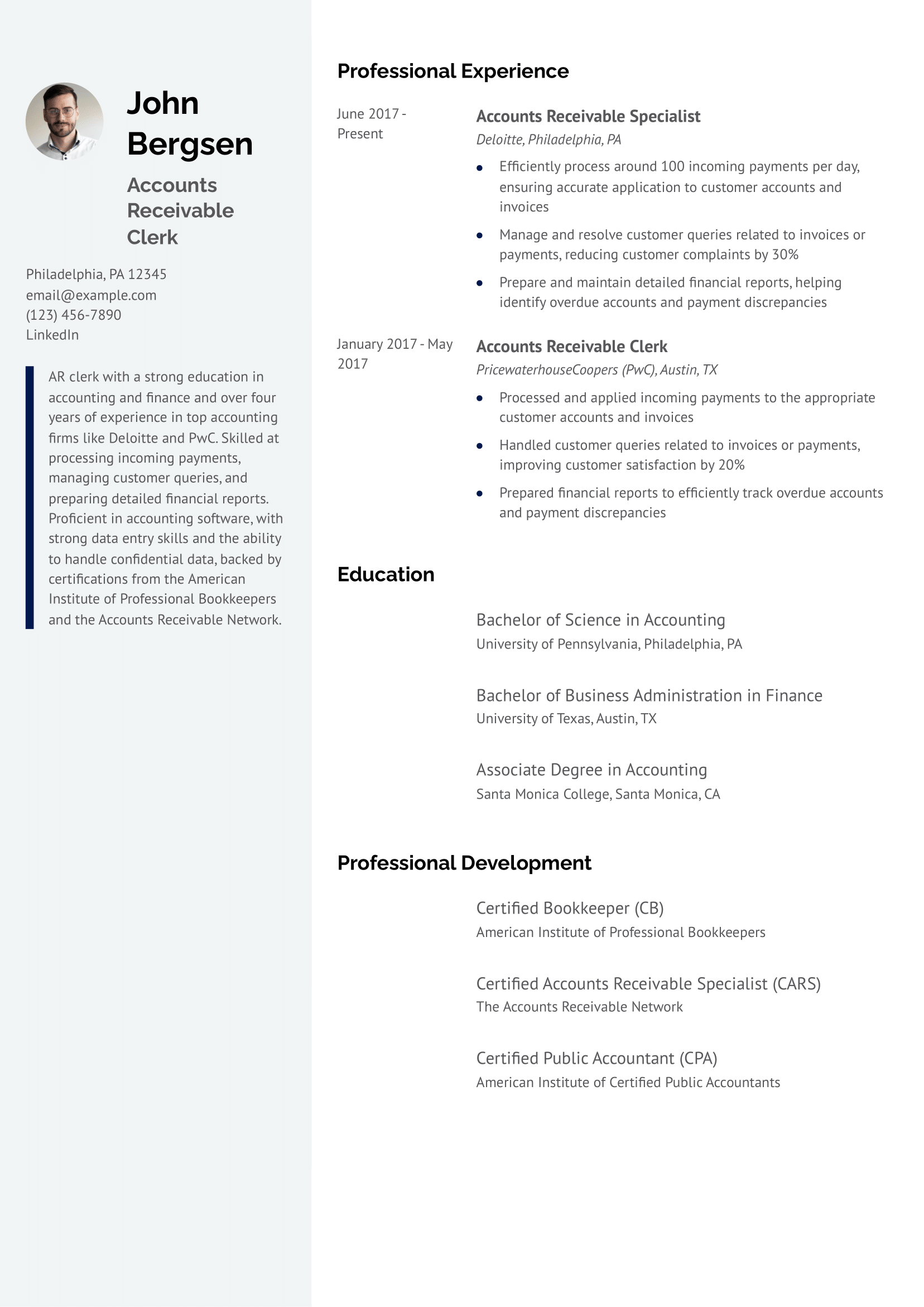

Accounts Receivable Clerk Resume Example

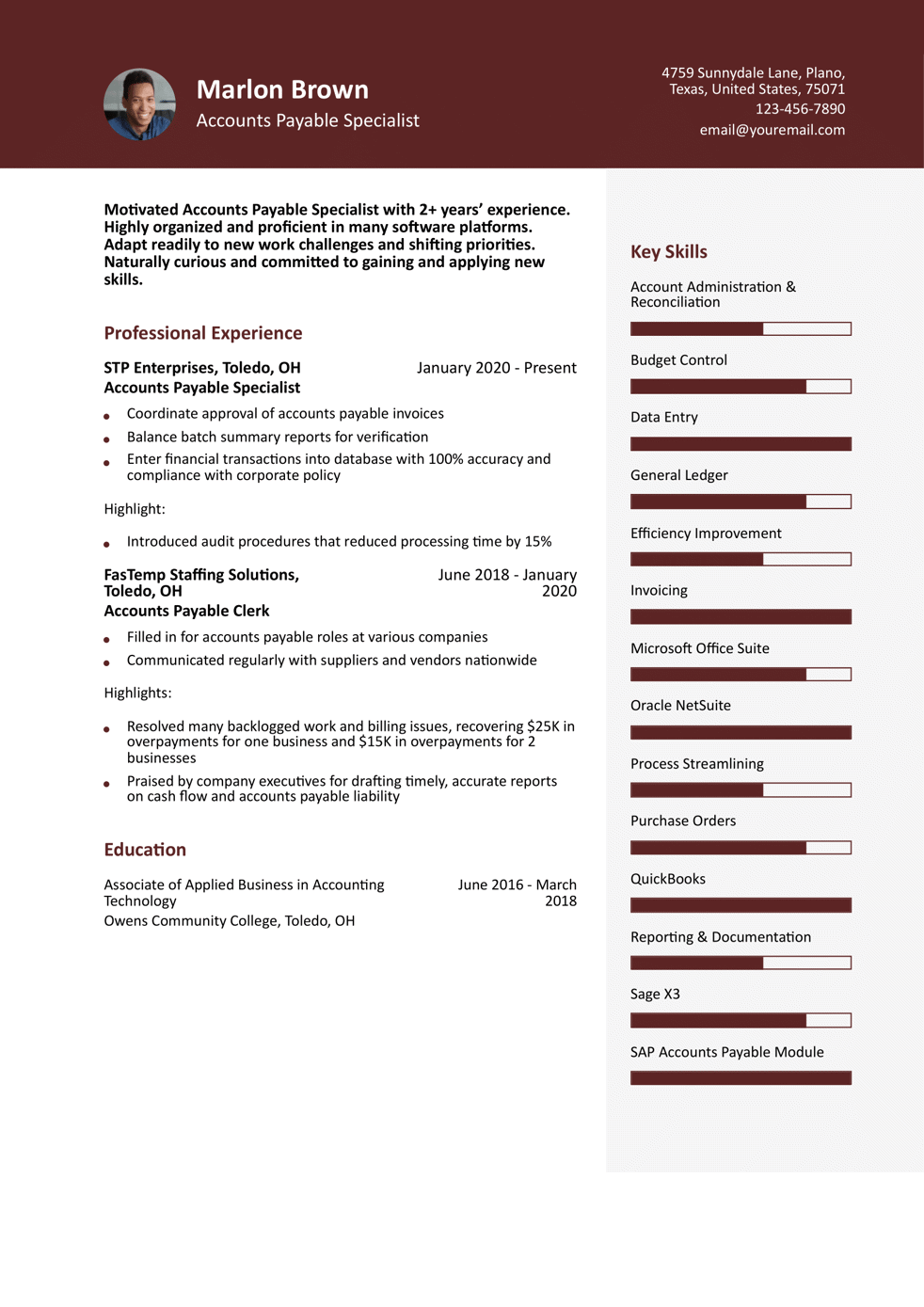

Accounts Payable Specialist Resume Example

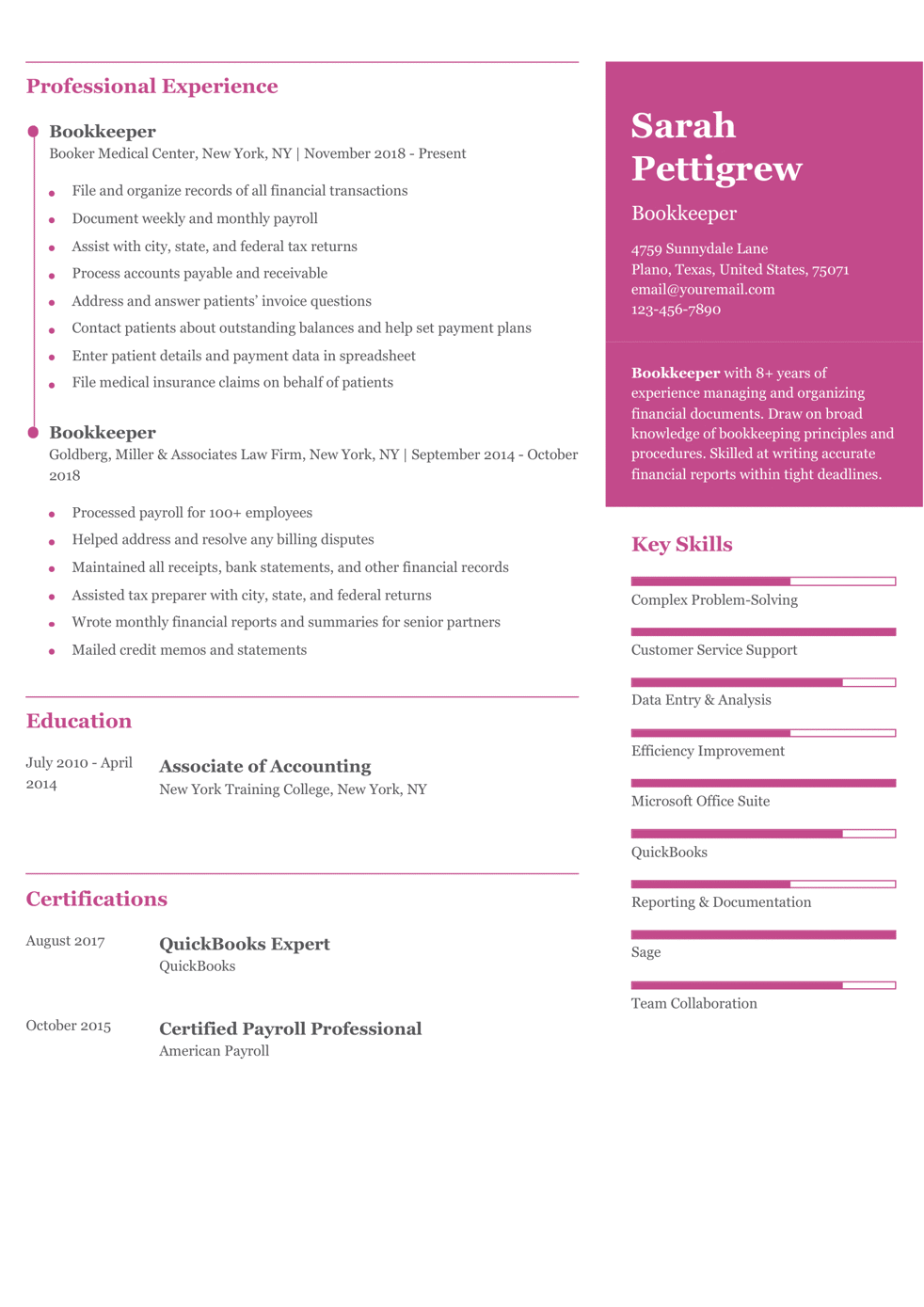

Bookkeeper Resume Example

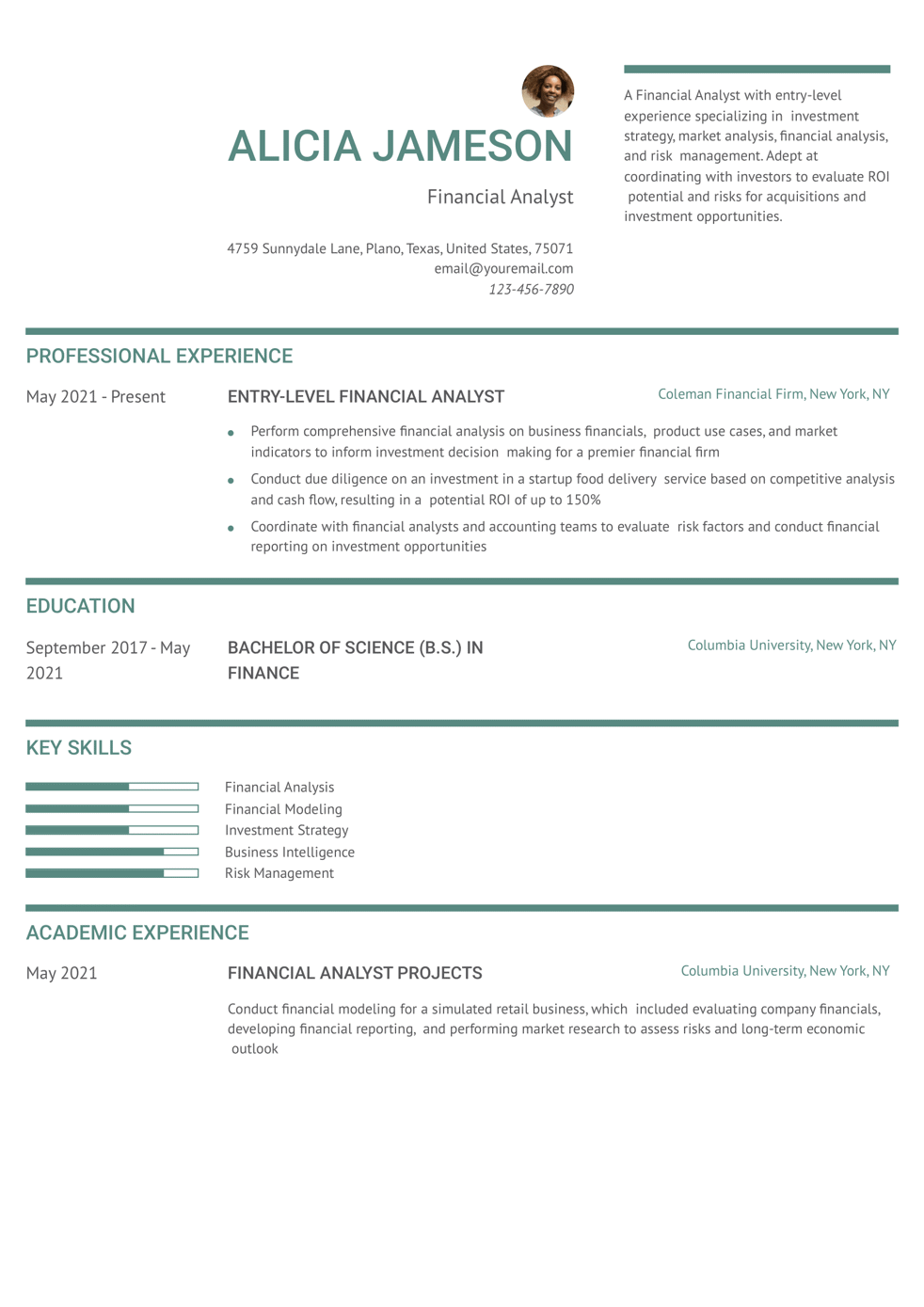

Entry-Level Financial Analyst Resume Example

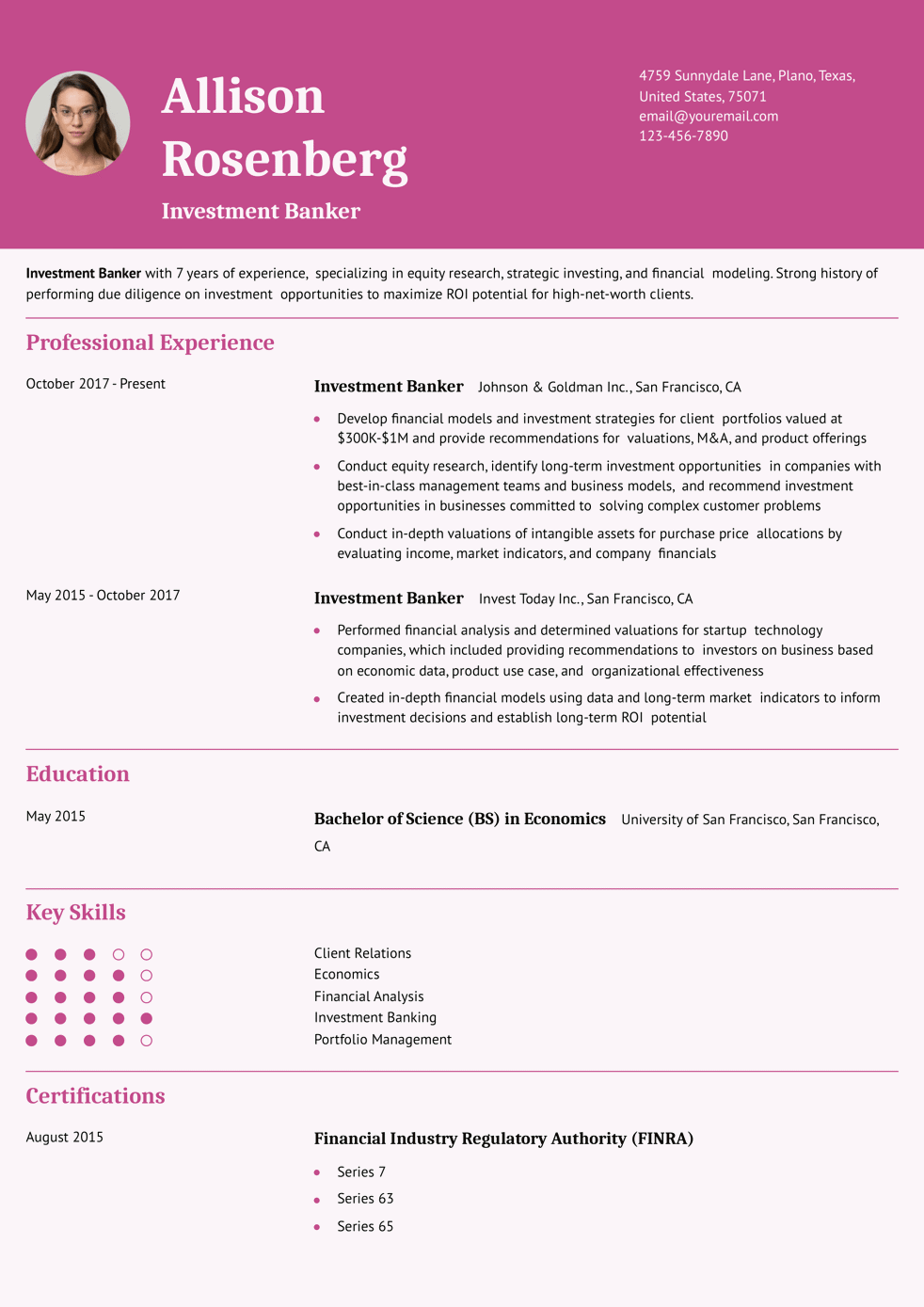

Finance Resume Example

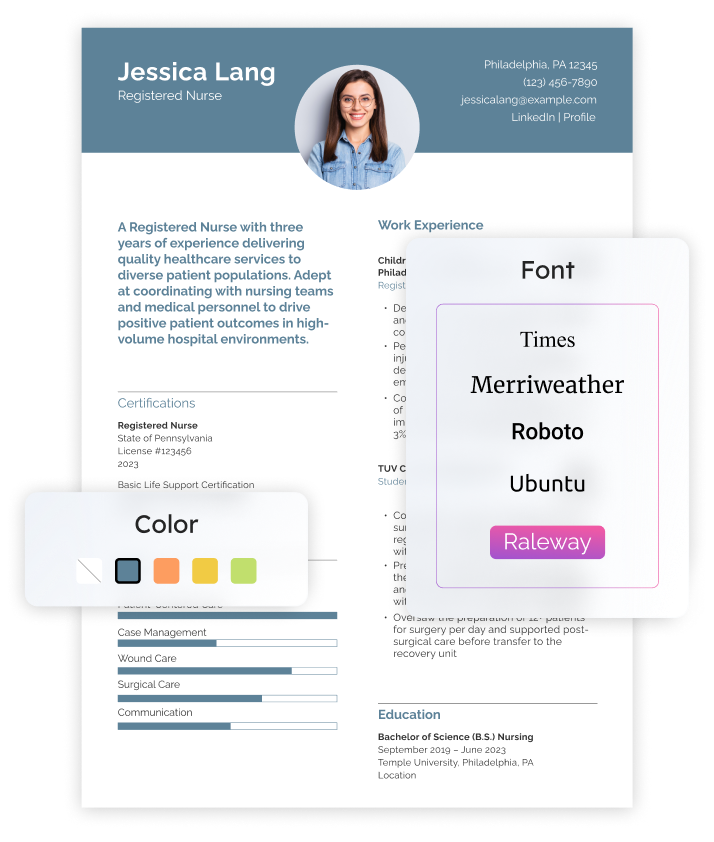

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Accounts Receivable Text-Only Resume Templates and Examples

How To Write an Accounts Receivable Resume

Create an accounts receivable (AR) resume with the same focus on detail you bring to your work as an AR professional. Start by making a list of facts. Include your experience, such as leading AR teams, tracking payments, and results you’ve achieved for employers, along with relevant education and certifications. Then choose a template that lets you organize those facts to tell a cohesive story about your qualifications for the position. Learn more about creating an AR resume with the tips and examples below.

1. Write a dynamic profile summarizing your accounts receivable qualifications

Open your resume with a short summary of your career highlights. Focus on how your experience, education, and skills meet specific needs listed in the employer’s job posting. Highlight anything that sets you apart from similar applicants. For example, you could mention your in-depth experience with Xero or other accounting programs or emphasize your ability to work in a fast-paced environment.

Senior-Level Profile Example

Senior AR specialist with over 11 years of advancement and experience. Skilled at leading, training, and motivating AR team members. Draw on deep knowledge of Microsoft Office software and specialist accountancy programs, including Xero and Sage Business Cloud. Maintain high precision and efficiency in dynamic and fast-paced work settings.

Entry-Level Profile Example

Motivated AR clerk with over two years of experience tracking payments for various company departments. Provide timely, accurate billing to help businesses raise efficiency and profit. Equally effective working solo or on a team. Quickly adapt to new work challenges and industry conditions.

2. Create a powerful list of your accounts receivable experience

The professional experience section must do more than list your past employers and job duties. Use this section to give examples of your success and indicate the value you’ll generate in your next role. Include bullet points on your past results, and quantify the information whenever possible. For example, rather than just saying you reduced AR, give details such as the type of accounts, the time span, and the amount you reduced them.

Senior-Level Professional Experience Example

Senior Accounts Receivable Specialist

ARAG North America, Des Moines, IA | February 2017 to present

- Audit accounts to ensure correct setup and premium application

- Oversee AR files and prepare 5500 forms

- Investigate and reconcile any account discrepancies, offering suggestions to prevent recurrence

- Liaise with clients to obtain necessary files and resolve underpayment issues

- Train new hires on AR principles and processes

Highlight:

- Streamlined various AR processes, raising overall billing efficiency 35%

Entry-Level Professional Experience Example

Accounts Receivable Clerk

Electrical Designs Limited, Omaha, NE | July 2020 to present

- Maintain financial reports, bank reconciliations, and other documentation

- Quickly and accurately enter and code all invoices to accounts waiting for payment

- Help department manager process biweekly checks

- Research and resolve any account discrepancies

- Create customer accounts and enter data in central database

3. Include accounts receivable-related education and certifications

Always review job listings carefully so you know what education and certifications the employer is looking for. If you have those credentials, feature them in a concise, easy-to-scan format on your resume. Also, include any credentials that relate to your target job and may help you stand out. For example, a Certified Billing and Coding Specialist credential might be relevant if you’re applying to AR jobs in health care.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Associate of Science in Business Administration

- Franklin Community College, Atlanta, GA | 2014

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Accounts Receivable Specialist (ARS), Institute of Finance & Management, 2017

4. Outline your most useful accounts receivable skills and proficiencies

Often, before you can impress a hiring manager with your resume, you have to get it past an applicant tracking system (ATS). One way to do that is by emphasizing those of your skills the ATS is likely coded to look for. Consider the list below and whether any of these skills align with your AR experience — when they do, incorporate them with your resume.

| Key Skills and Proficiencies | |

|---|---|

| Account reconciliation | Accounting |

| Bookkeeping | Budgeting |

| Collections | Customer service |

| Data analysis | Data entry |

| General accounting software | General ledger |

| Invoicing | Microsoft Excel |

| QuickBooks | Ten-key |

| Time management | Vendor relations |

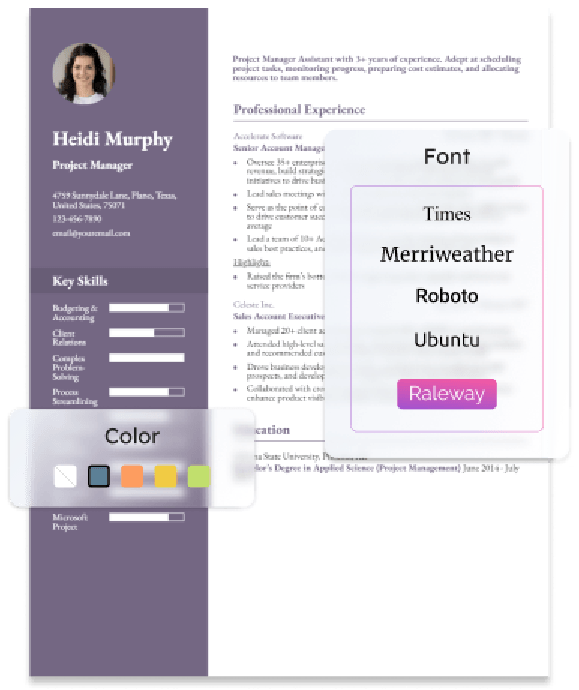

How To Pick the Best Accounts Receivable Resume Template

Choose a simple resume template that focuses on your relevant information. Avoid fancy templates with expressive fonts or flourishes, and stick with basic formatting to ensure a clean, concise document.

Rebecca Finney - recruiter and trainer in financial industries, LinkedIn

Meet our expert: Rebecca Finney has spent over five years in agency recruiting, primarily in the banking, finance, and accounting industries for permanent and contract staffing.

1. What are the most in-demand skills for accounts receivable that should be featured on a candidate’s resume?-

Hard Skills

- Customer service

- Investigation

- Proficiency with accounting software (Quickbooks, Sage, SAP, and such)

- Proficiency with Microsoft Office

- Reports and analysis

Soft Skills

- Customer-service oriented

- Professional and interpersonal communication

2. What work experience and other accomplishments are hiring managers looking for in an accounts receivable candidate?-

Hiring managers often prefer AR candidates with previous experience in AR and collections. Even prior experience in customer experience is worth highlighting because much of AR does have roots in customer service.

3. What else, in addition to a resume, should an accounts receivable candidate be prepared to provide hiring managers?-

It never hurts to include a cover letter as long as the grammar, syntax, and spelling are correct and the context is relevant to the job that the candidate is applying for. Sometimes, candidates may be asked to complete a Microsoft Proficiency test, so any previous certifications that a candidate can provide are recommended.

4. What advice would you give an accounts receivable candidate about their job search? -

Utilize your alumni network. Accountants know other accountants. In an interview, talk specifically about your accounting experience(s), and the systems/programs you’ve used. Explain how your actions have supported other accountants.

Frequently Asked Questions: Accounts Receivable Resume Examples and Advice

What makes an Accounts Receivable CV stand out to recruiters?-

An Accounts Receivable CV stands out by clearly demonstrating your expertise and achievements in the field. Be sure to use measurable outcomes and include quantifiable results wherever possible. Show how your contributions directly impacted the company, whether it’s through cost savings, operational efficiency, or revenue growth. Keep the layout clean and easy to navigate, focusing on relevant experience.

What are common action verbs for accounts receivable resumes?-

Action verbs serve several purposes on your resume. They signal you’re an applicant who gets things done. When you start bullet points and sentences with strong verbs, you make it easier for hiring managers to scan your resume and remember information. Start with some of the options below, which are commonly used on AR resumes.

| Action Verbs | |

|---|---|

| Audit | Balance |

| Calculate | Charge |

| Close | Collect |

| Coordinate | Create |

| Credit | Enter |

| Identify | Invoice |

| Post | Prepare |

| Prevent | Process |

| Reconcile | Report |

| Resolve | Streamline |

| Update | Write off |

How do you align your resume with an accounts receivable job posting?-

Start by cross-referencing your skills and experience with what’s mentioned in the job posting. Anytime those two lists overlap, highlight that fact on your resume by using similar words and phrases. For example, if the employer seeks someone with experience using Sage accounting tools, cite them in your profile or skills section.

Job opportunities for accounting clerks of all types are on the decline, according to the Bureau of Labor Statistics, so aligning your resume with each job posting can help you stand out in a competitive field.

What is the best accounts receivable resume format?-

Most AR professionals should use the combination (or hybrid) format. True to its name, this format combines two important features of other resume formats: the chronological format’s experience section and the functional format’s profile section.

A combination resume offers the best of both worlds by fusing these two sections. The experience section lets you outline your recent work history – essential information for most employers. At the same time, the profile section lets you display your career highlights at the top, regardless if they’re from that work history or another part of your background. The resulting resume is straightforward yet strategic. It gives hiring managers the clearest possible view of your background and relevant skills, so they can decide to proceed with your candidacy.

How long should my accounts receivable resume be?-

An accounts receivable resume should typically be one page long, especially if you have less than 10 years of experience. A two-page resume may be appropriate for seasoned professionals with extensive achievements, but only if every detail adds value to your candidacy. Focus on conciseness and relevance by tailoring your resume to the job you're applying for. Highlight your most impactful accomplishments, certifications, and key skills rather than listing every career detail.

Including work experience from the last 10 to 15 years is generally recommended. Older positions can be summarized briefly or omitted unless highly relevant. Remember, your resume is a snapshot of your qualifications, not an exhaustive career history. Prioritize clarity and impact to make a strong impression.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

A cover letter lets you elaborate on your experience and why you’re the right choice for the position. For tips on this document, see our bookkeeper cover letter guide.