Investment bankers provide financial analysis to corporations, governments, and large institutions. These positions are highly lucrative due to the high earning potential of bonus structures. You must create an accomplishment-driven resume to separate yourself from the competition during your job search.

The key is to build a resume that highlights your advanced knowledge of financial strategy and brands you as a thought leader within the investment banking industry. Throughout this guide, we’ll provide expert tips to help you translate your career experience into a powerful marketing document.

“Investment banking resumes should emphasize financial modeling and analysis, deal experience, and valuation techniques and software tools expertise. Let your resume reflect your precision and drive.”

Most Popular Investment Banking Resumes

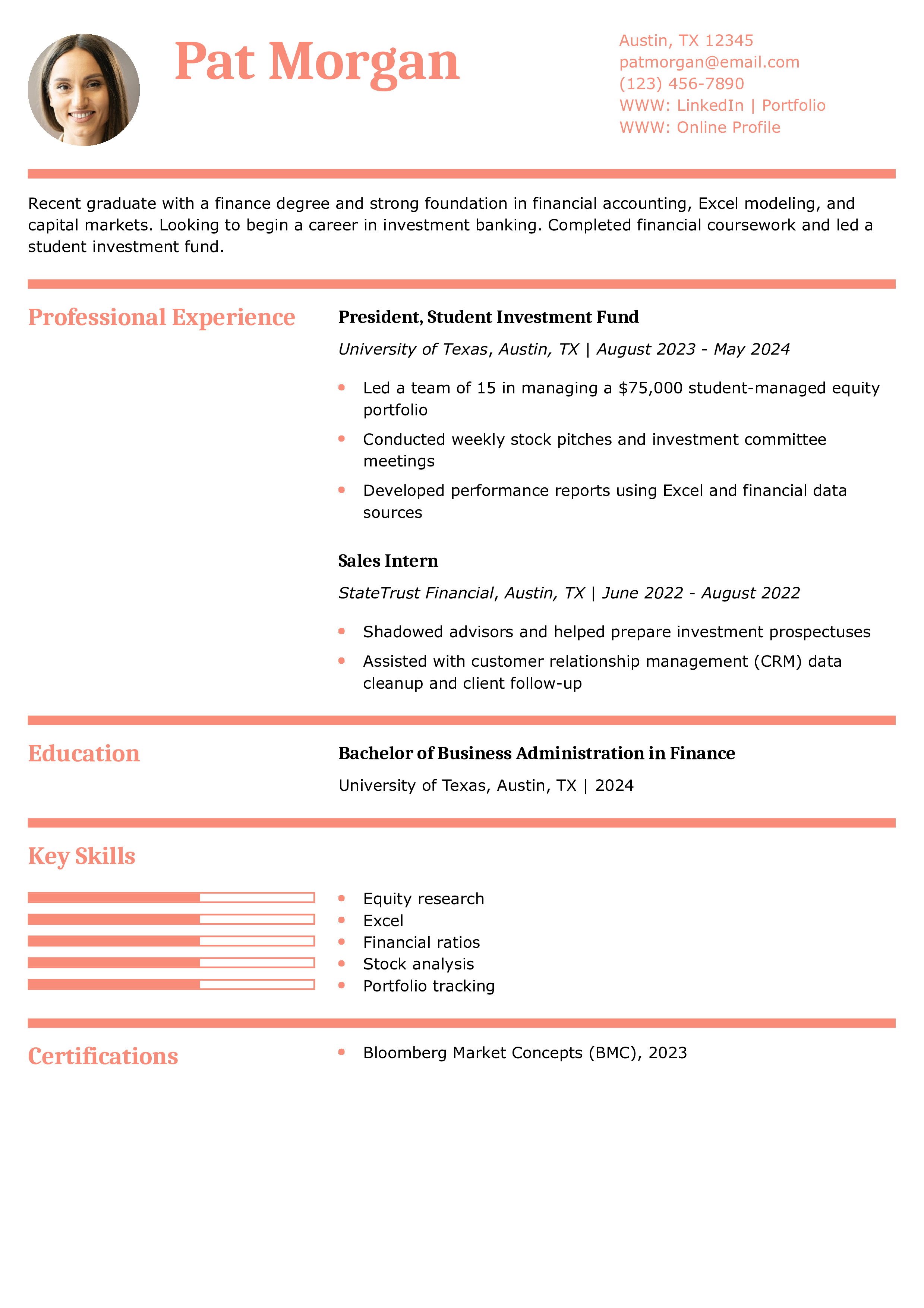

Entry-Level Investment Banking Resume

Why This Resume Is a Great Example

This resume shows how a recent graduate can compete by leveraging internships, academic research, and technical training. It clearly demonstrates interest and readiness for an analyst role.

Key Tips

To boost a junior resume, include relevant coursework and tools. Explore more in resume objective examples.

Experienced Investment Banking Associate Resume

Why This Resume Is a Great Example

This resume outlines technical and client-facing experience, backed by progression from analyst to associate. It highlights relevant licenses and leadership in deal execution.

Key Tips

To demonstrate seniority, emphasize cross-functional leadership. Learn more in how to list certifications on a resume.

Goldman Sachs Investment Banking Analyst Resume

Why This Resume Is a Great Example

This resume highlights experience with a top-tier firm, giving it immediate credibility. It focuses on IPO readiness and precision, which are critical for investment banking success.

Key Tips

Highlighting brand-name employers early in your career can be a major advantage. See more advice at resume summary examples.

Investment Banking Summer Analyst Resume

Why This Resume Is a Great Example

This resume illustrates how a summer analyst can clearly present early experience. It blends finance work with leadership roles outside the field.

Key Tips

Early-career candidates should include all leadership and finance-relevant roles. Explore how to put volunteer work on a resume for similar ideas.

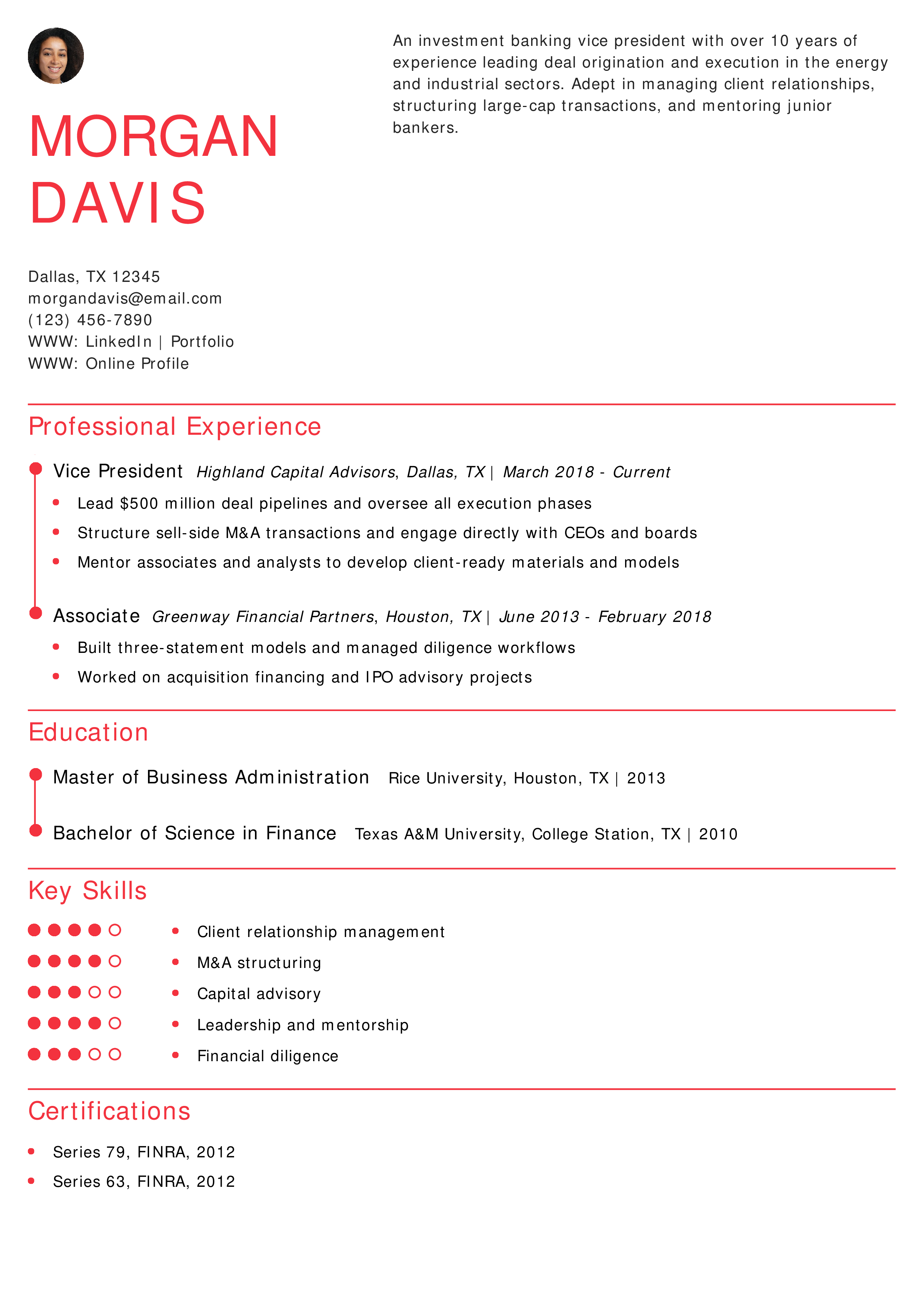

Investment Banking Vice President Resume

Why This Resume Is a Great Example

This resume highlights leadership, high-value deals, and strong mentoring — a must for VP-level roles. It clearly outlines progression and sector expertise.

Key Tips

To show growth, include how you lead people and processes. For formatting ideas, review resume outline examples.

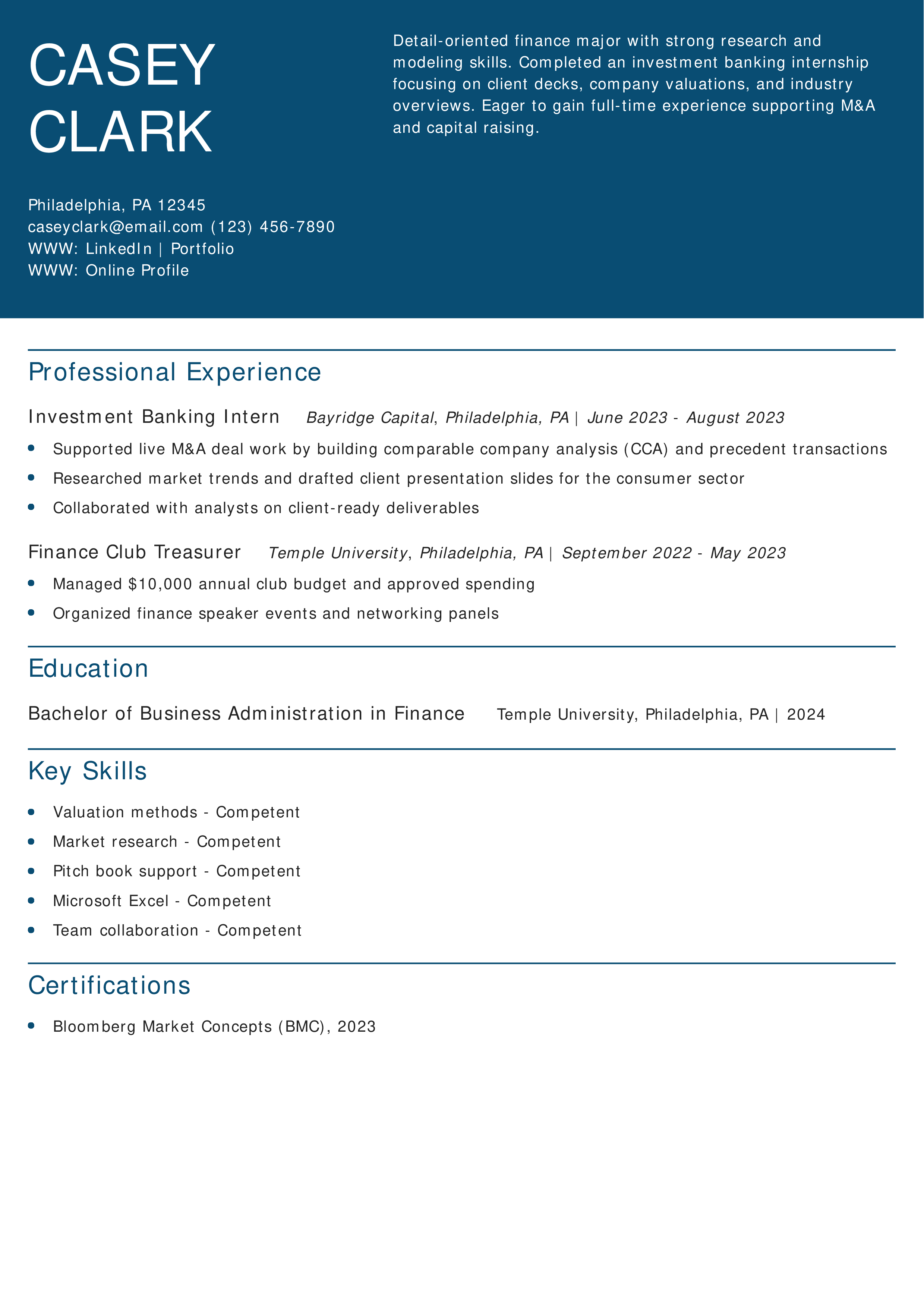

Investment Banking Intern Resume

Why This Resume Is a Great Example

This resume emphasizes relevant internship experience and shows initiative through extracurricular finance involvement. It strikes a great balance for students entering the field.

Key Tips

Highlight student finance clubs and internships, even if brief. See more strategies on how to put the expected graduation date on a resume.

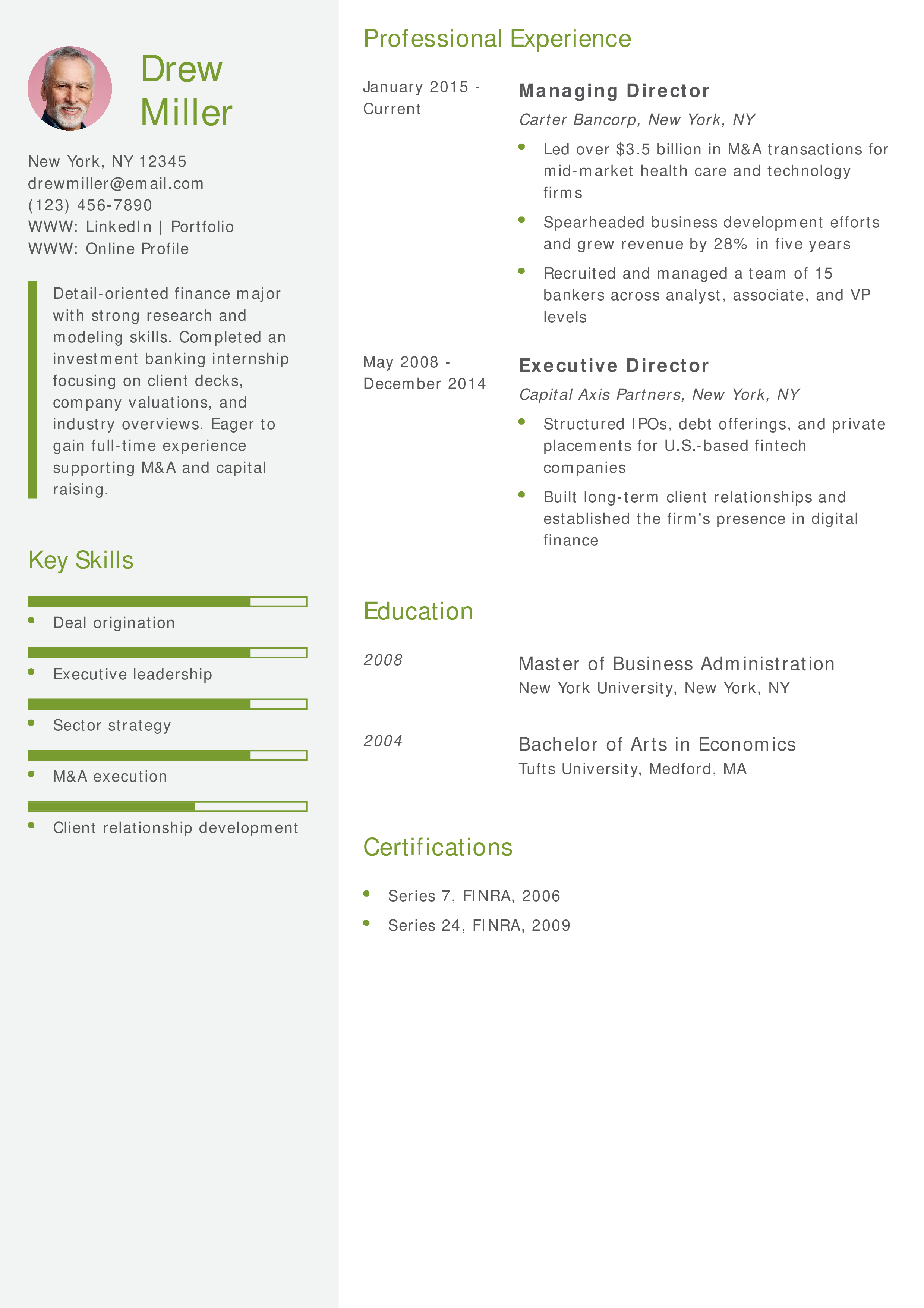

Managing Director Investment Banking Resume

Why This Resume Is a Great Example

This resume conveys executive-level leadership with clear deal sizes and team scope. It reflects strategic thinking and business development success.

Key Tips

High-level resumes should showcase leadership and growth metrics. Learn more at should a resume be one page.

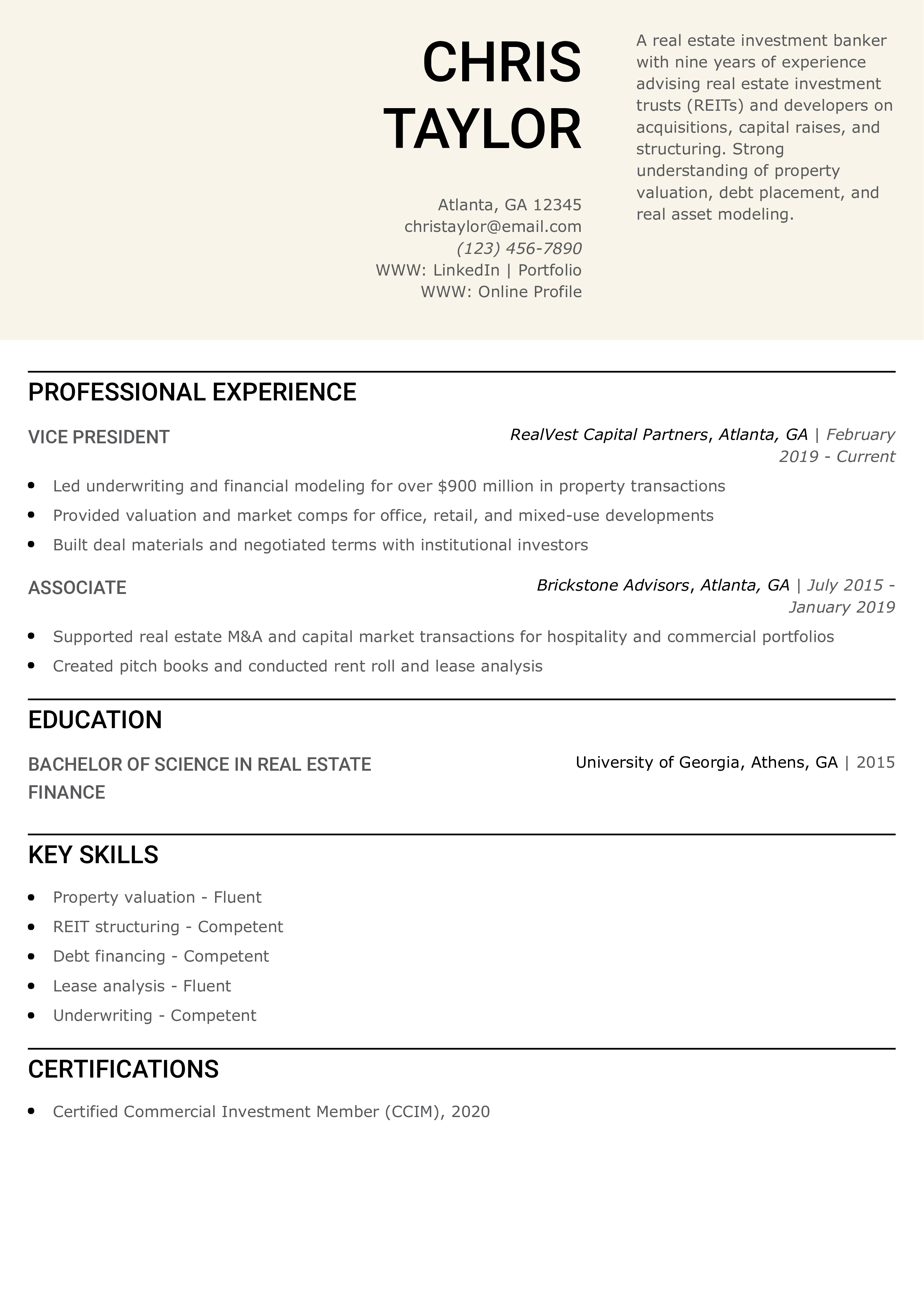

Real Estate Investment Banking Resume

Why This Resume Is a Great Example

This resume highlights real estate industry specialization and relevant deal experience. It demonstrates value through large transaction volume and technical knowledge.

Key Tips

Highlight industry-specific terms and designations for niche industries like real estate. Learn more about technical skills for resumes.

Investment Banking with No Experience Resume

Why This Resume Is a Great Example

This resume proves that leadership and financial exposure can be compelling even without banking experience. It’s well-structured and focused.

Key Tips

If you lack experience, lead with extracurriculars and tools you’ve used. Explore more about what to put on a resume.

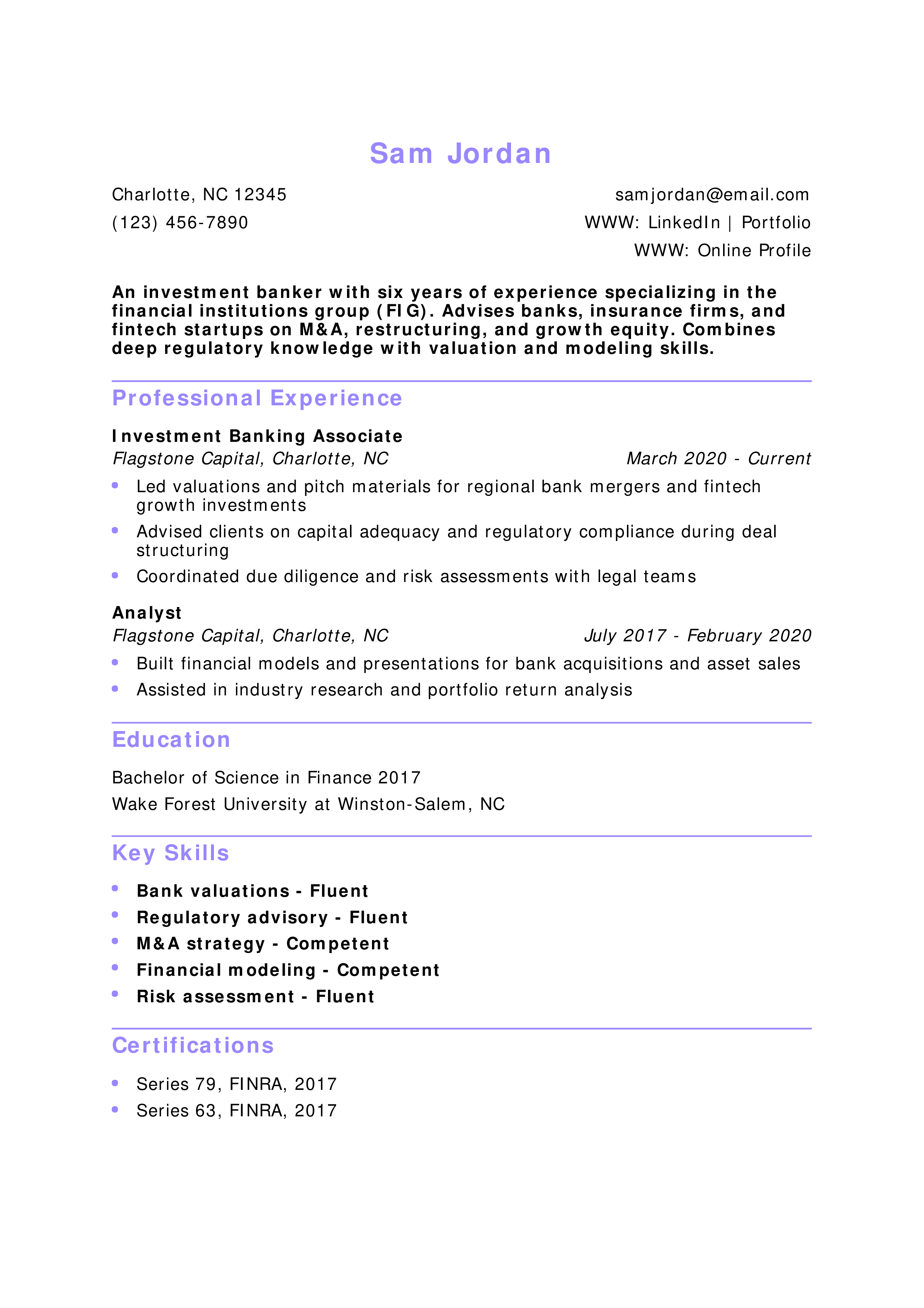

Financial Institutions Group Investment Banking Resume

Why This Resume Is a Great Example

This resume shows a clear niche in financial institutions and provides examples of regulatory experience, a critical skill for FIG bankers.

Key Tips

For sector-specific resumes, use industry keywords and common deal types. Read more at resume language skills.

Investment Banking Associate Director Resume

Why This Resume Is a Great Example

This resume highlights international experience and senior-level leadership in investment banking. It shows the ability to manage clients and coordinate cross-functional teams.

Key Tips

If you’ve worked across borders, emphasize your geographic exposure and coordination skills. See more at resume interests section.

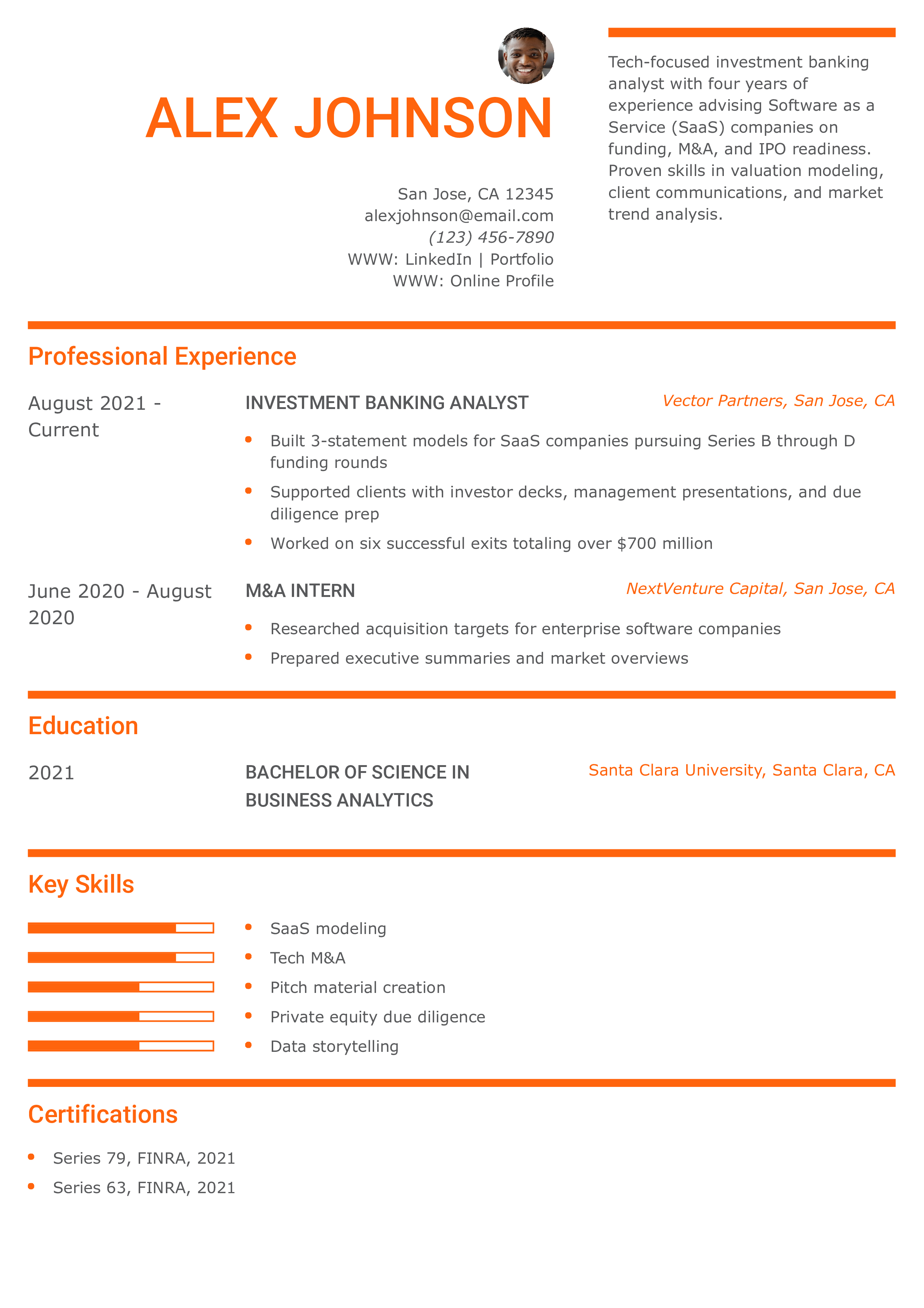

Technology Investment Banking Analyst Resume

Why This Resume Is a Great Example

This resume targets a fast-growing sector with the right blend of technical and client skills. It’s focused, current, and aligned with investor needs in tech.

Key Tips

If you're applying to tech IB roles, tailor your resume with sector-specific tools and transaction types. Learn more in how to list relevant coursework on a resume.

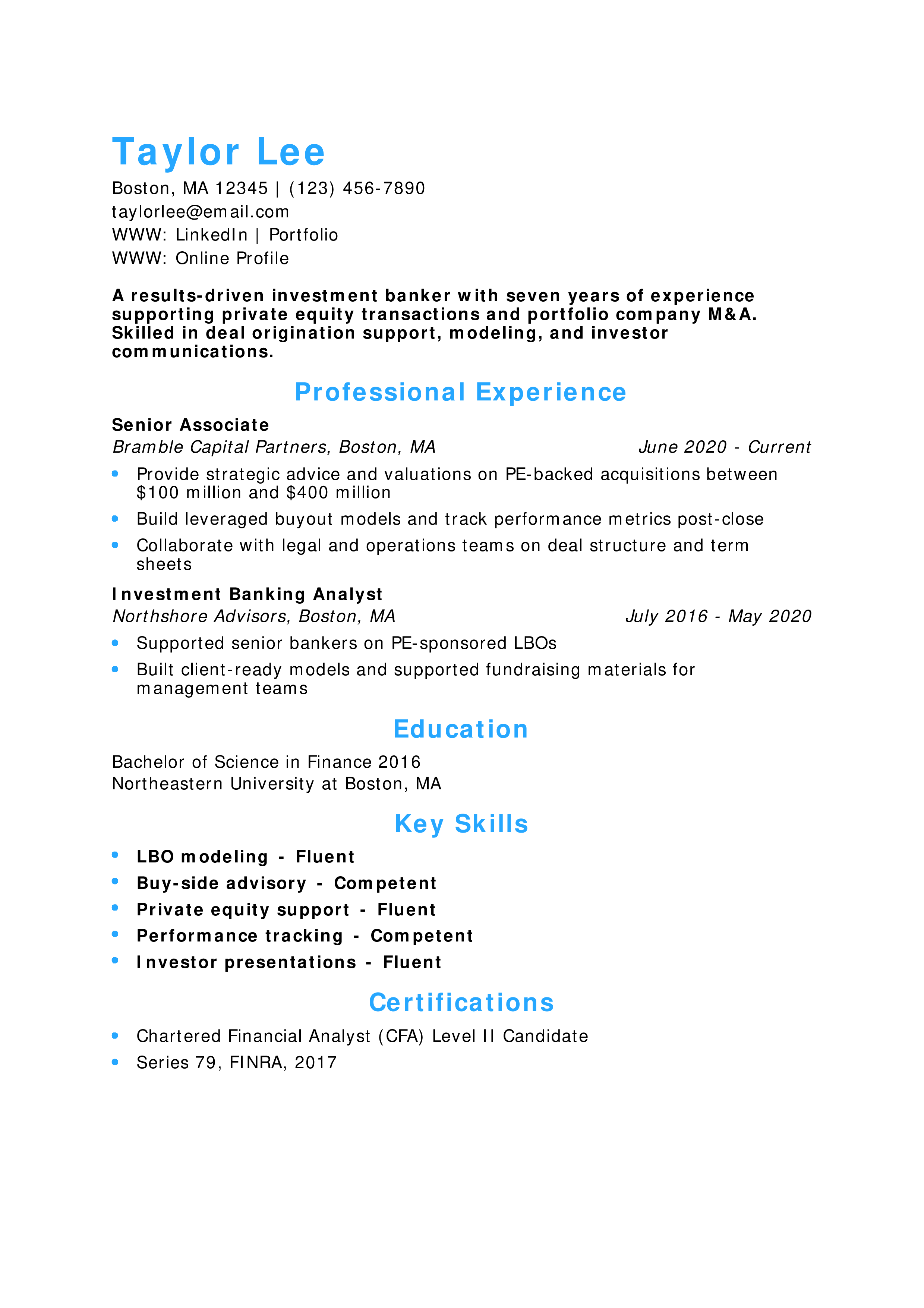

Private Equity Investment Banking Resume

Why This Resume Is a Great Example

This resume clearly aligns with private equity transaction work, blending banking execution with post-deal analysis.

Key Tips

If you're moving between PE and IB roles, use language from both to show crossover knowledge. Explore Cv vs. Resume to tailor appropriately.

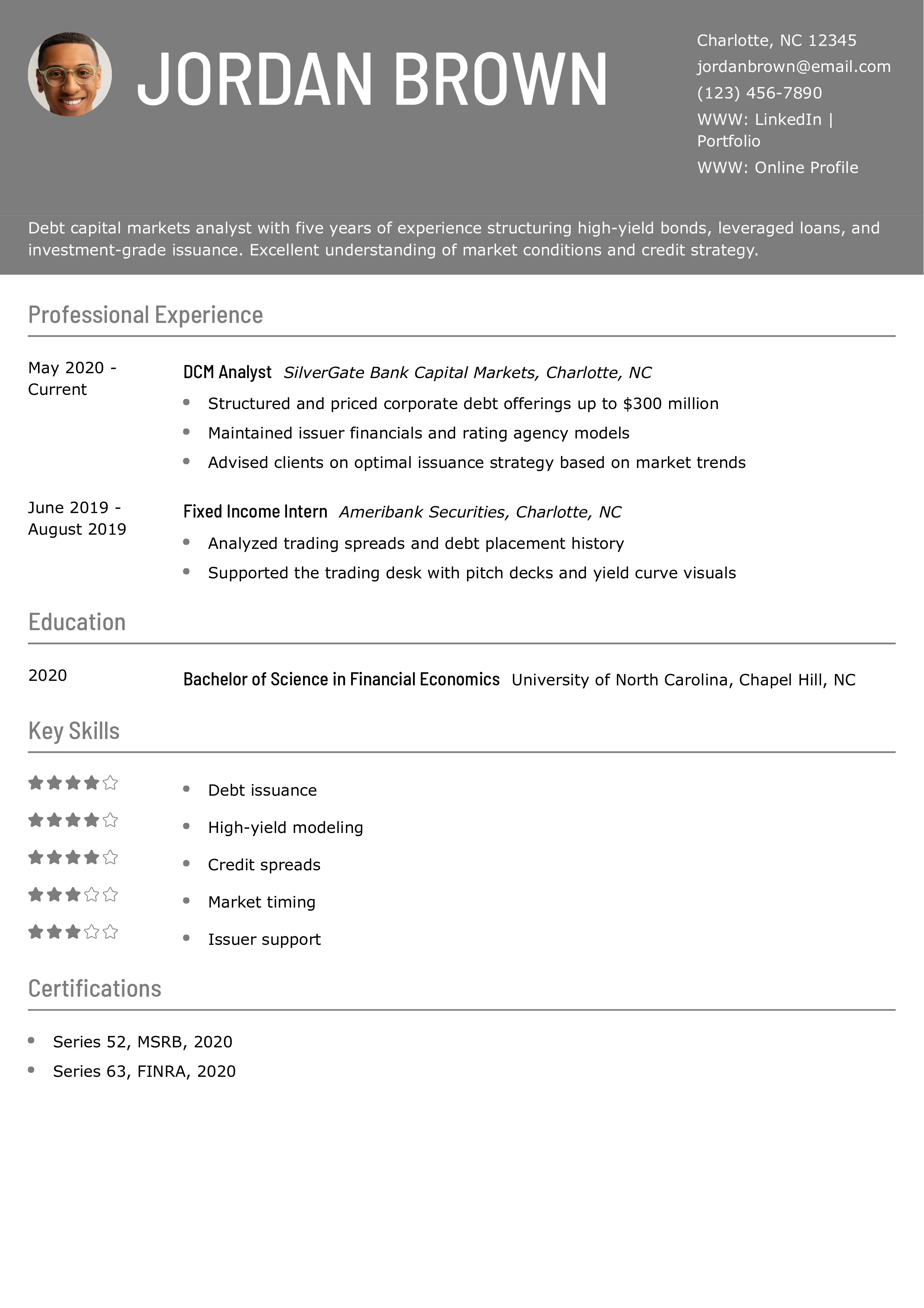

Debt Capital Markets Analyst Resume

Why This Resume Is a Great Example

This resume clarifies a specialized role within capital markets. It focuses on pricing, credit, and real-time market analysis.

Key Tips

For market-facing roles, emphasize financial acumen and issuer communications. Learn how to structure your bullet points using best fonts for a resume.

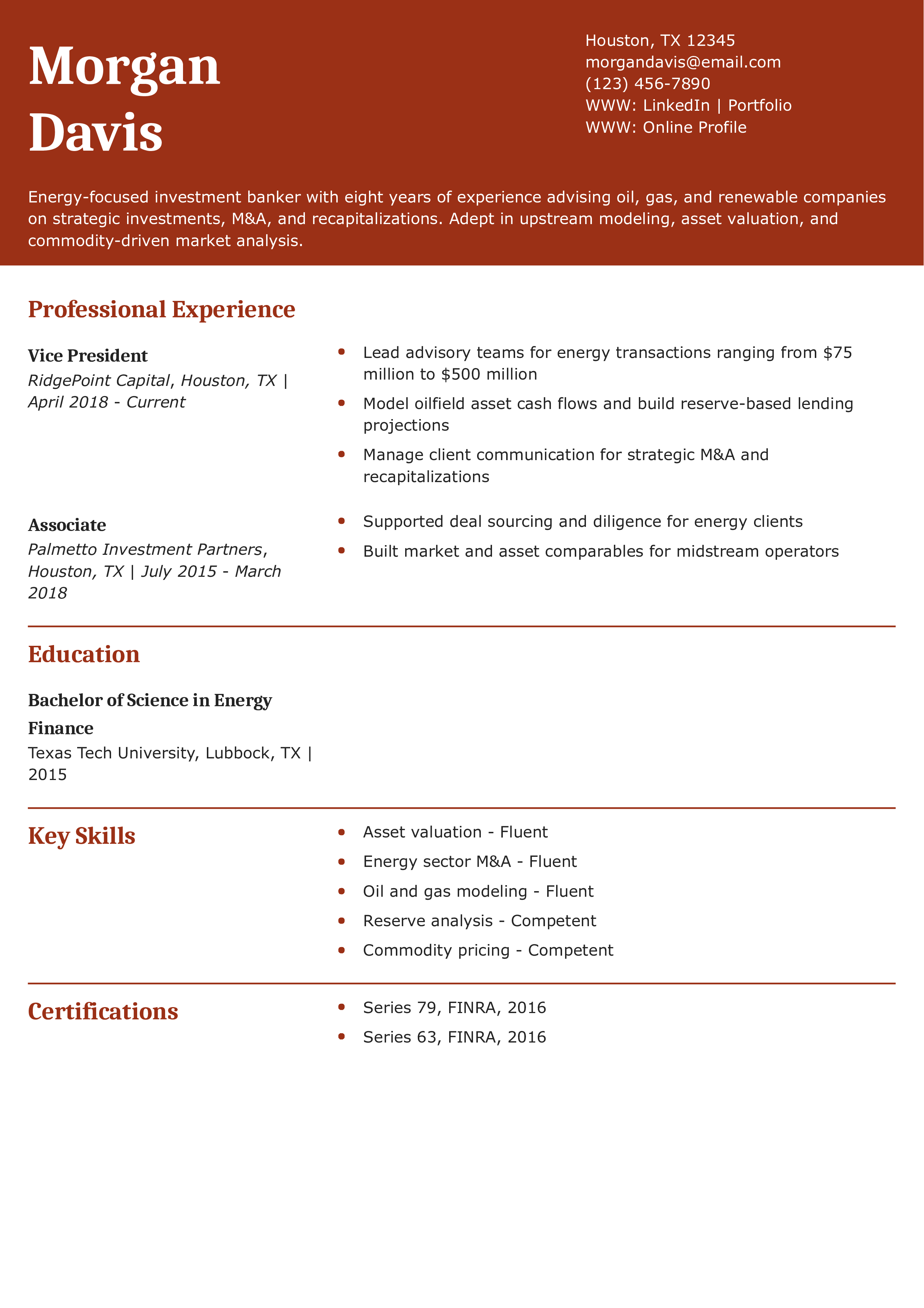

Energy Investment Banking Resume

Why This Resume Is a Great Example

This resume targets and supports a sector niche with technical, modeling, and valuation expertise. It's built for energy-focused firms.

Key Tips

Use clear industry terms and transaction types to signal depth. Get more sector-specific tips from resume skills.

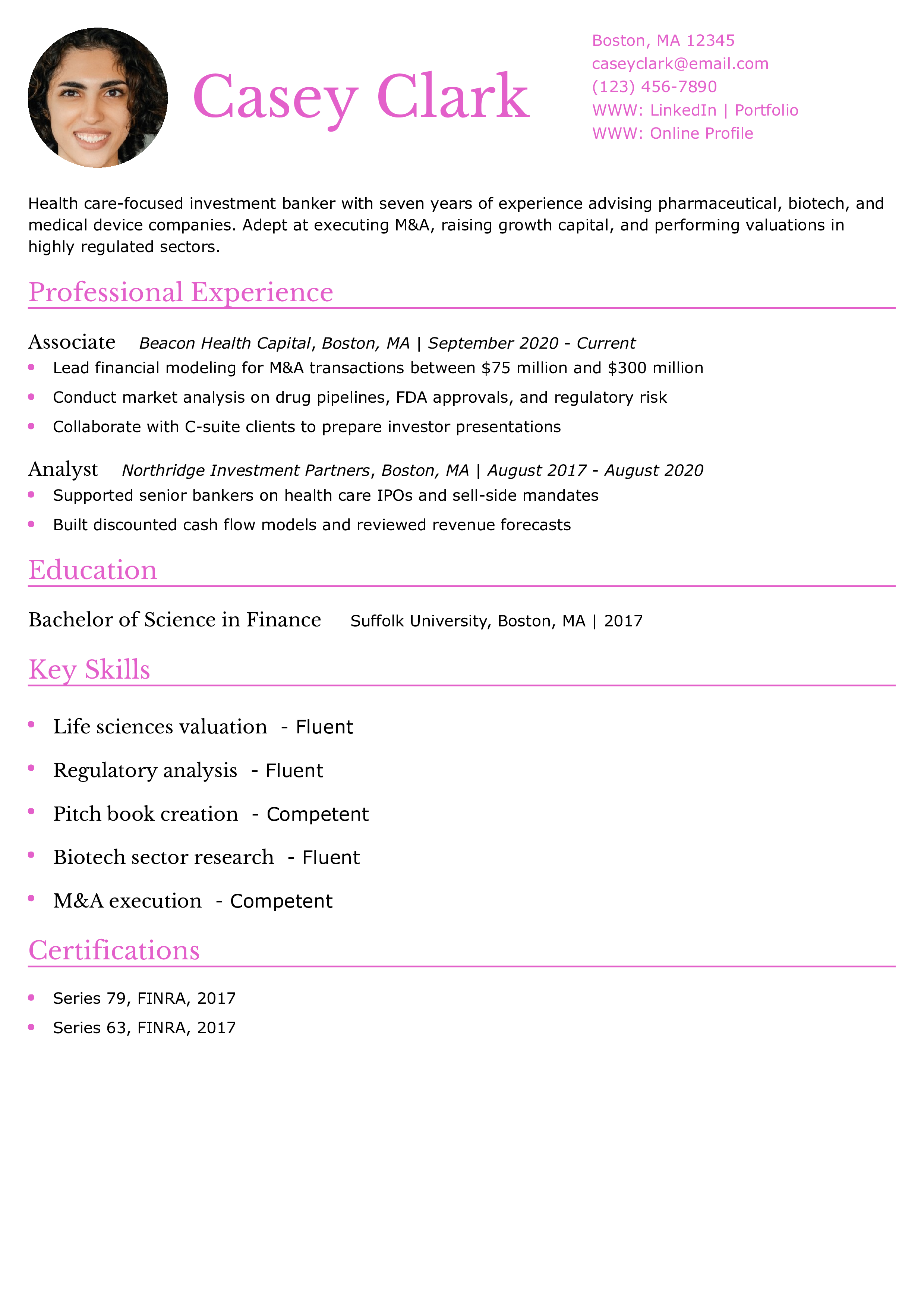

Health Care Investment Banking Resume

Why This Resume Is a Great Example

This resume showcases sector-specific experience in health care, including technical modeling and regulatory expertise — key for pharma and biotech roles.

Key Tips

If you specialize in a highly regulated industry, emphasize your familiarity with compliance. For help tailoring your resume, visit how to list your education on a resume.

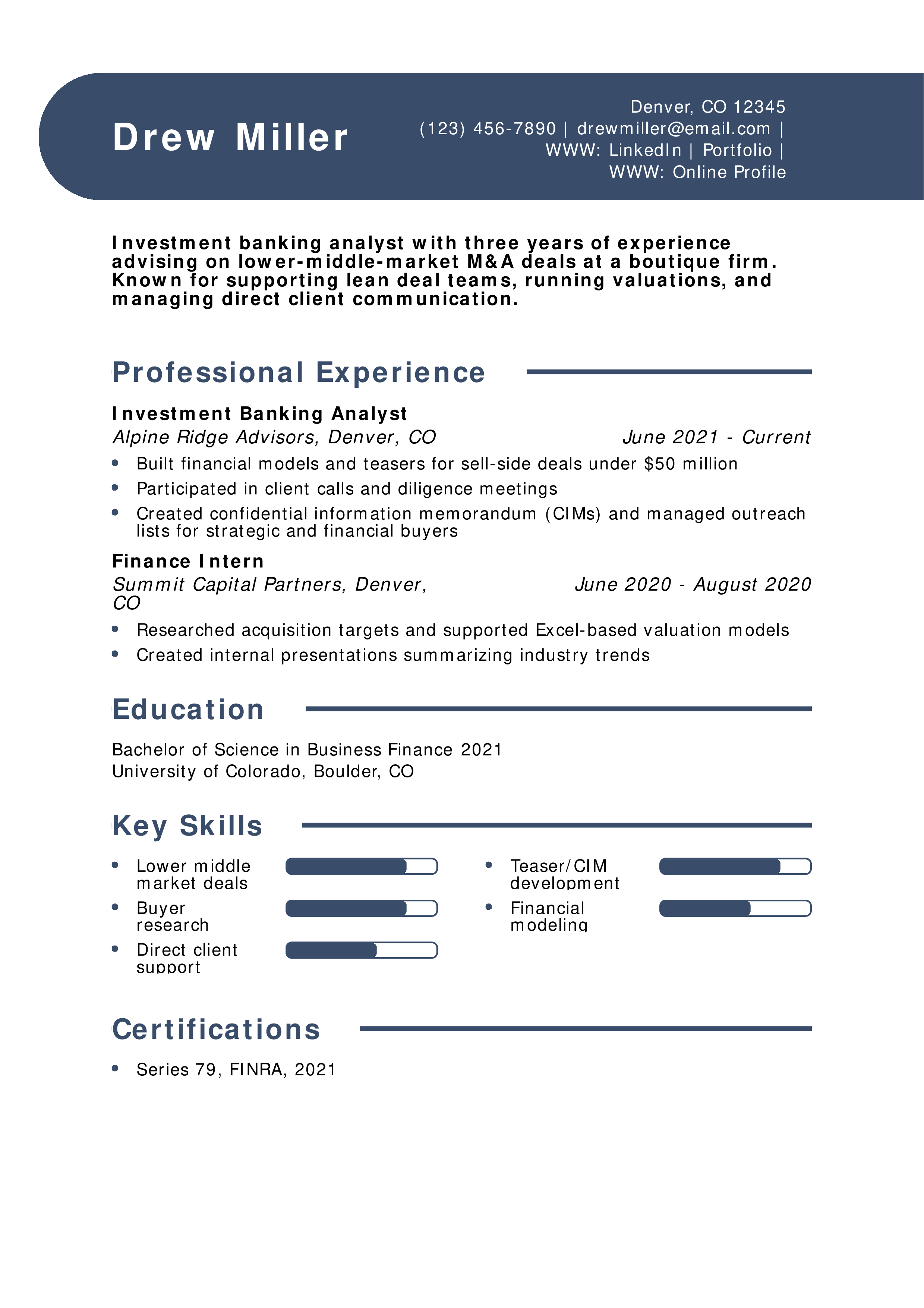

Boutique Investment Banking Analyst Resume

Why This Resume Is a Great Example

This resume shows how a junior banker can take on high responsibility in a boutique firm. It emphasizes technical ability and cross-functional communication.

Key Tips

If you've worn multiple hats at a smaller firm, highlight that versatility. Learn more at resume outline examples.

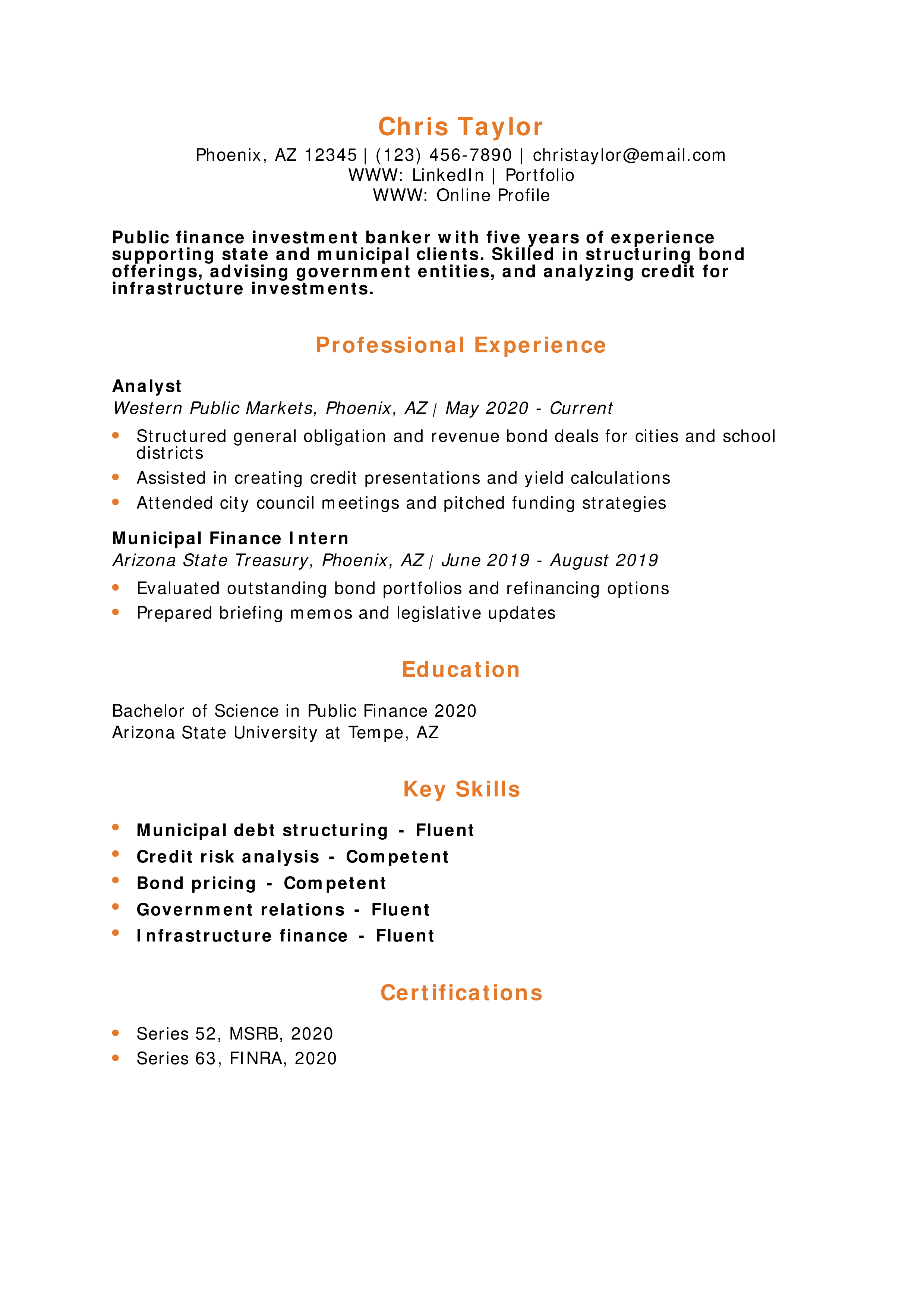

Public Finance Investment Banking Resume

Why This Resume Is a Great Example

This resume stands out for its clear focus on municipal finance, a unique and vital investment banking niche.

Key Tips

If your clients are government entities, show how you've communicated with public stakeholders. See more at resume language skills.

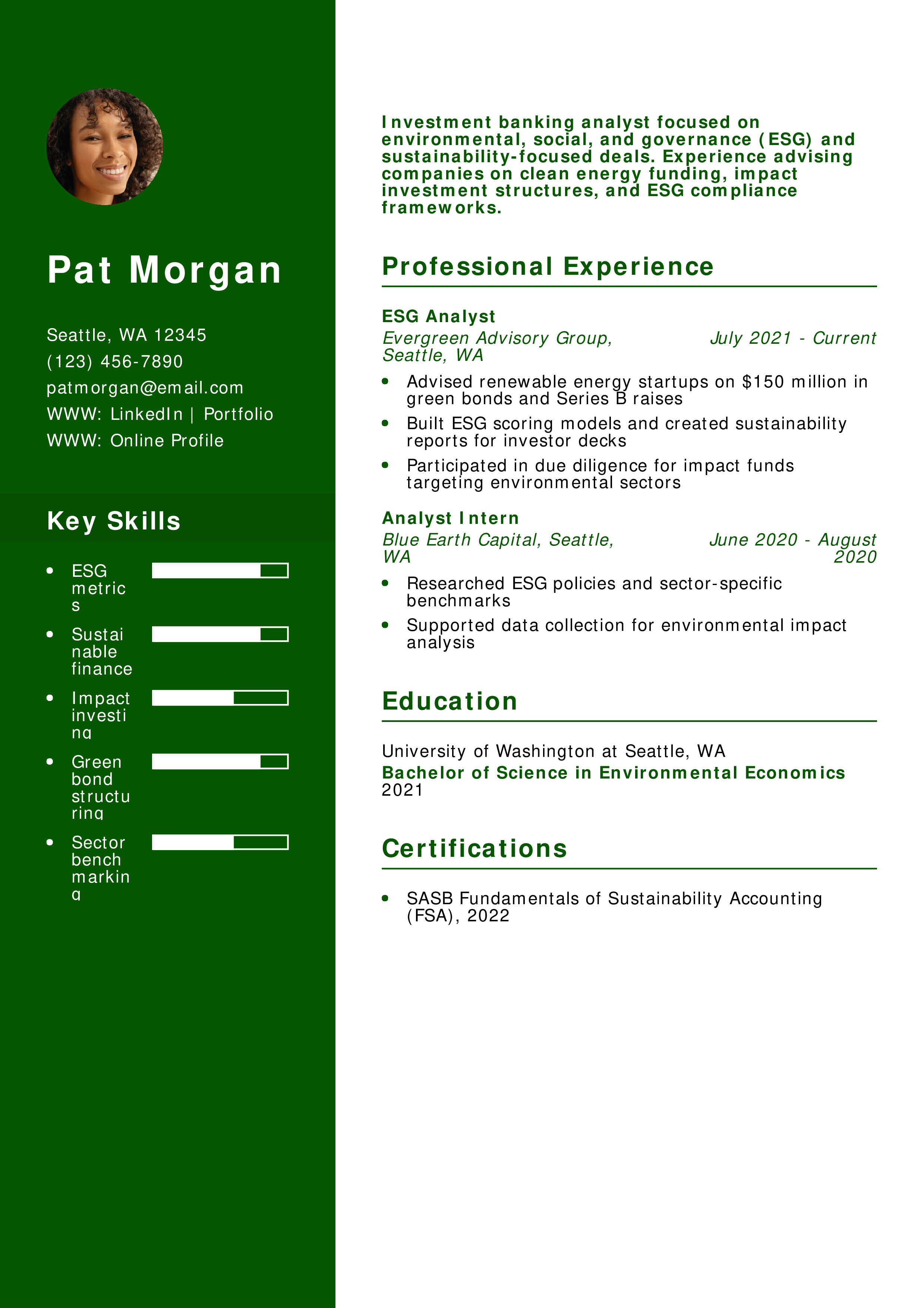

Environmental, Social, and Governance Investment Banking Resume

Why This Resume Is a Great Example

This resume highlights ESG-specific experience, showing technical finance skills and mission-driven impact — perfect for today’s market.

Key Tips

If you’re applying for sustainability-focused roles, include certifications and metrics. For formatting tips, check out best resume formats.

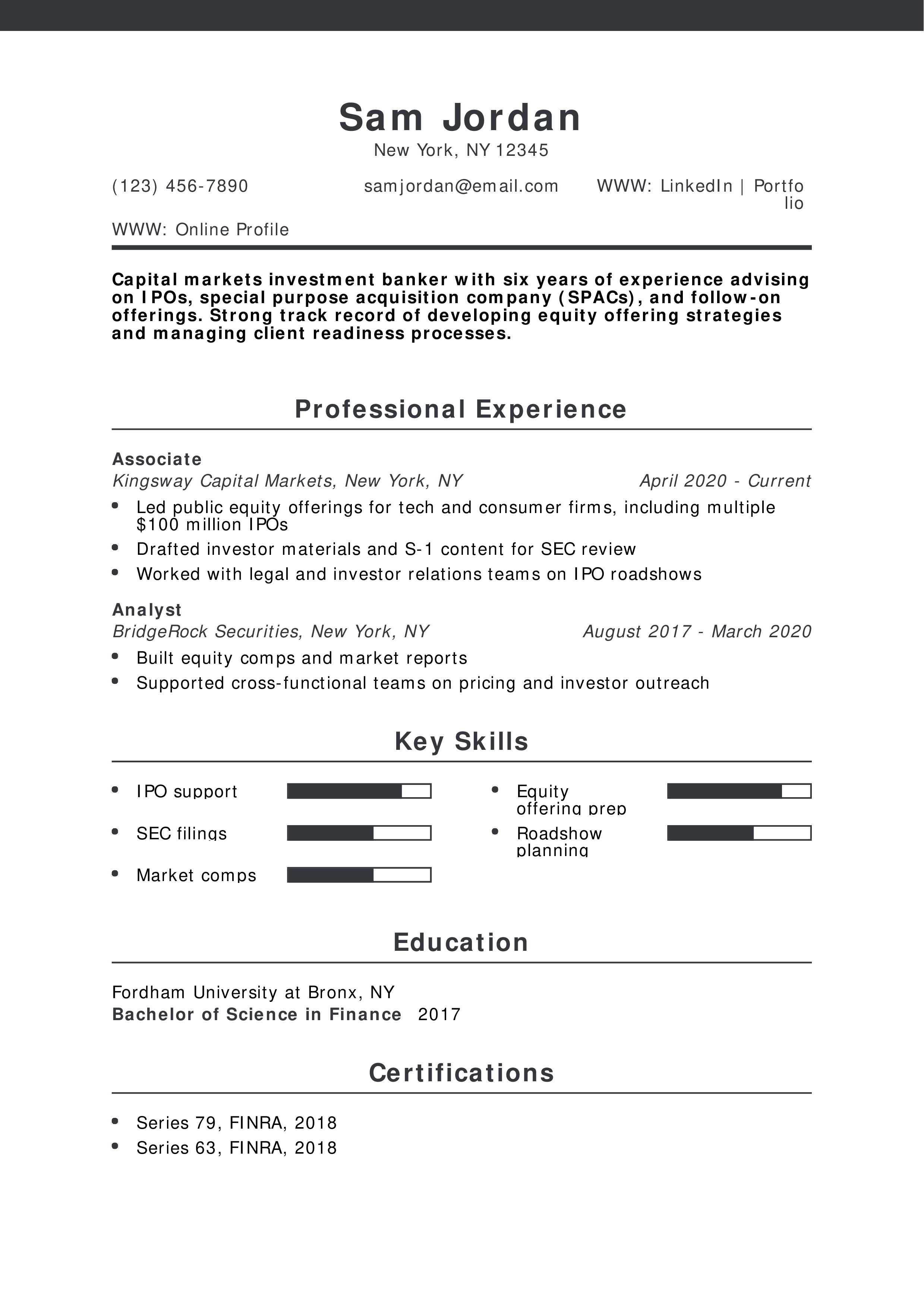

Capital Markets Investment Banking Resume

Why This Resume Is a Great Example

This resume shows how capital markets professionals support public offerings with precision and attention to compliance.

Key Tips

For capital markets roles, focus on SEC work, investor communication, and public company processes. Learn more about how to make a resume.

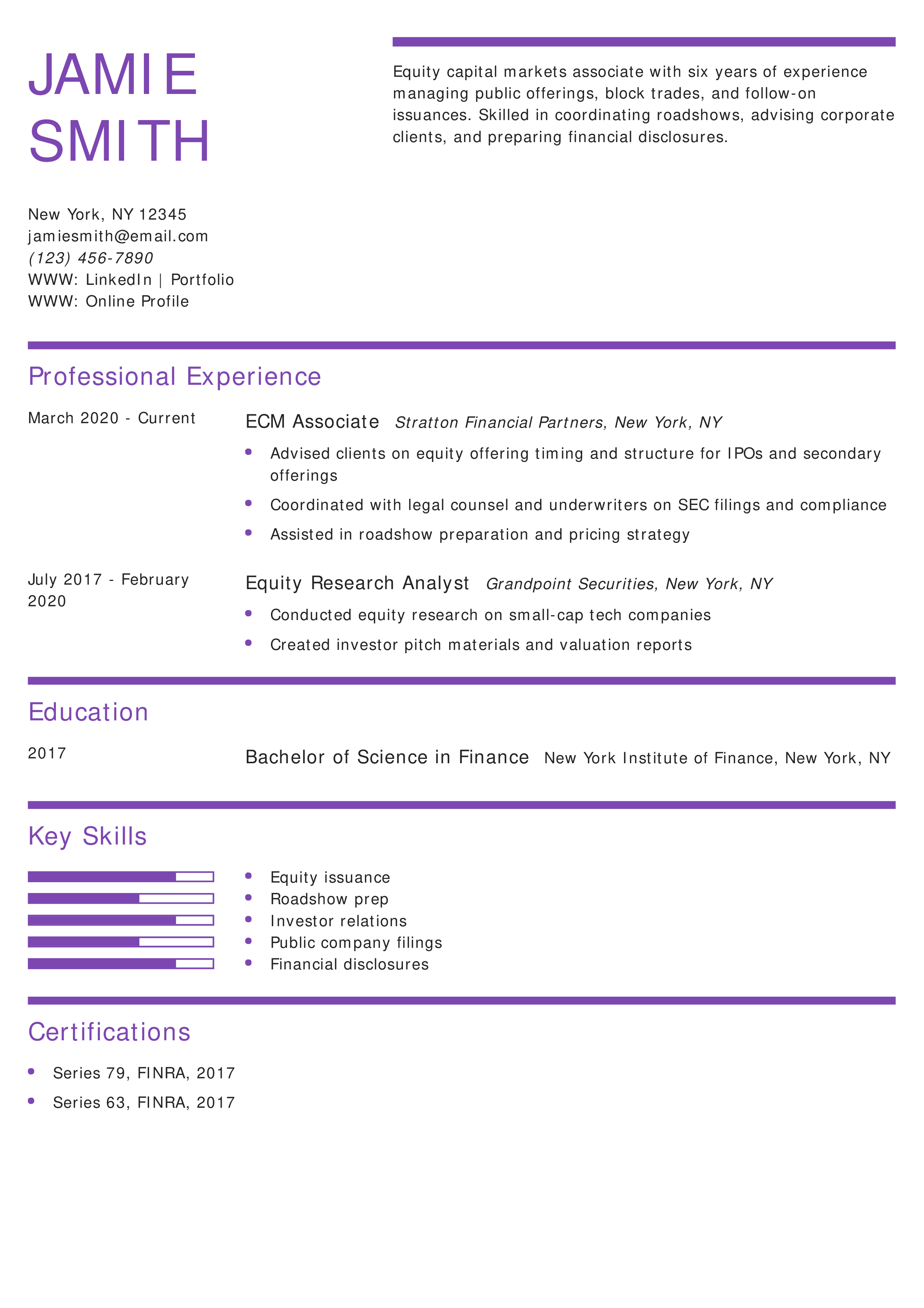

Equity Capital Markets Investment Banking Resume

Why This Resume Is a Great Example

This resume effectively highlights public equity transaction experience and outlines a clear career trajectory from research into capital markets.

Key Tips

Include regulatory and investor-facing work for equity capital markets (ECM) roles. Learn how to highlight it with resume skills.

Restructuring Investment Banking Resume

Why This Resume Is a Great Example

This resume demonstrates deep restructuring knowledge and clear experience in high-stakes financial scenarios.

Key Tips

For roles involving distressed companies, show specific technical skills like liquidity and waterfall modeling. Read more about how to list publications on a resume or CV.

Cross-border Mergers and Acquisitions Investment Banking Resume

Why This Resume Is a Great Example

This resume showcases global deal-making expertise, backed by a clear sector and regional focus.

Key Tips

For cross-border work, highlight language skills, regions covered, and multi-jurisdictional collaboration. For more guidance, see resume language skills.

Special Purpose Acquisition Company Investment Banking Resume

Why This Resume Is a Great Example

This resume clearly targets SPAC-specific skills, which are highly relevant in a specialized M&A environment.

Key Tips

Use that exact terminology if you're in a niche like SPACs or PIPEs. Learn how to integrate emerging deal types in your resume with resume objective examples.

Family Office Investment Banking Resume

Why This Resume Is a Great Example

This resume speaks directly to the unique needs of family offices, blending investment expertise with wealth strategy.

Key Tips

Private wealth roles require showing trust, discretion, and planning skills. Learn how to reflect this in how to list references on a resume.

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Investment Banking Text-Only Resume Templates and Examples

How To Write an Investment Banking Resume

Banking resumes that avoid deal or product details feel surface level. Show me the clients you supported, products you sold, or problems you resolved. That clarity matters more than titles.

1. Write a compelling profile summarizing your qualifications

To grab the hiring manager’s attention, you must create a strong opening summary that captures the most compelling aspects of your professional experience. Start by detailing your job title, years of experience, and three to four specializations that align with the job description.

As an investment banker, also emphasize the types of industries you’ve worked in. Use the summary to show hiring managers that you’ve acquired knowledge of various kinds of businesses, which is essential for making the right financial decisions.

Professional Profile - Example #1

Profile

An investment banker with five years of experience specializing in financial analysis, client relations, economics, and commercial banking. A proven track record of developing investment strategies for high-net-worth clients and maximizing portfolio performance.

Professional Profile - Example #2

Profile

An investment banker with over 10 years of experience providing investment strategies for opportunities within the alternative energy, automotive, and utility industries. A proven track record of maximizing portfolio growth and profitability by evaluating competitive advantages and identifying long-term market potential.

2. Add an accomplishment-driven professional experience section

When crafting your professional experience section, consider whether or not your bullet points are accomplishment-driven, emphasizing the value you generated for clients and organizations. Also, ensure that your document effectively captures the full scope of your financial analysis and investment strategy expertise.

Leverage monetary figures, percentages, and financial data from your career as an investment banker to maximize the impact of your bullet points. Incorporating numbers into your document will draw the reader’s eye and establish credibility and a sense of scope for your professional achievements. For example, you could highlight the size of the investment portfolios you managed or how your financial strategies positively impacted return on investment (ROI).

Professional Experience - Example #1

Professional Experience

Investment Banker, Johnson and Goldman Inc., San Francisco, CA

October 2017 – present

- Develop financial models and investment strategies for client portfolios valued at $300,000 to $1 million and provide recommendations for valuations, mergers and acquisitions (M&A,) and product offerings

- Conduct equity research, identify long-term investment opportunities in companies with best-in-class management teams and business models, and recommend investment opportunities in businesses committed to solving complex customer problems

- Perform in-depth valuations of intangible assets for purchase price allocations by evaluating income, market indicators, and company financials

Professional Experience - Example #2

Investment Banker, Klein and Davidson Consulting, New York, NY

September 2016 – present

- Create dynamic investment strategies for client portfolios valued at up to $1.5 million, develop complex financial models, and deliver presentations to clients and prospects

- Build relationships with corporate leaders and lead investigative meetings between high-profile investors and C-level executives during the due diligence phase

- Identify opportunities within the clean energy space, including solar companies and electric vehicle manufacturers

3. Include relevant education and certifications

In addition to your education, you’ll need to highlight certifications to advance your investment banking career. Many institutions require these credentials, even for entry-level roles. Some certifications you should target are the Series 7, Series 63, Series 66, and Series 79 licenses, all acquired through FINRA. Obtaining a Certified Financial Analyst designation is also worth considering, as this is one of the industry’s oldest and most prominent credentials.

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Series 7, FINRA, 2018

- Series 63, FINRA, 2016

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] [Dates Enrolled]

Example

- Bachelor of Science (B.S.) Economics

- Columbia University, New York, NY September 2007- May 2011

4. List relevant key skills and proficiencies

Most organizations rely on Applicant Tracking Systems (ATS) to identify qualified candidates for potential job opportunities. If your resume has certain keywords, your application may reach the hiring manager. To mitigate this risk, evaluate the job description and integrate key terms that match the needs of the organization you’re applying to. Below are keywords you may encounter throughout your job search:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Client relations |

| Due diligence | Economics |

| Equity research | Finance |

| Financial analysis | Financial modeling |

| Financial planning and analysis (FP&A) | Investment banking |

| Investment strategy | Leadership |

| Market analysis | M&A |

| Portfolio management | Relationship building |

| ROI analysis | Strategic investing |

| Strategic partnerships | Valuations |

5. Highlight your leadership and client relations skills

Showcasing your leadership capabilities and client relations experience while pursuing investment banker opportunities is important. In this role, you’ll be interfacing with high-level executives and attending meetings with various cross-functional teams to conduct due diligence and provide recommendations to grow client portfolios. Interpersonal skills are essential for investment bankers, as you’ll need to communicate high-level financial strategies and concepts to the C-suite.

How To Pick the Best Investment Banker Resume Template

If you struggle to find a suitable template, you’re not alone. With various options, finding the ideal fit for your professional needs can be challenging. The most important aspect of any resume template is structure and organization. Hiring managers will be interested in your financial expertise and investment banking accomplishments first and foremost, so avoid flashy colors and graphics that may draw the reader’s eye away from your content.

Frequently Asked Questions: Investment Banking Resume Examples and Advice

Can I adjust an Investment Banking resume example for different roles or industries?-

Yes, you can easily adjust an Investment Banking resume example by aligning your profile summary and key skills with the job description. If you are applying to different industries, emphasize transferable skills and any industry-specific experience. For example, if you’re applying to a finance role after working in tech, highlight your data analysis and financial reporting skills as relevant to both fields.

What are common action verbs for investment banking resumes?-

Needing more action verbs when crafting your professional experience section is common. It's essential to differentiate your word choice, as your bullet points may appear stale or redundant. We've compiled a list of action verbs to keep your content fresh and compelling:

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Collaborated | Conducted |

| Coordinated | Created |

| Determined | Developed |

| Drove | Enhanced |

| Evaluated | Identified |

| Implemented | Led |

| Managed | Negotiated |

| Oversaw | Performed |

| Provided | Supported |

| Finance | |

How do you align your resume with a job description?-

According to the Corporate Finance Institute, the average annual salary for investment bankers ranges from $125,000 to $500,000, depending on your experience level. Align your resume with individual job descriptions to differentiate yourself from the competition. Start by researching the company and incorporating qualifications, skills, and achievements that match their needs.

For example, suppose an organization heavily focuses on investment opportunities in startup technology companies. In that case, craft bullet points that highlight your ability to evaluate long-term ROI potential based on market indicators and product use cases. You'll increase the odds of landing your next job opportunity by showcasing specific examples of you developing investment strategies and facilitating portfolio growth.

What is the best investment banker resume format?-

Reverse chronological is the ideal format for investment banker resumes. Hiring managers will always be most interested in your recent experience, which places those jobs at the top of your document. Avoid functional resume formats here.

Should my investment banker resume be one or two pages?-

Your investment banker resume should ideally be one page, especially if you have fewer than 10 years of experience. A two-page resume can be effective for seasoned professionals with a longer track record if it highlights accomplishments and skills directly relevant to the job. Every detail should add value and strengthen your candidacy.

Limit your work experience to the past 10 to 15 years, unless earlier positions are highly relevant. Keeping your resume concise and targeted will make a strong and memorable impression on potential employers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Crafting a matching cover letter can be a strong asset for your job application. This allows you to showcase aspects of yourself as a professional that you can’t usually highlight on your resume. In your middle paragraphs, mention the organization's reputation, mission statement, or culture and why this draws you to apply for the position. For more information, please see our business cover letter guide.