To craft a results-driven financial planning and analysis (FP&A) resume, tell your unique story within the finance industry by emphasizing your strongest career achievements. Highlight your ability to improve profitability, drive business transformations, and reduce operating costs.

Give examples of you enhancing financial reporting processes to facilitate data-driven decision-making. Showcase your ability to grow revenue for clients, businesses, and organizations. This guide will help you translate your FP&A experience into a powerful marketing document.

Most Popular Financial Planning and Analysis (FPA) Resumes

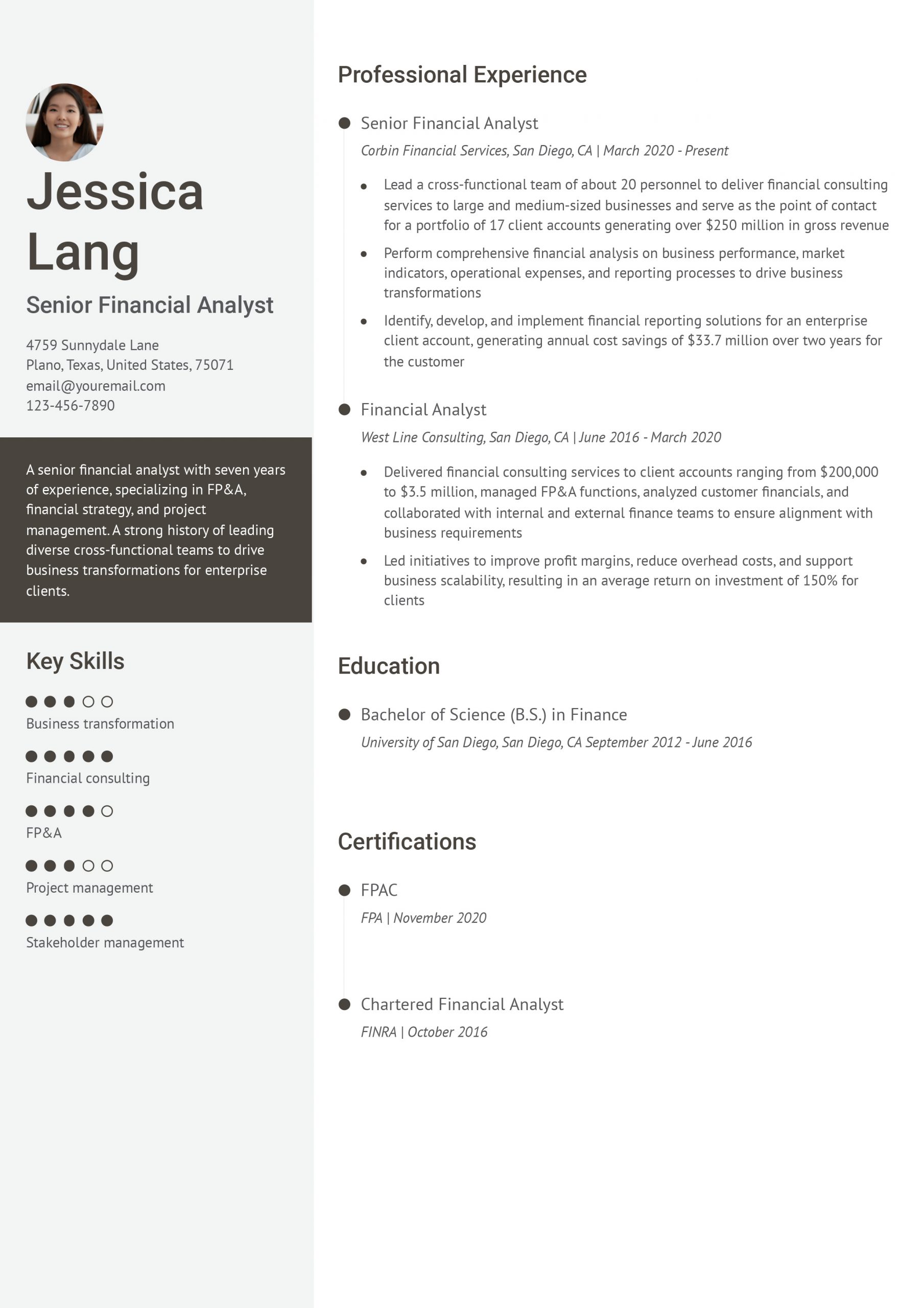

Entry-Level FP&A Resume Example

Why this financial planning and analysis resume example is strong:

This entry-level resume highlights the candidate’s established experience and backs that up with key skills and education.

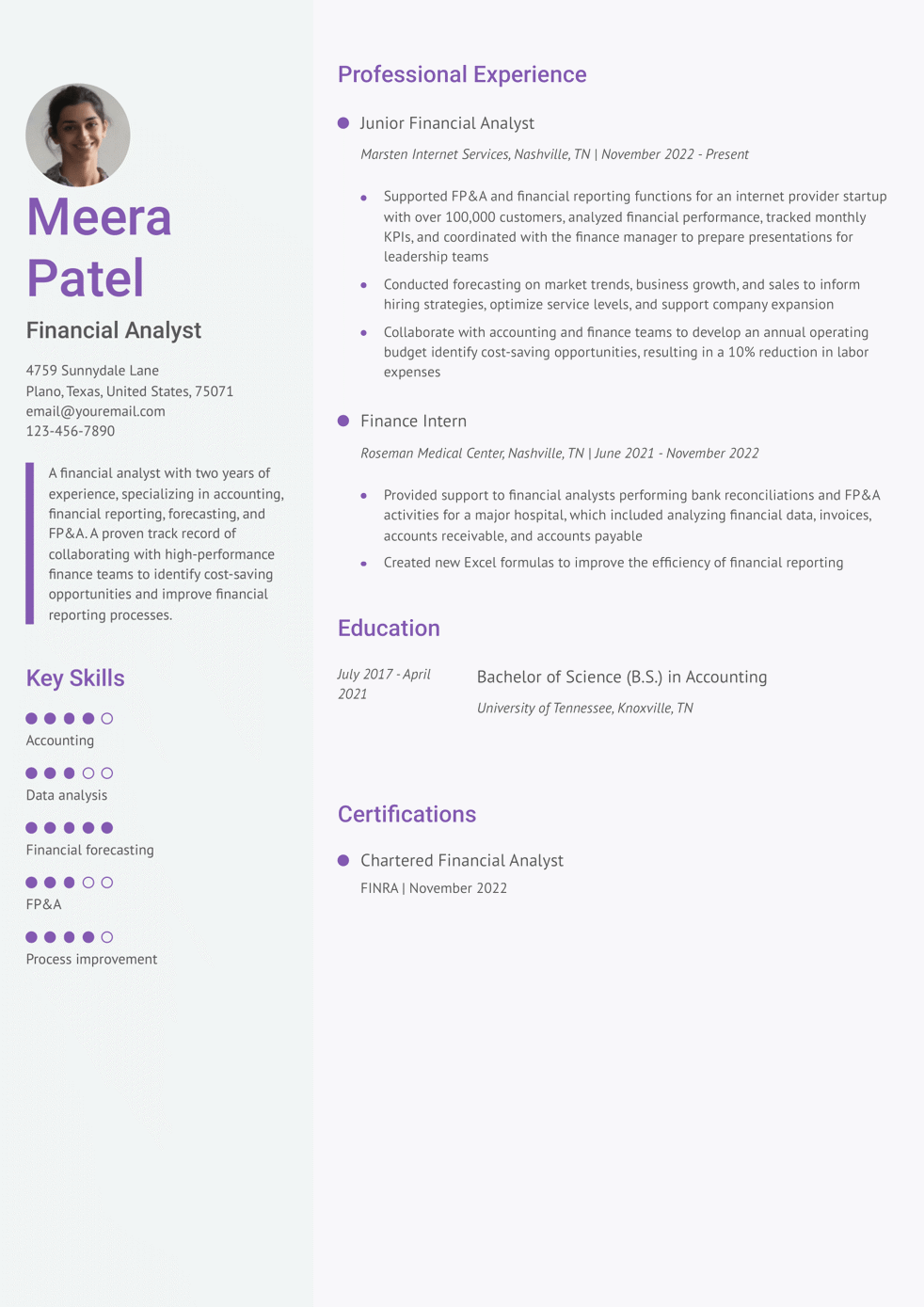

Mid-Career FP&A Resume Example

Why this financial planning and analysis resume example is strong:

This mid-career resume focuses on the candidate's accomplishments in their professional experience and goes on to list their relevant certifications.

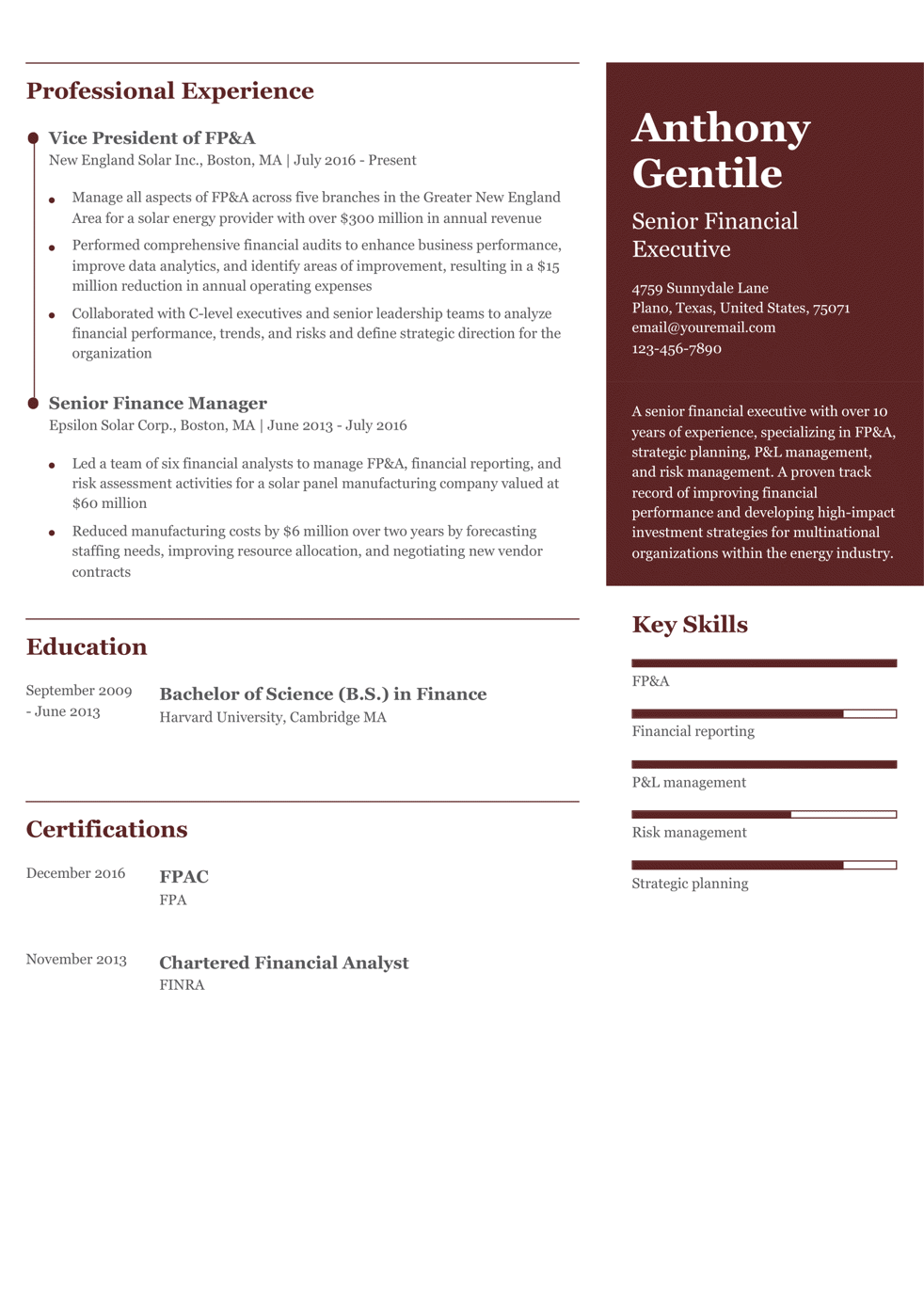

Senior-Level FP&A Resume Example

Why this financial planning and analysis resume example is strong:

This senior-level candidate uses the resume profile to recap their extensive experience and key career accomplishments.

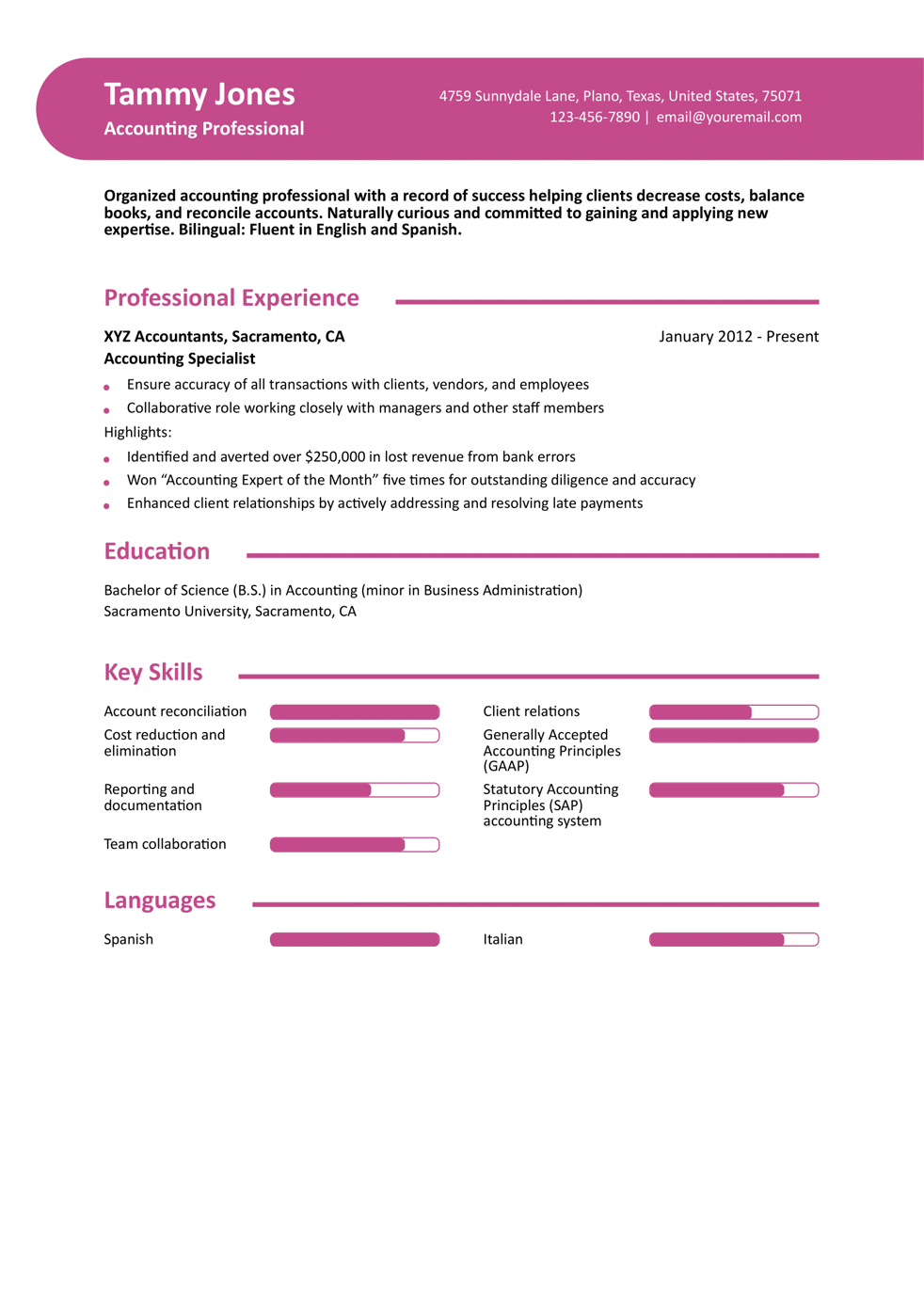

Accountant Resume Example

Why this accountant resume example is strong:

The candidate in this resume has limited experience, so they open their resume with key skills and highlight additional key points based on their professional expertise.

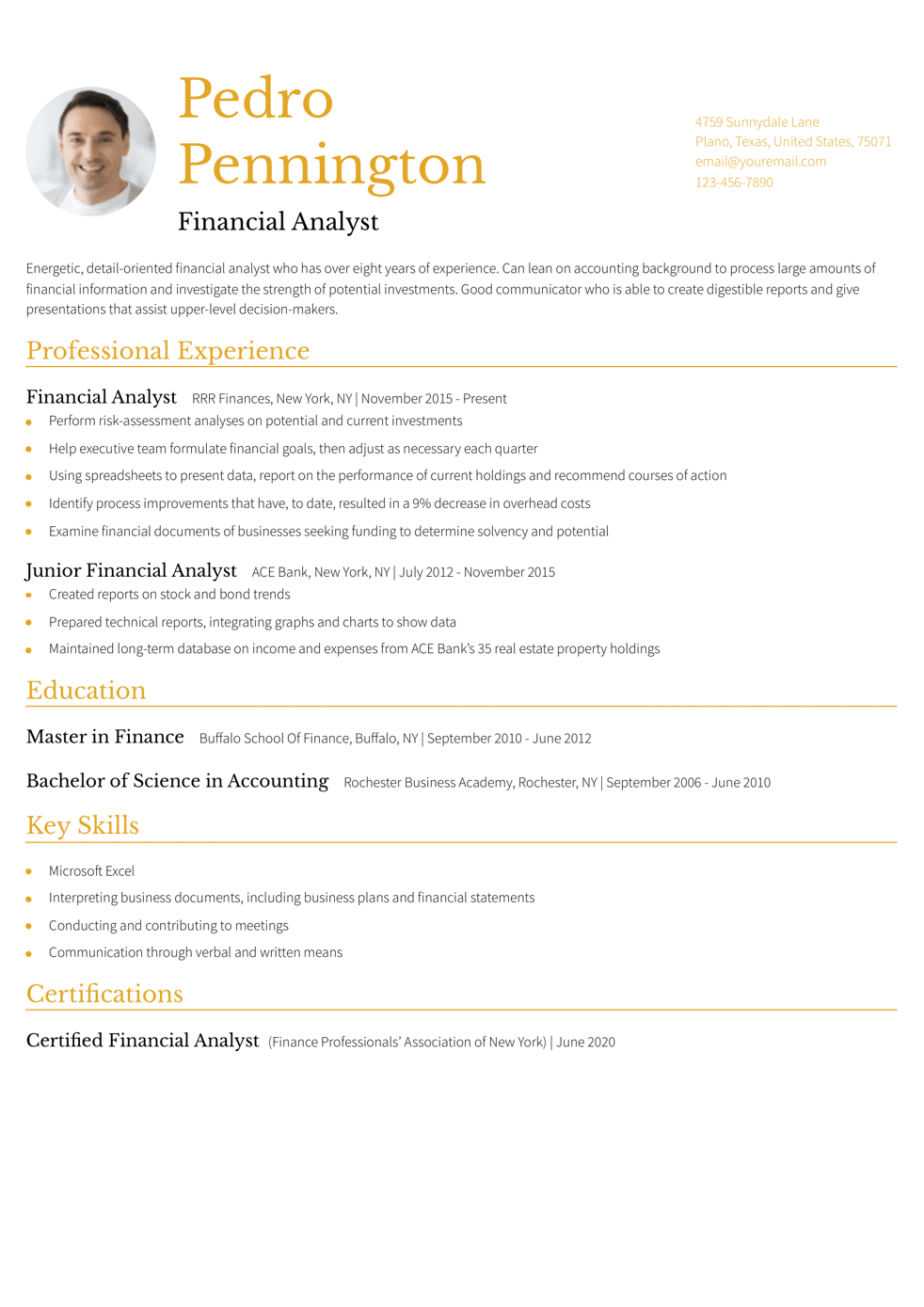

Financial Analyst Resume Example

Why this financial analyst resume example is strong:

This resume keeps the formatting clean to showcase key accomplishments under the candidate’s professional experience and their extensive education, skills, and certifications.

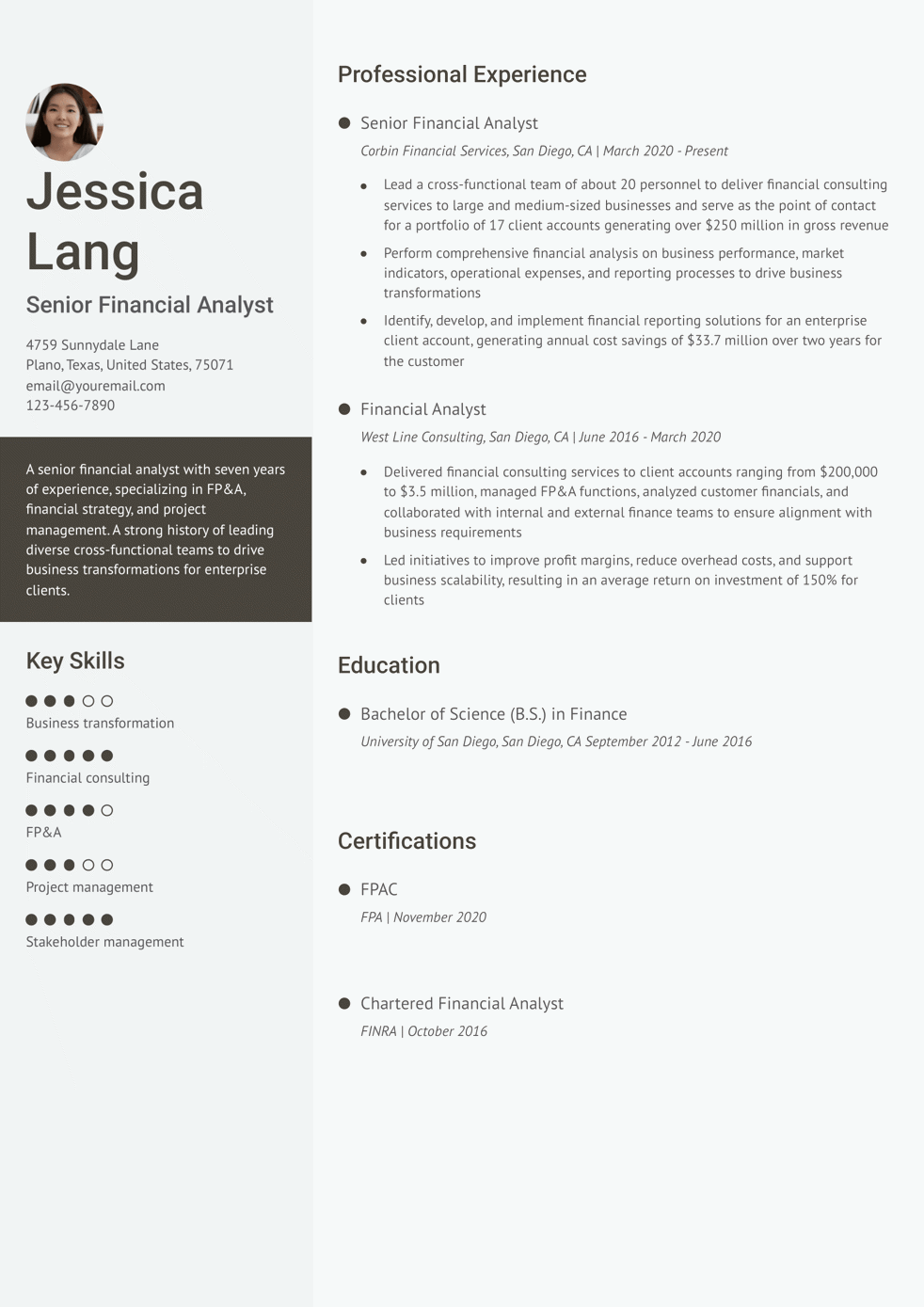

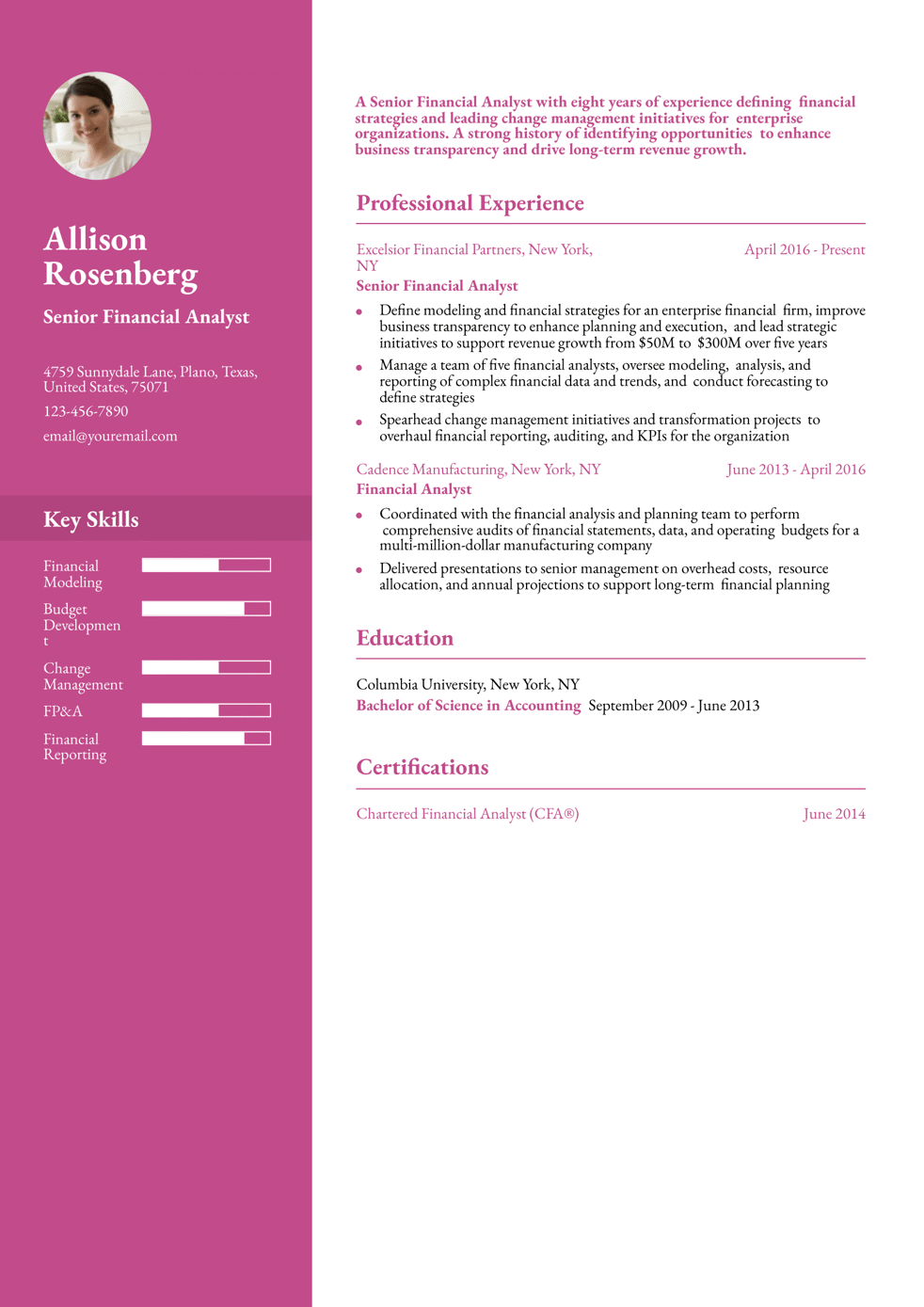

Senior Financial Analyst Resume Example

Why this senior financial analyst resume example is strong:

As a senior-level candidate, they use their resume to focus on their work experience and key accomplishments in those roles.

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Financial Planning and Analysis Text-Only Resume Templates and Examples

How To Write a Financial Planning and Analysis Resume

1. Write a brief summary of your financial planning and analysis qualifications

Craft a compelling snapshot of your career to grab the attention of prospective employers.

Start with an opening sentence that details your job title, years of experience, industry, and three to four skills that match the job posting. Highlight your comprehensive financial knowledge and FP&A capabilities. Incorporate a strong metric, key performance indicators (KPI), or financial figure to show hiring managers your proven track record of success. Showcase your ability to improve profit margins, identify financial trends, and mitigate risks to help businesses scale.

Senior-Level Profile Example

A senior financial executive with over 10 years of experience specializing in FP&A, strategic planning, profit and loss (P&L) management, and risk management. A proven track record of improving financial performance and developing high-impact investment strategies for multinational organizations within the energy industry.

Entry-Level Profile Example

A financial analyst with two years of experience, specializing in accounting, financial reporting, forecasting, and FP&A. A proven track record of collaborating with high-performance finance teams to identify cost-saving opportunities and improve financial reporting processes.

2. Add your financial planning and analysis experience with compelling examples

Your professional experience section is the focal point of the resume. To make a positive impression on the hiring manager, tell your story by highlighting your strongest accomplishments as a finance professional. Focus on aspects of your experience that align with the organization’s needs. Establish context for the reader and incorporate hard numbers, financial data, profit margins, and monetary figures to maximize the impact of your bullet points.

For example, if your FP&A activities uncovered pathways to reduce operational expenses, quantify this achievement with a percentage or financial figure. If your financial reporting and market analysis helped define strategies for business expansion, emphasize revenue growth or an increase in profitability. Paint a clear picture of your experience to differentiate yourself from the competition and land your next big job opportunity.

Senior-Level Professional Experience Example

Vice President of FP&A, New England Solar Inc., Boston, MA | July 2016 – present

- Manage all aspects of FP&A across five branches in the Greater New England Area for a renewable energy provider with over $300 million in annual revenue

- Performed comprehensive financial audits to enhance business performance, improve data analytics, and identify areas of improvement, resulting in a $15 million reduction in annual operating expenses

- Collaborated with C-level executives and senior leadership teams to analyze financial performance, trends, and risks and define strategic direction for the organization

Entry-Level Professional Experience Example

Financial Analyst, Marsten Internet Services, Nashville, TN | November 2022 – present

- Supported FP&A and financial reporting functions for an internet provider startup with over 100,000 customers, analyzed financial performance, tracked monthly KPIs, and coordinated with the finance manager to prepare presentations for leadership teams

- Conducted forecasting on market trends, business growth, and sales to inform hiring strategies, optimize service levels, and support company expansion

- Collaborate with accounting and finance teams to develop an annual operating budget identify cost-saving opportunities, resulting in a 10% reduction in labor expenses

3. Outline your education and financial planning and analysis-related certifications

Highlight relevant education, courses, training, and certifications to show hiring managers you have the qualifications their company is looking for. List your college degrees, universities, and graduation dates. Feature industry certifications such as the Chartered Financial Analyst (CFA) or Corporate Financial Planning and Analysis (FPAC). This shows prospective employers you’re committed to expanding your finance knowledge and career growth.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Bachelor of Science (B.S.) Finance

- Harvard University, Cambridge, MA | 2016

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- FPAC, FPA | 2020

- Chartered Financial Analyst, FINRA | 2016

4. Include a list of skills and proficiencies related to financial planning and analysis

Incorporate key skills and financial terms from the job description to ensure compliance with Applicant Tracking Systems (ATS). Carefully analyze each posting and feature appropriate keywords throughout your resume. Provide a mix of financial terminology and leadership skills to highlight your versatility as a candidate. Show specific examples of using these skill sets throughout your career, rather than only listing them in your skills section. Below, you’ll find a list of potential terms you may encounter while applying for FP&A jobs:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Business administration |

| Business intelligence | Client relations |

| Data-driven decision making | Financial analysis |

| Financial modeling | Financial reporting |

| Financial strategy | Forecasting |

| FP&A | Generally accepted accounting principles (GAAP) |

| Growth strategy | Investment strategy |

| Mergers and acquisition (M&A) | Project management |

| Risk management | Statistical analysis |

| Systems Applications and Products (SAP) | Variance analysis |

How To Pick the Best Financial Planning and Analysis Resume Template

Selecting a template can be challenging for many job seekers. Finding an option that meets industry standards and encapsulates your personal brand is often difficult. The key is to choose a format that is sleek, well-structured, and easy to read. Avoid formats with overly decorative fonts, colors, and graphics, as these visual elements may distract the reader from your content. Instead, select an elegant, single-column template that allows the hiring manager to easily scan your resume for key information.

1. What are the most in-demand skills for an FPA that should be featured on a candidate’s resume? -

The most in-demand skills for an FPA beyond a completed bachelor of arts or science in economics, mathematics, finance, business administration, or accounting are as follows.

- Relevant coursework (for more recent graduates)

- Ability to work with, filter, and manipulate large data sets

- Ability to understand company spending and budgets

- P&L (profit and loss) experience

- Financial reporting experience

- Experience with Excel (list your capabilities, i.e., pivot tables, v-lookups, h-lookups, macros)

- Experience with other programs, i.e., Tableau, Power BI, SQL, etc.

- Experience communicating with/presenting to management, key stakeholders, C-suite

- Organization

- Time management

- Ability to work in a team environment

- Professionalism

- Clear, articulate communication

2. What work experience and other accomplishments are hiring managers seeking in an FPA?-

Hiring managers are looking for the following types of work experience.

- Internship in Finance or Accounting where the person has FPA responsibilities

- Extracurricular involvement in a club, church, etc., related to Finance or that provides FPA experience

- Graduate education (completed or pending) in finance, mathematics, or economics, i.e., MBA, master’s in data analytics, master’s in finance

- Applicable certificates Exce

- Attendance in applicable “boot camps,” such as data analytics

3. What else, in addition to a resume, should an FPA candidate be prepared to provide hiring managers?-

Occasionally, FPA candidates are asked to complete an Excel assessment that tests their abilities to complete various tasks ranging in difficulty across the program. Additionally, candidates may be given a “case study” where they are provided with a scenario or financial data and asked questions based on the given information.

In an interview, candidates should be able to provide examples of projects they have worked on, their responsibilities, how they completed their assigned tasks, and the project results.

4. What advice would you give an FPA candidate about their job search?-

- Tailor your resume to the job you are applying for (i.e., if the position asks for experience creating macros in Excel, make sure that’s in your resume!)

- Take advantage of LinkedIn and other job boards. If you see a position posted on LinkedIn by a Recruiter, apply to the job and then message the Recruiter letting them know you submitted an application, that you’re very interested, and would love to schedule some time to connect further about the opportunity.

- If you find a position you are particularly interested in, include a cover letter expressing why you’re interested and why you think you would be a good fit.

- Leverage your network. If you have a peer, former colleague, or friend who works in FPA, reach out. You never know who they may know who needs an FPA Analyst or Manager.

Frequently Asked Questions: Financial Planning and Analysis Resume Examples and Advice

Can I adjust a Financial Planning and Analysis (FPA) resume example for different roles or industries?-

Yes, you can easily adjust a Financial Planning and Analysis (FPA) resume example by aligning your profile summary and key skills with the job description. If you are applying to different industries, emphasize transferable skills and any industry-specific experience. For example, if you’re applying to a finance role after working in tech, highlight your data analysis and financial reporting skills as relevant to both fields.

What are common action verbs for financial planning and analysis resumes?-

Often, a few verbs can accurately convey your career achievements and job responsibilities. That being said, differentiating your usage of verbs can infuse a dynamic and engaging element into your writing. To help you keep your bullet points fresh and compelling, we’ve provided a list of strong action verbs to craft your professional experience section:

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Coordinated | Created |

| Designed | Developed |

| Drove | Enhanced |

| Evaluated | Examined |

| Executed | Forecasted |

| Identified | Implemented |

| Improved | Led |

| Managed | Oversaw |

| Performed | Planned |

| Supported | |

How do you align your resume with a financial planning and analysis job description?-

According to the Bureau of Labor Statistics, the average annual salary for financial analysts was $95,570 in 2023. These positions are expected to grow by 9% over the next decade. Although these projections are optimistic, you’ll face no shortage of competition for the most lucrative opportunities. Align your resume with the job description to maximize your chances of landing the interview.

For example, if a company is seeking a financial analyst with a strong background in consulting, you’d highlight your background generating cost savings and improving financial reporting for client businesses. If an employer is looking for a candidate with expertise in investment strategy, emphasize your ability to conduct long-range financial planning and identify risk factors.

What is the best financial planning and analysis resume format?-

Reverse chronological is the ideal format for FP&A resumes. This approach places your most recent and relevant work experience at the forefront of your document. If you’re in the early stages of your career, consider reordering your sections tactically. In this situation, placing your skills and academic projects above your professional experience is appropriate. That said, it’s still important to feature detailed bullet points rather than only listing skills and buzzwords.

What’s the ideal length for a financial planning and analysis resume?-

A one-page resume is ideal for most financial planning and analysis positions, especially if you have less than 10 years of experience. For experienced professionals, a two-page resume may be appropriate, but only if it includes valuable, job-relevant content. Focus on showcasing your key achievements, certifications, and skills that align with the job description.

Aim to include work experience from the last 10 to 15 years. Older roles can be summarized or omitted unless they add significant value. Keeping your resume concise and relevant will leave a strong impression on hiring managers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!