How To Write an Investment Banking Resume

Investment bankers provide financial analysis to corporations, governments, and large institutions. These positions are highly lucrative due to the high earning potential of bonus structures. You must create an accomplishment-driven resume to separate yourself from the competition during your job search.

The key is to build a resume that highlights your advanced knowledge of financial strategy and brands you as a thought leader within the investment banking industry. Throughout this guide, we’ll provide expert tips to help you translate your career experience into a powerful marketing document.

- Entry-Level

- Mid-Career

- Senior-Level

1. Write a dynamic profile summarizing your investment banking qualifications

To grab the hiring manager’s attention, you must create a strong opening summary that captures the most compelling aspects of your professional experience. Start by detailing your job title, years of experience, and three to four specializations that align with the job description. As an investment banker, you should also emphasize the types of industries you’ve worked in. Use the summary to show hiring managers that you’ve acquired knowledge of various kinds of businesses, which is essential for making the right financial decisions.

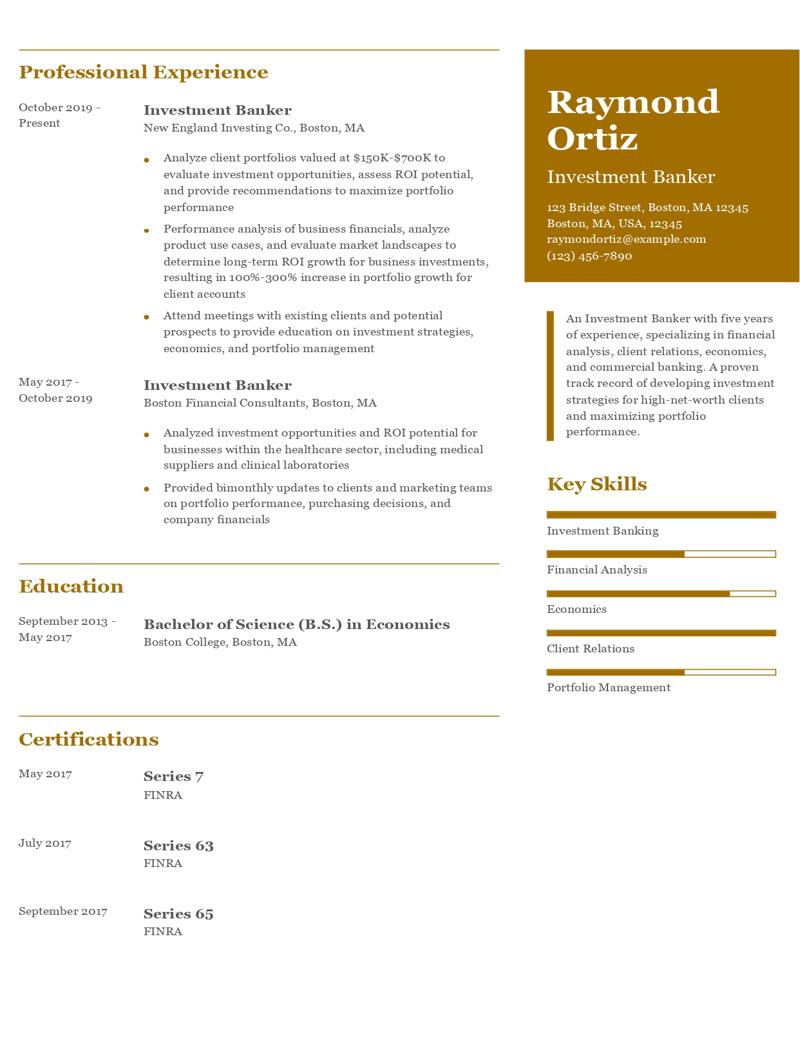

Professional Profile - Example #1

Profile

An Investment Banker with five years of experience specializing in financial analysis, client relations, economics, and commercial banking. A proven track record of developing investment strategies for high-net-worth clients and maximizing portfolio performance.

Professional Profile - Example #2

Profile

An Investment Banker with 10+ years of experience specializing in providing investment strategies for opportunities within the alternative energy, automotive, and utility industries. A proven track record of maximizing portfolio growth and profitability by evaluating competitive advantages and identifying long-term market potential.

2. Outline your investment banking experience in a compelling list

When crafting your professional experience section, you’ll want to consider whether or not your bullet points are accomplishment-driven, emphasizing the value you generated for clients and organizations. You’ll also want to ensure that your document effectively captures the full scope of your expertise in financial analysis and investment strategy.

Try leveraging monetary figures, percentages, and financial data from your career as an investment banker to maximize the impact of your bullet points. Incorporating numbers into your document will draw the reader’s eye and establish credibility and a sense of scope for your professional achievements. For example, you could highlight the size of the investment portfolios you managed or how your financial strategies positively impacted ROI.

Professional Experience - Example #1

Professional Experience

Investment Banker, Johnson and Goldman Inc., San Francisco, CA

October 2017 – Present

- Develop financial models and investment strategies for client portfolios valued at $300K to $1M and provide recommendations for valuations, M&A, and product offerings

- Conduct equity research, identify long-term investment opportunities in companies with best-in-class management teams and business models, and recommend investment opportunities in businesses committed to solving complex customer problems

- Conduct in-depth valuations of intangible assets for purchase price allocations by evaluating income, market indicators, and company financials

Professional Experience - Example #2

Investment Banker, Klein and Davidson Consulting, New York, NY

September 2016 – Present

- Create dynamic investment strategies for client portfolios valued at up to $1.5M, develop complex financial models, and deliver presentations to clients and prospects

- Build relationships with corporate leaders and lead investigative meetings between high-profile investors and C-level executives during the due diligence phase

- Identify opportunities within the clean energy space, including solar companies and electric vehicle manufacturers

3. Outline your education and investment banking-related certifications

In addition to your education, you’ll need to highlight certifications to advance your investment banking career. Many institutions require these credentials, even for entry-level roles. Some certifications you should target are the Series 7, Series 63, Series 66, and Series 79 licenses, all acquired through FINRA. Obtaining a Certified Financial Analyst designation is also worth considering, as this is one of the industry’s oldest and most prominent credentials.

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Series 7, FINRA, 2018

- Series 63, FINRA, 2016

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] [Dates Enrolled]

Example

- Bachelor of Science (B.S.) Economics

- Columbia University, New York, NY September 2007- May 2011

4. Include a list of your skills and proficiencies related to investment banking

Most organizations rely on Applicant Tracking Systems (ATS) to identify qualified candidates for potential job opportunities. If your resume lacks certain keywords, your application may not reach the hiring manager. To mitigate this risk, evaluate the job description and integrate key terms that match the needs of the organization you’re applying to. Below, you’ll find a list of keywords that you may encounter throughout your job search:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Client Relations |

| Due Diligence | Economics |

| Equity Research | Finance |

| Financial Analysis | Financial Modeling |

| Financial Planning and Analysis (FP&A) | Investment Banking |

| Investment Strategy | Leadership |

| Market Analysis | Merger and Acquisition (M&A) |

| Portfolio Management | Relationship Building |

| ROI Analysis | Strategic Investing |

| Strategic Partnerships | Valuations |

5. Highlight Your Leadership and Client Relations Skills

Showcasing your leadership capabilities and client relations experience while pursuing investment banker opportunities is important. In this role, you’ll be interfacing with high-level executives and attending meetings with various cross-functional teams to conduct due diligence and provide recommendations to grow client portfolios. Interpersonal skills are essential for investment bankers, as you’ll need to communicate high-level financial strategies and concepts to the C-suite.

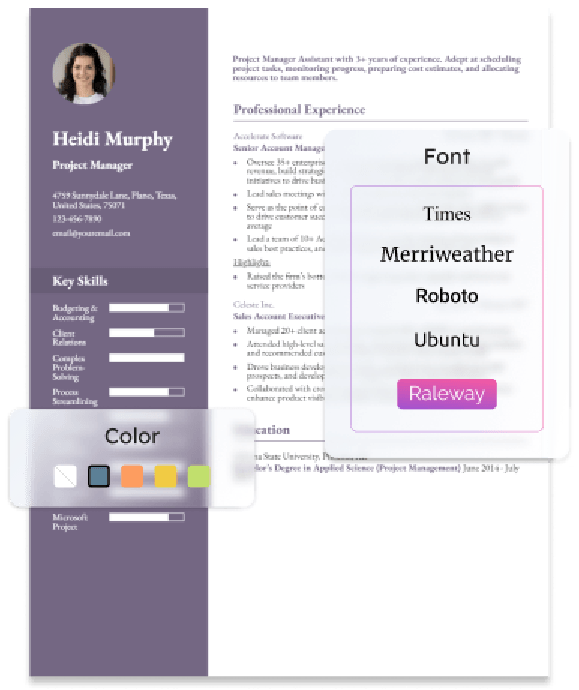

How To Pick the Best Investment Banker Resume Template

If you struggle to find a suitable template, you’re not alone. With such a wide variety of options, finding the ideal fit for your professional needs can be challenging. The most important aspect of any resume template is structure and organization. Hiring managers will be interested in your financial expertise and investment banking accomplishments first and foremost, so avoid flashy colors and graphics that may draw the reader’s eye away from your content.

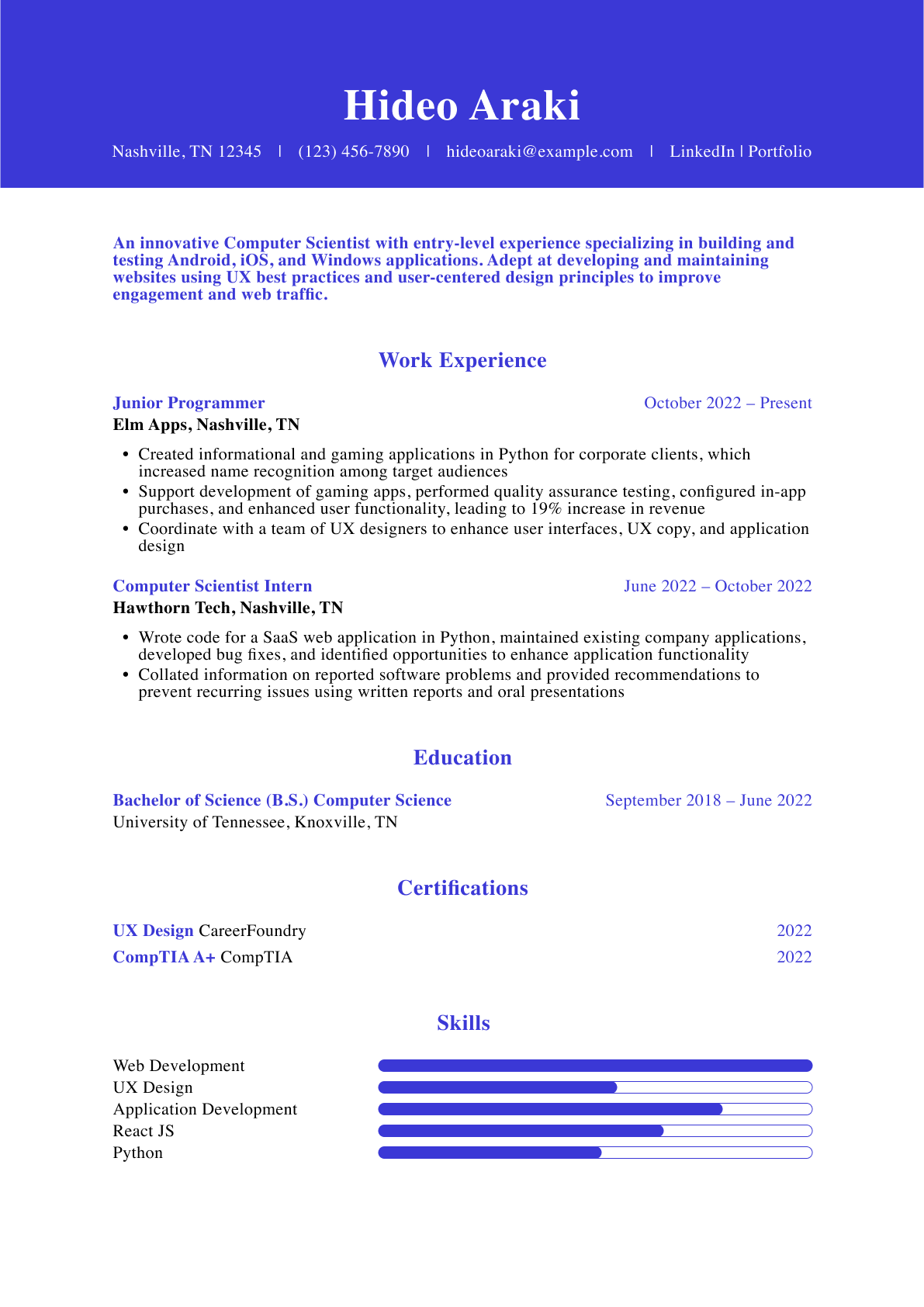

Investment Banking Text-Only Resume Templates and Examples

- Example #1

- Example #2

- Example #3

Allison Rosenberg

(123) 456-7890

[email protected]

123 Santa Maria, San Francisco, CA 12345

Profile

An Investment Banker with seven years of experience, specializing in equity research, strategic investing, and financial modeling. A strong history of performing due diligence on investment opportunities to maximize ROI potential for high-net-worth clients.

Professional Experience

Investment Banker, Johnson and Goldman Inc., San Francisco, CA

October 2017 – Present

- Develop financial models and investment strategies for client portfolios valued at $300K-$1M and provide recommendations for valuations, M&A, and product offerings

- Conduct equity research, identify long-term investment opportunities in companies with best-in-class management teams and business models, and recommend investment opportunities in businesses committed to solving complex customer problems

- Conduct in-depth valuations of intangible assets for purchase price allocations by evaluating income, market indicators, and company financials

Investment Banker, Invest Today Inc., San Francisco, CA

May 2015 – October 2017

- Performed financial analysis and determined valuations for startup technology companies, which included providing recommendations to investors on business based on economic data, product use case, and organizational effectiveness

- Created in-depth financial models using data and long-term market indicators to inform investment decisions and establish long-term ROI potential

Education

Bachelor of Science (B.S.) Economics

University of San Francisco, San Francisco, CA September 2011 – May 2015

Key Skills

- Investment Banking

- Financial Analysis

- Economics

- Client Relations

- Portfolio Management

Certifications

- Series 7, FINRA, 2015

- Series 63, FINRA, 2015

- Series 65, FINRA, 2015

Frequently Asked Questions: Investment Banking Resume Examples and Advice

What are common action verbs for investment banking resumes?-

It’s easy to find yourself running out of action verbs when crafting your professional experience section. It's essential to differentiate your word choice, as your bullet points may appear stale or redundant. To help you out, we’ve compiled a list of action verbs you can use to keep your content fresh and compelling:

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Collaborated | Conducted |

| Coordinated | Created |

| Determined | Developed |

| Drove | Enhanced |

| Evaluated | Identified |

| Implemented | Led |

| Managed | Negotiated |

| Oversaw | Performed |

| Provided | Supported |

| Finance | |

How do you align your resume with a job description?-

According to the Corporate Finance Institute, the average annual salary for investment bankers ranges from $125K to $500K, depending on your experience level. Align your resume with individual job descriptions to differentiate yourself from the competition. Start by researching the company and incorporating qualifications, skills, and achievements that match their needs.

For example, suppose an organization heavily focuses on investment opportunities in startup technology companies. In that case, craft bullet points that highlight your ability to evaluate long-term ROI potential based on market indicators and product use cases. You'll increase the odds of landing your next job opportunity by showcasing specific examples of you developing investment strategies and facilitating portfolio growth.

What is the best investment banker resume format?-

Reverse chronological is the ideal format for investment banker resumes. Hiring managers will always be most interested in your recent experience, which places those jobs at the top of your document. Avoid functional resume formats here.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Crafting a matching cover letter can be a strong asset for your job application. This allows you to showcase aspects of who you are as a professional that you wouldn’t usually be able to highlight on your resume. In your middle paragraphs, you should mention the organization’s reputation, mission statement, or culture and why this draws you to apply for the position. For information, view our business cover letter guide.