Karen Lane

(655) 863-6548

[email protected]

72 Light Lane, Los Angeles, CA 90003

Profile

Commercial Banking Professional with 2+ years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

Key Skills

- Commercial Banking Procedures

- Customer Service

- Foreign Currency Handling

- Negotiations

- Risk Assessment & Management

- Team Leadership

- Wealth Management

Professional Experience

Commercial Bank of California, Los Angeles, CA | November 2018 to January 2021

Commercial Banking Officer (September 2019 to January 2021)

- Opened and closed 50+ accounts per week

- Helped clients analyze risks and set appropriate banking plans

- Attended and contributed to industry conferences and panel discussions

- Led and managed a 5-person team

Junior Banking Associate (November 2018 to August 2019)

- Built and maintained positive client relationships

- Provided payroll, bookkeeping, and tax return preparation services

- Clarified clients’ banking needs and suggested appropriate accounts and services

Education & Credentials

- Bachelor of Science (BS) – Finance, Loyola Marymount University, Los Angeles, CA

- Certified Public Accountant, American Institute of Certified Public Accountants

Jerry Jones

(738) 274-2648

[email protected]

91 Riverside Avenue, Los Angeles, California, 90001

Profile

High achieving and analytical investment banker with seven years of experience in the banking industry. Proven ability to work alongside a wide variety of clients to provide useful investment insights and outline any potential risks. Possesses a bachelor’s degree in finance from California State University and a master’s degree from Claremont McKenna College. Excellent communication skills, in-depth knowledge of the current trends in the investment banking industry, and success-orientated attitude.

Professional Experience

Investment Banker, 1st Capital Bank, Los Angeles, CA

June 2017 – March 2021

- Oversaw and managed the relationship-banking team, which resulted in a 15% increase in revenue and increased profitability

- Prepared and organized the execution of equity transactions

- Successfully achieved the 2020 target of $15M

- Participated in industry conferences and panel discussions

Investment Associate, American First National Bank, Los Angeles, CA

November 2014 – June 2017

- Helped to increase the yearly revenue by 6% via regular client-orientated sales events

- Performed company equity research

- Contributed to the preparation of fact-based growth opportunity reports

Education

- Master of Finance, Claremont McKenna College, Claremont, CA | September 2012 – July 2013

- Bachelor of Science in Finance, California State University, Northridge, CA | September 2009 – July 2012

Key Skills

- Tax audits

- Risk management and compliance

- Wealth management

- Knowledge of commercial and private banking

- Team leadership

- Exceptional communication skills

- Impressive ability to build and maintain working relationships

Certifications:

- CFA Institute certified Chartered Financial Analyst (CFA), August 2013

Monica Reese

(246) 802-4680

[email protected]

135 Main Avenue, San Francisco, CA 35791

Profile

Commercial Banking Associate with 10+ years’ experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Professional Experience

Commercial Banking Associate, Bank of San Francisco, San Francisco, CA

November 2017 to Present

- Lead and performance-manage a team of 12 associates

- Help customers open new bank accounts and access online services

Highlights:

- Consistently earned 98%+ client satisfaction rating

- Drove a 45% increase in customer use of online services

- Trained and mentored 7 new hires in 2021

Banking Associate, Bank of America, San Francisco, CA

September 2012 to October 2017

- Delivered prompt, thorough service to 50+ small business clients

- Gathered information for new account holders by completing CIP and Enhanced Due Diligence forms

- Clarified each client’s needs and suggested appropriate credit cards, personal loans, and other bank products

Highlight:

- Consistently ranked in top 5% of team for upselling

Education

Bachelor of Science in Business Administration (Finance), University of San Francisco, CA | 2012

Key Skills

- Customer Service & Relations

- New Hire Training & Mentoring

- Regulatory Compliance

- Task Prioritization

- Team Leadership

Language

Fluency in Spanish

Pedro Pennington

(111) 222-3333

[email protected]

New York, NY 10001

Profile

Energetic, detail-oriented financial analyst with over eight years of experience. I can lean on an accounting background to process large amounts of financial information and investigate the strength of potential investments. A good communicator who can create digestible reports and give presentations that assist upper-level decision-makers.

Professional Experience

Financial Analyst, RRR Finances, New York, NY

November 2015 – present

- Perform risk-assessment analyses on potential and current investments

- Help executive team formulate financial goals, then adjust as necessary each quarter

- Using spreadsheets to present data, report on the performance of current holdings, and recommend courses of action

- Identify process improvements that have, to date, resulted in a 9% decrease in overhead costs

- Examine financial documents of businesses seeking funding to determine solvency and potential

Junior Financial Analyst, ACE Bank, New York, NY

July 2012 – November 2015

- Created reports on stock and bond trends

- Prepared technical reports, integrating graphs and charts to show data

- Maintained long-term database on income and expenses from ACE Bank’s 35 real estate property holdings

Education

- Master of Finance, Buffalo School Of Finance, Buffalo, NY June 2012

- Bachelor of Science in Accounting, Rochester Business Academy, Rochester, NY June 2010

Key Skills

- Microsoft Excel

- Interpreting business documents, including business plans and financial statements

- Conducting and contributing to meetings

- Communication through verbal and written means

Certifications

- Certified Financial Analyst, Finance Professionals’ Association of New York, 2020

Allison Rosenberg

(123) 456-7890

[email protected]

San Francisco, CA 12345

Profile

Investment banker with seven years of experience specializing in equity research, strategic investing, and financial modeling. Strong history of performing due diligence on investment opportunities to maximize return on investment (ROI) potential for high-net-worth clients.

Key Skills

- Client relations

- Economics

- Financial analysis

- Investment banking

- Portfolio management

Professional Experience

Investment Banker, Johnson & Goldman Inc., San Francisco, CA

October 2017 to present

- Develop financial models and investment strategies for client portfolios valued at $300,000 to $1 million and provide recommendations for valuations, mergers and acquisitions (M&A), and product offerings

- Conduct equity research, identify long-term investment opportunities in companies with best-in-class management teams and business models, and recommend investment opportunities in businesses committed to solving complex customer problems

- Perform in-depth valuations of intangible assets for purchase price allocations by evaluating income, market indicators, and company financials

Investment Banker, Invest Today Inc., San Francisco, CA

May 2015 to October 2017

- Managed financial analysis and determined valuations for startup technology companies, which included providing recommendations to investors on business based on economic data, product use case, and organizational effectiveness

- Created in-depth financial models using data and long-term market indicators to inform investment decisions and establish long-term ROI potential

Education

Bachelor of Science (BS) – Economics, University of San Francisco, CA | 2015

Certifications

Financial Industry Regulatory Authority (FINRA) | 2015

- Series 7

- Series 63

- Series 65

Allison Rosenberg

(123) 456-7890

[email protected]

New York, NY 12345

Profile

A senior financial analyst with eight years of experience defining financial strategies and leading change management initiatives for enterprise organizations. A strong history of identifying opportunities to enhance business transparency and drive long-term revenue growth.

Professional Experience

Senior Financial Analyst, Excelsior Financial Partners, New York, NY

April 2016 – Present

- Define modeling and financial strategies for an enterprise financial firm, improve business transparency to enhance planning and execution, and lead strategic initiatives to support revenue growth from $50 million to $300 million over five years

- Manage a team of five financial analysts, oversee modeling, analysis, and reporting of complex financial data and trends, and conduct forecasting to define strategies

- Spearhead change management initiatives and transformation projects to overhaul financial reporting, auditing, and key performance indicators (KPIs) for the organization

Financial Analyst, Cadence Manufacturing, New York, NY

June 2013 – April 2016

- Coordinated with the financial analysis and planning team to perform comprehensive audits of financial statements, data, and operating budgets for a multi-million-dollar manufacturing company

- Delivered presentations to senior management on overhead costs, resource allocation, and annual projections to support long-term financial planning

Education

Bachelor of Science (B.S.) Accounting, Columbia University, New York, NY | June 2013

Key Skills

- Financial modeling

- Budget development

- Change management

- Financial planning and analysis (FP&A)

- Financial reporting

Certifications

- Chartered Financial Analyst (CFA), 2014

Jamie Smith

(000) 111-2222 | [email protected] | Houston, TX 77002 | LinkedIn.com/in/jamiesmith

Profile

Results-driven banking center manager with over eight years of progressive leadership experience in retail banking. Proven track record of increasing operational efficiency, coaching high-performing teams, and achieving consistent growth in new customer accounts and loan volume. Adept at implementing compliance procedures and driving customer satisfaction.

Professional Experience

Banking Center Manager, Horizon Bank, Houston, TX | March 2019 – Present

- Lead a team of 14 associates in a high-traffic branch serving over 10,000 customers

- Achieved a 23% increase in small business loans in FY 2023

- Maintained 98% audit compliance rating by standardizing internal procedures

Assistant Branch Manager, Sun Community Bank, Houston, TX | June 2015 – February 2019

- Supported branch operations and oversaw daily staff activities

- Increased new account openings by 18% year-over-year through community outreach initiatives

Key Skills

Bank operations management

Team coaching and development

Customer relationship building

Loan and product sales

Compliance and risk management

Education

Bachelor of Business Administration (BBA), Texas A&M University, College Station, TX | 2015

Alex Johnson

(555) 987-6543 | [email protected] | Boston, MA 02116 | LinkedIn.com/in/alexjohnson

Profile

Motivated and detail-oriented associate investment banker with five years of experience conducting market research, due diligence, and financial modeling for M&A deals and IPOs. Strong background in cross-border transactions and working with early-stage tech firms.

Professional Experience

Investment Banking Associate, Beacon Partners, Boston, MA | July 2020 – Present

- Built financial models and valuation reports for 15+ middle-market transactions

- Led due diligence for three $100M+ tech acquisitions in 2023

- Supported roadshows and investor materials for two successful IPO launches

Investment Banking Analyst, Metro Capital, Boston, MA | August 2018 – June 2020

- Conducted industry research and prepared presentation materials for client pitches

- Created comparative company analysis reports used in negotiations

Key Skills

M&A deal structuring

Equity and debt offerings

Valuation and modeling

Client presentations

Capital markets research

Education

Master of Business Administration (MBA), Babson College, Wellesley, MA | 2018

Bachelor of Science (BS), Finance, University of Massachusetts Amherst | 2015

Taylor Lee

(212) 765-4321 | [email protected] | Chicago, IL 60601 | LinkedIn.com/in/taylorlee

Profile

Experienced relationship banker with six years of success in building strong client relationships, increasing account retention, and providing tailored financial solutions. Skilled in upselling banking products and handling customer concerns with empathy and efficiency.

Professional Experience

Relationship Banker, First National Bank, Chicago, IL | February 2019 – Present

- Maintained a client portfolio of 150+ personal and small business accounts

- Increased personal loan sales by 25% through personalized outreach campaigns

- Recognized as “Top Performer” in customer satisfaction survey two years in a row

Bank Teller, Northern Trust Bank, Chicago, IL | July 2016 – January 2019

- Handled deposits, withdrawals, and transactions for over 100 customers per day

- Promoted savings and credit card products to existing customers

Key Skills

Client retention and outreach

Product cross-selling

Account servicing

Conflict resolution

Banking software (Jack Henry, Fiserv)

Education

Bachelor of Arts (BA) – Economics, DePaul University, Chicago, IL | 2016

Jordan Brown

(444) 222-1111 | [email protected] | Phoenix, AZ 85001 | LinkedIn.com/in/jordanbrown

Profile

Strategic and performance-focused branch manager with over nine years of experience overseeing bank operations, developing staff, and growing customer portfolios. Proven ability to manage compliance, increase operational efficiency, and exceed growth goals.

Professional Experience

Branch Manager, Union Bank, Phoenix, AZ | August 2018 – Present

- Grew branch deposit base by 31% in four years

- Trained and mentored 11 new hires, four of whom were promoted within two years

- Implemented a compliance checklist that reduced errors by 35%

Assistant Branch Manager, Wells Fargo, Phoenix, AZ | April 2015 – July 2018

- Helped manage daily operations of a 10-person branch team

- Spearheaded a customer retention initiative that increased satisfaction scores by 20%

Key Skills

Branch operations

Loan origination and approval

Performance tracking

Team development

Compliance oversight

Education

Bachelor of Science – Business Administration, Arizona State University | 2014

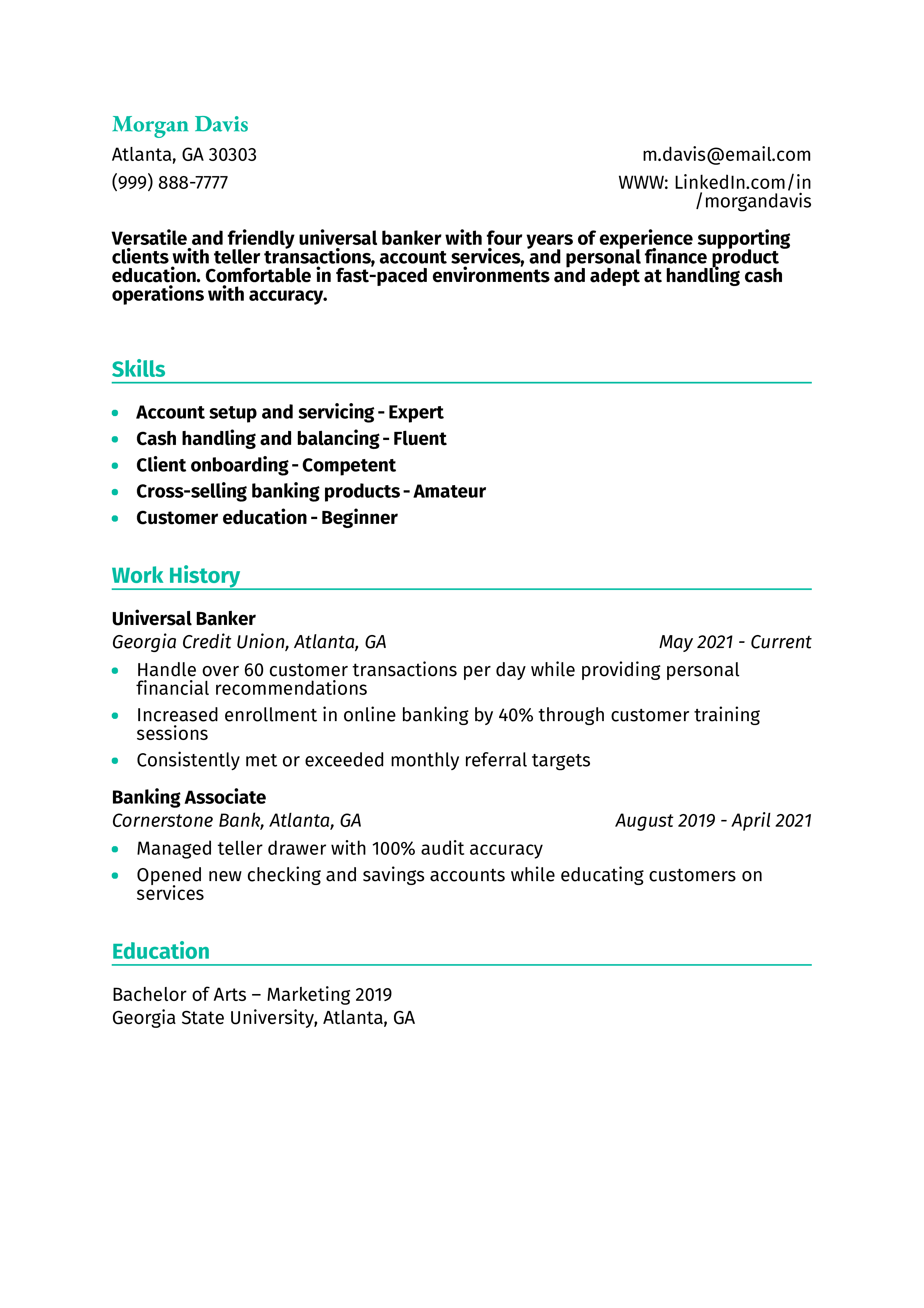

Morgan Davis

(999) 888-7777 | [email protected] | Atlanta, GA 30303 | LinkedIn.com/in/morgandavis

Profile

Versatile and friendly universal banker with four years of experience supporting clients with teller transactions, account services, and personal finance product education. Comfortable in fast-paced environments and adept at handling cash operations with accuracy.

Professional Experience

Universal Banker, Georgia Credit Union, Atlanta, GA | May 2021 – Present

- Handle over 60 customer transactions per day while providing personal financial recommendations

- Increased enrollment in online banking by 40% through customer training sessions

- Consistently met or exceeded monthly referral targets

Banking Associate, Cornerstone Bank, Atlanta, GA | August 2019 – April 2021

- Managed teller drawer with 100% audit accuracy

- Opened new checking and savings accounts while educating customers on services

Key Skills

Account setup and servicing

Cash handling and balancing

Client onboarding

Cross-selling banking products

Customer education

Education

Bachelor of Arts – Marketing, Georgia State University, Atlanta, GA | 2019

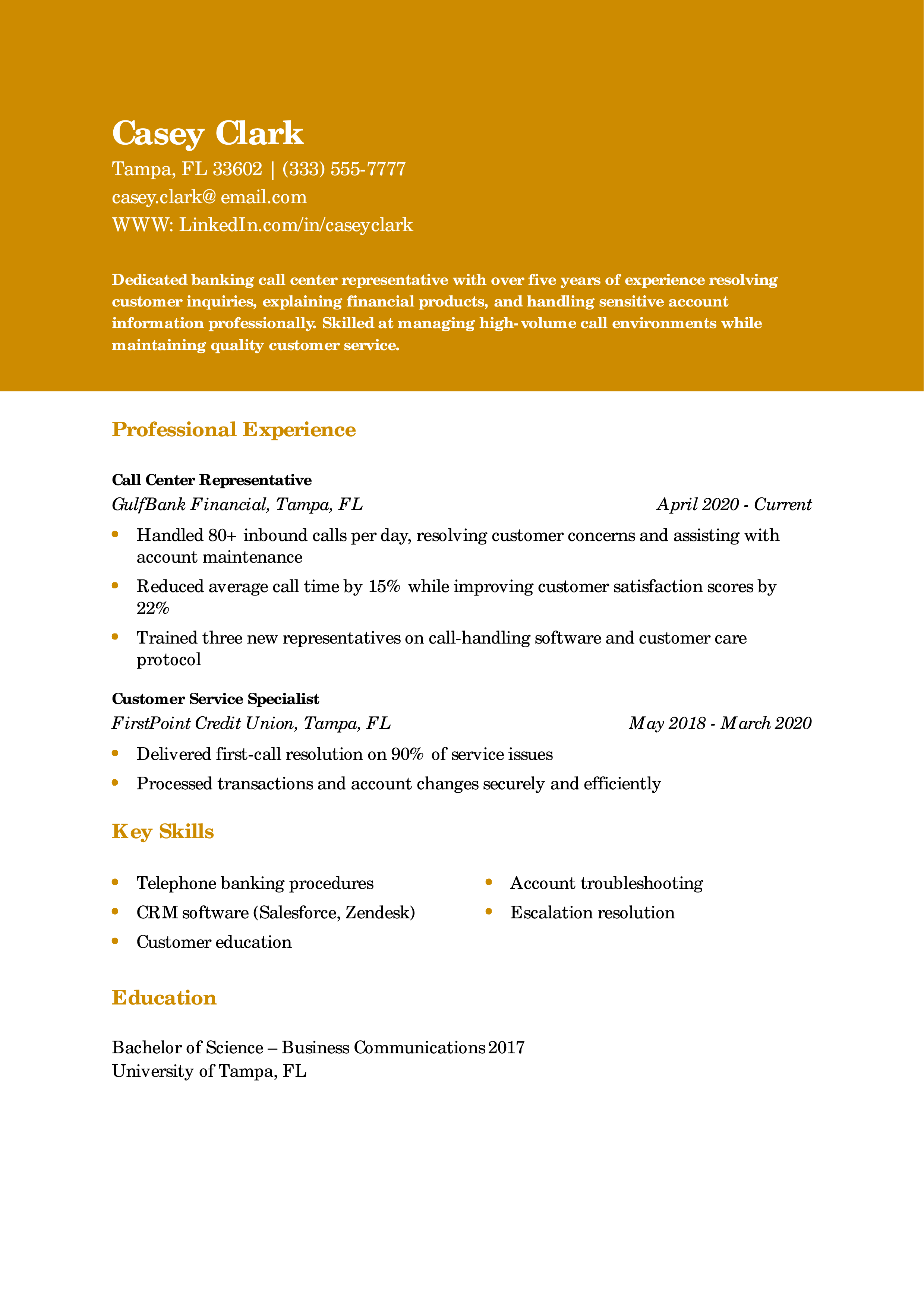

Casey Clark

(333) 555-7777 | [email protected] | Tampa, FL 33602 | LinkedIn.com/in/caseyclark

Profile

Dedicated banking call center representative with over five years of experience resolving customer inquiries, explaining financial products, and handling sensitive account information professionally. Skilled at managing high-volume call environments while maintaining quality customer service.

Professional Experience

Call Center Representative, GulfBank Financial, Tampa, FL | April 2020 – Present

- Handled 80+ inbound calls per day, resolving customer concerns and assisting with account maintenance

- Reduced average call time by 15% while improving customer satisfaction scores by 22%

- Trained three new representatives on call-handling software and customer care protocol

Customer Service Specialist, FirstPoint Credit Union, Tampa, FL | May 2018 – March 2020

- Delivered first-call resolution on 90% of service issues

- Processed transactions and account changes securely and efficiently

Key Skills

Telephone banking procedures

Account troubleshooting

CRM software (Salesforce, Zendesk)

Escalation resolution

Customer education

Education

Bachelor of Science – Business Communications, University of Tampa, FL | 2017

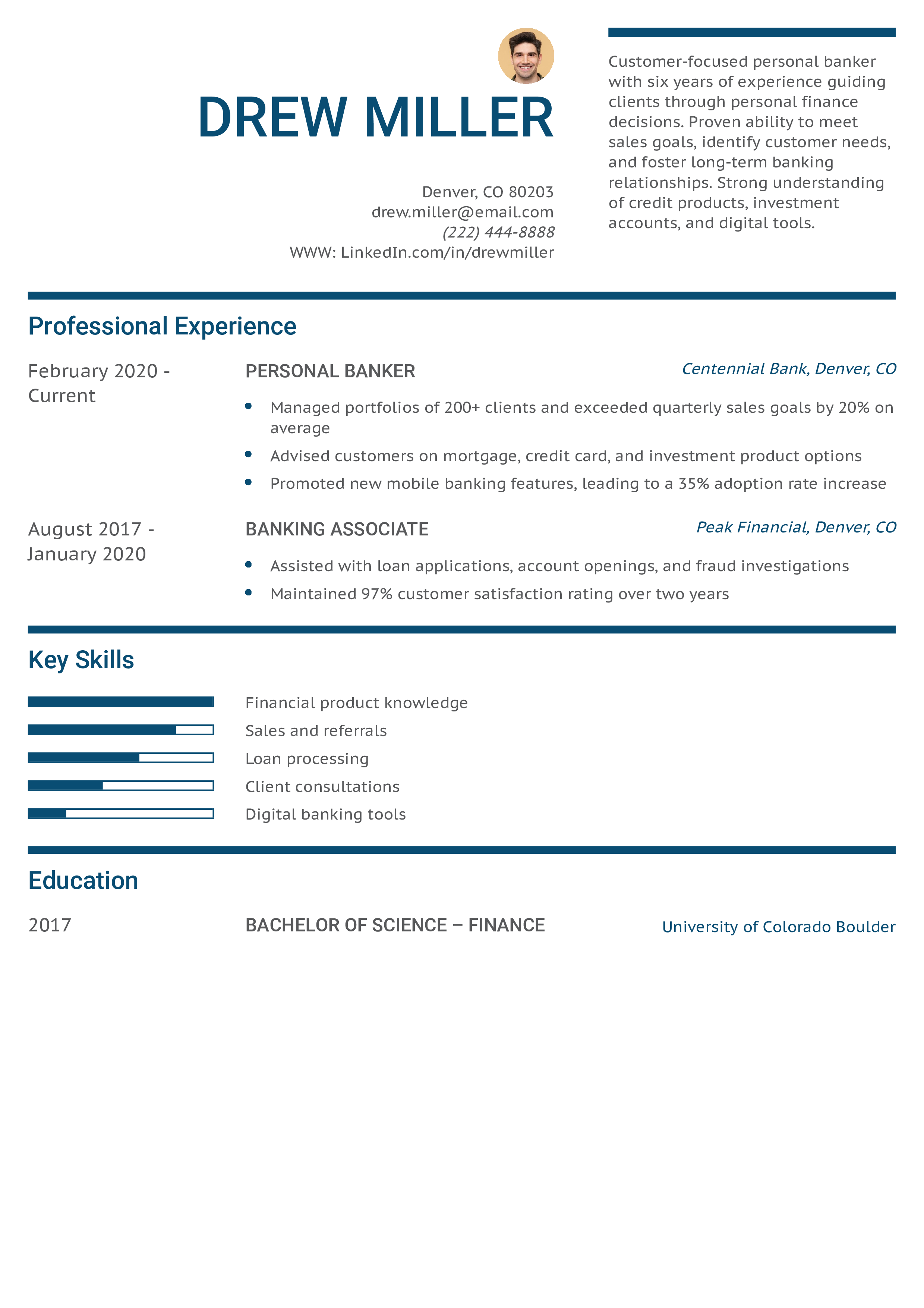

Drew Miller

(222) 444-8888 | [email protected] | Denver, CO 80203 | LinkedIn.com/in/drewmiller

Profile

Customer-focused personal banker with six years of experience guiding clients through personal finance decisions. Proven ability to meet sales goals, identify customer needs, and foster long-term banking relationships. Strong understanding of credit products, investment accounts, and digital tools.

Professional Experience

Personal Banker, Centennial Bank, Denver, CO | February 2020 – Present

- Managed portfolios of 200+ clients and exceeded quarterly sales goals by 20% on average

- Advised customers on mortgage, credit card, and investment product options

- Promoted new mobile banking features, leading to a 35% adoption rate increase

Banking Associate, Peak Financial, Denver, CO | August 2017 – January 2020

- Assisted with loan applications, account openings, and fraud investigations

- Maintained 97% customer satisfaction rating over two years

Key Skills

Financial product knowledge

Sales and referrals

Loan processing

Client consultations

Digital banking tools

Education

Bachelor of Science – Finance, University of Colorado Boulder | 2017

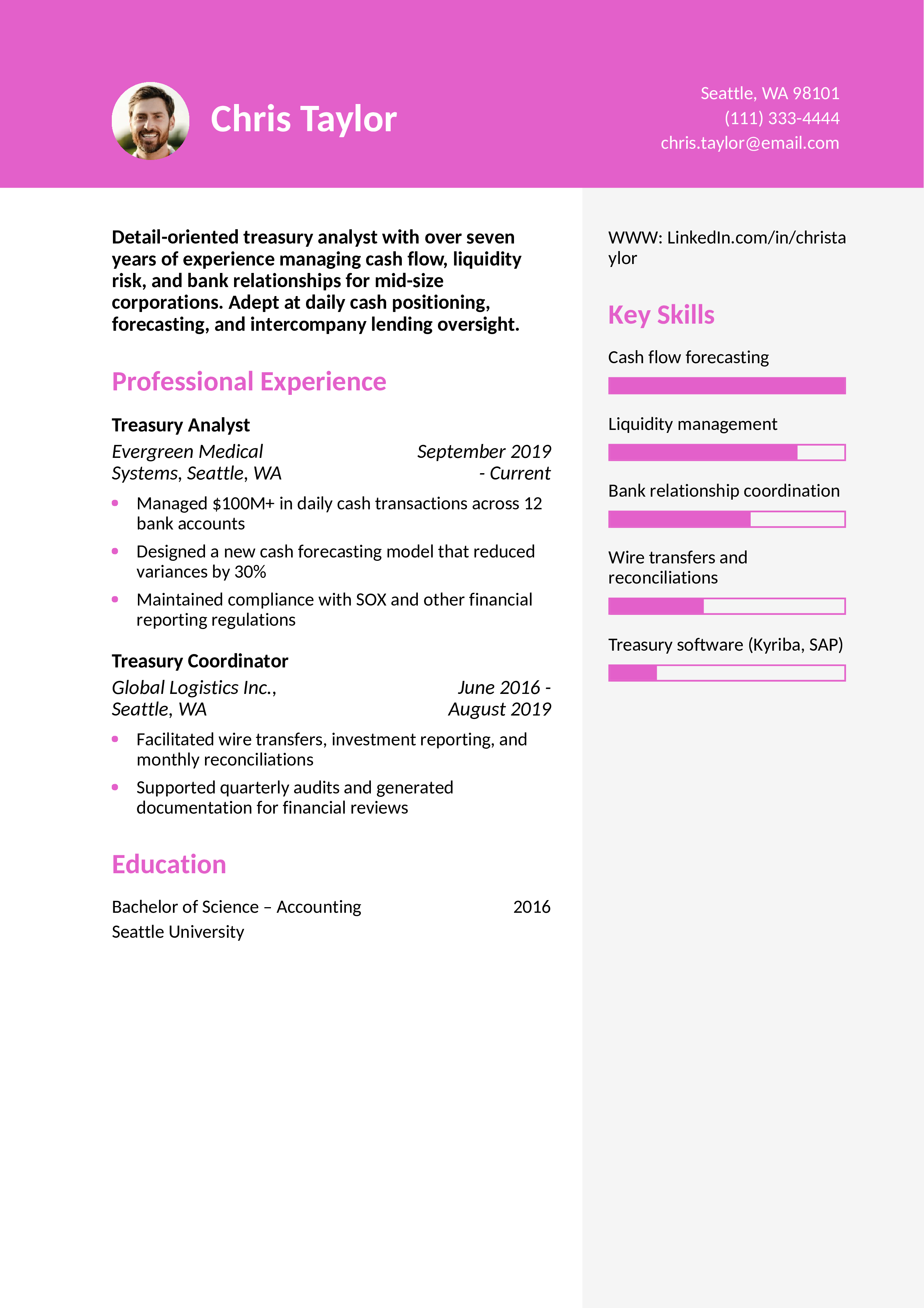

Chris Taylor

(111) 333-4444 | [email protected] | Seattle, WA 98101 | LinkedIn.com/in/christaylor

Profile

Detail-oriented treasury analyst with over seven years of experience managing cash flow, liquidity risk, and bank relationships for mid-size corporations. Adept at daily cash positioning, forecasting, and intercompany lending oversight.

Professional Experience

Treasury Analyst, Evergreen Medical Systems, Seattle, WA | September 2019 – Present

- Managed $100M+ in daily cash transactions across 12 bank accounts

- Designed a new cash forecasting model that reduced variances by 30%

- Maintained compliance with SOX and other financial reporting regulations

Treasury Coordinator, Global Logistics Inc., Seattle, WA | June 2016 – August 2019

- Facilitated wire transfers, investment reporting, and monthly reconciliations

- Supported quarterly audits and generated documentation for financial reviews

Key Skills

Cash flow forecasting

Liquidity management

Bank relationship coordination

Wire transfers and reconciliations

Treasury software (Kyriba, SAP)

Education

Bachelor of Science – Accounting, Seattle University | 2016

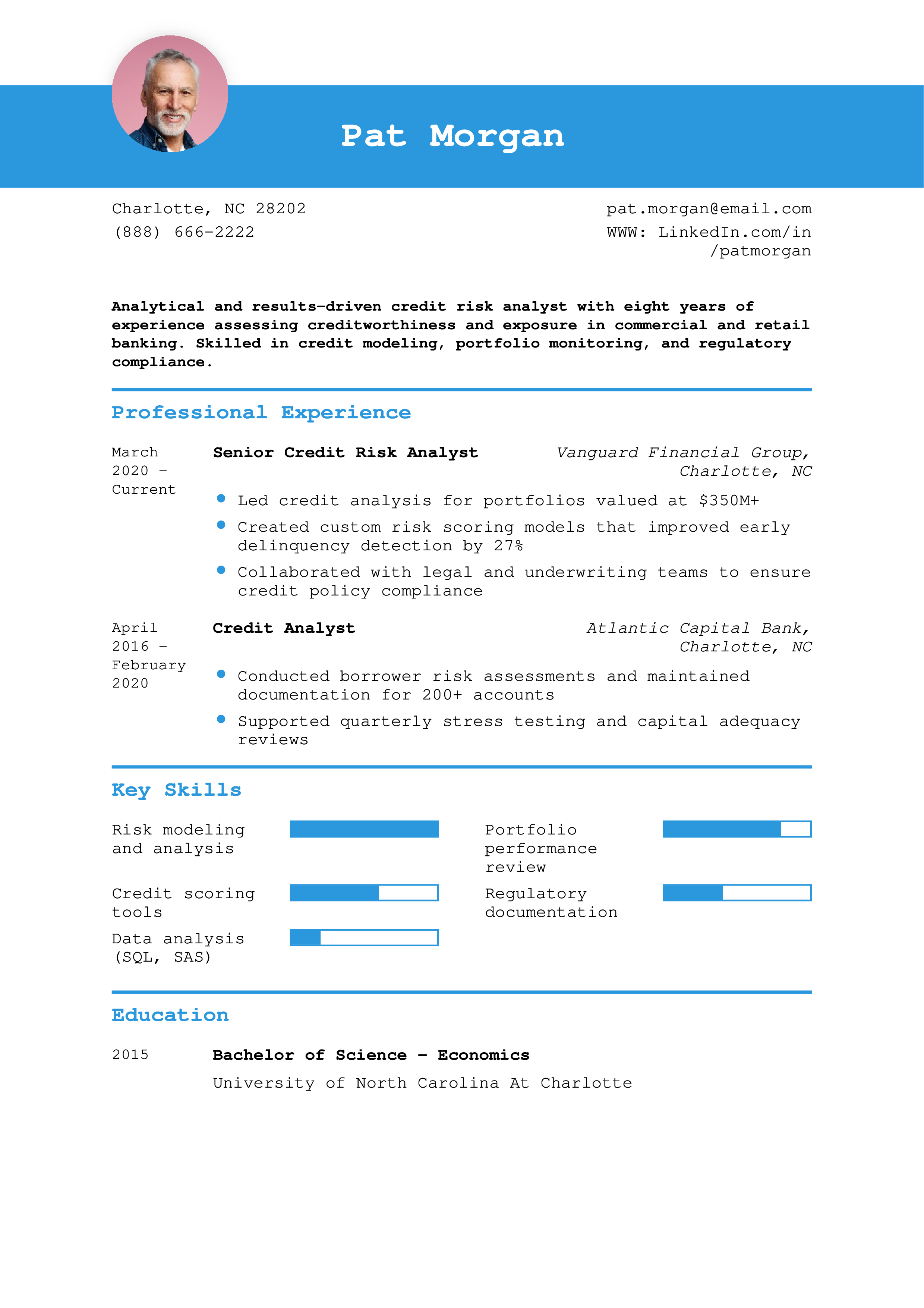

Pat Morgan

(888) 666-2222 | [email protected] | Charlotte, NC 28202 | LinkedIn.com/in/patmorgan

Profile

Analytical and results-driven credit risk analyst with eight years of experience assessing creditworthiness and exposure in commercial and retail banking. Skilled in credit modeling, portfolio monitoring, and regulatory compliance.

Professional Experience

Senior Credit Risk Analyst, Vanguard Financial Group, Charlotte, NC | March 2020 – Present

- Led credit analysis for portfolios valued at $350M+

- Created custom risk scoring models that improved early delinquency detection by 27%

- Collaborated with legal and underwriting teams to ensure credit policy compliance

Credit Analyst, Atlantic Capital Bank, Charlotte, NC | April 2016 – February 2020

- Conducted borrower risk assessments and maintained documentation for 200+ accounts

- Supported quarterly stress testing and capital adequacy reviews

Key Skills

Risk modeling and analysis

Portfolio performance review

Credit scoring tools

Regulatory documentation

Data analysis (SQL, SAS)

Education

Bachelor of Science – Economics, University of North Carolina at Charlotte | 2015

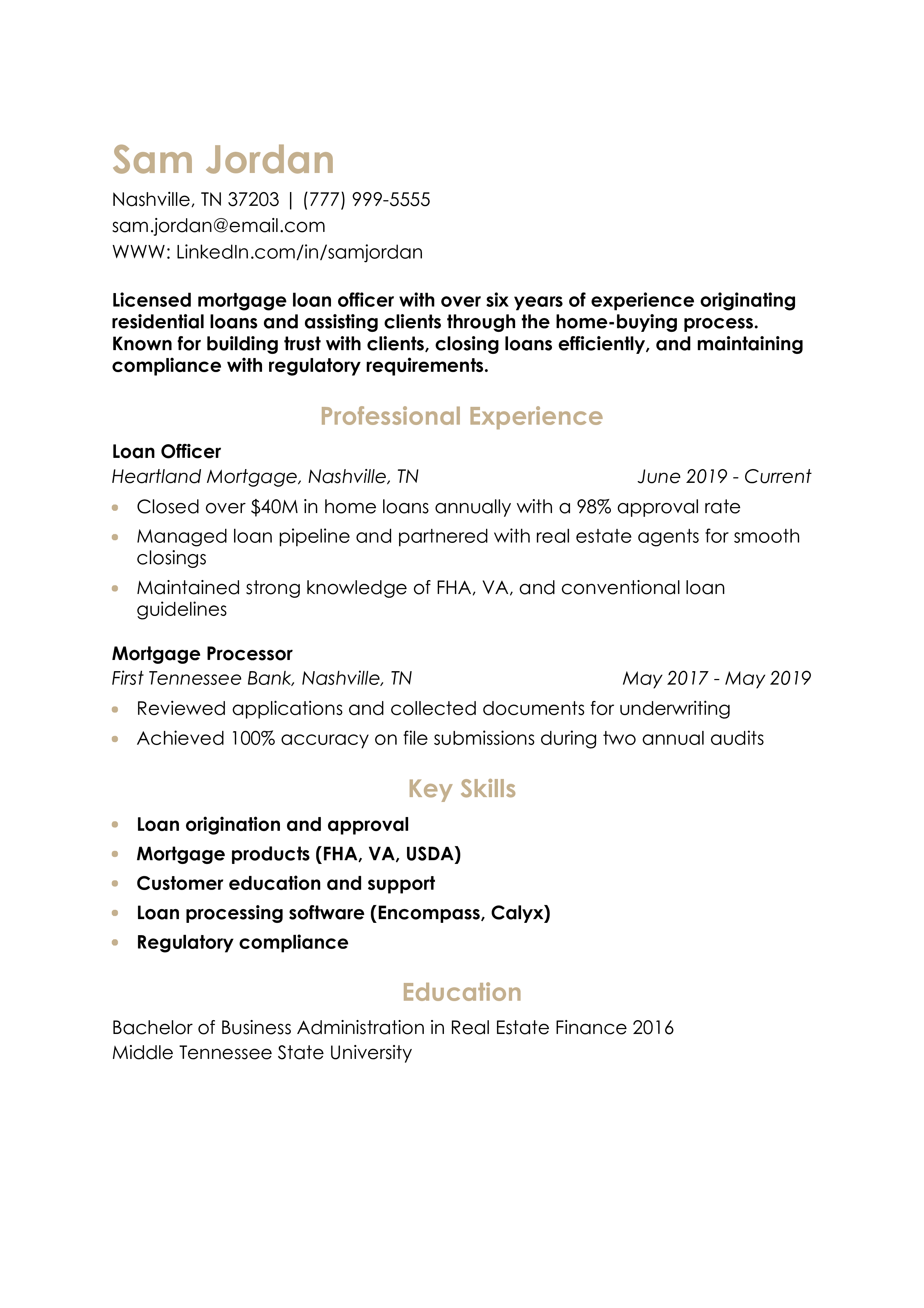

Sam Jordan

(777) 999-5555 | [email protected] | Nashville, TN 37203 | LinkedIn.com/in/samjordan

Profile

Licensed mortgage loan officer with over six years of experience originating residential loans and assisting clients through the home-buying process. Known for building trust with clients, closing loans efficiently, and maintaining compliance with regulatory requirements.

Professional Experience

Loan Officer, Heartland Mortgage, Nashville, TN | June 2019 – Present

- Closed over $40M in home loans annually with a 98% approval rate

- Managed loan pipeline and partnered with real estate agents for smooth closings

- Maintained strong knowledge of FHA, VA, and conventional loan guidelines

Mortgage Processor, First Tennessee Bank, Nashville, TN | May 2017 – May 2019

- Reviewed applications and collected documents for underwriting

- Achieved 100% accuracy on file submissions during two annual audits

Key Skills

Loan origination and approval

Mortgage products (FHA, VA, USDA)

Customer education and support

Loan processing software (Encompass, Calyx)

Regulatory compliance

Education

Bachelor of Business Administration – Real Estate Finance, Middle Tennessee State University | 2016

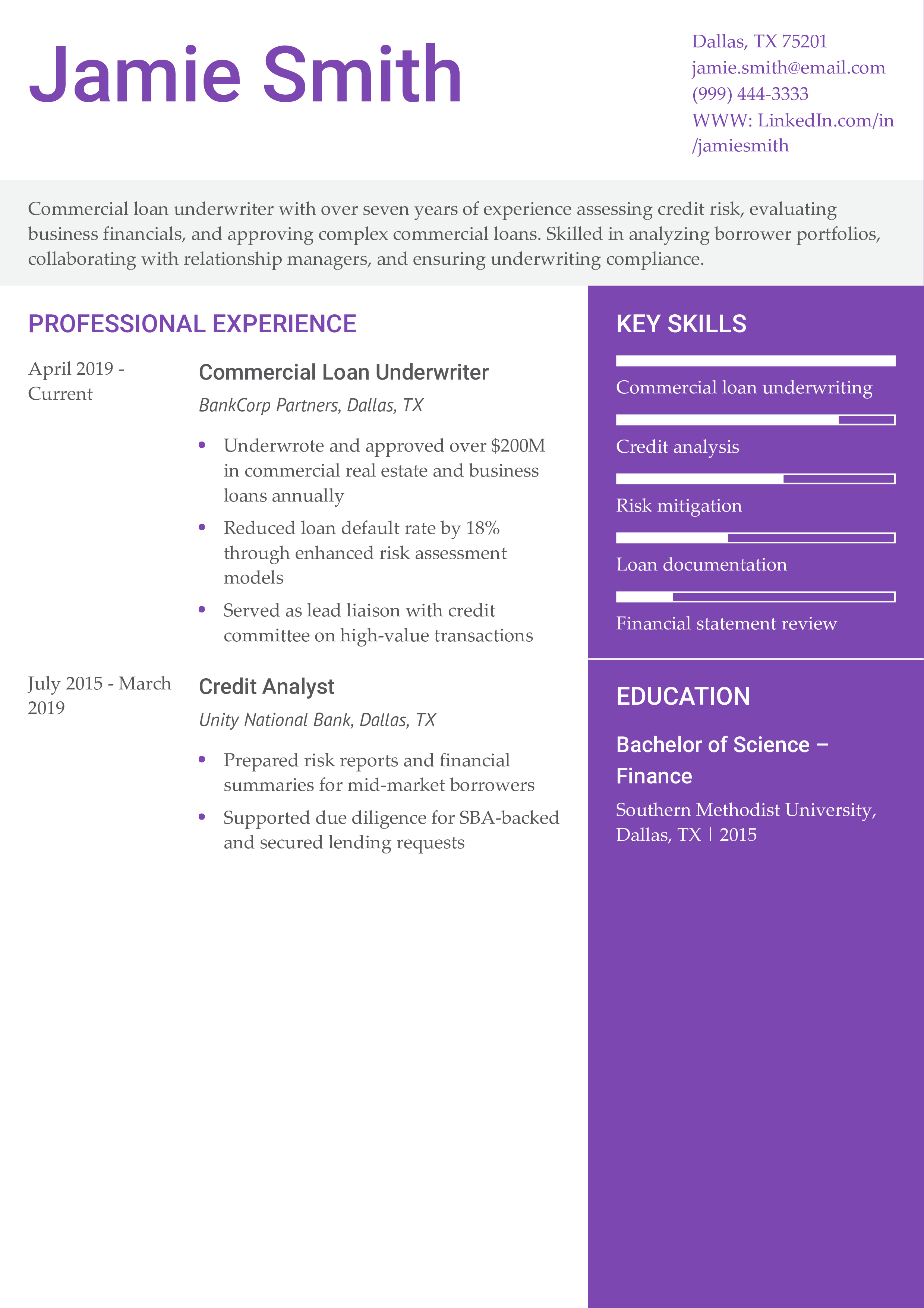

Jamie Smith

(999) 444-3333 | [email protected] | Dallas, TX 75201 | LinkedIn.com/in/jamiesmith

Profile

Commercial loan underwriter with over seven years of experience assessing credit risk, evaluating business financials, and approving complex commercial loans. Skilled in analyzing borrower portfolios, collaborating with relationship managers, and ensuring underwriting compliance.

Professional Experience

Commercial Loan Underwriter, BankCorp Partners, Dallas, TX | April 2019 – Present

- Underwrote and approved over $200M in commercial real estate and business loans annually

- Reduced loan default rate by 18% through enhanced risk assessment models

- Served as lead liaison with credit committee on high-value transactions

Credit Analyst, Unity National Bank, Dallas, TX | July 2015 – March 2019

- Prepared risk reports and financial summaries for mid-market borrowers

- Supported due diligence for SBA-backed and secured lending requests

Key Skills

Commercial loan underwriting

Credit analysis

Risk mitigation

Loan documentation

Financial statement review

Education

Bachelor of Science – Finance, Southern Methodist University, Dallas, TX | 2015

Alex Johnson

(321) 123-6789 | [email protected] | Minneapolis, MN 55401 | LinkedIn.com/in/alexjohnson

Profile

Compliance analyst with over six years of experience in regulatory reporting, anti-money laundering (AML) procedures, and risk controls within the banking sector. Experienced in building compliance frameworks and coordinating internal audits.

Professional Experience

Compliance Analyst, Great Lakes Bank, Minneapolis, MN | January 2020 – Present

- Maintained up-to-date compliance with federal banking regulations including BSA and AML laws

- Led quarterly compliance reviews and updated policy documentation across five departments

- Trained over 20 employees on internal controls and risk protocols

Banking Operations Specialist, FirstNorth Financial, Minneapolis, MN | June 2017 – December 2019

- Supported internal audits and reconciliations related to regulatory filings

- Monitored flagged transactions and escalated high-risk cases for review

Key Skills

Regulatory compliance

AML/BSA procedures

Internal audits

Risk assessments

Policy development

Education

Bachelor of Science – Criminal Justice, University of Minnesota | 2016

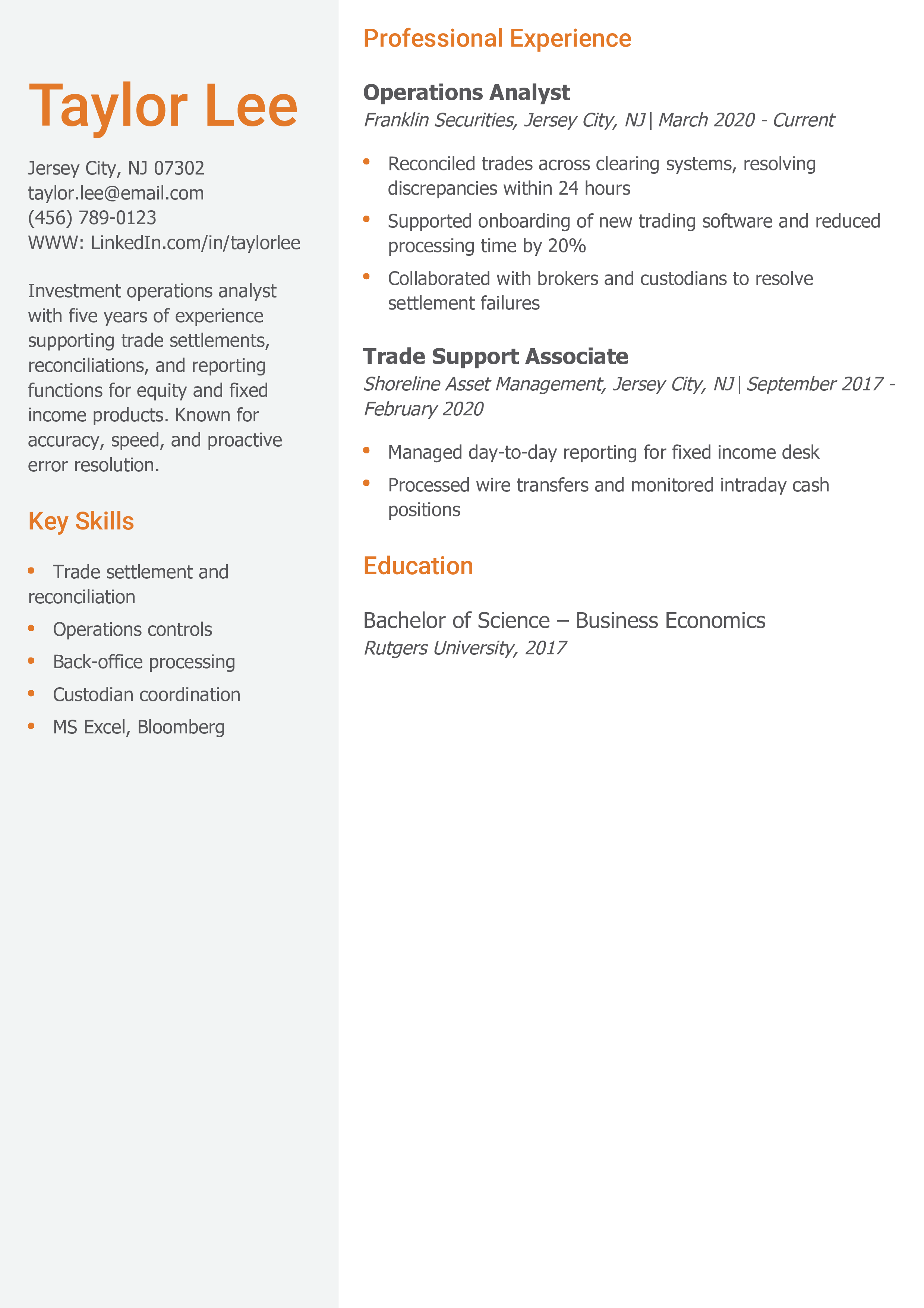

Taylor Lee

(456) 789-0123 | [email protected] | Jersey City, NJ 07302 | LinkedIn.com/in/taylorlee

Profile

Investment operations analyst with five years of experience supporting trade settlements, reconciliations, and reporting functions for equity and fixed income products. Known for accuracy, speed, and proactive error resolution.

Professional Experience

Operations Analyst, Franklin Securities, Jersey City, NJ | March 2020 – Present

- Reconciled trades across clearing systems, resolving discrepancies within 24 hours

- Supported onboarding of new trading software and reduced processing time by 20%

- Collaborated with brokers and custodians to resolve settlement failures

Trade Support Associate, Shoreline Asset Management, Jersey City, NJ | September 2017 – February 2020

- Managed day-to-day reporting for fixed income desk

- Processed wire transfers and monitored intraday cash positions

Key Skills

Trade settlement and reconciliation

Operations controls

Back-office processing

Custodian coordination

MS Excel, Bloomberg

Education

Bachelor of Science – Business Economics, Rutgers University | 2017

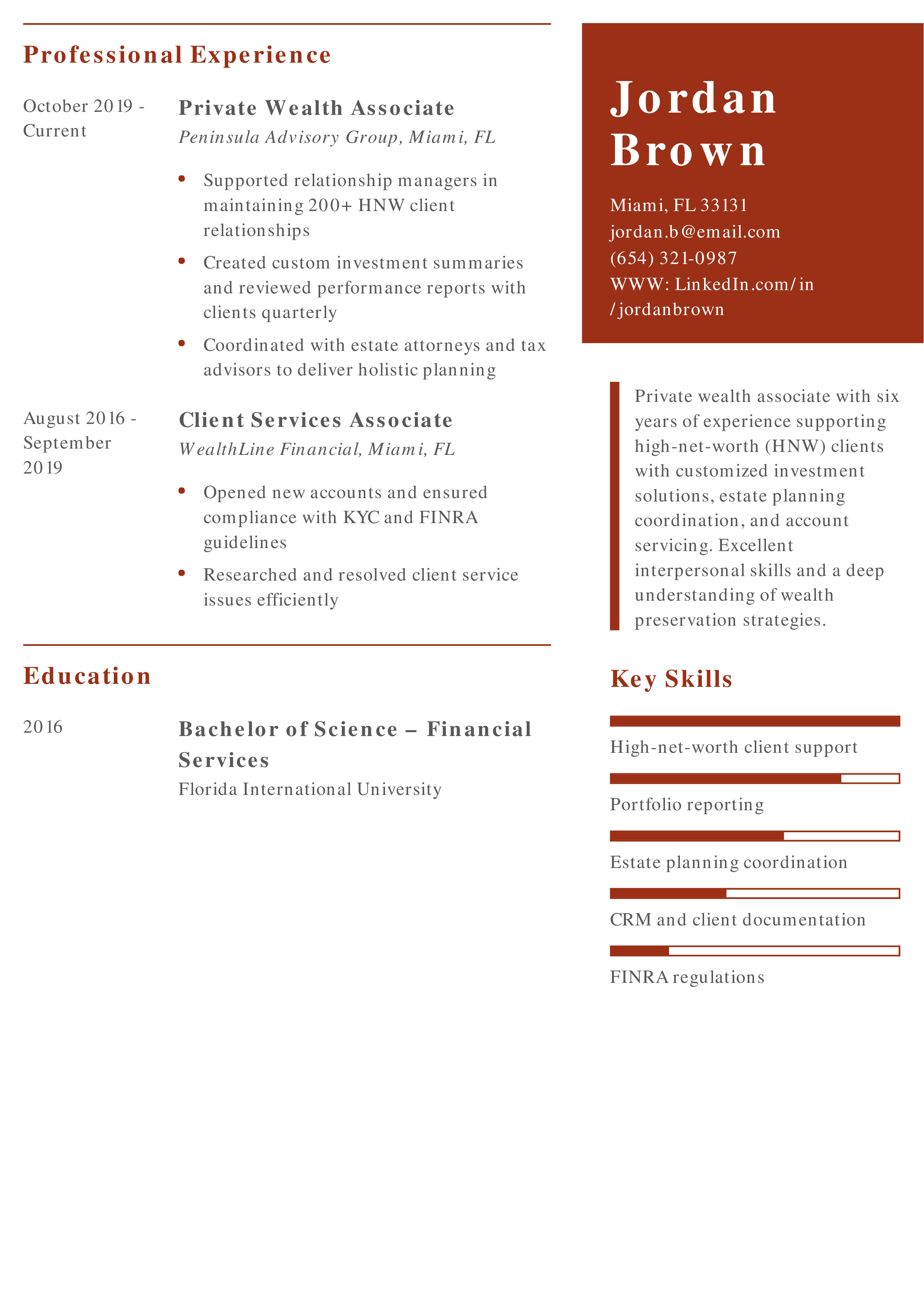

Jordan Brown

(654) 321-0987 | [email protected] | Miami, FL 33131 | LinkedIn.com/in/jordanbrown

Profile

Private wealth associate with six years of experience supporting high-net-worth (HNW) clients with customized investment solutions, estate planning coordination, and account servicing. Excellent interpersonal skills and a deep understanding of wealth preservation strategies.

Professional Experience

Private Wealth Associate, Peninsula Advisory Group, Miami, FL | October 2019 – Present

- Supported relationship managers in maintaining 200+ HNW client relationships

- Created custom investment summaries and reviewed performance reports with clients quarterly

- Coordinated with estate attorneys and tax advisors to deliver holistic planning

Client Services Associate, WealthLine Financial, Miami, FL | August 2016 – September 2019

- Opened new accounts and ensured compliance with KYC and FINRA guidelines

- Researched and resolved client service issues efficiently

Key Skills

High-net-worth client support

Portfolio reporting

Estate planning coordination

CRM and client documentation

FINRA regulations

Education

Bachelor of Science – Financial Services, Florida International University | 2016

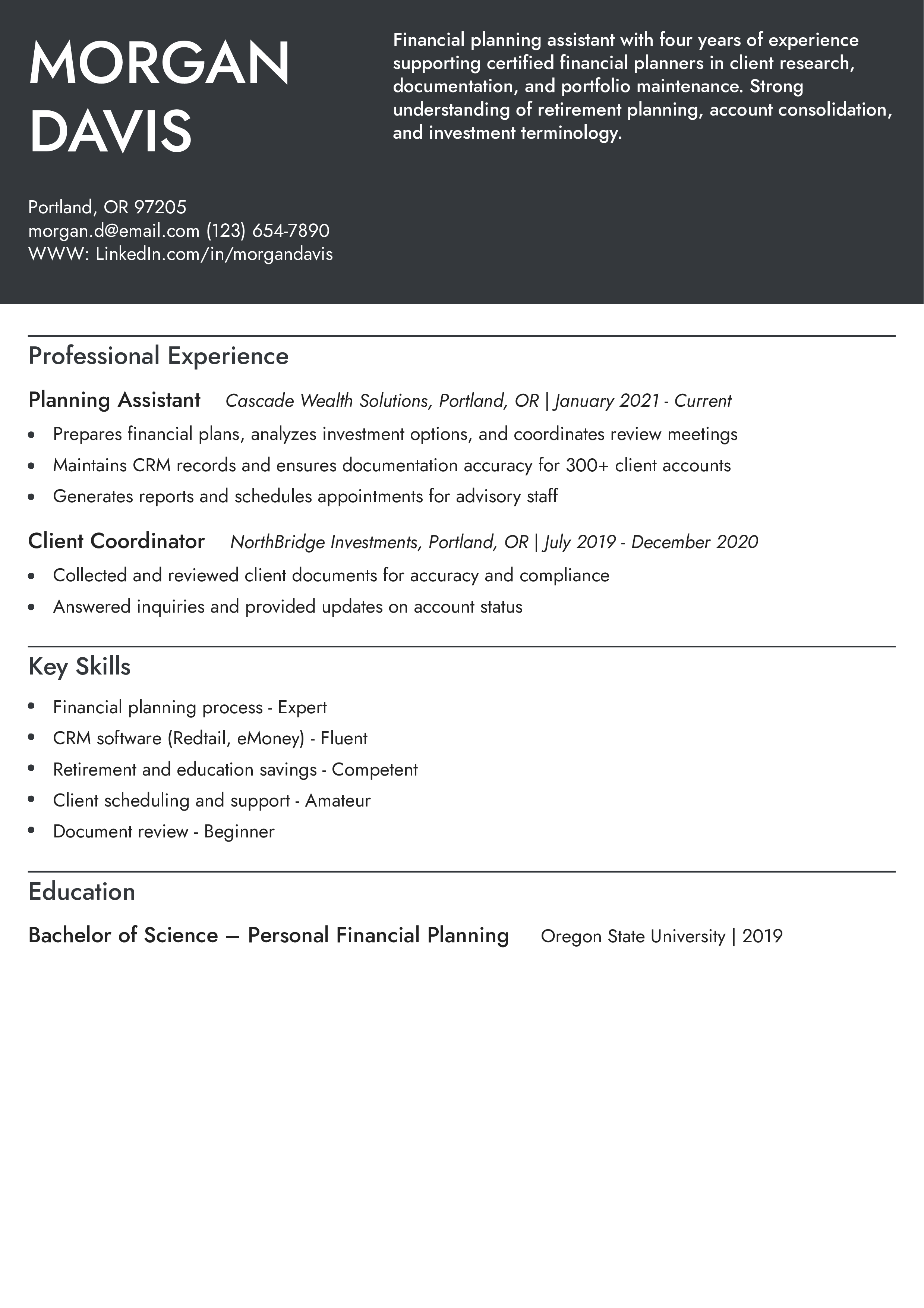

Morgan Davis

(123) 654-7890 | [email protected] | Portland, OR 97205 | LinkedIn.com/in/morgandavis

Profile

Financial planning assistant with four years of experience supporting certified financial planners in client research, documentation, and portfolio maintenance. Strong understanding of retirement planning, account consolidation, and investment terminology.

Professional Experience

Planning Assistant, Cascade Wealth Solutions, Portland, OR | January 2021 – Present

- Prepares financial plans, analyzes investment options, and coordinates review meetings

- Maintains CRM records and ensures documentation accuracy for 300+ client accounts

- Generates reports and schedules appointments for advisory staff

Client Coordinator, NorthBridge Investments, Portland, OR | July 2019 – December 2020

- Collected and reviewed client documents for accuracy and compliance

- Answered inquiries and provided updates on account status

Key Skills

Financial planning process

CRM software (Redtail, eMoney)

Retirement and education savings

Client scheduling and support

Document review

Education

Bachelor of Science – Personal Financial Planning, Oregon State University | 2019

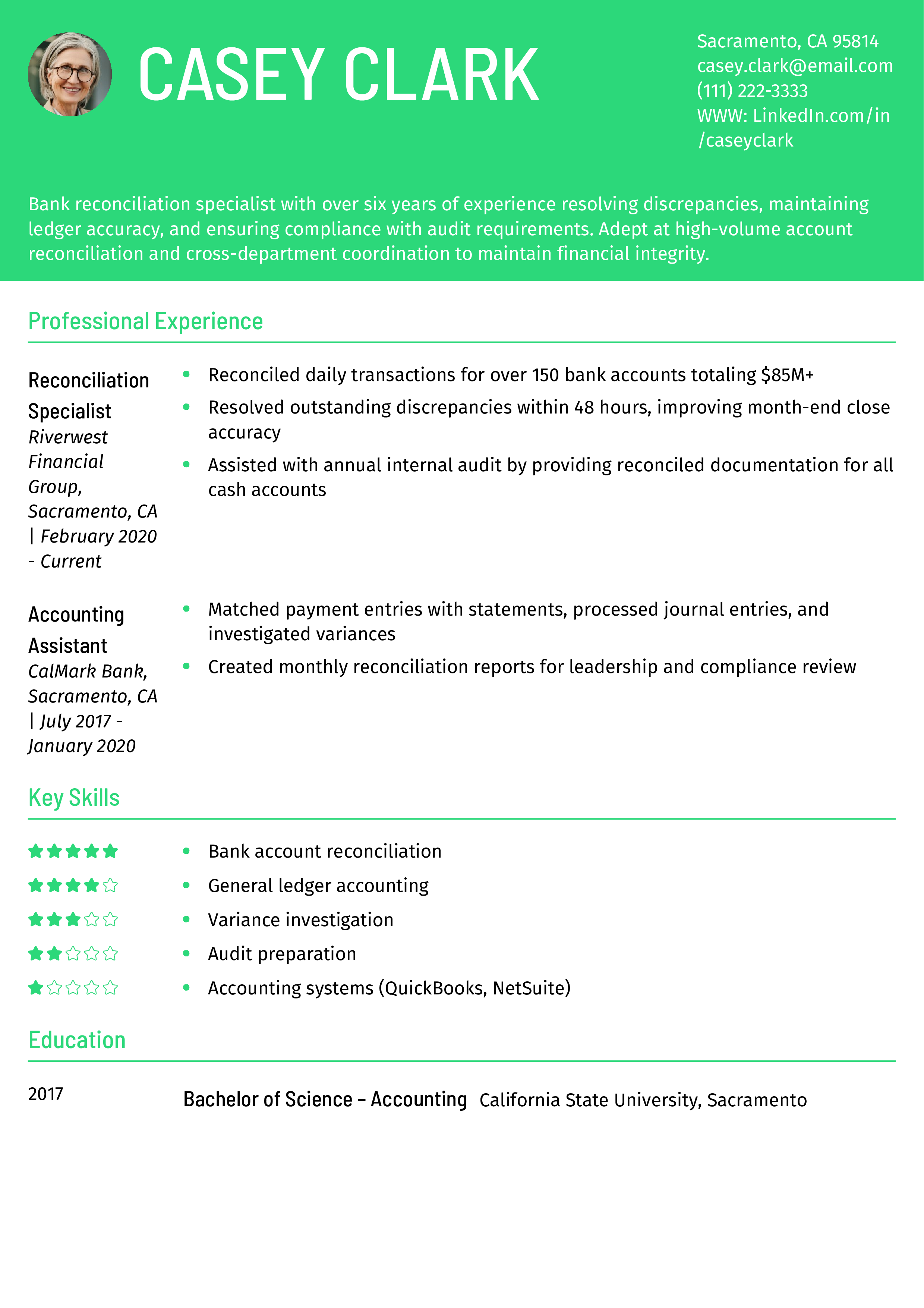

Casey Clark

(111) 222-3333 | [email protected] | Sacramento, CA 95814 | LinkedIn.com/in/caseyclark

Profile

Bank reconciliation specialist with over six years of experience resolving discrepancies, maintaining ledger accuracy, and ensuring compliance with audit requirements. Adept at high-volume account reconciliation and cross-department coordination to maintain financial integrity.

Professional Experience

Reconciliation Specialist, Riverwest Financial Group, Sacramento, CA | February 2020 – Present

- Reconciled daily transactions for over 150 bank accounts totaling $85M+

- Resolved outstanding discrepancies within 48 hours, improving month-end close accuracy

- Assisted with annual internal audit by providing reconciled documentation for all cash accounts

Accounting Assistant, CalMark Bank, Sacramento, CA | July 2017 – January 2020

- Matched payment entries with statements, processed journal entries, and investigated variances

- Created monthly reconciliation reports for leadership and compliance review

Key Skills

Bank account reconciliation

General ledger accounting

Variance investigation

Audit preparation

Accounting systems (QuickBooks, NetSuite)

Education

Bachelor of Science – Accounting, California State University, Sacramento | 2017

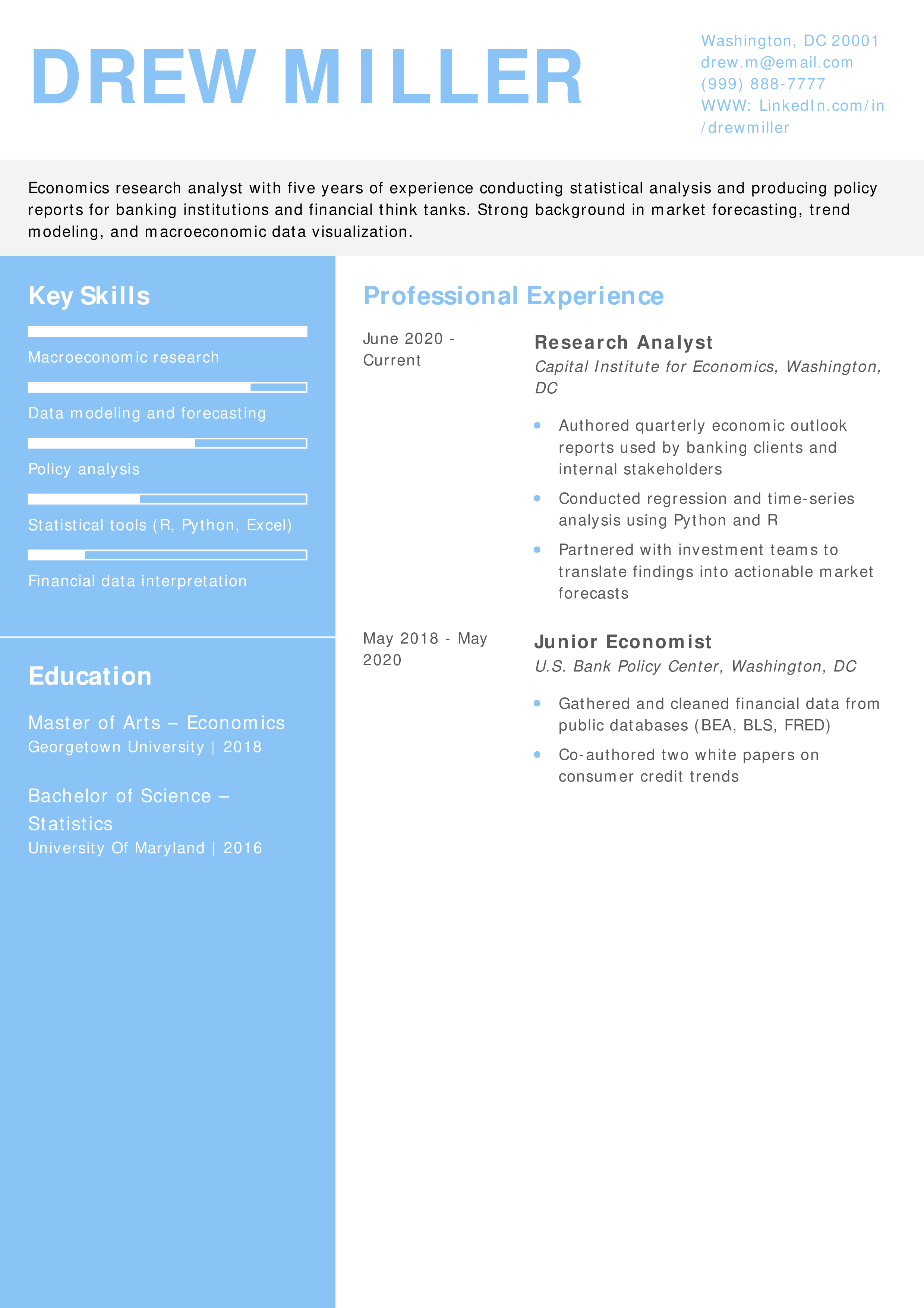

Drew Miller

(999) 888-7777 | [email protected] | Washington, DC 20001 | LinkedIn.com/in/drewmiller

Profile

Economics research analyst with five years of experience conducting statistical analysis and producing policy reports for banking institutions and financial think tanks. Strong background in market forecasting, trend modeling, and macroeconomic data visualization.

Professional Experience

Research Analyst, Capital Institute for Economics, Washington, DC | June 2020 – Present

- Authored quarterly economic outlook reports used by banking clients and internal stakeholders

- Conducted regression and time-series analysis using Python and R

- Partnered with investment teams to translate findings into actionable market forecasts

Junior Economist, U.S. Bank Policy Center, Washington, DC | May 2018 – May 2020

- Gathered and cleaned financial data from public databases (BEA, BLS, FRED)

- Co-authored two white papers on consumer credit trends

Key Skills

Macroeconomic research

Data modeling and forecasting

Policy analysis

Statistical tools (R, Python, Excel)

Financial data interpretation

Education

Master of Arts – Economics, Georgetown University | 2018

Bachelor of Science – Statistics, University of Maryland | 2016

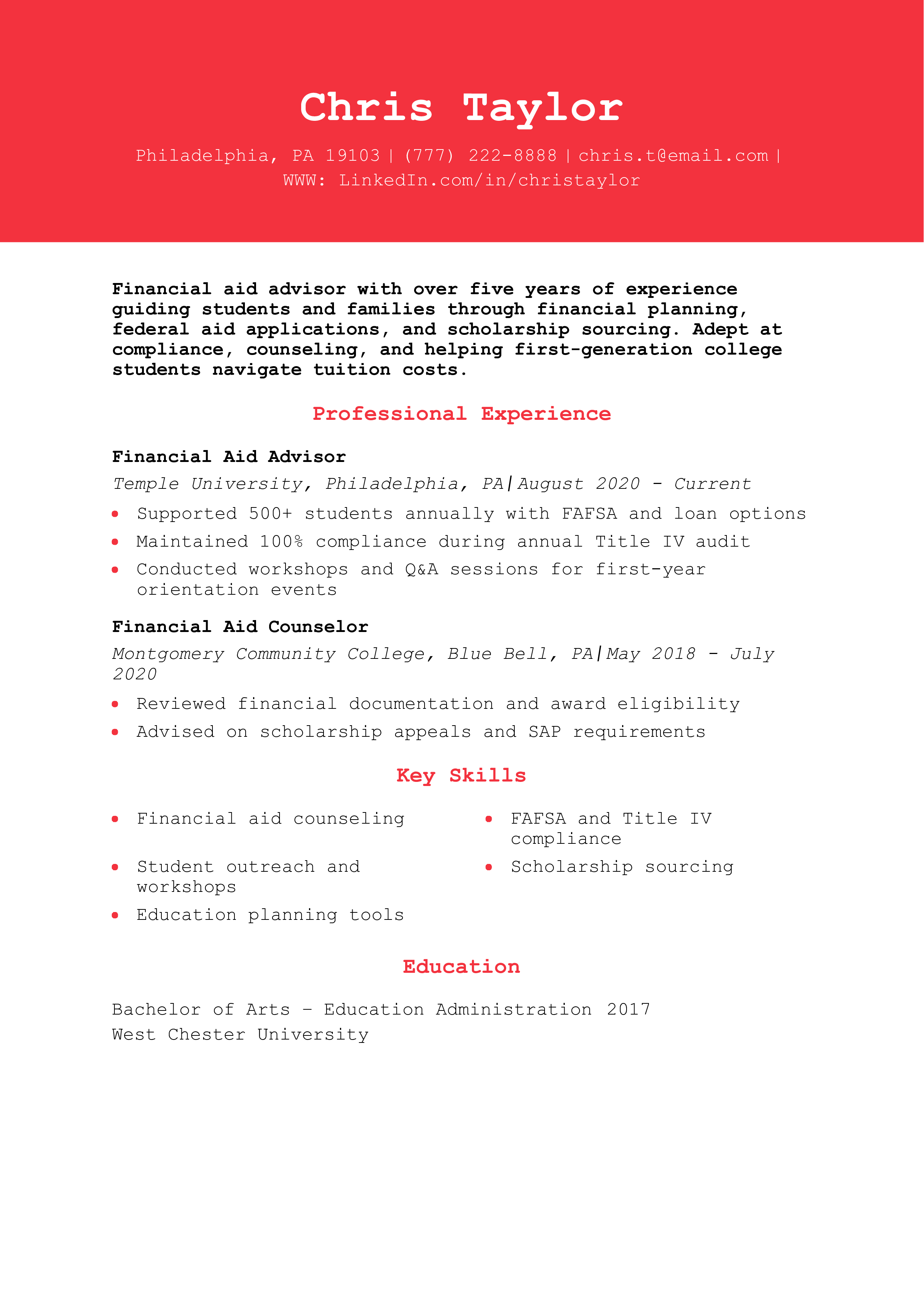

Chris Taylor

(777) 222-8888 | [email protected] | Philadelphia, PA 19103 | LinkedIn.com/in/christaylor

Profile

Financial aid advisor with over five years of experience guiding students and families through financial planning, federal aid applications, and scholarship sourcing. Adept at compliance, counseling, and helping first-generation college students navigate tuition costs.

Professional Experience

Financial Aid Advisor, Temple University, Philadelphia, PA | August 2020 – Present

- Supported 500+ students annually with FAFSA and loan options

- Maintained 100% compliance during annual Title IV audit

- Conducted workshops and Q&A sessions for first-year orientation events

Financial Aid Counselor, Montgomery Community College, Blue Bell, PA | May 2018 – July 2020

- Reviewed financial documentation and award eligibility

- Advised on scholarship appeals and SAP requirements

Key Skills

Financial aid counseling

FAFSA and Title IV compliance

Student outreach and workshops

Scholarship sourcing

Education planning tools

Education

Bachelor of Arts – Education Administration, West Chester University | 2017

Pat Morgan

(444) 555-6666 | [email protected] | Newark, NJ 07102 | LinkedIn.com/in/patmorgan

Profile

Strategic treasury operations manager with over 10 years of experience directing cash management, bank relations, and liquidity strategy for international corporations. Expert at implementing controls and process improvements to ensure financial stability and compliance.

Professional Experience

Treasury Operations Manager, Continental Brands Corp., Newark, NJ | February 2018 – Present

- Managed global treasury operations spanning $300M+ in daily cash flow

- Led automation of payment processes, reducing manual errors by 40%

- Directed FX hedging strategies to mitigate currency risk exposure across five countries

Senior Treasury Analyst, TruVista Global, Newark, NJ | May 2014 – January 2018

- Oversaw daily banking relationships and cash positions

- Developed monthly KPI dashboard for treasury team performance

Key Skills

Cash and liquidity management

Treasury policy and controls

Global banking relationships

FX strategy and hedging

Treasury systems (Kyriba, SAP)

Education

Master of Business Administration – Finance, Rutgers Business School | 2014

Bachelor of Science – Corporate Finance, Montclair State University | 2012