How To Write an Insurance Sales Resume

As an insurance sales professional, your resume is a powerful marketing tool showcasing your skills from sales to networking and achievements in the industry. This guide provides actual insurance sales resume examples and expert advice tailored to the needs of agents. Learn strategies to feature your sales achievements, quantify your performance, and demonstrate your knowledge of insurance products and industry regulations so your resume grabs the attention of hiring managers and positions you as a top candidate in the field.

- Entry-level

- Mid-career

- Senior-level

1. Create a profile by summarizing your insurance sales qualifications

Your resume profile should concisely capture your expertise, experience, and achievements within the insurance sector. In two to three sentences, focus on your specific role as an insurance sales agent, emphasizing your years of experience and quantifiable accomplishments. Incorporate relevant keywords to show your deep understanding of the field and alignment with the position you’re applying for. Remember to take a persuasive approach to your writing.

To captivate readers, include an impressive statistic that showcases your success, such as exceeding sales targets by a certain percentage or consistently achieving high client satisfaction ratings. Your profile should immediately convey your value as a sales professional in the insurance industry and entice employers to delve deeper into your resume.

Senior-Level Profile Example:

An insurance sales executive with over 10 years of experience building lucrative sales pipelines and identifying opportunities to secure new business. A proven track record of delivering in-depth presentations on insurance products and improving annual sales revenue by up to 150%.

Entry-Level Profile Example:

A dynamic insurance sales representative with two years of experience working in high-volume sales environments. Adept at interfacing potential sales prospects and identifying ideal insurance products based on individual customer needs.

2. Outline your insurance sales experience in a compelling list

Crafting this section is vital to your resume as it demonstrates an ability to drive results and contribute to the success of an organization. Start by quantifying your experience to showcase your impact, such as the number of policies sold, revenue generated, or percentage increase in client retention.

These quantifiable achievements prove your effectiveness as an insurance sales agent. Incorporate details about successful sales strategies, client relationship management, lead generation, and market analysis to underscore your abilities further. As you create each bullet point, use action verbs to add a dynamic element to your resume. This strategy emphasizes your proactive approach and draws the hiring manager’s attention to all you’ve accomplished.

Senior-Level Professional Experience Example:

Insurance Sales Manager, The Insurance Company, San Diego, CA

June 2014 – February 2021

- Built, managed, and led a team of over 50 insurance sales agents, identified opportunities to improve performance, and provided training on cross-selling techniques, resulting in over $1.5 million in annual sales

- Developed new sales pipelines and referral networks, provided coaching to team members to improve closed rates, and achieved a 150% increase in annual sales revenue

Entry-Level Professional Experience Example:

Entry-Level Remote Insurance Sales Representative, Banking Life, Saginaw, MI

July 2019 – present

- Field inbound calls from 15 to 30 sales prospects each day, conduct cold calling and prospecting, and utilize upselling techniques to achieve 125% to 140% of monthly sales quotas

- Manage consultations to identify client needs, financial goals, and resources

- Develop a coordinated protection plan for immediate coverage and long-term strategy

- Cross-selling and upselling additional company products to existing clients

3. List any of your education and certifications relevant to insurance sales

Including relevant education and certifications on an insurance sales agent resume is essential, especially in such a highly regulated industry. Employers want to see you possess the necessary licenses and qualifications to sell insurance products. In your education section, starting with your highest level completed, list the degree name, institution, location, and graduation date.

It’s vital to include your state insurance license and indicate the lines of authority you hold, such as Property and Casualty (P&C) or Life and Health (L&H). Additionally, highlight any specialized certifications or designations specific to the insurance industry, such as Certified Insurance Agent (CIA) or Certified Insurance Sales Professional (CISP). Create a separate certification section and list each license or certificate title, issuing organization, and date received.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] [Dates Enrolled]

Example

- Bachelor of Science in Business Administration, Risk Management and Insurance

- University of Baltimore, Baltimore, MD, September 2009 – July 2013

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Life and Health Insurance License, Maryland Insurance Administration, 2013 (#2222-45A)

4. List your insurance sales-related skills and proficiencies

Employers can quickly assess your qualifications and suitability for the role when you include a key skills section. As you list your skills, focus on those directly related to insurance sales and customer service. Feature your technical knowledge of insurance products and services and showcase your interpersonal ability to communicate complex insurance concepts. It’s also valuable to highlight your proficiency in sales and customer relationship management (CRM) software. Adapt your skillset to match the specific requirements of the job you’re applying for, considering the insurance company’s target market and product offerings. Take a look at our list of examples below:

| Key Skills and Proficiencies | |

|---|---|

| Business administration | Casualty insurance |

| Cold calling | Communication |

| Compliance | Consultative sales |

| Customer service | Final expense |

| Health insurance | Lead generation |

| Life insurance | Medicare |

| Negotiation | New business development |

| Prospecting | Quoting |

| Relationship management | Sales |

| Underwriting | |

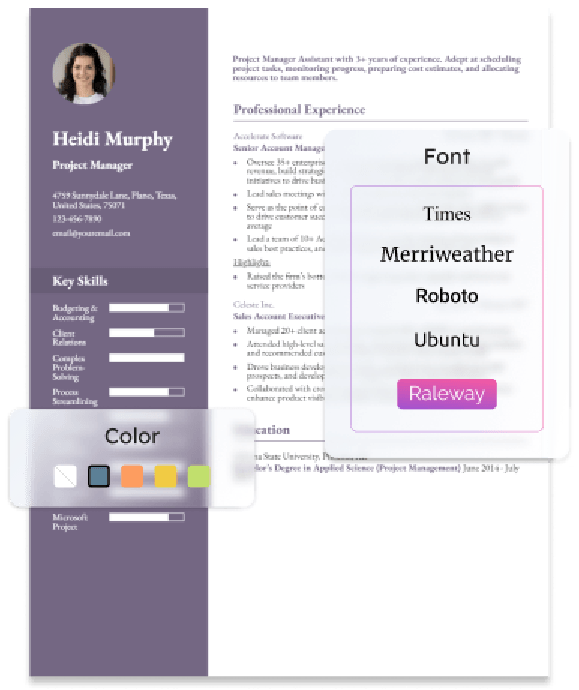

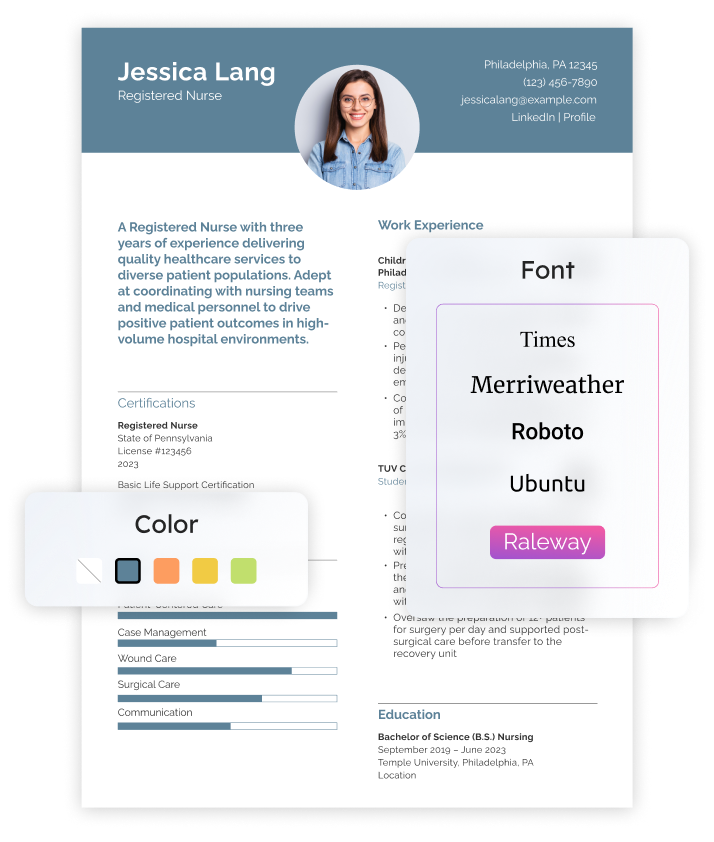

How To Pick the Best Insurance Sales Resume Template

A template lays the foundation for the content of your resume. It’s just as important as the writing itself. The best resume template for insurance sales is clean and organized. It should focus on featuring your most relevant professional accomplishments and key skills. Look for an easily customizable template that allows you to tailor the content to match the specific job requirements and present your unique strengths as an insurance sales agent. Strike a balance between your personal style and professionalism, avoiding decorative fonts and graphics that could distract from your resume’s content.

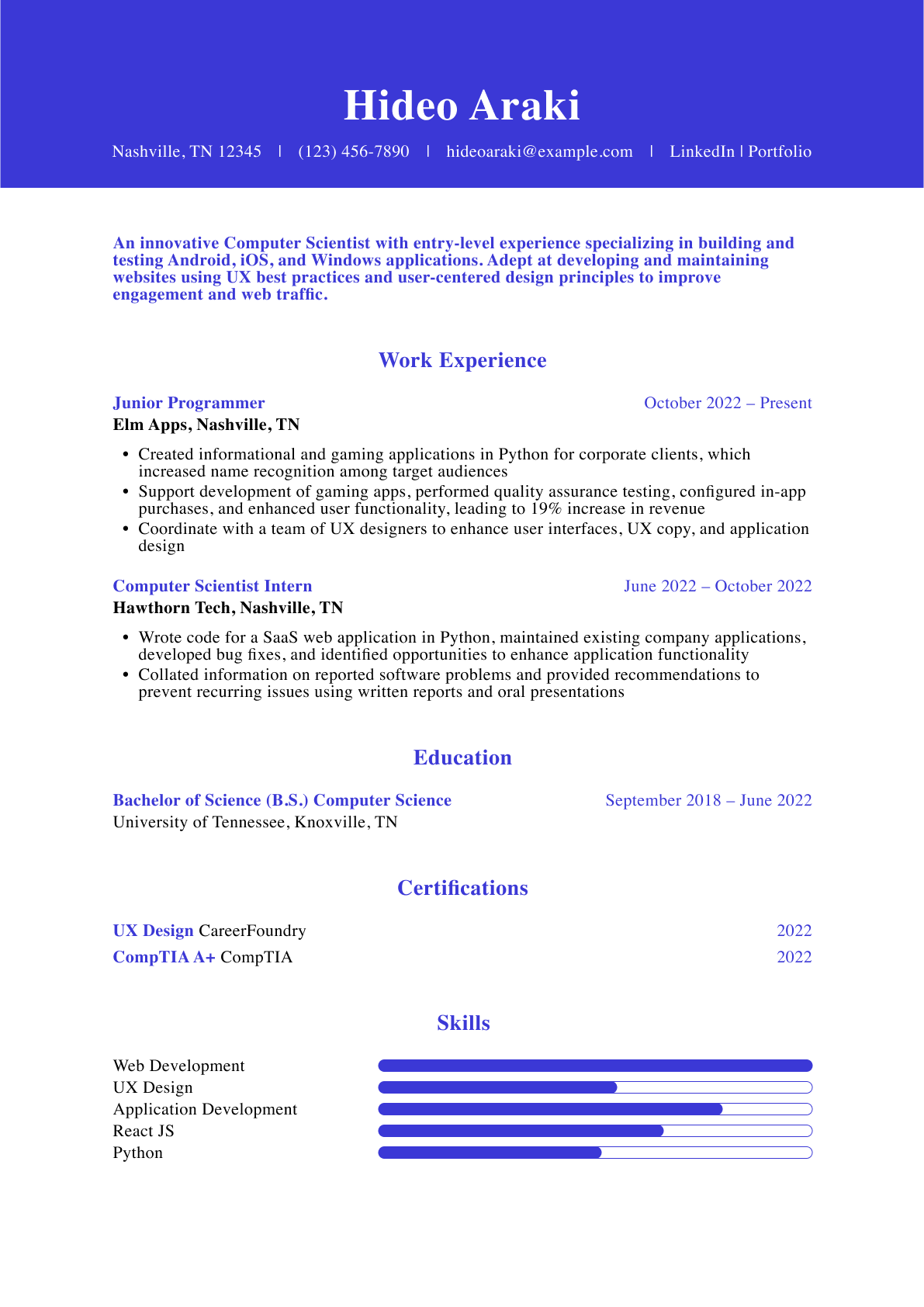

Insurance Sales Text-Only Resume Templates and Examples

- Entry-level

- Mid-career

- Senior-level

Jasmine Burgess

(456) 789-0123

[email protected]

901 Address Road, Baltimore, MD 76543

Profile

A Life Insurance Sales Representative with seven years of experience identifying and selling cost-effective solutions to customers and managing long-term relationships. Adept at building rapport with client accounts and leading initiatives to uncover new business and enhance sales growth.

Professional Experience

Sales Representative, Family First Life, Baltimore, MD

February 2016- Present

- Maintain a comprehensive understanding of mortgage protection and life insurance products, deliver engaging sales presentations, and generate over $400K in annual revenue

- Conduct consultations with clients and gain insights into their needs to recommend the most suitable policies

- Follow up on potential leads and search existing client lists to find opportunities for upselling

- Communicate with insurance companies to obtain quotes and set up policies for clients

Life Insurance Agent, Assurance, Baltimore, MD

July 2013 – February 2016

- Secured over $300K in new business in 2015, exceeded sales targets by 20% month over month, and provided comparisons of different policies to support customers

- Scheduled health screening for life insurance clients with approved clinics

- Clearly explained the billing options and benefits of individual insurance companies and policies to clients

Education

Bachelor of Science in Business Administration, Risk Management and Insurance

University of Baltimore, Baltimore, MD, September 2009 – July 2013

Key Skills

- Insurance Sales

- Communication

- Salesforce CRM

- Client Relations

- Account Management

Certifications

- Life and Health Insurance License, Maryland Insurance Administration, 2013 (#2222-45A)

Frequently Asked Questions: Insurance Sales Resume Examples and Advice

What are common action verbs for insurance sales resumes?-

Crafting the professional experience section of a resume is sometimes challenging. It can be a daunting task to find the right words to describe your responsibilities and achievements. We've compiled a list of common action verbs to showcase your skills and accomplishments in the insurance industry. Action verbs inject energy and impact into your resume, enabling you to highlight your abilities. You can use these verbs to emphasize your persuasive communication, negotiation prowess, and ability to meet or exceed sales targets. Consider using some of the following words in your insurance sales resume:

| Action Verbs | |

|---|---|

| Advise | Assist |

| Bill | Build |

| Collaborate | Communicate |

| Conduct | Cultivate |

| Develop | Engage |

| Generate | Identify |

| Influence | Improve |

| Manage | Market |

| Negotiate | Network |

| Prospect | Sell |

How do you align your resume with an insurance sales job description?-

The Bureau of Labor Statistics predicts a 6% growth in insurance sales agent employment between 2021 and 2031. Over the decade, we can expect to see more than 32,000 new jobs added to the workforce. Although the field will see an uptick in job opportunities, applicants still need an outstanding resume to land their dream job. Stand out from the crowd by aligning your resume with the job description.

Especially if you have a specific insurance opening in mind, it's crucial to tailor your resume to that position. Thoroughly review the job description to understand the requirements and qualifications sought by the employer. Then, carefully align your skills, experiences, and accomplishments with those desired for the role. For example, if an insurance company is looking for a candidate to primarily sell life insurance and health insurance policies, you’d provide tangible examples of you successfully selling these specific types of products.

What is the best insurance sales resume format?-

In most instances, the best resume format for insurance sales is reverse chronological. This approach emphasizes your most recent and relevant work experience while showcasing your career progression and sales performance. Functional resumes are generally considered outdated by most recruiters and hiring managers. Even if you’re starting at the entry level or have gaps in your work history, you’d be better served creating detailed bullet points for your previous jobs to emphasize transferable skills and experience.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!