To craft a good finance resume, you’ll need to show you can manage money successfully for clients or organizations. The tips and examples below will help you write each section of your resume so it gets you interviews for your next finance job.

“Finance resumes should highlight analysis, forecasting, and business insights. Show how your work drives smart decisions.”

Most Popular Finance Resumes

Entry-Level

Mid-Career

Senior-Level

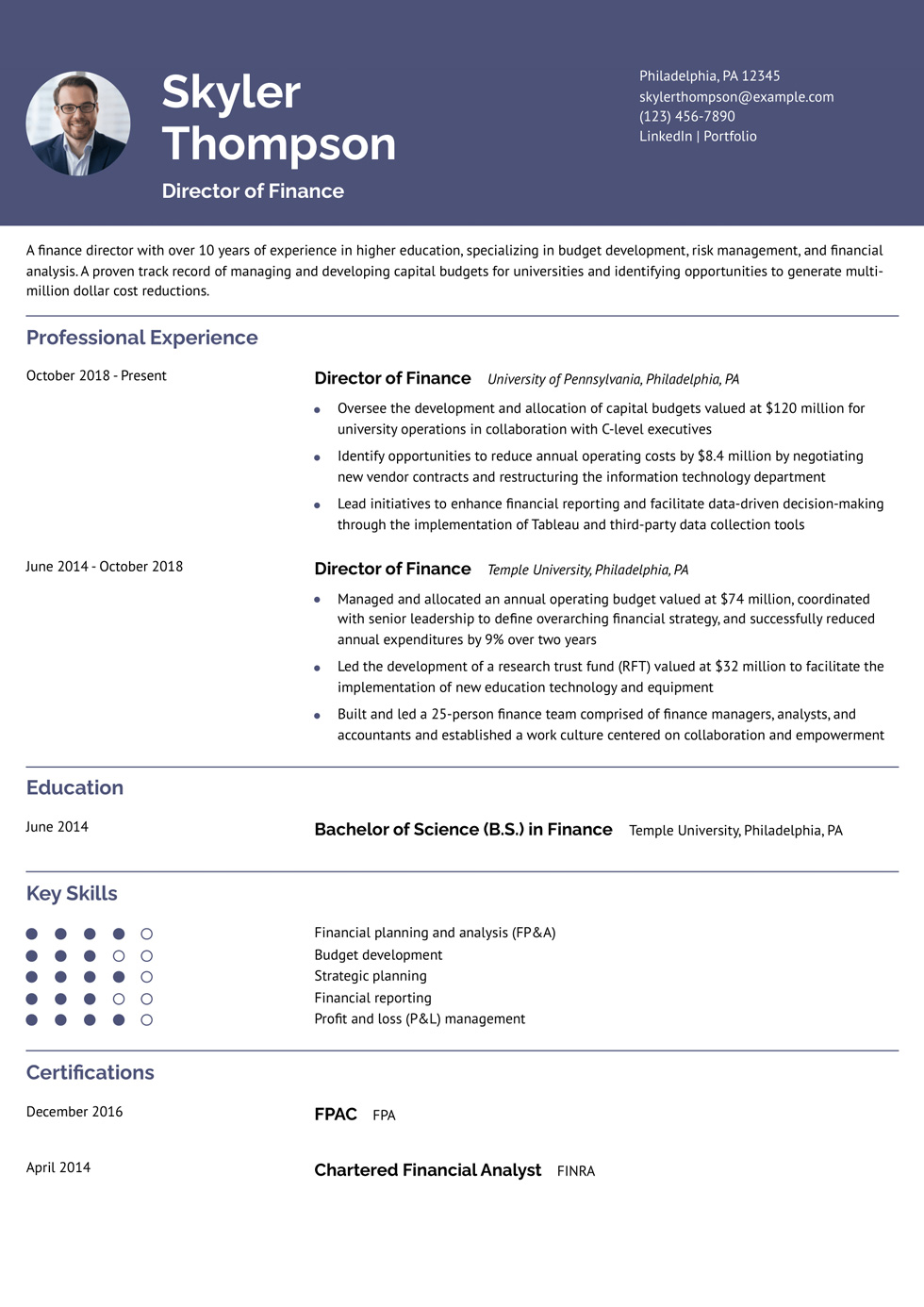

Finance Resume Example

Why This Resume Is a Great Example

This finance resume example is effective in several ways. By quantifying the size of the capital budgets and cost reductions they achieved, the hiring manager immediately sees that the candidate has a strong history of success at the director level.

Financial Analyst Resume Example

Why This Resume Is a Great Example

In this example, the candidate is pursuing financial analyst positions. By heavily emphasizing their expertise in financial reporting and data visualization, the applicant is able to show potential employers the value they can bring to their organizations.

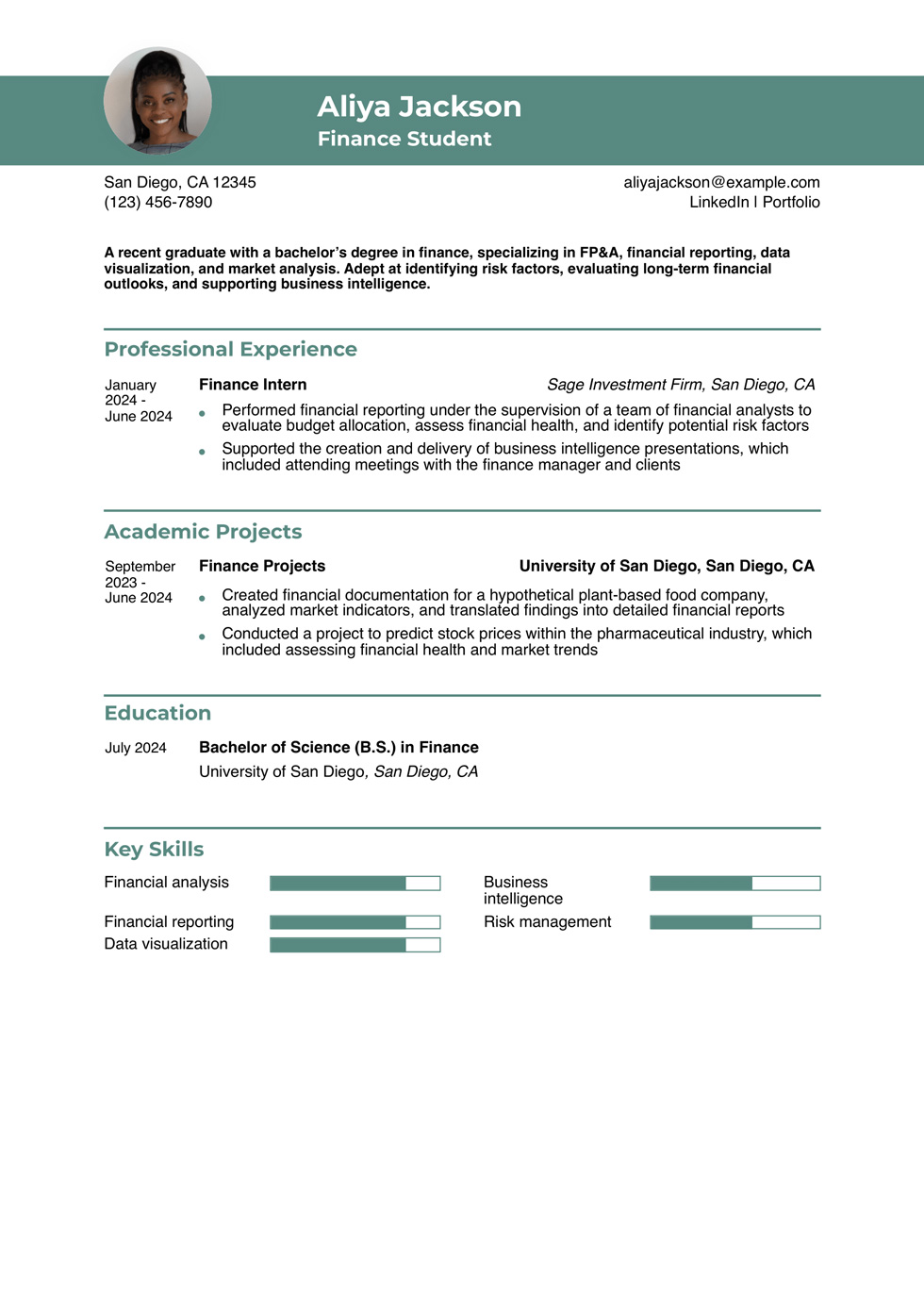

Finance Student Resume Example

Why This Resume Is a Great Example

Job hunting can be especially challenging as a recent graduate, but this example shows how you can leverage internships and academic projects to make a positive impression on the hiring manager. Although they can’t provide hard numbers, these bullet points are effective in demonstrating the candidate’s comprehensive understanding of finance.

Vice President of Finance Resume Example

Why This Resume Is a Great Example

This finance resume is a great example for how to pursue C-level positions. Incorporating large monetary figures is key, but to position yourself as an executive leader, it’s also important to demonstrate how you can collaborate effectively across all levels of the organization. Balancing these different aspects will help show potential employers you’re the ideal culture fit for their company.

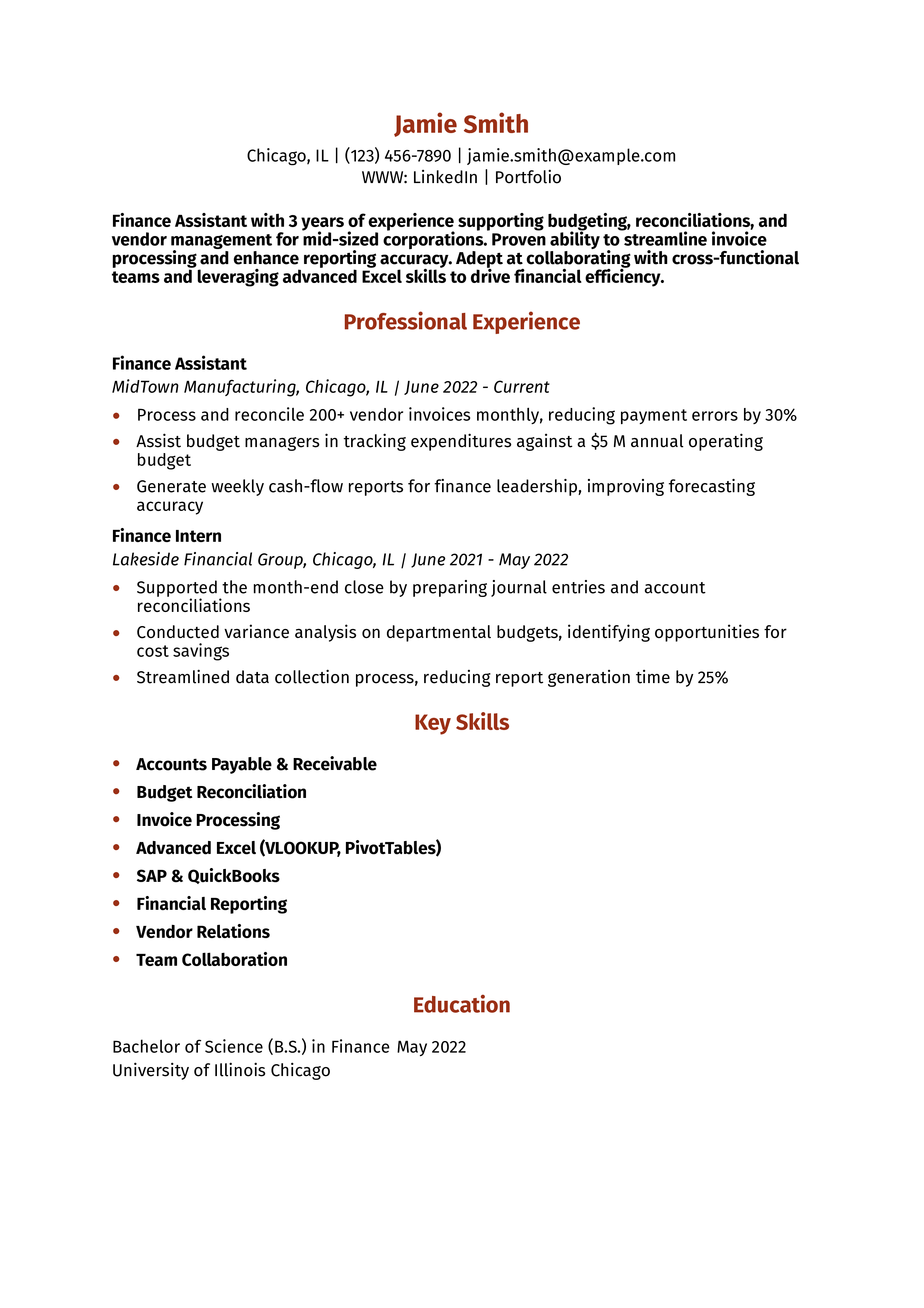

Finance Assistant Resume Example

Why This Resume Is a Great Example

Jamie Smith’s resume effectively showcases hands-on support in core finance functions, quantifying both volume (200+ invoices) and budget size ($5 M). The candidate’s progression from intern to full-time assistant demonstrates career growth, and clear bullet points highlight impact rather than just responsibilities.

Key Tips

Quantify your achievements by including metrics like invoice volumes and error reductions to help hiring managers grasp your scope of work. For more on showcasing your skills, see Resume Skills.

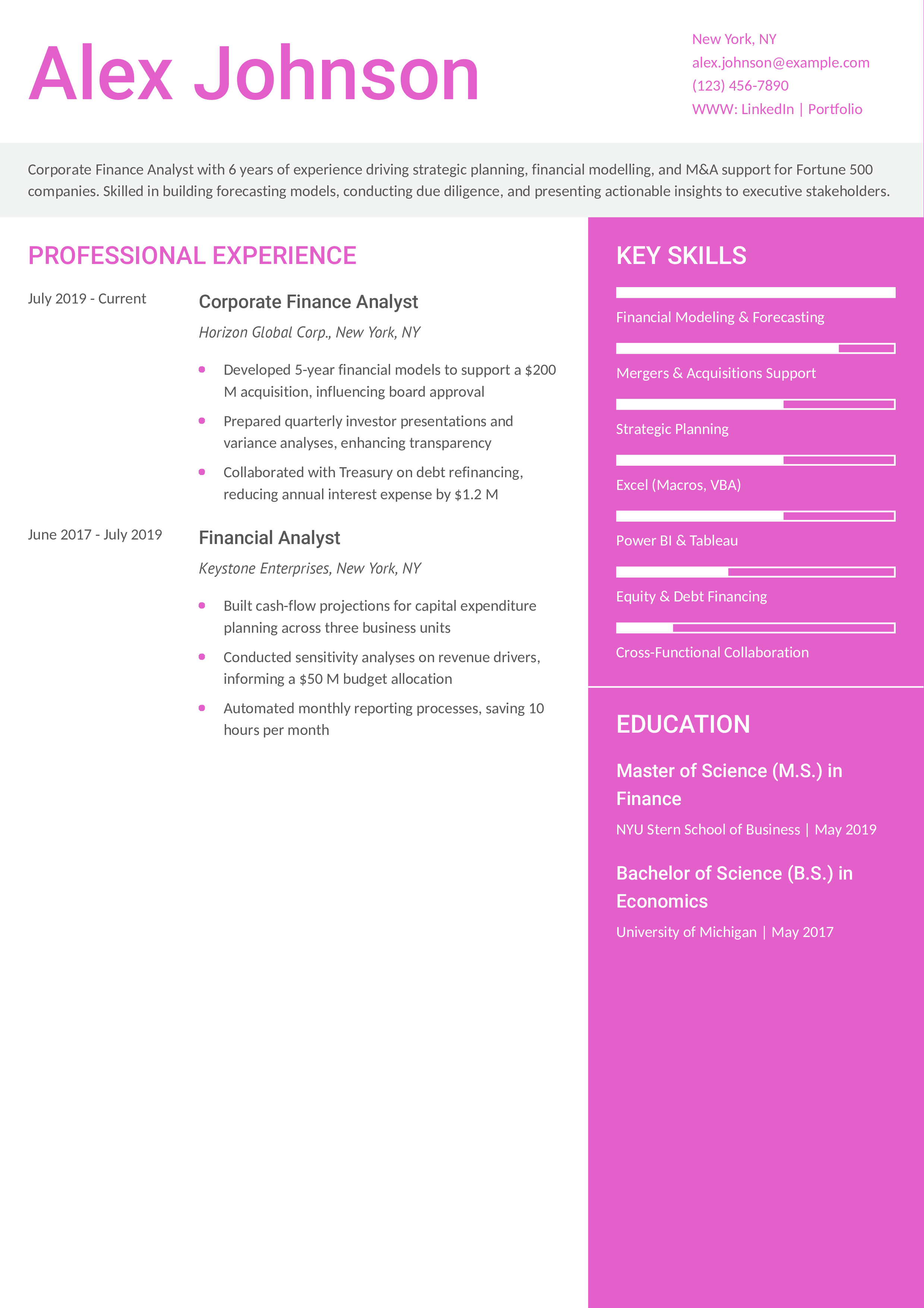

Corporate Finance Resume Example

Why This Resume Is a Great Example

Alex Johnson’s resume emphasizes high-impact projects—acquisition modeling and interest-cost savings—demonstrating both technical expertise and strategic influence. The dual degrees with relevant timelines validate the candidate’s academic rigor and fast career progression.

Key Tips

Show strategic impact by highlighting board-level deliverables and cost savings to underscore your value. Learn more about structuring your resume effectively in Best Resume Formats.

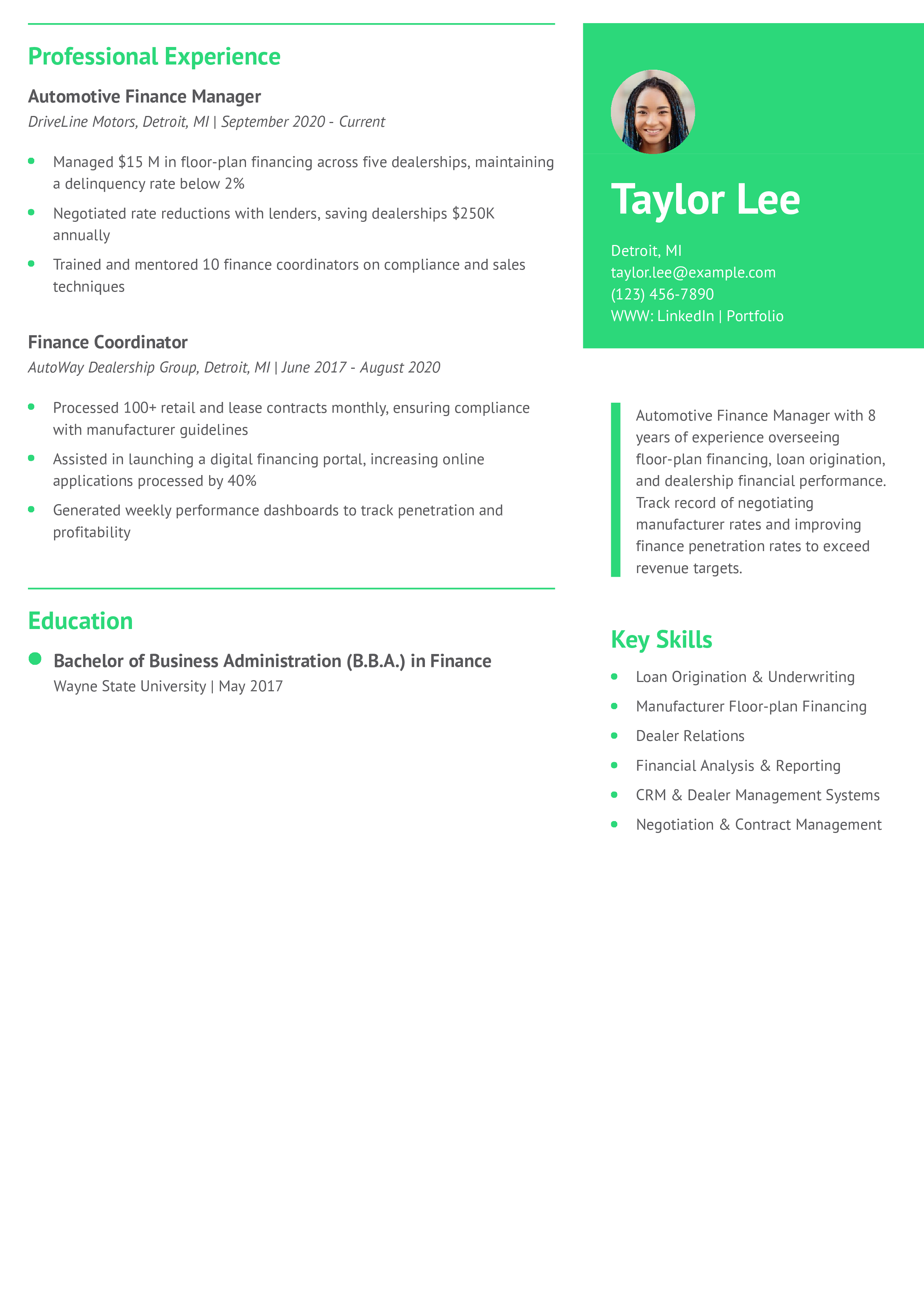

Automotive Finance Manager Resume Example

Why This Resume Is a Great Example

Taylor Lee’s resume blends industry-specific achievements, like floor-plan management and digital portal implementation, with quantifiable outcomes, illustrating both operational strength and innovation. The clear progression from coordinator to manager highlights leadership development.

Key Tips

Include industry-specific terminology like “floor-plan financing” to signal your domain expertise to recruiters. For guidance on highlighting customer-facing skills, see Customer Service Skills for a Resume.

Finance Business Partner Resume Example

Why This Resume Is a Great Example

Jordan Brown’s resume clearly demonstrates the impact of strategic partnerships through quantifiable improvements in forecast accuracy and revenue growth. The progression from analyst to finance business partner shows career development and increasing leadership responsibility.

Key Tips

Focus on how you influence business outcomes by partnering with other departments to drive financial performance. For guidance on crafting compelling objectives that frame your strategic value, see Resume Objective Examples.

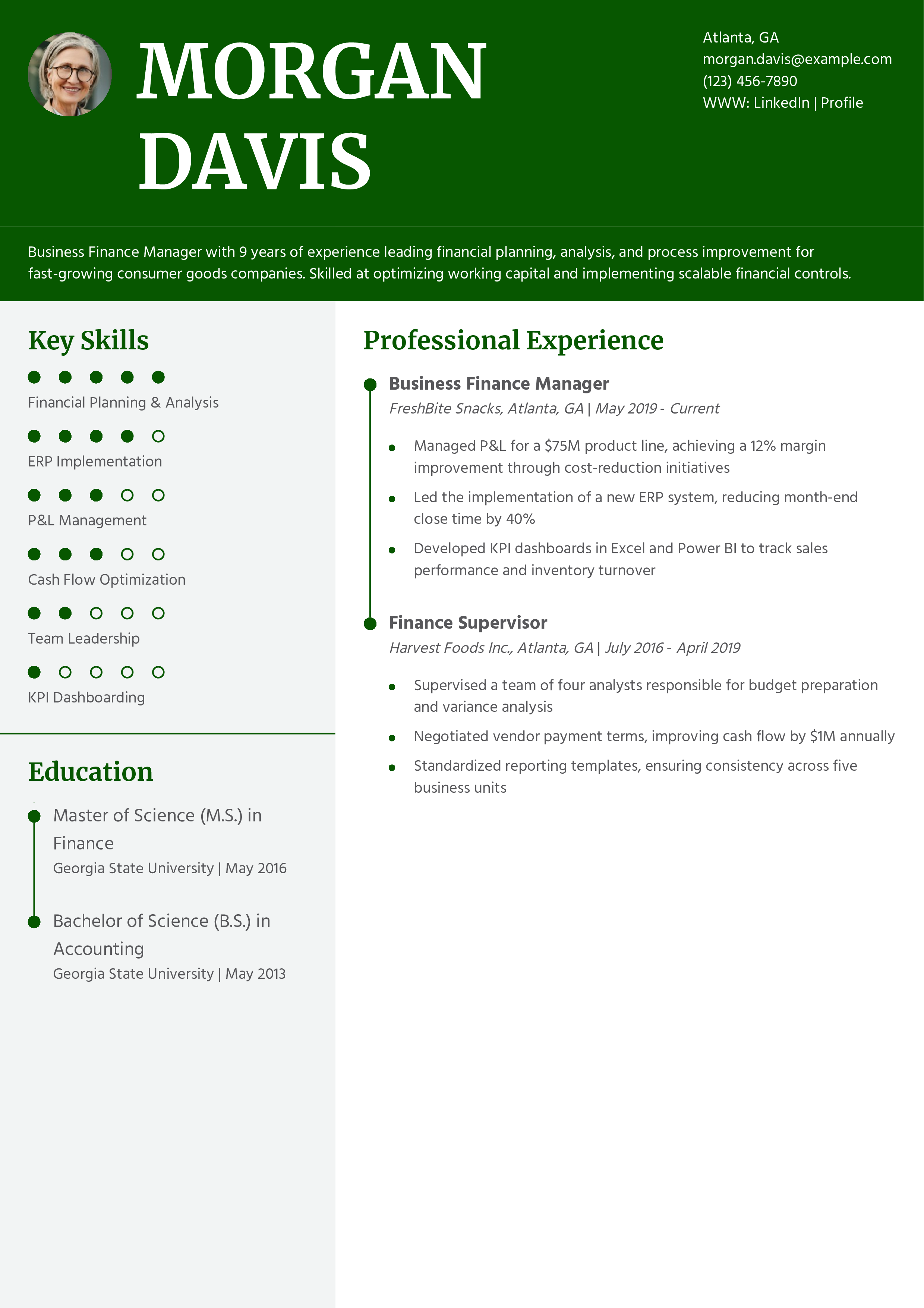

Business Finance Manager Resume Example

Why This Resume Is a Great Example

Morgan Davis’s resume highlights both strategic and operational accomplishments, quantifying margin improvements and cash-flow gains. The dual degrees in finance and accounting reinforce the candidate’s strong financial foundation.

Key Tips

Demonstrate your ability to lead financial transformations by including specific system implementations and process improvements. For advice on choosing the best resume fonts that ensure readability, see Best Font for Resume.

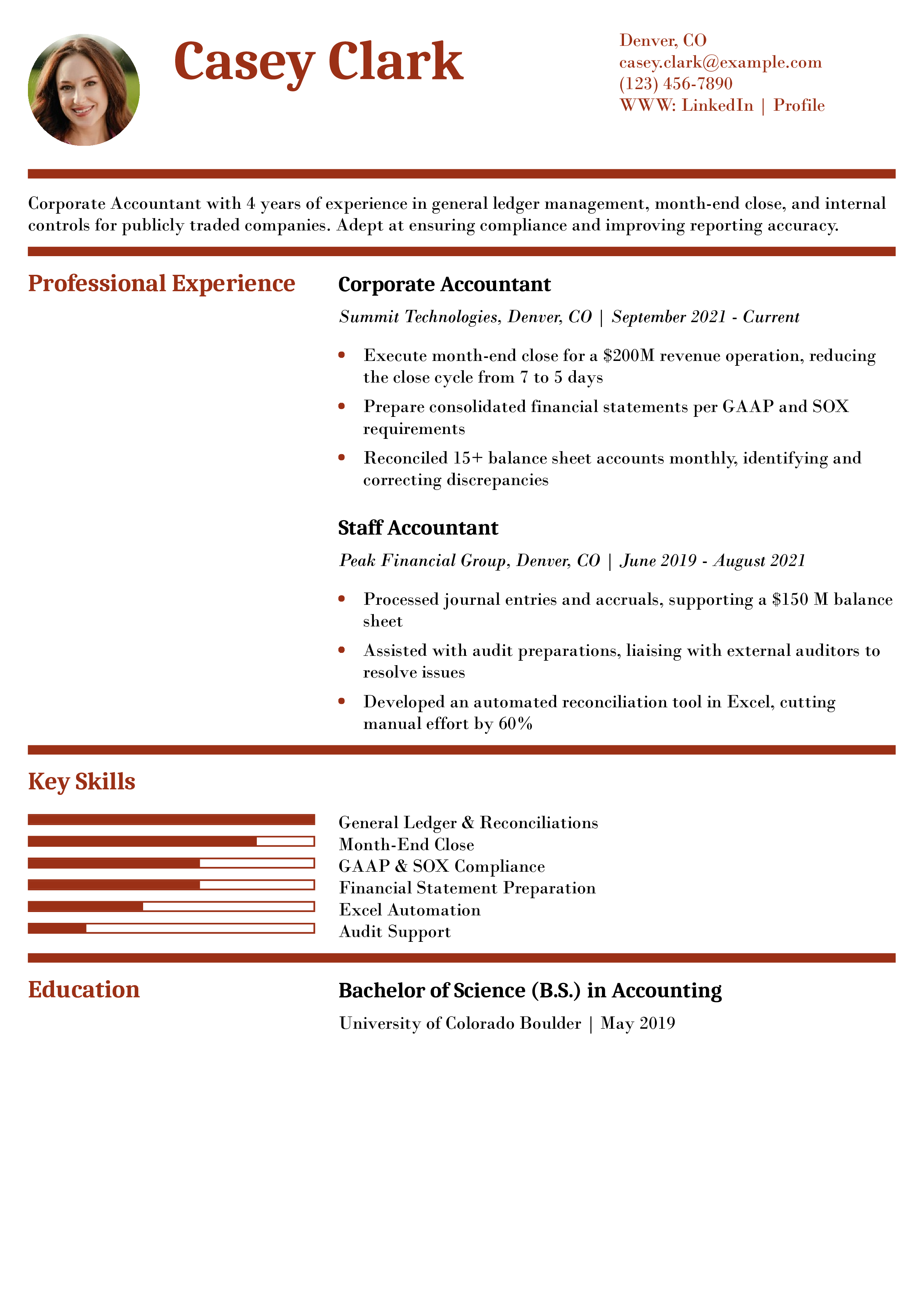

Corporate Accountant Resume Example

Why This Resume Is a Great Example

Casey Clark’s resume effectively highlights efficiency gains—shortening the close cycle and automating reconciliations, which directly translate to cost savings. Clear mention of GAAP and SOX shows attention to regulatory detail.

Key Tips

Quantify process improvements to demonstrate your efficiency in routine accounting tasks. For examples of strong resume summaries that set the tone for your expertise, see Resume Summary Examples.

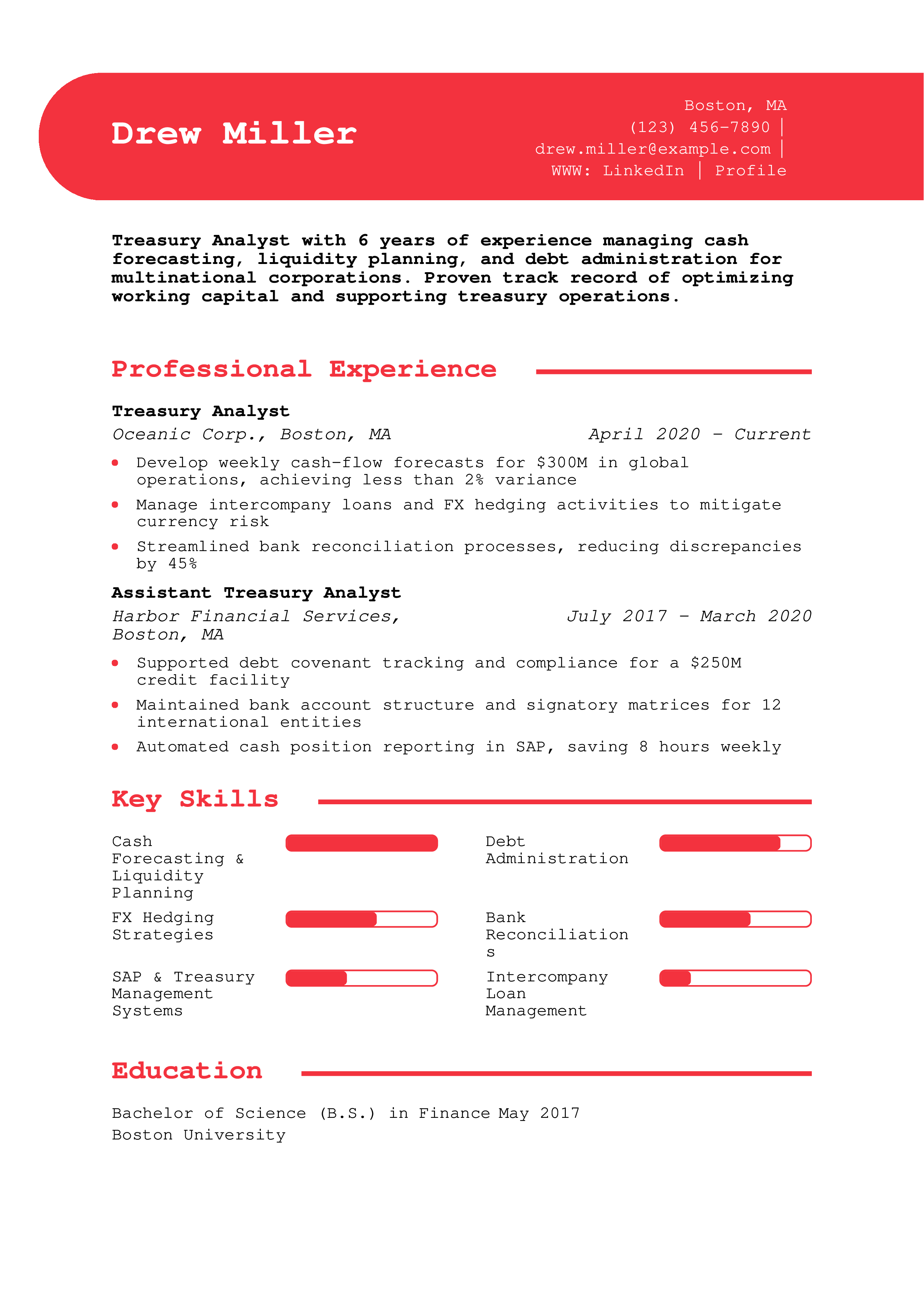

Treasury Analyst Resume Example

Why This Resume Is a Great Example

Drew Miller’s resume emphasizes precision in forecasting and risk management, with clear statistics on forecast variance and reconciliation improvements. The focus on automation underscores technical initiative.

Key Tips

Highlight your role in minimizing financial risk by showcasing forecast accuracy and hedging activities. For tips on structuring your resume layout, see Resume Outline Examples.

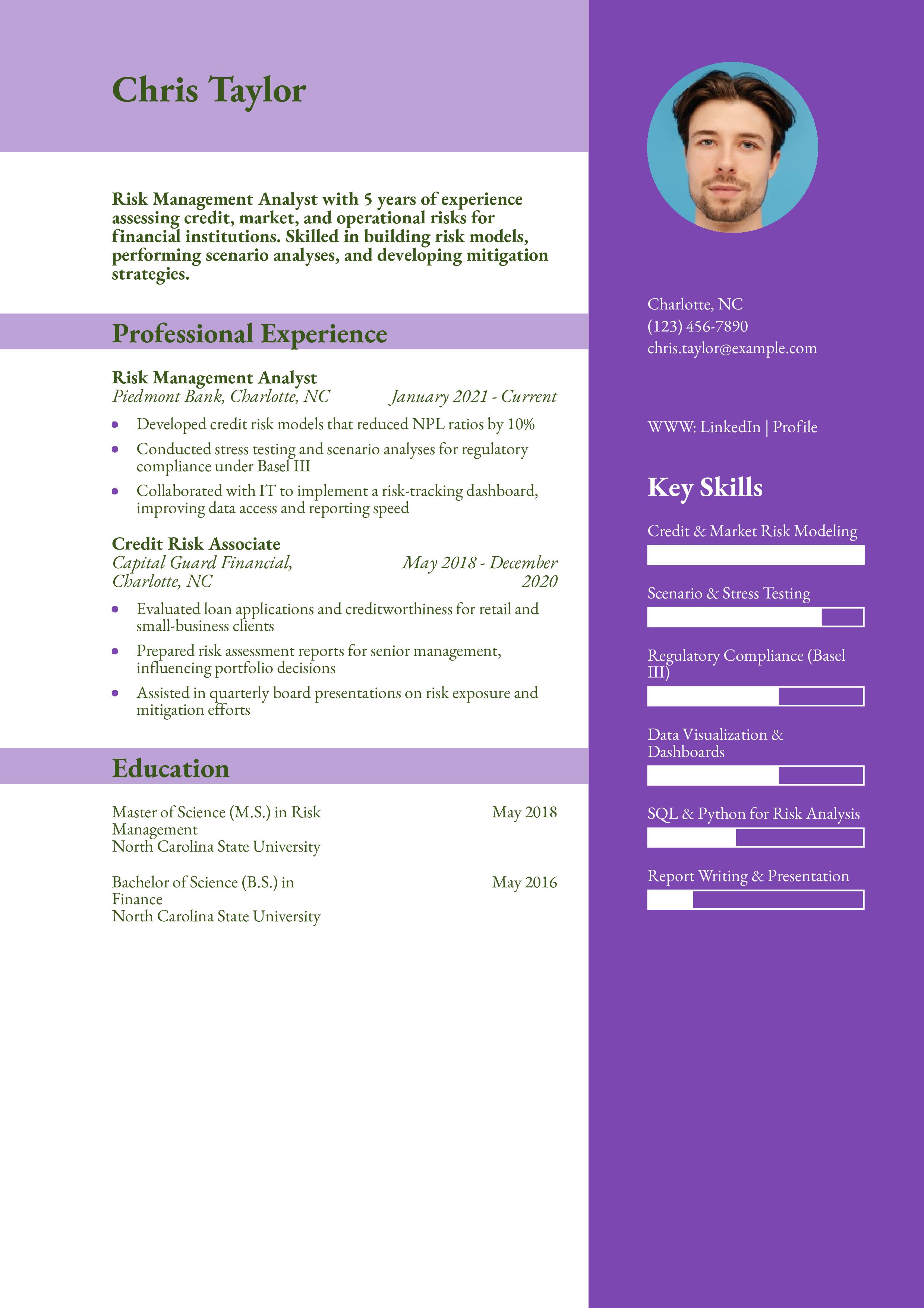

Risk Management Analyst Resume Example

Why This Resume Is a Great Example

Chris Taylor’s resume quantifies risk-reduction outcomes and demonstrates technical prowess in model development and dashboard implementation. Dual degrees highlight both practical and theoretical expertise.

Key Tips

Showcase how your analyses directly reduce risk by including percentage improvements and regulatory impacts. For guidance on emphasizing soft skills alongside technical expertise, see Soft Skills for a Resume.

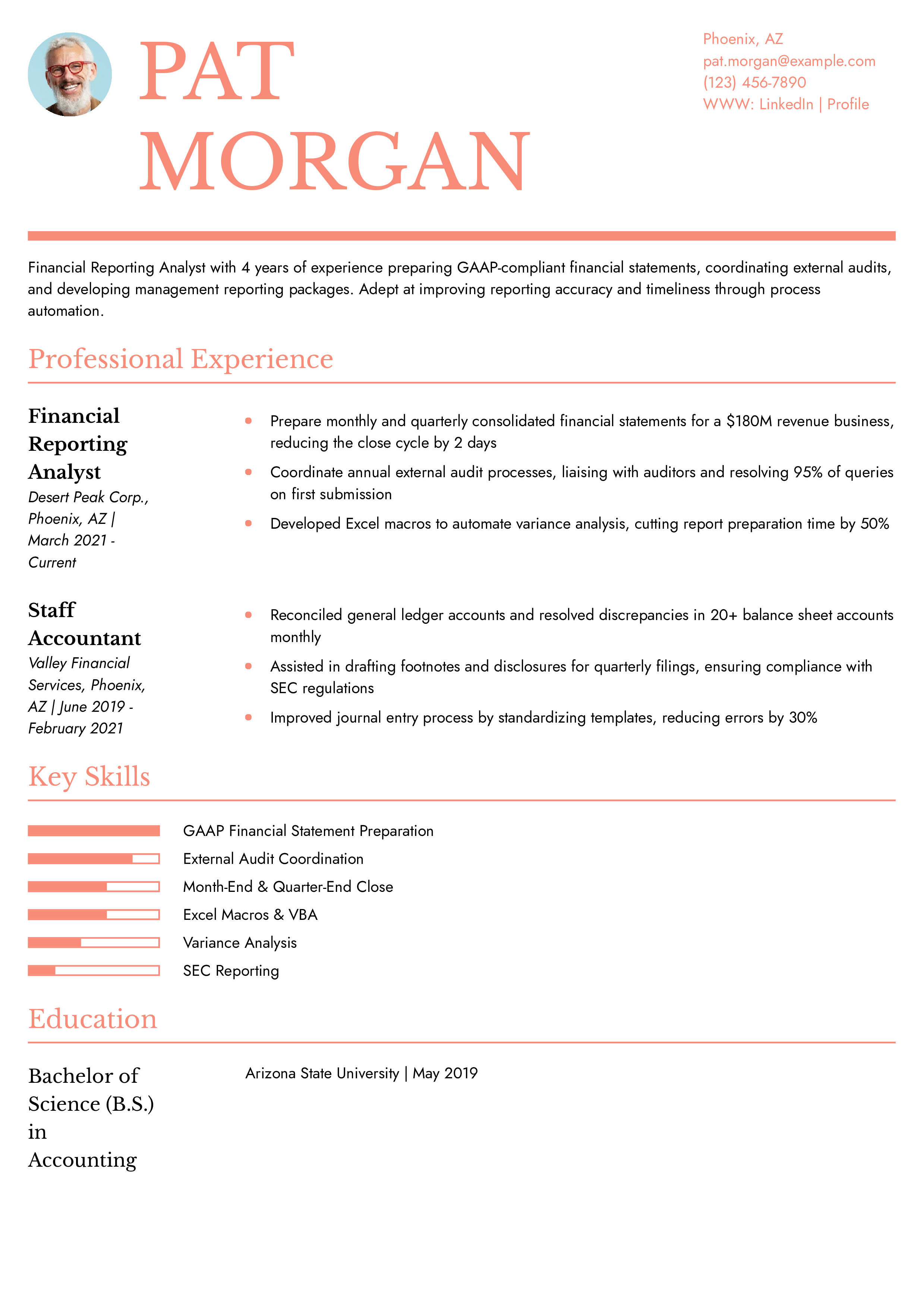

Financial Reporting Analyst Resume Example

Why This Resume Is a Great Example

Pat Morgan’s resume demonstrates clear efficiency gains—shortening the close cycle and automating variance analysis—while highlighting compliance expertise through audit coordination and SEC reporting.

Key Tips

Showcase how you’ve improved reporting processes and cycle times to illustrate your analytical impact. For tips on crafting strong resume summaries, see Resume Summary Examples.

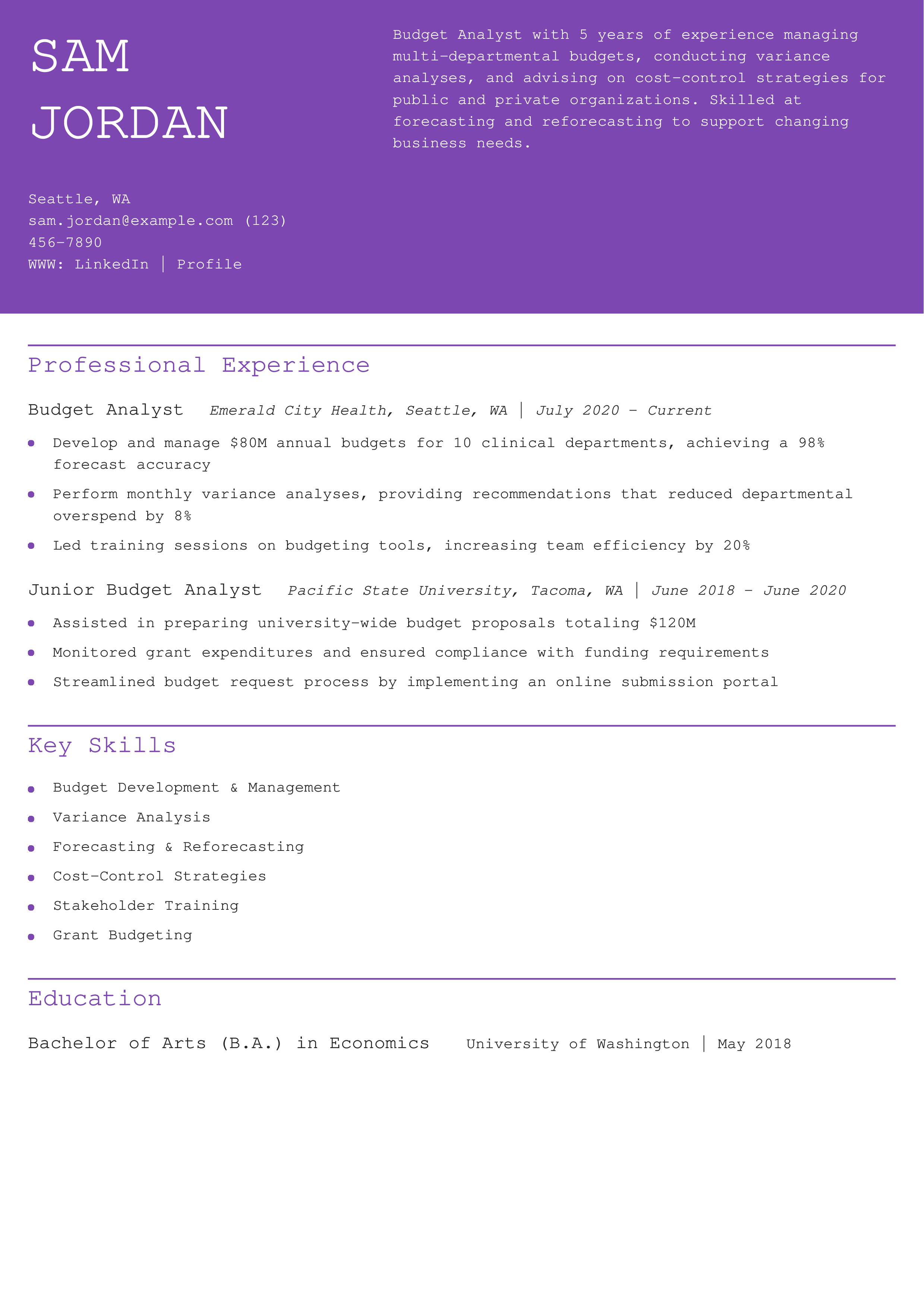

Budget Analyst Resume Example

Why This Resume Is a Great Example

Sam Jordan’s resume quantifies forecast accuracy and cost reductions, showing a direct link between analysis and organizational savings, while also highlighting leadership through training initiatives.

Key Tips

Emphasize the accuracy and financial impact of your budget forecasts to demonstrate your precision. For advice on highlighting your objectives, see Resume Objective Examples.

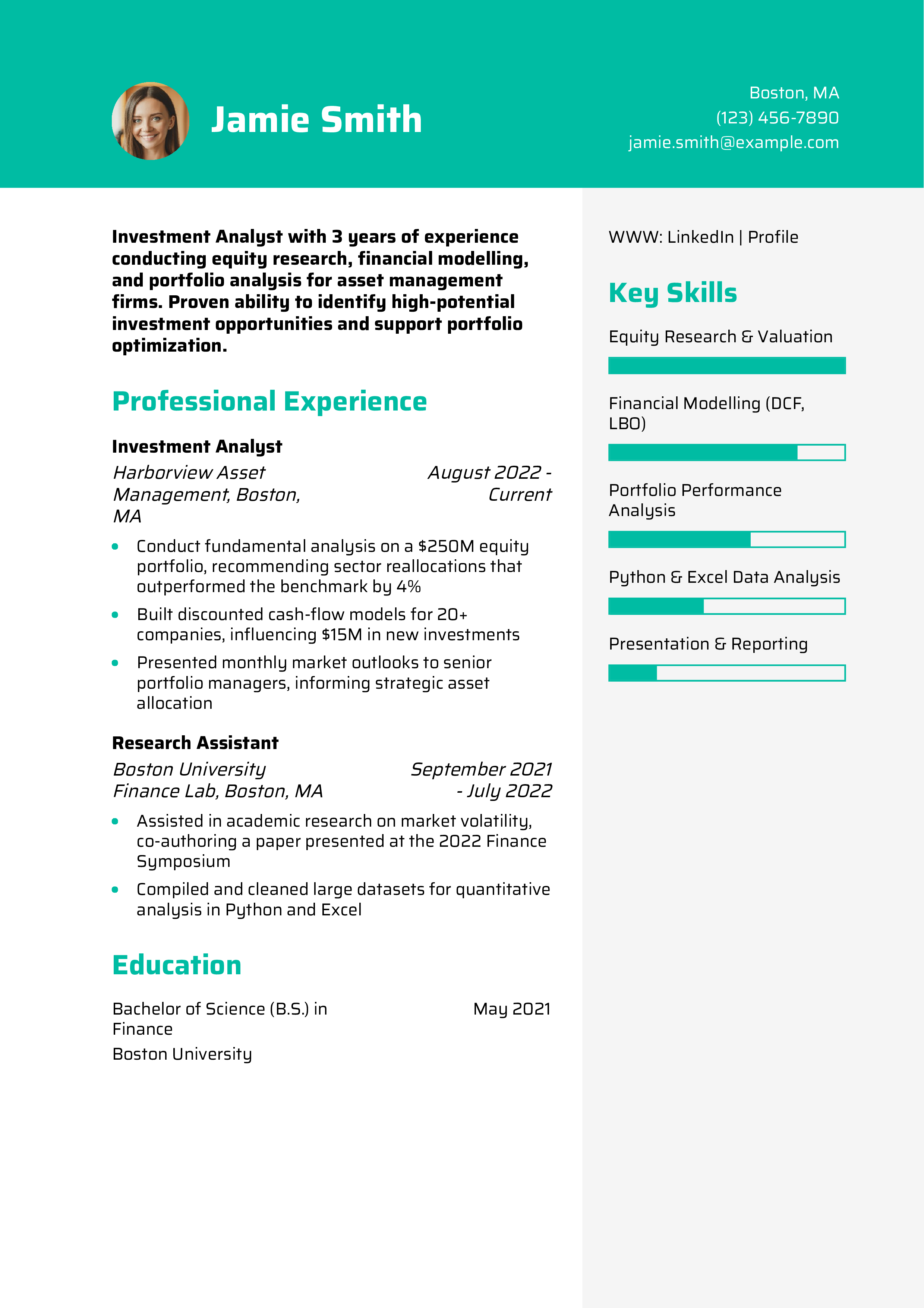

Investment Analyst Resume Example

Why This Resume Is a Great Example

Jamie Smith’s resume ties quantitative modelling results to portfolio performance improvements and showcases both practical investing skills and academic research contributions.

Key Tips

Highlight specific returns or benchmark outperformance to prove your analytical prowess. For more on showcasing resume skills, see Resume Skills.

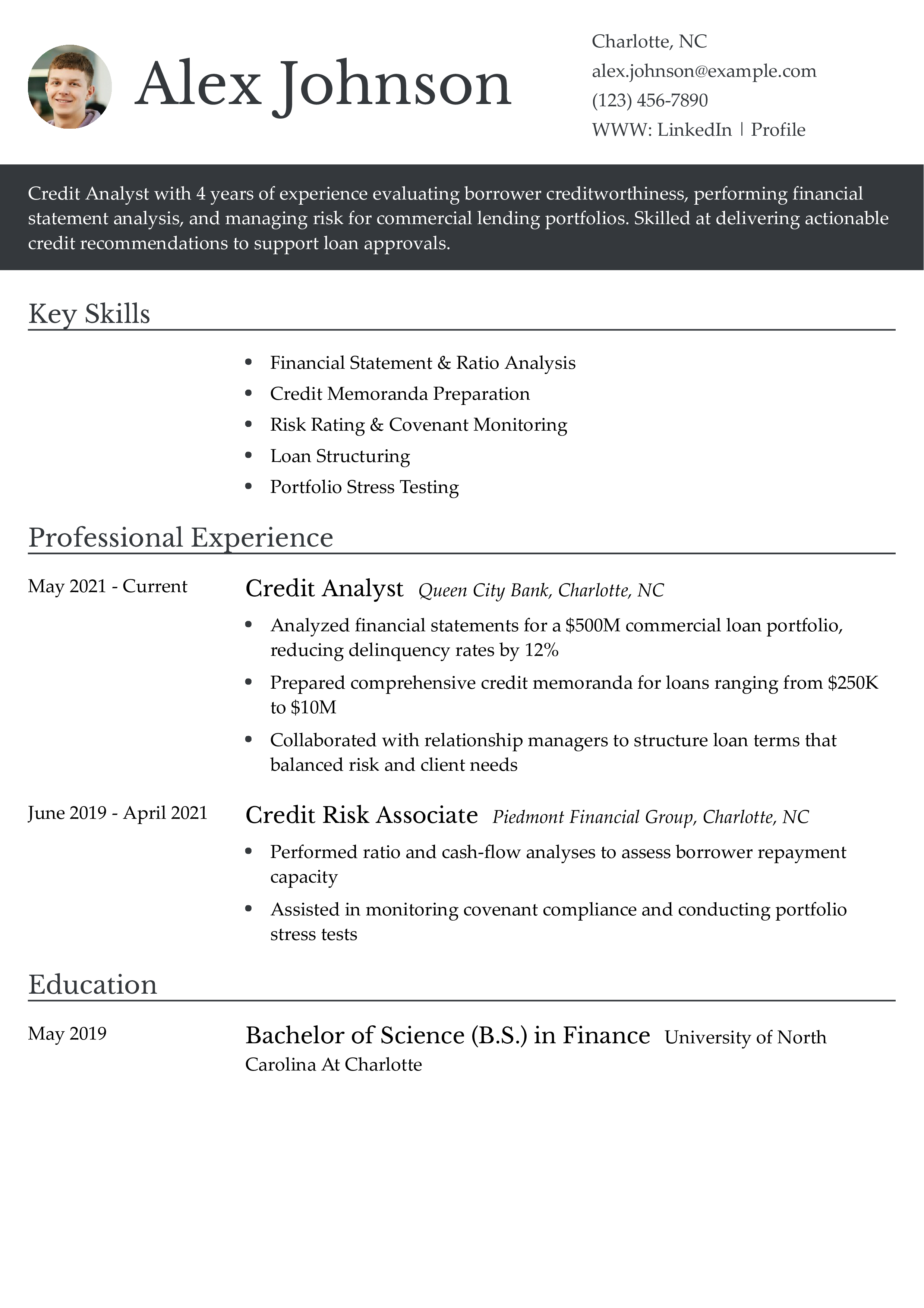

Credit Analyst Resume Example

Why This Resume Is a Great Example

Alex Johnson’s resume links detailed credit assessments to measurable portfolio improvements and highlights collaboration with client-facing teams to structure balanced loan agreements.

Key Tips

Demonstrate your risk-management impact by quantifying reductions in delinquency or loss rates. For tips on effective resume formatting, see Best Resume Formats.

FP&A Manager Resume Example

Why This Resume Is a Great Example

Taylor Lee’s resume quantifies FP&A process improvements and ties modeling efforts to strategic outcomes, showcasing both leadership and technical acumen.

Key Tips

Emphasize forecast accuracy and reporting efficiencies to illustrate your FP&A impact. For guidance on outlining your resume, see Resume Outline Examples.

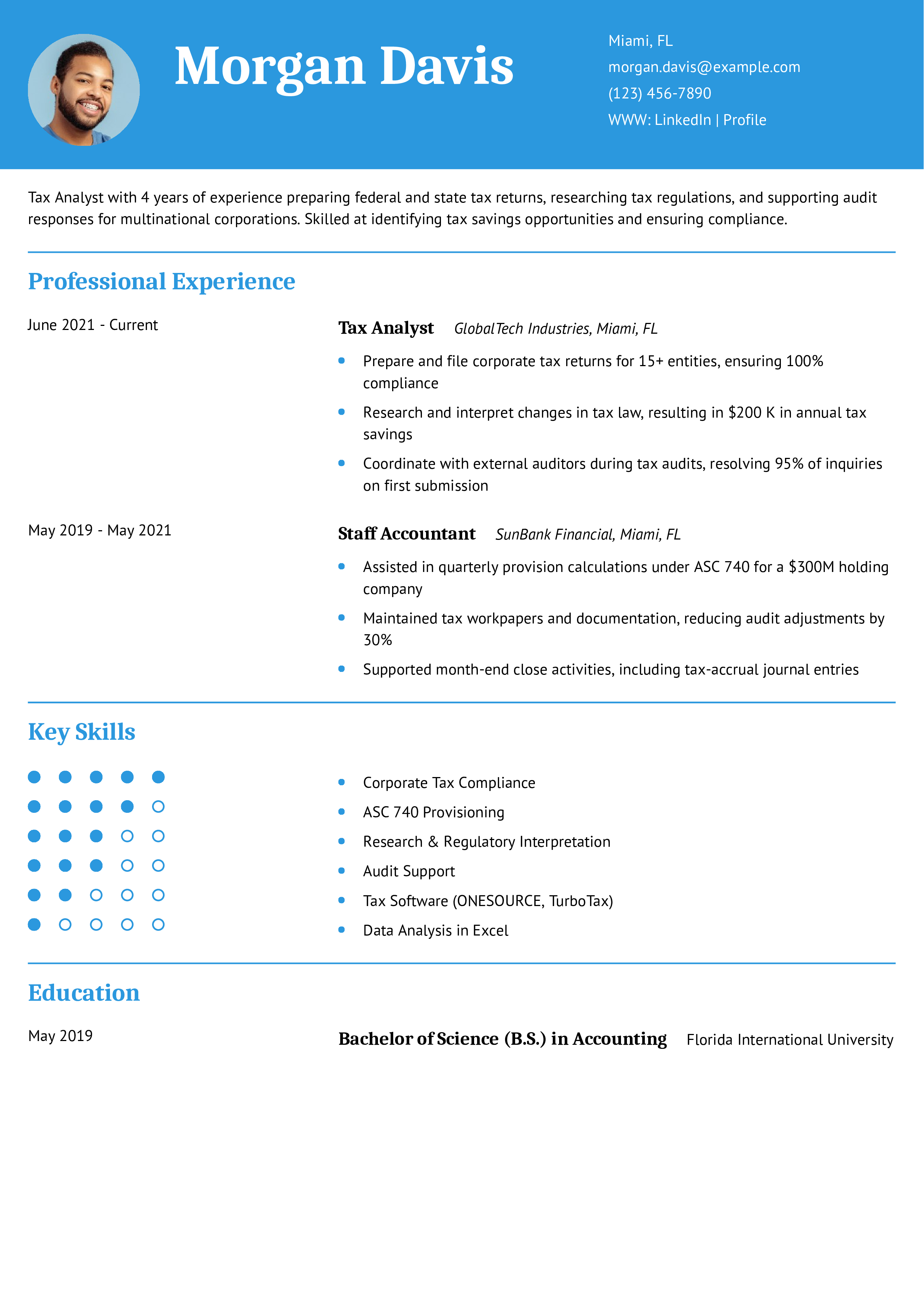

Tax Analyst Resume Example

Why This Resume Is a Great Example

Morgan Davis’s resume quantifies tax savings and highlights compliance expertise, demonstrating clear business impact and attention to regulatory detail.

Key Tips

Showcase your ability to deliver tax savings by quantifying dollar amounts and compliance improvements. For guidance on structuring your resume from top to bottom, see How to Make a Resume.

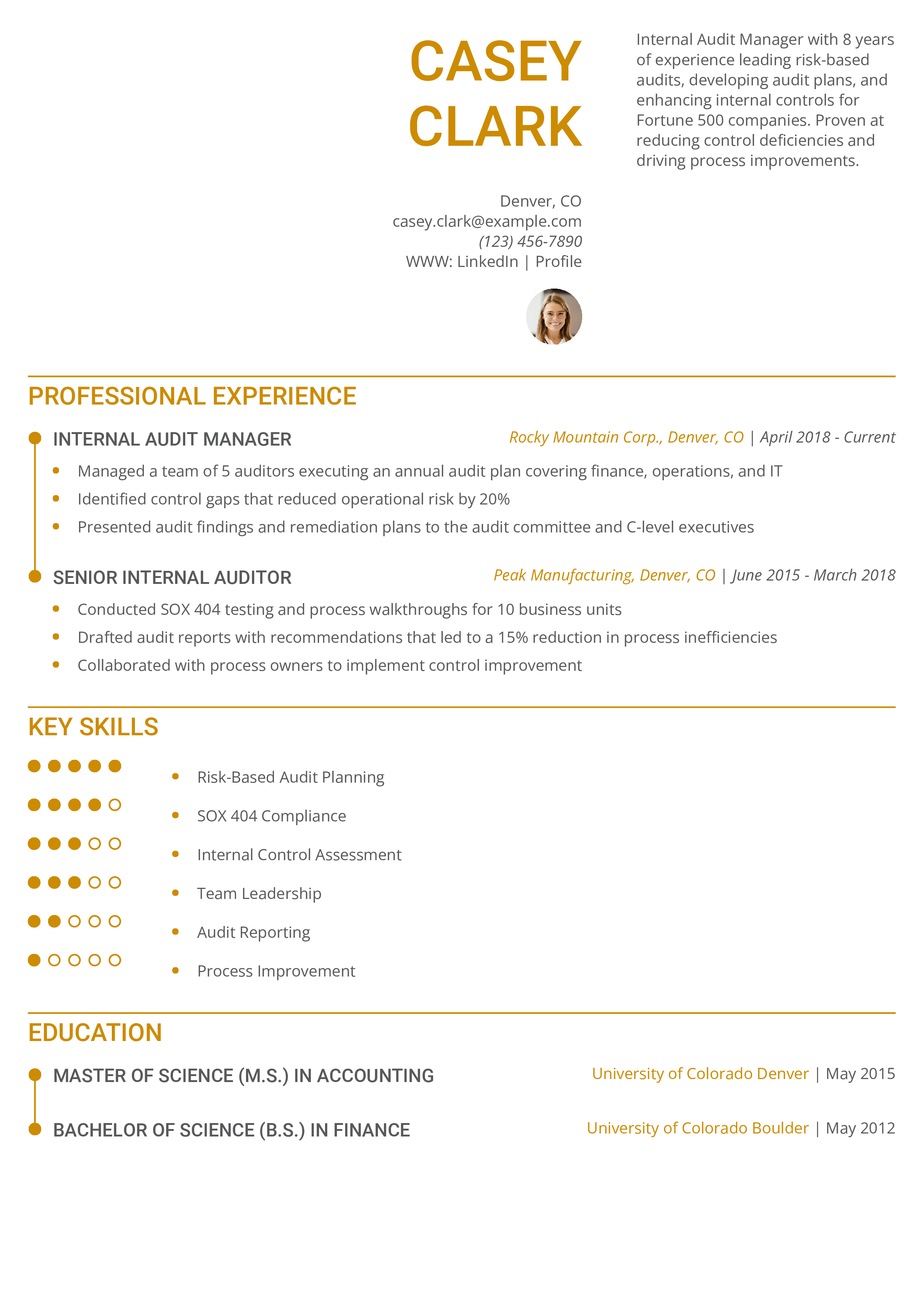

Internal Audit Manager Resume Example

Why This Resume Is a Great Example

Casey Clark’s resume highlights leadership of audit functions and quantifies risk reductions, showcasing both managerial skills and technical audit expertise.

Key Tips

Demonstrate your impact on risk reduction by including percentages and process improvements. For advice on listing certifications and credentials, see How to List Certifications on a Resume.

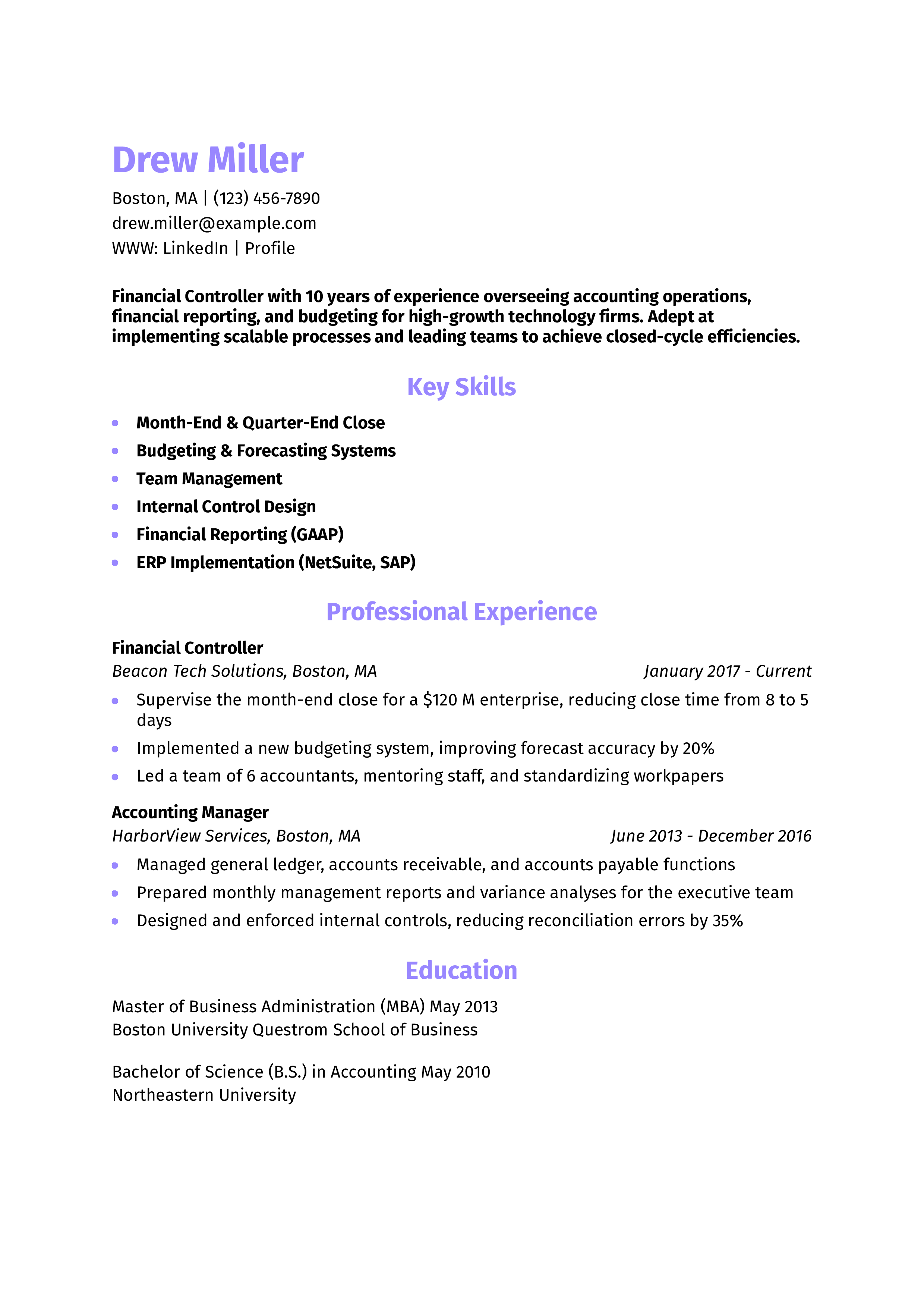

Financial Controller Resume Example

Why This Resume Is a Great Example

Drew Miller’s resume quantifies cycle-time improvements and control enhancements, demonstrating strong leadership and process-optimization skills.

Key Tips

Highlight your ability to streamline financial operations by including time reductions and accuracy gains. For insights on what hiring managers look for, see What to Put on a Resume.

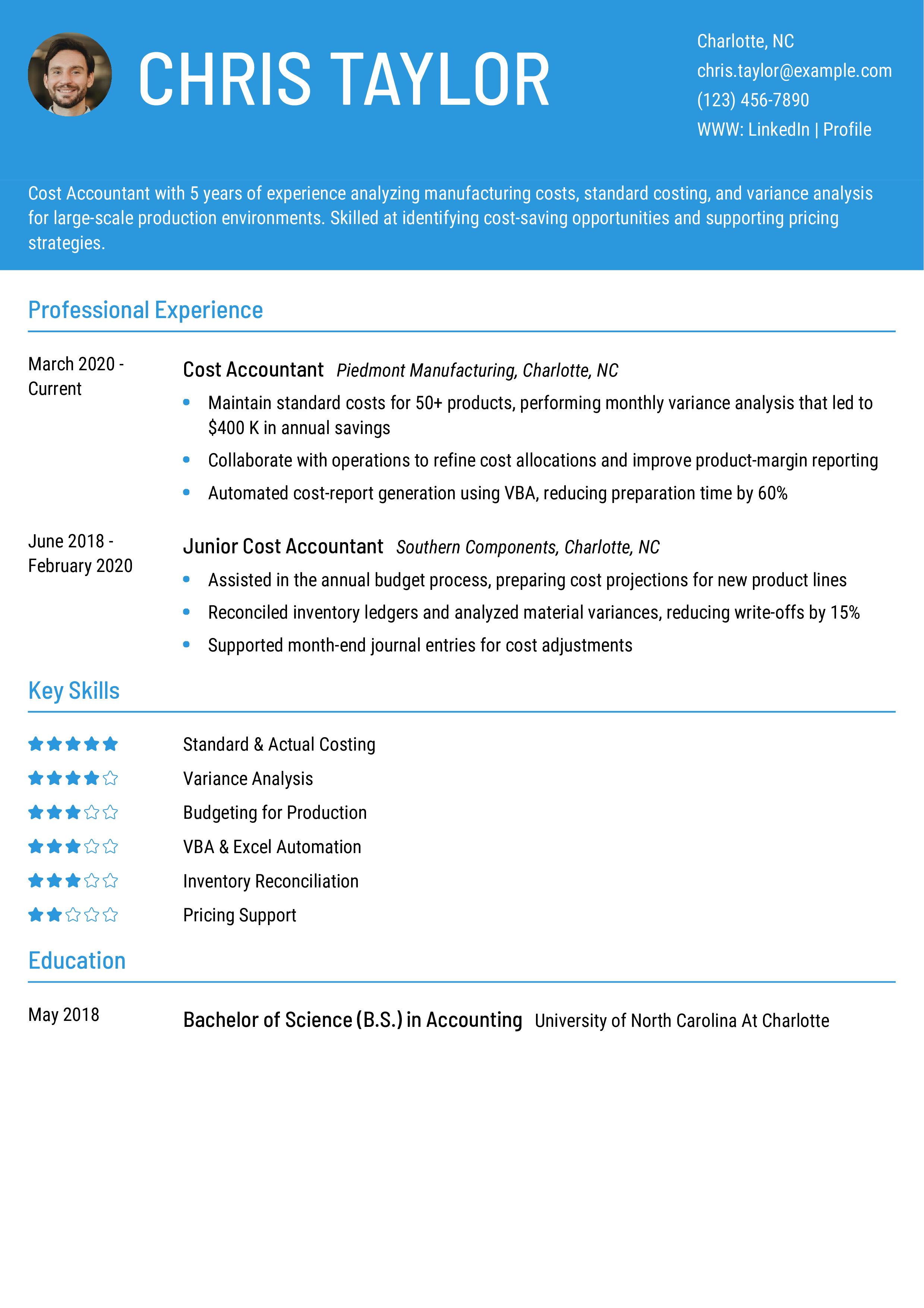

Cost Accountant Resume Example

Why This Resume Is a Great Example

Chris Taylor’s resume highlights substantial cost savings and process automation, demonstrating both analytical rigor and technical initiative.

Key Tips

Quantify your cost-reduction achievements to demonstrate financial impact. For guidance on keeping resumes concise, see Should a Resume Be One Page.

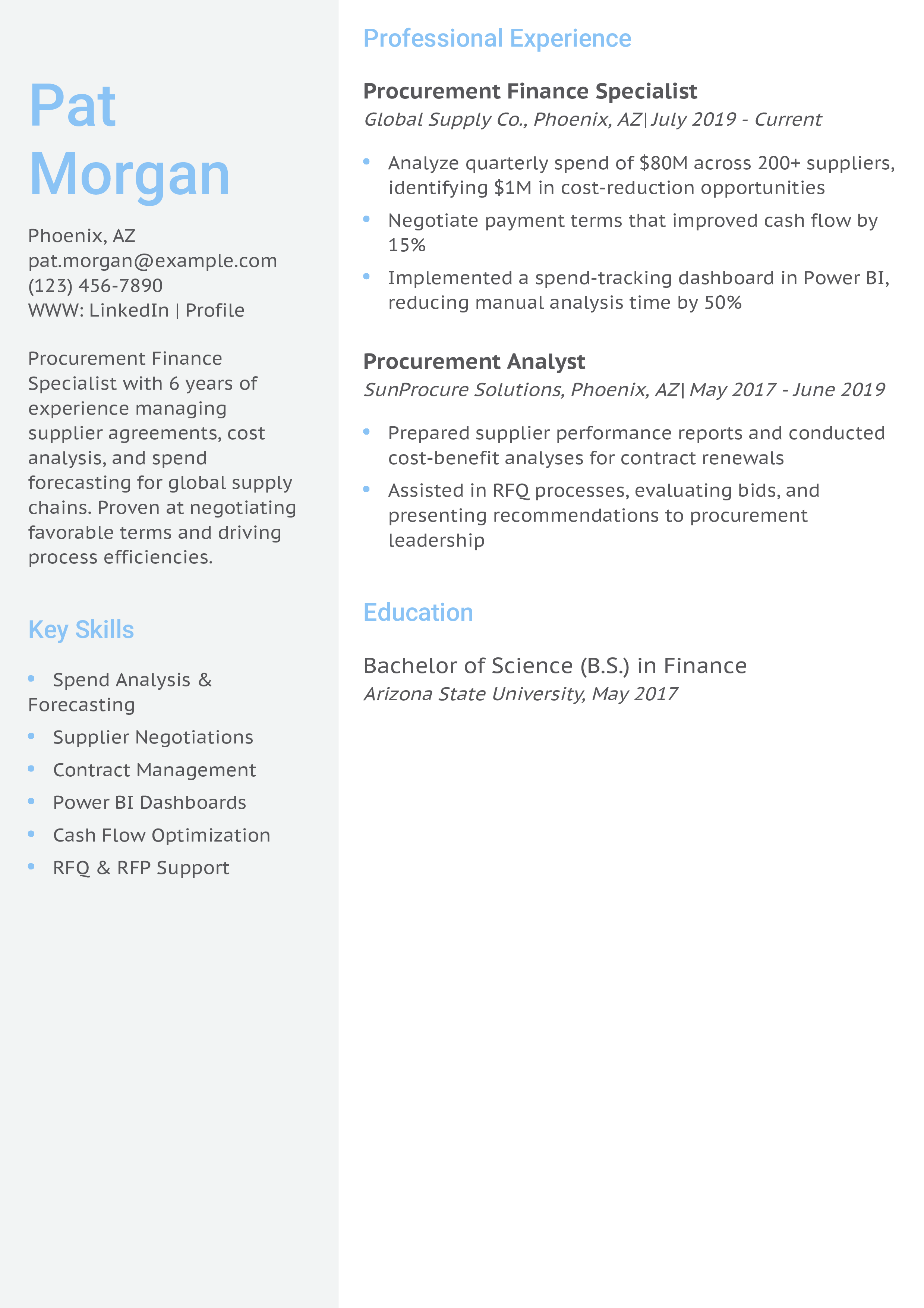

Procurement Finance Specialist Resume Example

Why This Resume Is a Great Example

Pat Morgan’s resume quantifies negotiation outcomes and cost savings while showcasing technical proficiency in spend analytics, underlining both strategic and analytical strengths.

Key Tips

Demonstrate your negotiation impact by including percentage improvements in cash flow and cost reductions. For advice on presenting your education effectively, see How to List Your Education on a Resume.

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Finance Text-Only Resume Templates and Examples

How To Write a Finance Resume

Anchor your story in models built, budgets supported, and decisions influenced in real dollars. Employers want analysis that clearly shaped outcomes.

1. Create a profile by summarizing your finance qualifications

Your profile should briefly name the three to five top reasons you excel at managing and growing financial assets. This section aims to quickly train a hiring manager’s attention on your strengths as a finance professional. For instance, maybe you’re a great communicator who works closely with clients to understand their retirement goals. Or maybe you have years of experience paring back costs or structuring large transactions. Also, don’t be afraid to get specific in this section; a quantified work highlight is often the best way to make your profile stand out.

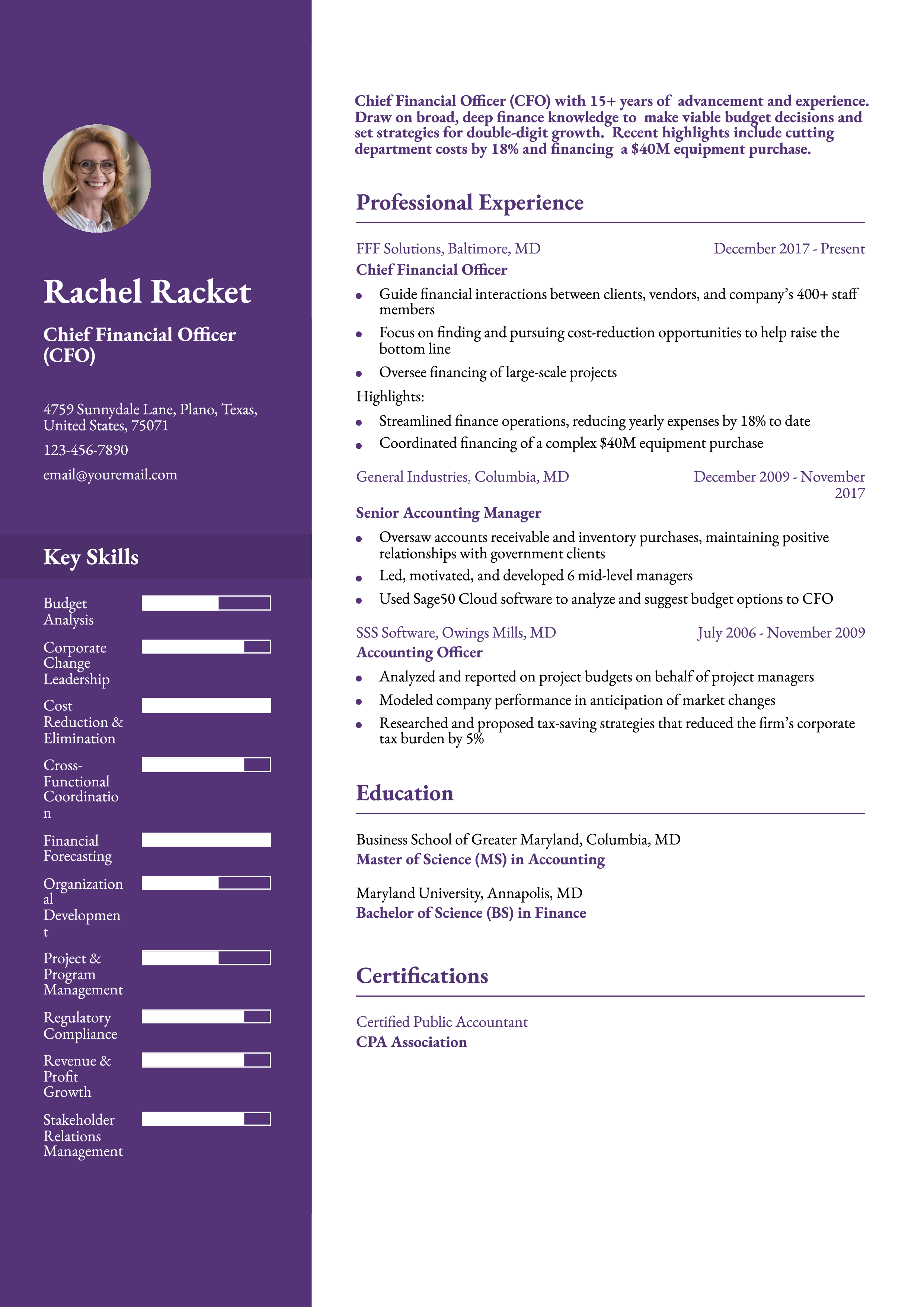

Senior-Level Profile Example

Chief Financial Officer (CFO) with over 15 years of advancement and experience. Draw on broad, deep finance knowledge to make viable budget decisions and set strategies for double-digit growth. Recent highlights include cutting department costs by 18% and financing a $40 million equipment purchase.

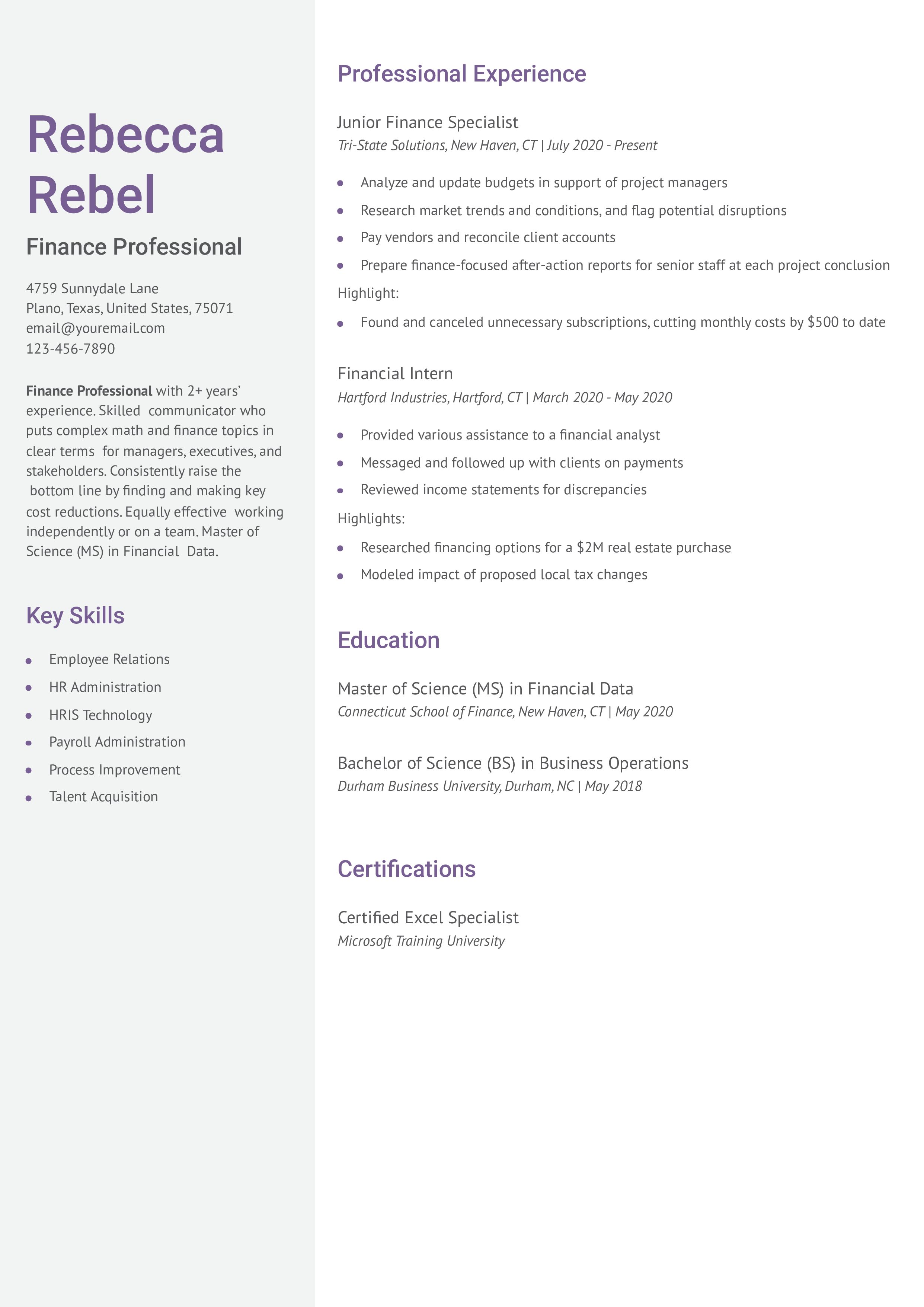

Entry-Level Profile Example

Finance professional with over two years of experience. Skilled communicator who puts complex math and finance topics in clear terms for managers, executives, and stakeholders. Consistently raise the bottom line by finding and making key cost reductions. Equally effective working solo or on a team. Master of Science (MS) in Financial Data.

2. Showcase your finance experience

View the experience section as a chance to give examples of your success overseeing client or company finances. The details you include in this section should depend on your background and target job. If you’re seeking an entry-level position and haven’t worked in finance before, focus each job description on transferable skills you gained, such as cash handling or client relations. If you have finance experience, include a “Highlights” or “Key Results” section under each job so hiring managers can envision your impact on their bottom line.

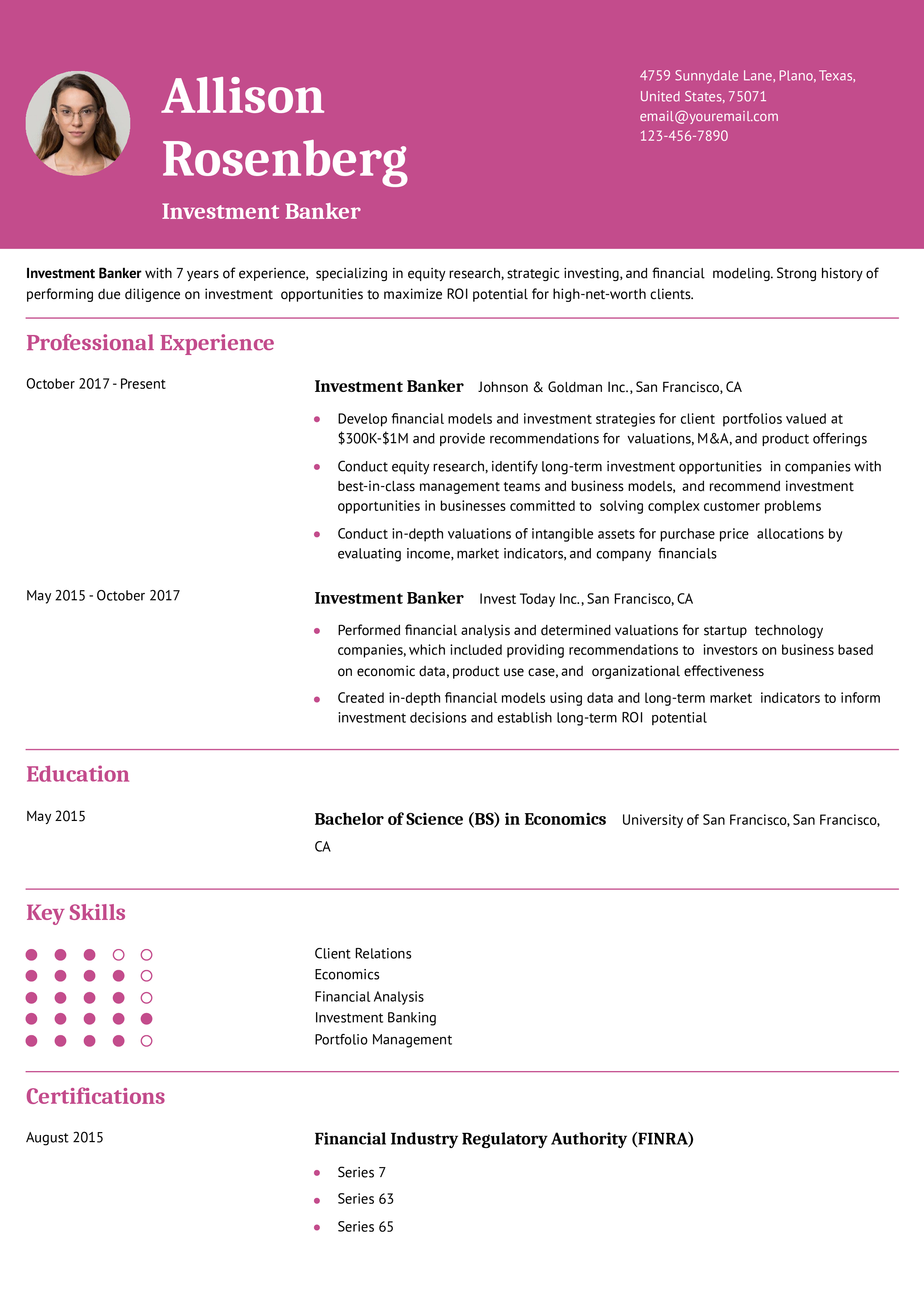

Senior-Level Professional Experience Example

Chief Financial Officer

FFF Solutions, Baltimore, MD | December 2017 – present

- Guide financial interactions between clients, vendors, and company’s over 400 staff members

- Focus on finding and pursuing cost-reduction opportunities to help raise the bottom line

- Oversee financing of large-scale projects

Highlights:

- Streamlined finance operations, reducing yearly expenses by 18% to date

- Coordinated financing of a complex $40 million equipment purchase

Entry-Level Professional Experience Example

Junior Finance Specialist

Tri-State Solutions, New Haven, CT | July 2020 – present

- Analyze and update budgets in support of project managers

- Research market trends and conditions and flag potential disruptions

- Pay vendors and reconcile client accounts

- Prepare finance-focused after-action reports for senior staff at each project conclusion

Highlights:

- Found and canceled unnecessary subscriptions, cutting monthly costs by $500 to date

3. Include education and certifications relevant to finance

Use the education and certifications sections to show you have a strong finance knowledge base. For each degree you’ve earned, specify if you majored in finance, business, accounting, or a related subject. Also feel free to list individual finance courses if they strongly overlap with your career focus, or if your work experience is limited.

Don’t forget to include any credentials (like Certified Public Accountant or Chartered Financial Analyst) that are required for your target job. But if part of your career has been outside finance, omit any credentials you’ve earned that don’t speak to your relevant expertise now.

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Certified Public Accountant, CPA Association, 2022

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] – [Graduation Year]

- [Select Coursework – optional]

Example

- Bachelor of Science (BS) – Finance

- Maryland University, Annapolis, MD – 2022

4. List finance-related skills and proficiencies

Add a Key Skills section to show how you can analyze, grow, or balance financial accounts, and the tools you use to promote a company’s bottom line. The list below can help you brainstorm plenty of relevant terms for this section.

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Bloomberg |

| Capital budgeting | Cash flow management |

| Client relations | Corporate finance |

| Cost reduction and elimination | Cross-functional coordination |

| Econometrics | Financial forecasting |

| Financial planning and analysis | Financial reporting |

| Investment analysis | Investment banking |

| Microsoft Excel | Portfolio management |

| Project and program management | Revenue and profit growth |

| Risk management | Stakeholder relations management |

| Strategic business planning | Targeted resource allocation |

| Tax planning and compliance | Team collaboration |

How To Pick the Best Finance Resume Template

Finance resumes should be neat and orderly, with your professional experience and key skills organized in an easy-to-read format. Look for simple templates that focus on your achievements rather than fancy fonts or graphics. Also, make sure you can easily tailor your chosen template to each job application.

Frequently Asked Questions: Finance Resume Examples and Advice

Can I adjust a Finance resume example for different roles or industries?-

Yes, you can easily adjust a Finance resume example by aligning your profile summary and key skills with the job description. If you are applying to different industries, emphasize transferable skills and any industry-specific experience. For example, if you’re applying to a finance role after working in tech, highlight your data analysis and financial reporting skills as relevant to both fields.

What are common action verbs for finance resumes?-

You may find it hard to think of a new action verb for every bullet point in your job descriptions. The list below can help you vary the language on your resume so it captures the value of your finance experience.

| Action Verbs | |

|---|---|

| Advised | Allocated |

| Amortized | Analyzed |

| Assessed | Audited |

| Balanced | Calculated |

| Circulated | Conducted |

| Controlled | Distributed |

| Enforced | Evaluated |

| Exchanged | Expedited |

| Generated | Implemented |

| Improved | Invested |

| Issued | Managed |

| Monitored | Opened |

| Optimized | Pinpointed |

| Prepared | Prevented |

| Processed | Ranked |

| Rebalanced | Reconciled |

| Resolved | Reviewed |

| Streamlined | Structured |

| Tracked | Transacted |

| Transferred | Verified |

| Won | |

How do you align your resume with a job posting?-

The Bureau of Labor Statistics forecasts that jobs for business and finance professionals will increase by about 7% (or 715,000 positions) between 2021 and 2031. This growth rate is roughly the same as the average for all U.S. vocations.

You can get more finance job interviews if you tailor your resume for each application. Add brief descriptions of the companies where you’ve worked in brackets right next to or below the company name. This shows any similarities between your past employers and the one who posted the job. For example, maybe you’ve worked for companies of a comparable size or firms with a similar mission or leadership philosophy. By working these details into your descriptions, you can make your resume that much more relevant to the job opening at hand.

What is the best finance resume format?-

In nearly all cases, use a Combination (or Hybrid) resume. It’s simplest for hiring managers to learn about your pertinent skills and experience, and it’s also easiest for you to align with your job goals.

With the combination format, you highlight your most relevant skills and experience in your Experience or Work History section and an intro section. (This combination of work history and intro content is where the format gets its name.) Your resume intro should include a Profile summary and Key Skills section, but you may also add a Career Highlights or Awards section. By choosing the details for these intro sections, you can (a) position yourself for your target job, and (b) give hiring managers a clear, quick view of what you offer.

What’s the ideal length for a finance resume?-

A one-page resume is ideal for most finance positions, especially if you have less than 10 years of experience. For experienced professionals, a two-page resume may be appropriate, but only if it includes valuable, job-relevant content. Focus on showcasing your key achievements, certifications, and skills that align with the job description.

Aim to include work experience from the last 10 to 15 years. Older roles can be summarized or omitted unless they add significant value. Keeping your resume concise and relevant will leave a strong impression on hiring managers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

To increase your chances of an interview, write and submit a strong cover letter. The key to a good letter is customizing it based on each job opening. Read our Finance cover letter guide to learn how.