Finance Resume Templates and Examples (Download in App)

- Entry-Level

- Mid-Career

- Senior-Level

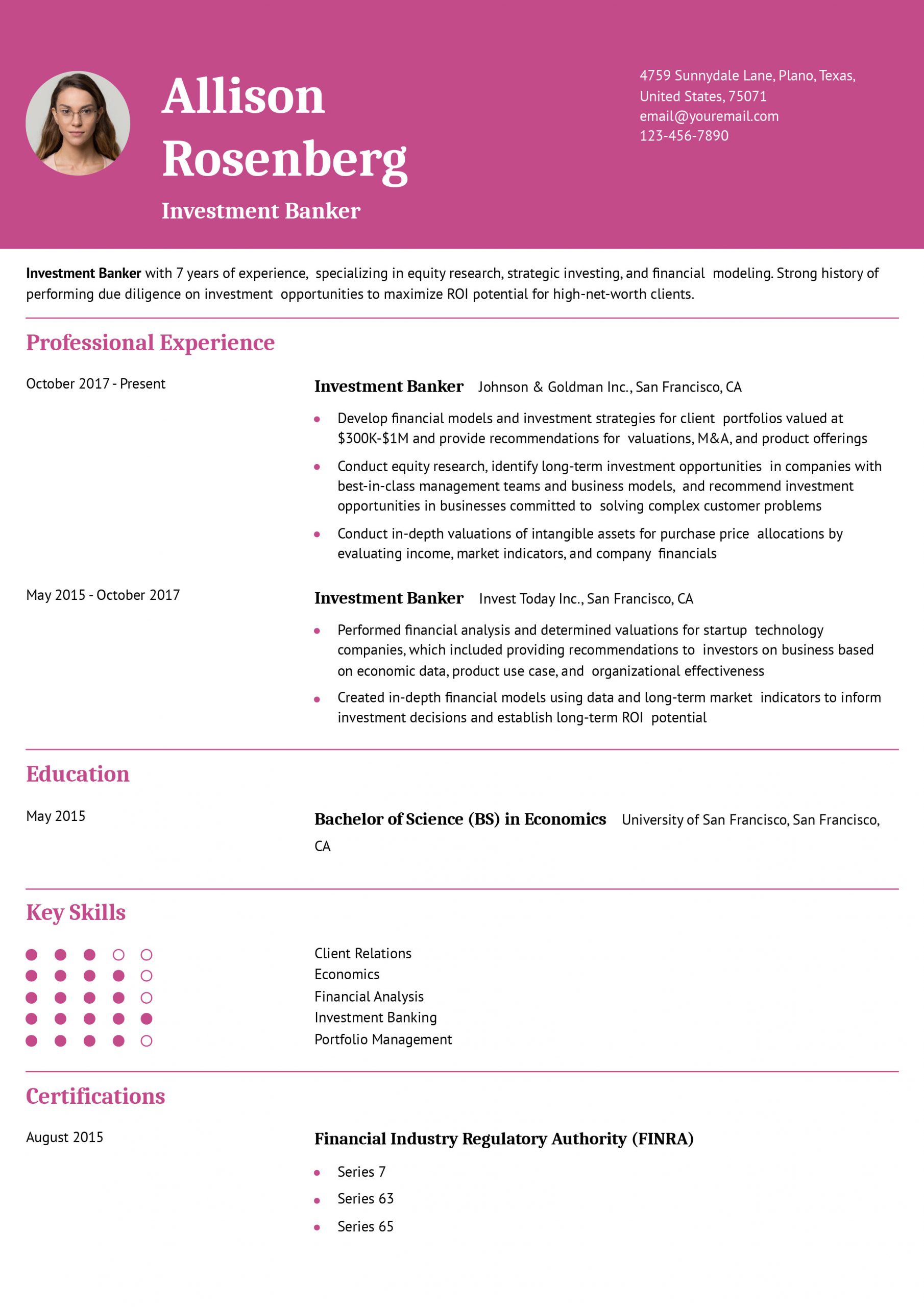

Most Popular Finance Resumes

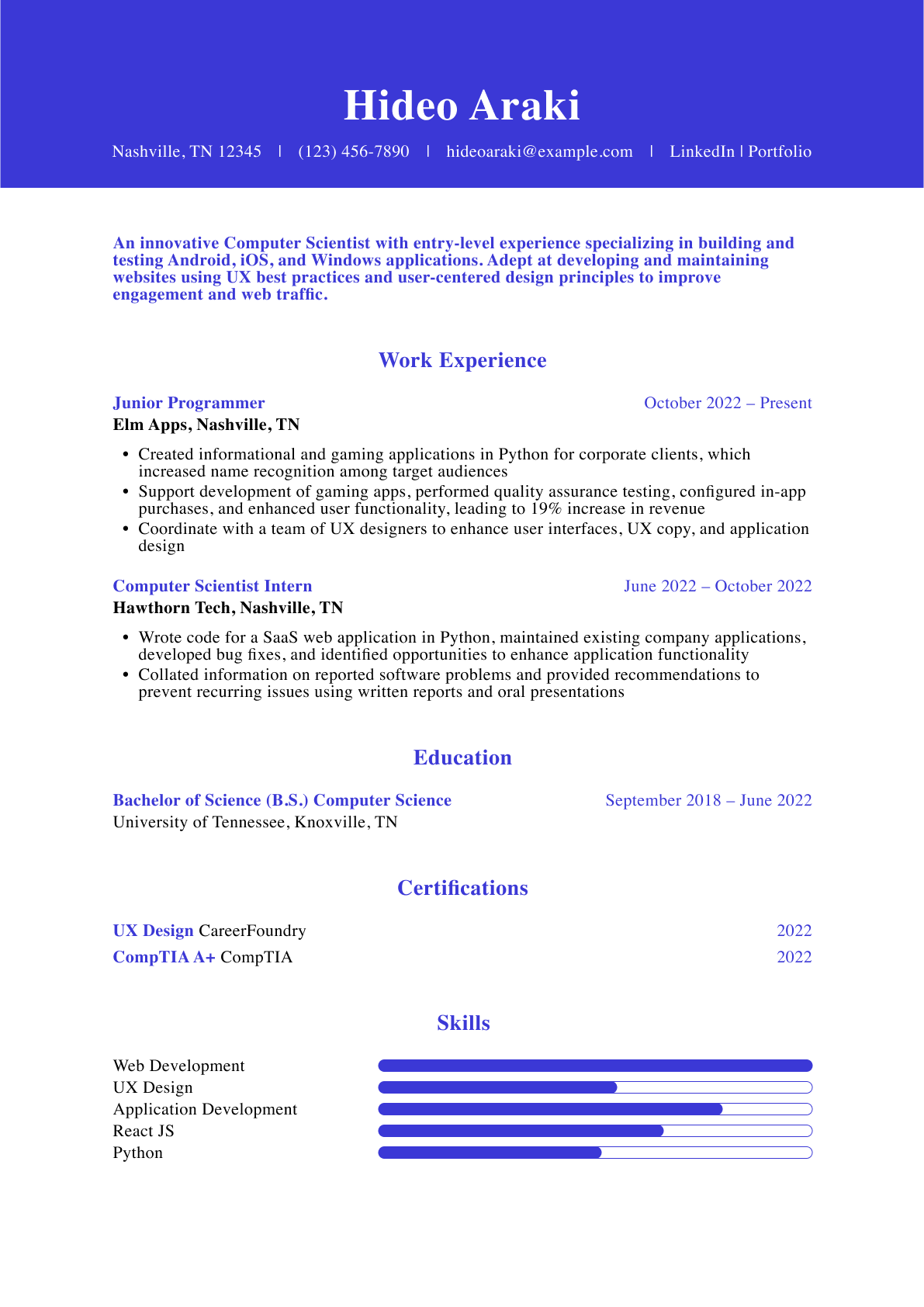

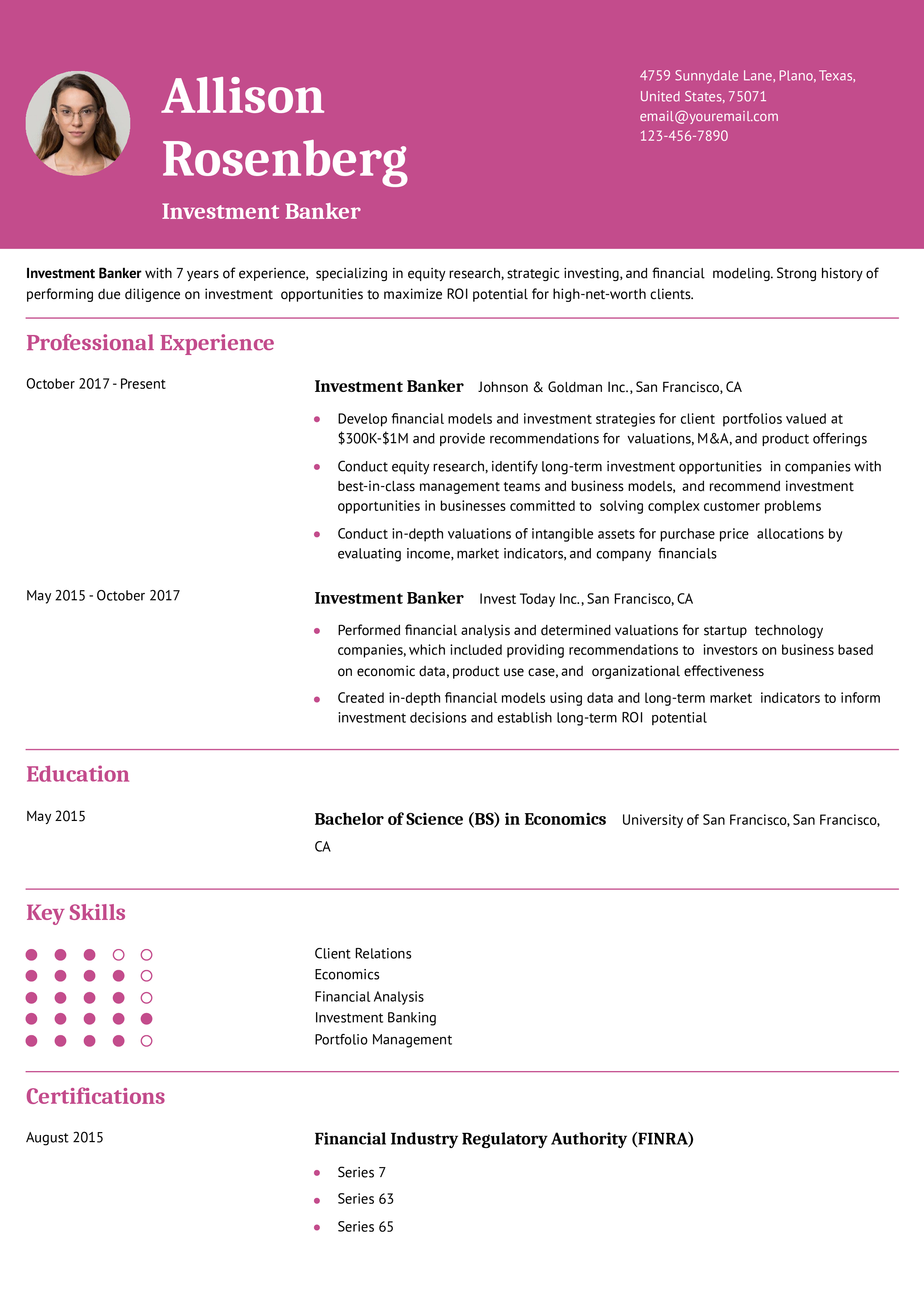

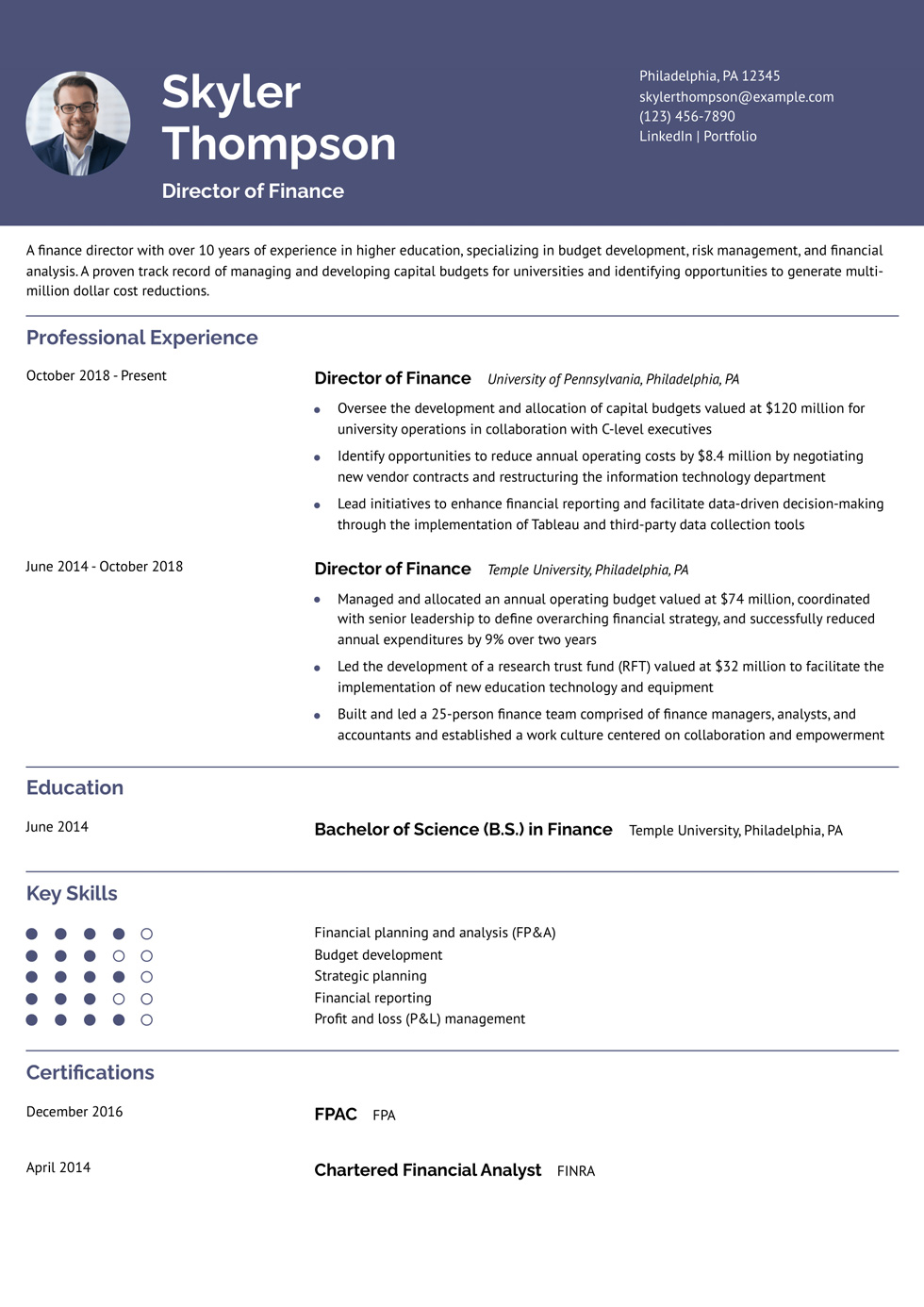

Finance Resume Example

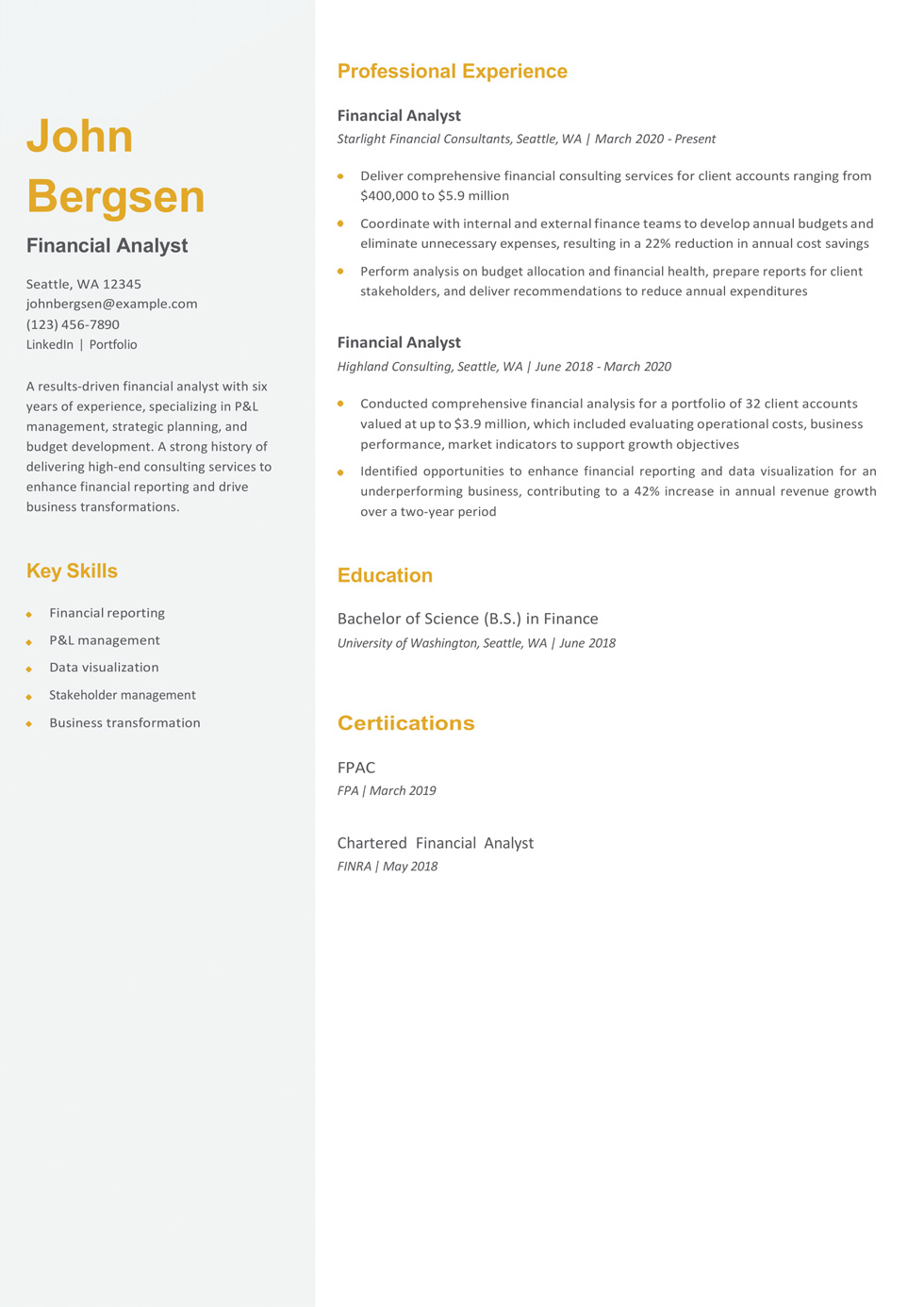

Financial Analyst Resume Example

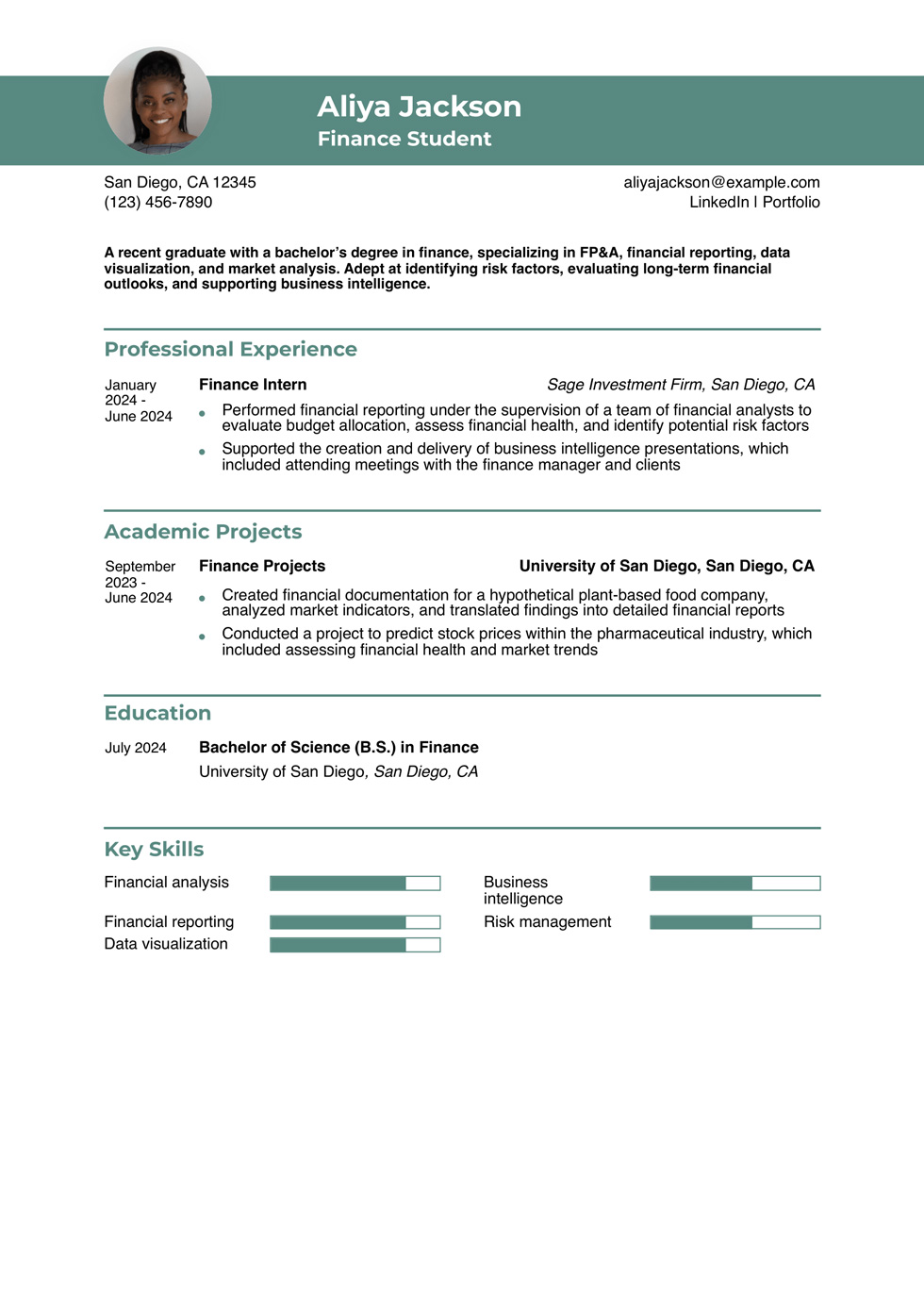

Finance Student Resume Example

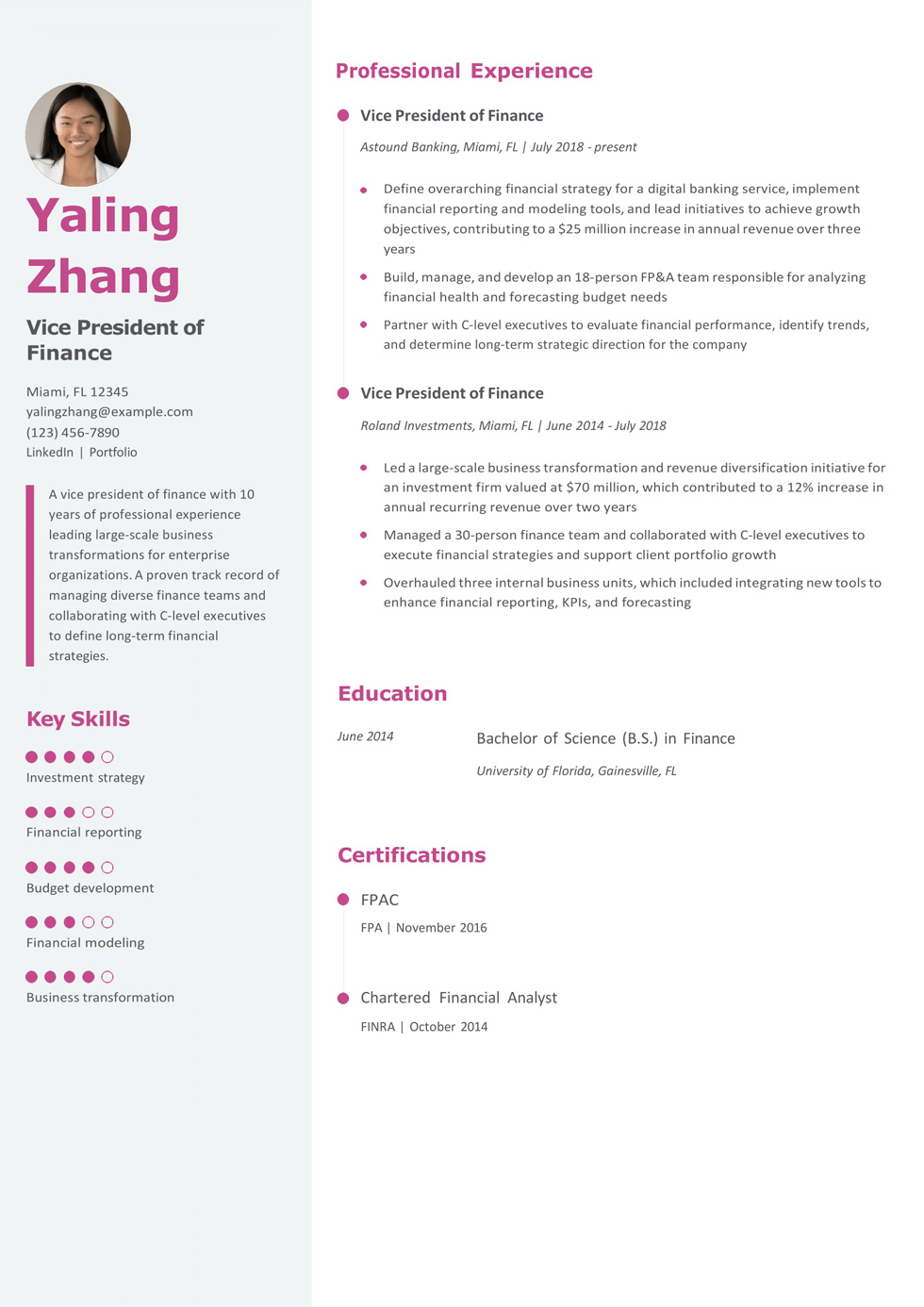

Vice President of Finance Resume Example

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Finance Text-Only Resume Templates and Examples

How To Write a Finance Resume

To craft a good finance resume, you’ll need to show you can manage money successfully for clients or organizations. The tips and examples below will help you write each section of your resume so it gets you interviews for your next finance job.

1. Create a profile by summarizing your finance qualifications

Your profile should briefly name the three to five top reasons you excel at managing and growing financial assets. This section aims to quickly train a hiring manager’s attention on your strengths as a finance professional. For instance, maybe you’re a great communicator who works closely with clients to understand their retirement goals. Or maybe you have years of experience paring back costs or structuring large transactions. Also, don’t be afraid to get specific in this section; a quantified work highlight is often the best way to make your profile stand out.

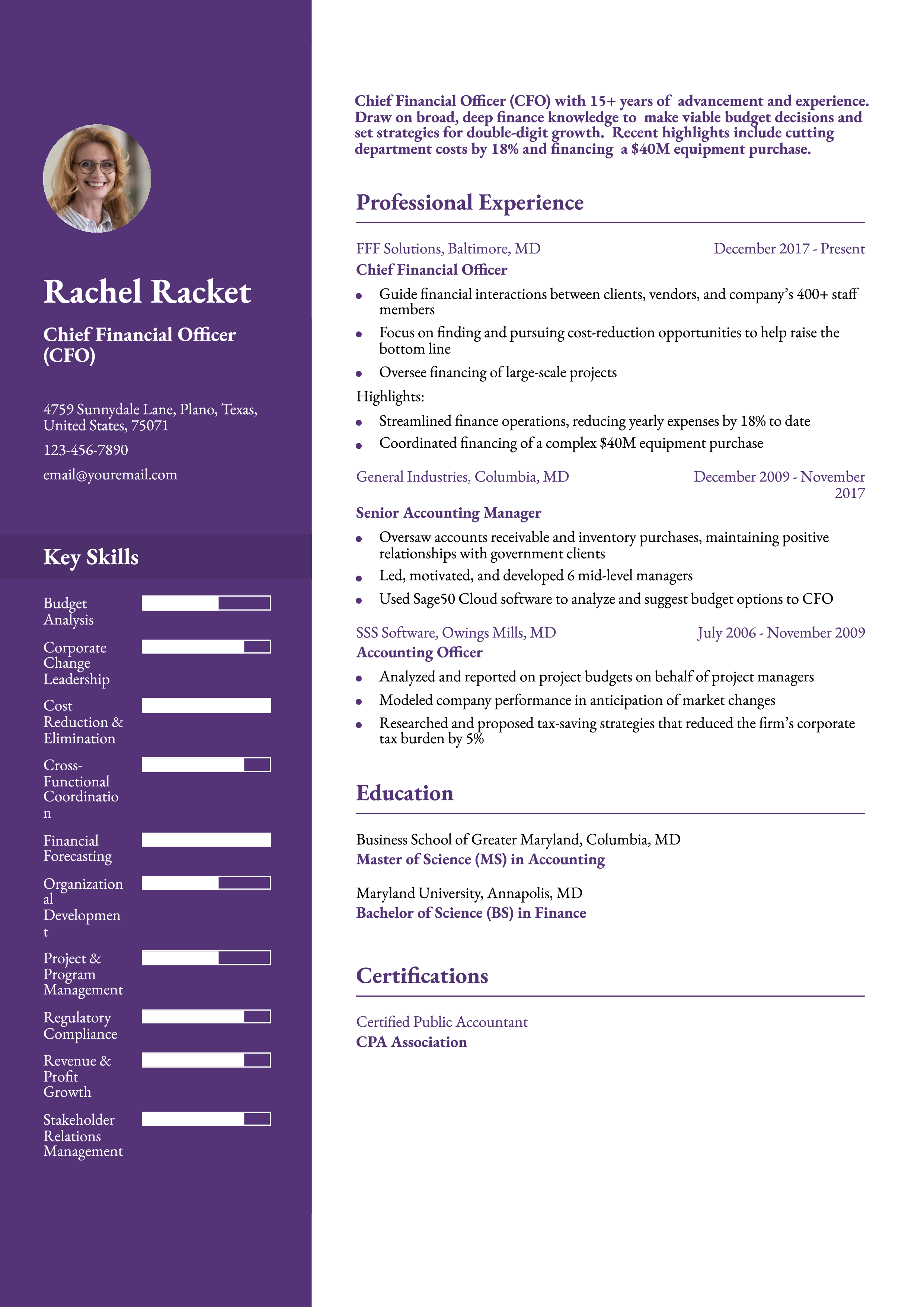

Senior-Level Profile Example

Chief Financial Officer (CFO) with over 15 years of advancement and experience. Draw on broad, deep finance knowledge to make viable budget decisions and set strategies for double-digit growth. Recent highlights include cutting department costs by 18% and financing a $40 million equipment purchase.

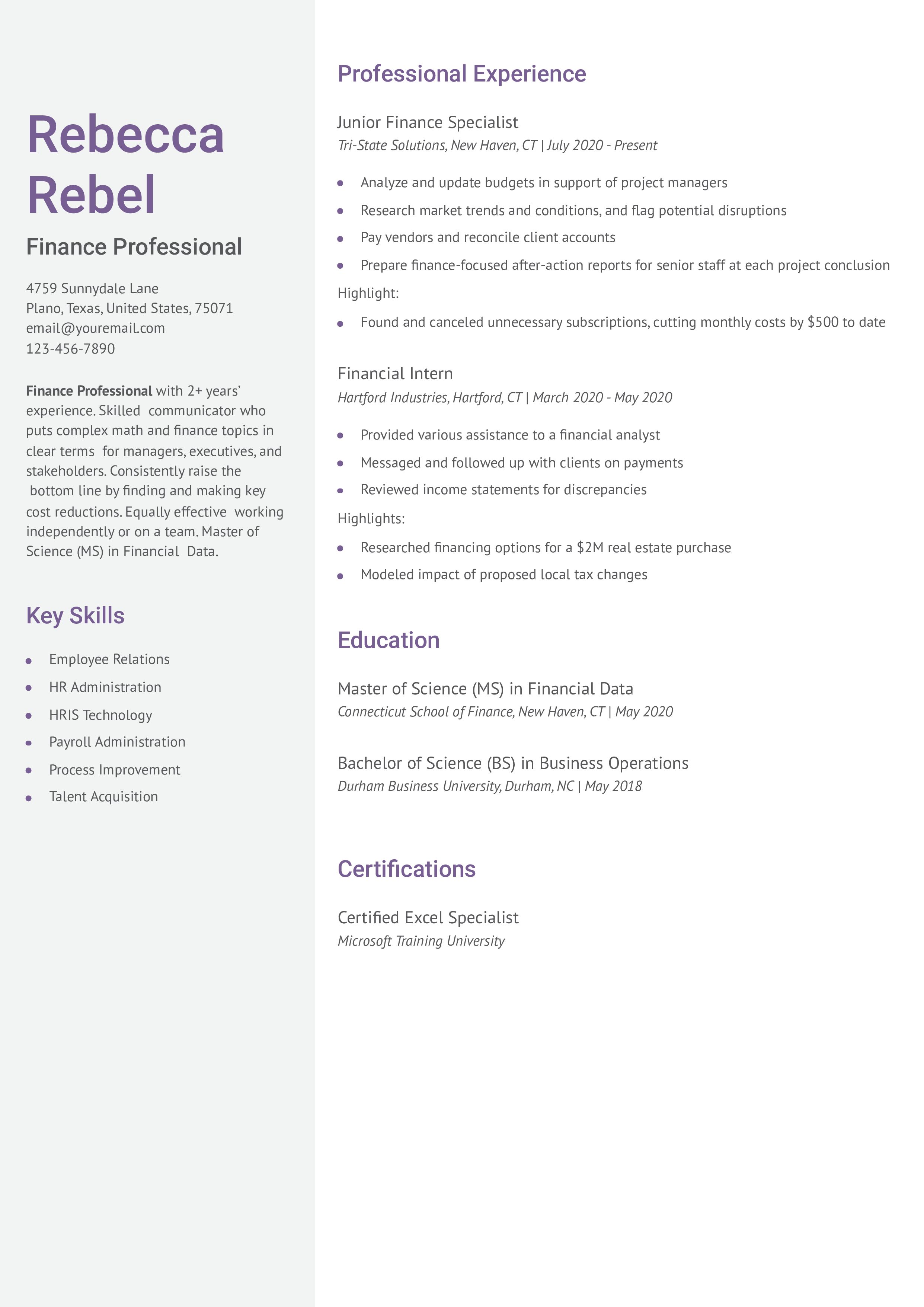

Entry-Level Profile Example

Finance professional with over two years of experience. Skilled communicator who puts complex math and finance topics in clear terms for managers, executives, and stakeholders. Consistently raise the bottom line by finding and making key cost reductions. Equally effective working solo or on a team. Master of Science (MS) in Financial Data.

2. Showcase your finance experience

View the experience section as a chance to give examples of your success overseeing client or company finances. The details you include in this section should depend on your background and target job. If you’re seeking an entry-level position and haven’t worked in finance before, focus each job description on transferable skills you gained, such as cash handling or client relations. If you have finance experience, include a “Highlights” or “Key Results” section under each job so hiring managers can envision your impact on their bottom line.

Senior-Level Professional Experience Example

Chief Financial Officer

FFF Solutions, Baltimore, MD | December 2017 – present

- Guide financial interactions between clients, vendors, and company’s over 400 staff members

- Focus on finding and pursuing cost-reduction opportunities to help raise the bottom line

- Oversee financing of large-scale projects

Highlights:

- Streamlined finance operations, reducing yearly expenses by 18% to date

- Coordinated financing of a complex $40 million equipment purchase

Entry-Level Professional Experience Example

Junior Finance Specialist

Tri-State Solutions, New Haven, CT | July 2020 – present

- Analyze and update budgets in support of project managers

- Research market trends and conditions and flag potential disruptions

- Pay vendors and reconcile client accounts

- Prepare finance-focused after-action reports for senior staff at each project conclusion

Highlights:

- Found and canceled unnecessary subscriptions, cutting monthly costs by $500 to date

3. Include education and certifications relevant to finance

Use the education and certifications sections to show you have a strong finance knowledge base. For each degree you’ve earned, specify if you majored in finance, business, accounting, or a related subject. Also feel free to list individual finance courses if they strongly overlap with your career focus, or if your work experience is limited.

Don’t forget to include any credentials (like Certified Public Accountant or Chartered Financial Analyst) that are required for your target job. But if part of your career has been outside finance, omit any credentials you’ve earned that don’t speak to your relevant expertise now.

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Certified Public Accountant, CPA Association, 2022

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] – [Graduation Year]

- [Select Coursework – optional]

Example

- Bachelor of Science (BS) – Finance

- Maryland University, Annapolis, MD – 2022

4. List finance-related skills and proficiencies

Add a Key Skills section to show how you can analyze, grow, or balance financial accounts, and the tools you use to promote a company’s bottom line. The list below can help you brainstorm plenty of relevant terms for this section.

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Bloomberg |

| Capital budgeting | Cash flow management |

| Client relations | Corporate finance |

| Cost reduction and elimination | Cross-functional coordination |

| Econometrics | Financial forecasting |

| Financial planning and analysis | Financial reporting |

| Investment analysis | Investment banking |

| Microsoft Excel | Portfolio management |

| Project and program management | Revenue and profit growth |

| Risk management | Stakeholder relations management |

| Strategic business planning | Targeted resource allocation |

| Tax planning and compliance | Team collaboration |

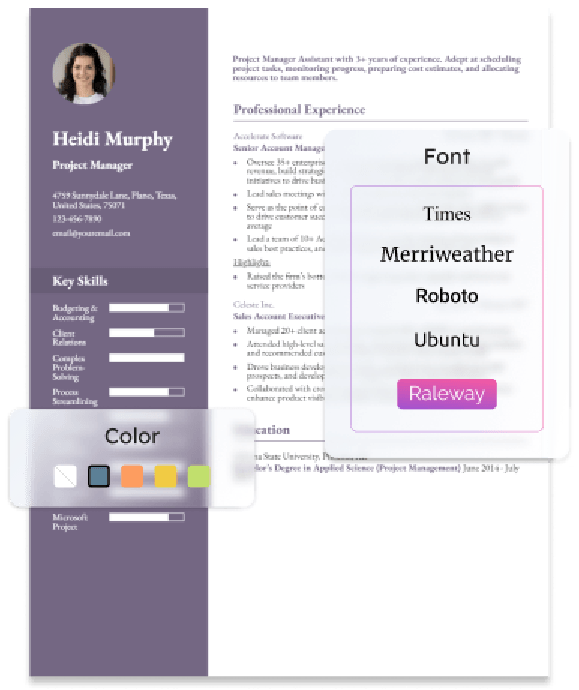

How To Pick the Best Finance Resume Template

Finance resumes should be neat and orderly, with your professional experience and key skills organized in an easy-to-read format. Look for simple templates that focus on your achievements rather than fancy fonts or graphics. Also, make sure you can easily tailor your chosen template to each job application.

Frequently Asked Questions: Finance Resume Examples and Advice

Can I adjust a Finance resume example for different roles or industries?-

Yes, you can easily adjust a Finance resume example by aligning your profile summary and key skills with the job description. If you are applying to different industries, emphasize transferable skills and any industry-specific experience. For example, if you’re applying to a finance role after working in tech, highlight your data analysis and financial reporting skills as relevant to both fields.

What are common action verbs for finance resumes?-

You may find it hard to think of a new action verb for every bullet point in your job descriptions. The list below can help you vary the language on your resume so it captures the value of your finance experience.

| Action Verbs | |

|---|---|

| Advised | Allocated |

| Amortized | Analyzed |

| Assessed | Audited |

| Balanced | Calculated |

| Circulated | Conducted |

| Controlled | Distributed |

| Enforced | Evaluated |

| Exchanged | Expedited |

| Generated | Implemented |

| Improved | Invested |

| Issued | Managed |

| Monitored | Opened |

| Optimized | Pinpointed |

| Prepared | Prevented |

| Processed | Ranked |

| Rebalanced | Reconciled |

| Resolved | Reviewed |

| Streamlined | Structured |

| Tracked | Transacted |

| Transferred | Verified |

| Won | |

How do you align your resume with a job posting?-

The Bureau of Labor Statistics forecasts that jobs for business and finance professionals will increase by about 7% (or 715,000 positions) between 2021 and 2031. This growth rate is roughly the same as the average for all U.S. vocations.

You can get more finance job interviews if you tailor your resume for each application. Add brief descriptions of the companies where you’ve worked in brackets right next to or below the company name. This shows any similarities between your past employers and the one who posted the job. For example, maybe you’ve worked for companies of a comparable size or firms with a similar mission or leadership philosophy. By working these details into your descriptions, you can make your resume that much more relevant to the job opening at hand.

What is the best finance resume format?-

In nearly all cases, use a Combination (or Hybrid) resume. It’s simplest for hiring managers to learn about your pertinent skills and experience, and it’s also easiest for you to align with your job goals.

With the combination format, you highlight your most relevant skills and experience in your Experience or Work History section and an intro section. (This combination of work history and intro content is where the format gets its name.) Your resume intro should include a Profile summary and Key Skills section, but you may also add a Career Highlights or Awards section. By choosing the details for these intro sections, you can (a) position yourself for your target job, and (b) give hiring managers a clear, quick view of what you offer.

What’s the ideal length for a finance resume?-

A one-page resume is ideal for most finance positions, especially if you have less than 10 years of experience. For experienced professionals, a two-page resume may be appropriate, but only if it includes valuable, job-relevant content. Focus on showcasing your key achievements, certifications, and skills that align with the job description.

Aim to include work experience from the last 10 to 15 years. Older roles can be summarized or omitted unless they add significant value. Keeping your resume concise and relevant will leave a strong impression on hiring managers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

To increase your chances of an interview, write and submit a strong cover letter. The key to a good letter is customizing it based on each job opening. Read our Finance cover letter guide to learn how.