- Entry-Level

- Mid-Career

- Senior-Level

Auto Insurance Claims Adjuster Text-Only Resume Templates and Examples

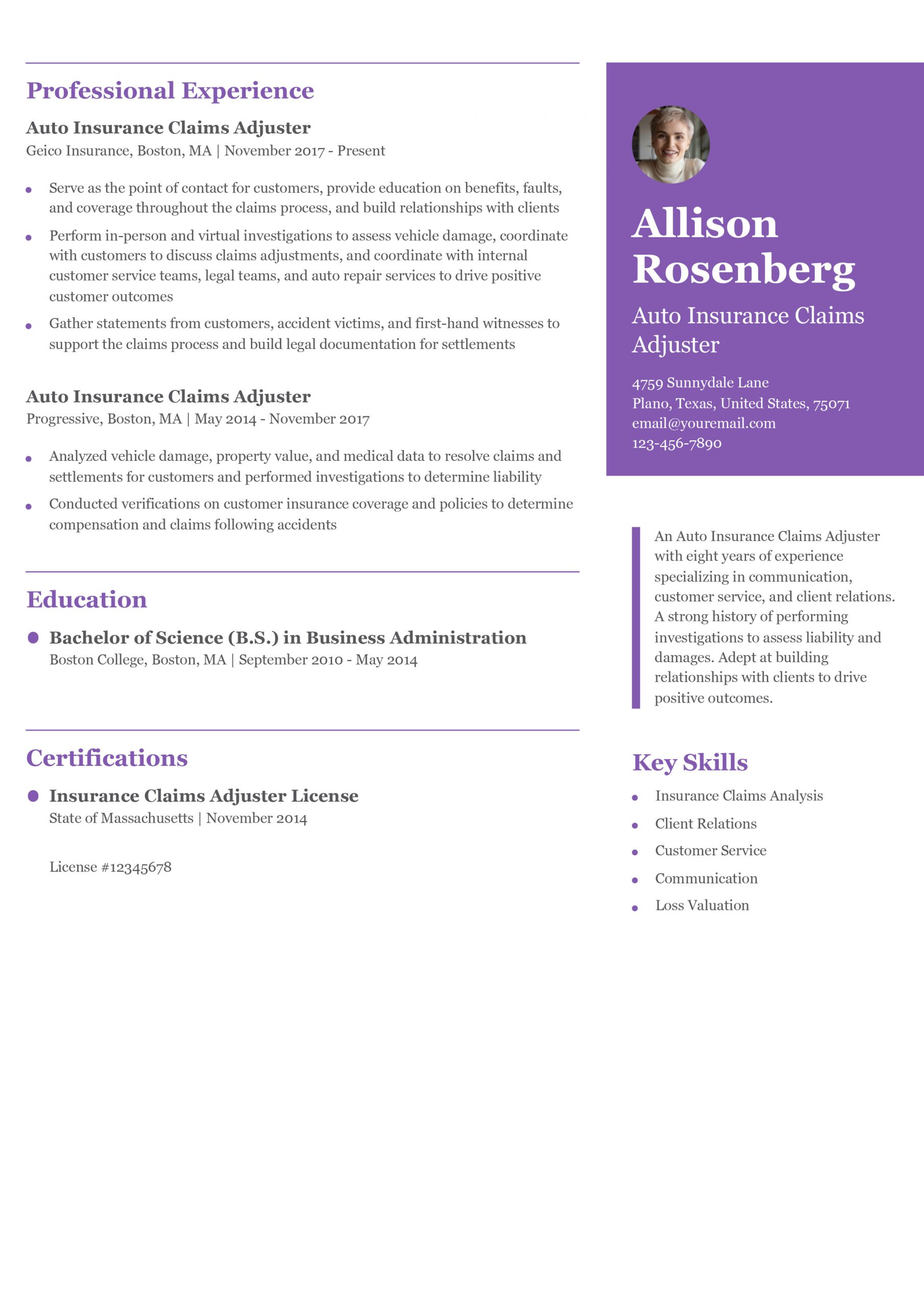

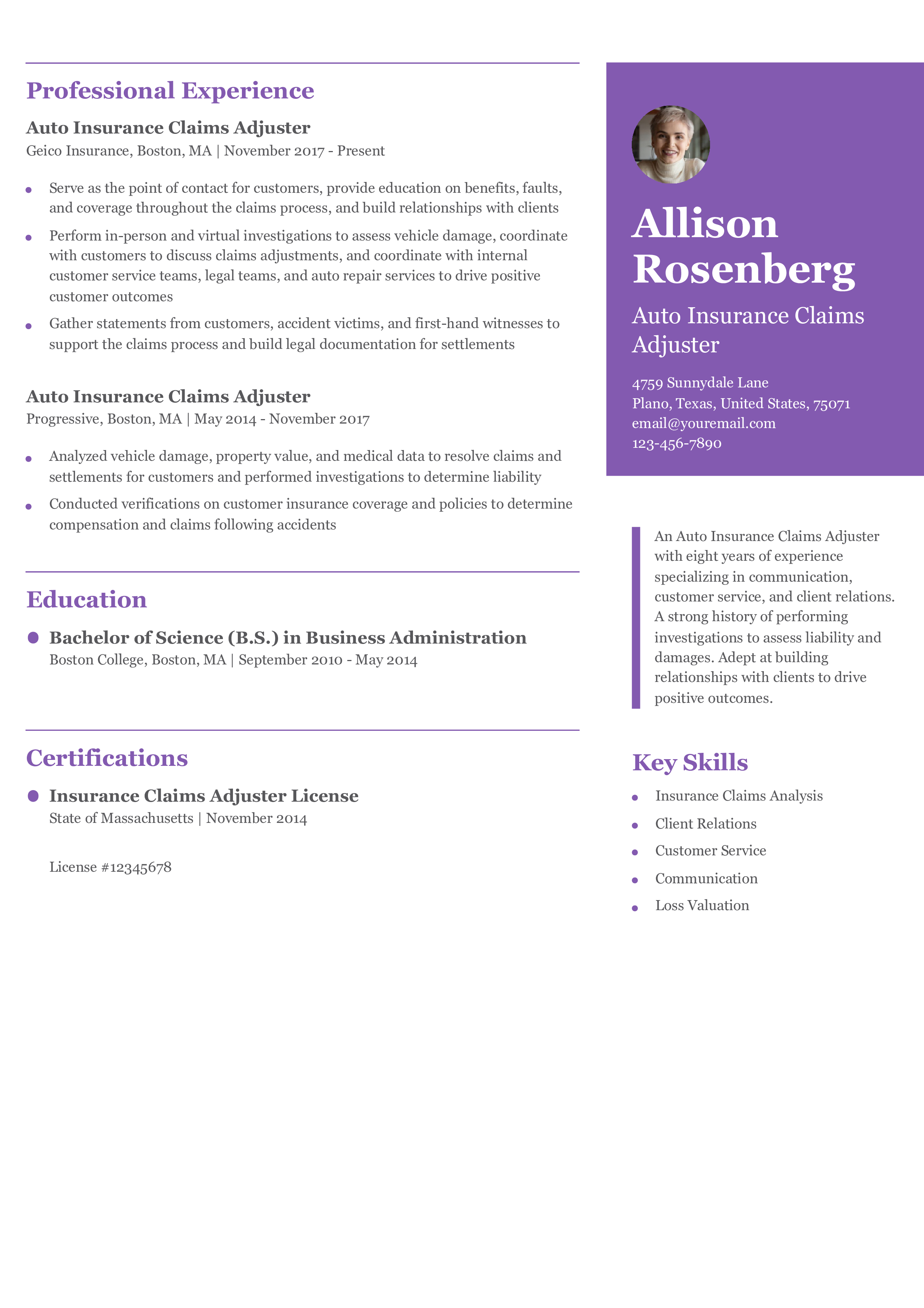

Allison Rosenberg

(123) 456-7890

[email protected]

123 Bridge Street, Boston, MA 12345

An Auto Insurance Claims Adjuster with eight years of experience specializing in communication, customer service, and client relations. A strong history of performing investigations to assess liability and damages. Adept at building relationships with clients to drive positive outcomes.

Professional ExperienceAuto Insurance Claims Adjuster, Geico Insurance, Boston, MA

November 2017 – Present

- Serve as the point of contact for customers, provide education on benefits, fault, and coverage throughout the claims process, and build relationships with clients

- Perform in-person and virtual investigations to assess vehicle damage, coordinate with customers to discuss claims adjustments, and coordinate with internal customer service teams, legal teams, and auto repair services to drive positive customer outcomes

- Gather statements from customers, accident victims, and first-hand witnesses to support the claims process and build legal documentation for settlements

Auto Insurance Claims Adjuster, Progressive, Boston, MA

May 2014 – November 2017

- Analyzed vehicle damage, property value, and medical data to resolve claims and settlements for customers and performed investigations to determine liability

- Conducted verifications on customer insurance coverage and policies to determine compensation and claims following accidents

Bachelor of Science (B.S.) Business Administration

Boston College, Boston, MA, September 2010 – May 2014

- Insurance Claims Analysis

- Client Relations

- Customer Service

- Communication

- Loss Valuation

- Insurance Claims Adjuster License, State of Massachusetts, License #12345678

How To Write an Auto Insurance Claims Adjuster Resume

Demonstrate your technical experience in evaluating vehicle damage, interfacing with customers, and driving positive business outcomes to build a winning auto insurance claims adjuster resume. Emphasize your comprehensive knowledge of insurance policies and auto repair technology to brand yourself as a subject matter expert within your space. This guide provides a variety of expert tips and advice to help you craft an accomplishment-driven resume that captures the nuances of your professional career.

1. Create a dynamic profile summarizing your auto insurance claims adjuster qualifications

Use this section to succinctly outline your experience, including how many years you’ve worked with vehicles or in the insurance industry. Highlight capabilities that make you a valuable candidate for this role, such as negotiation skills, vehicle knowledge, and proficiency with relevant claim or estimation software.

The profile summary should be short. Keep it to four sentences or fewer, and make every word count. Consider peppering in some action verbs or relevant skills with phrases such as “appraised property values” or “analyzed claims exposure” to demonstrate your experience and segue into the rest of your resume.

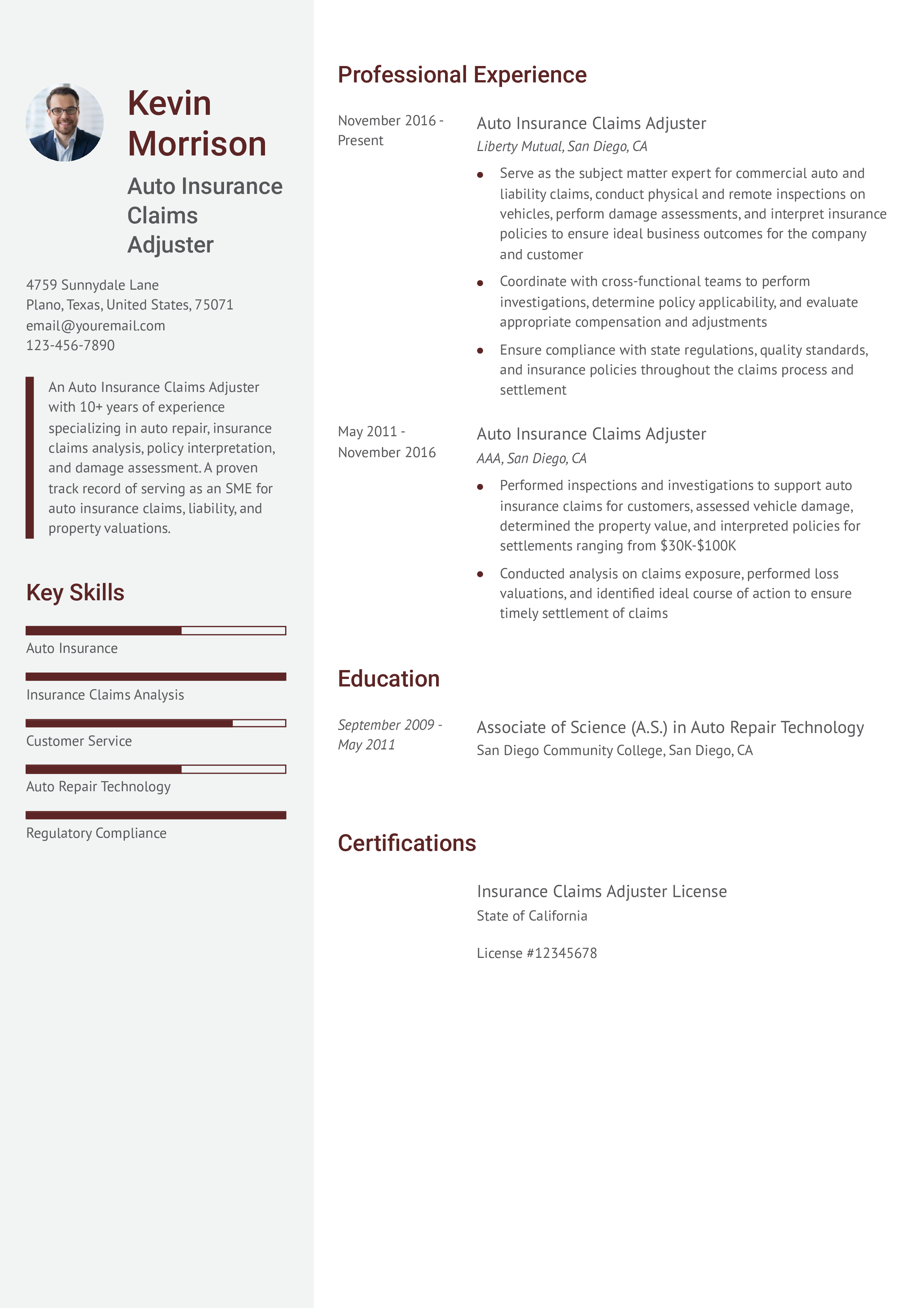

Senior-Level Profile Example

An Auto Insurance Claims Adjuster with 10+ years of experience specializing in auto repair, insurance claims analysis, policy interpretation, and damage assessment. A proven track record of serving as an SME for auto insurance claims, liability, and property valuations.

Entry-Level Profile Example

An Auto Insurance Claims Adjuster with five years of professional experience specializing in customer service, loss valuation, and damage assessments. A proven track record of performing inspections on damaged vehicles and supporting customers throughout the claims process.

2. Add a compelling section featuring your auto insurance claims adjuster experience

List recent and past work experience in this section, paying close attention to how you can describe accomplishments and duties in a way that’s likely to resonate with hiring managers. Stay away from cliched intros, such as “Responsible for.” Instead, break this section up with bullet points that include engaging action verbs and metrics.

For example, writing “performed in-person assessments of vehicle damage and increased policy-holder satisfaction by 10%” is stronger resume copy than “responsibilities including vehicle assessments.”

Be sure to also feature examples of you working effectively with clients, insurance companies, and auto repair services throughout your career. Customers who are beginning the claims process for their vehicle following an accident are typically not in the best state of mind. These types of experiences are often traumatic, and employers need candidates who can communicate with clients empathetically throughout the claims process.

Senior-Level Professional Experience Example

Auto Insurance Claims Adjuster, Liberty Mutual, San Diego, CA

November 2016 – Present

- Serve as the subject matter expert for commercial auto and liability claims, conduct physical and remote inspections on vehicles, perform damage assessments, and interpret insurance policies to ensure ideal business outcomes for the company and customer

- Coordinate with cross-functional teams to perform investigations, determine policy applicability, and evaluate appropriate compensation and adjustments

- Ensure compliance with state regulations, quality standards, and insurance policies throughout the claims process and settlement

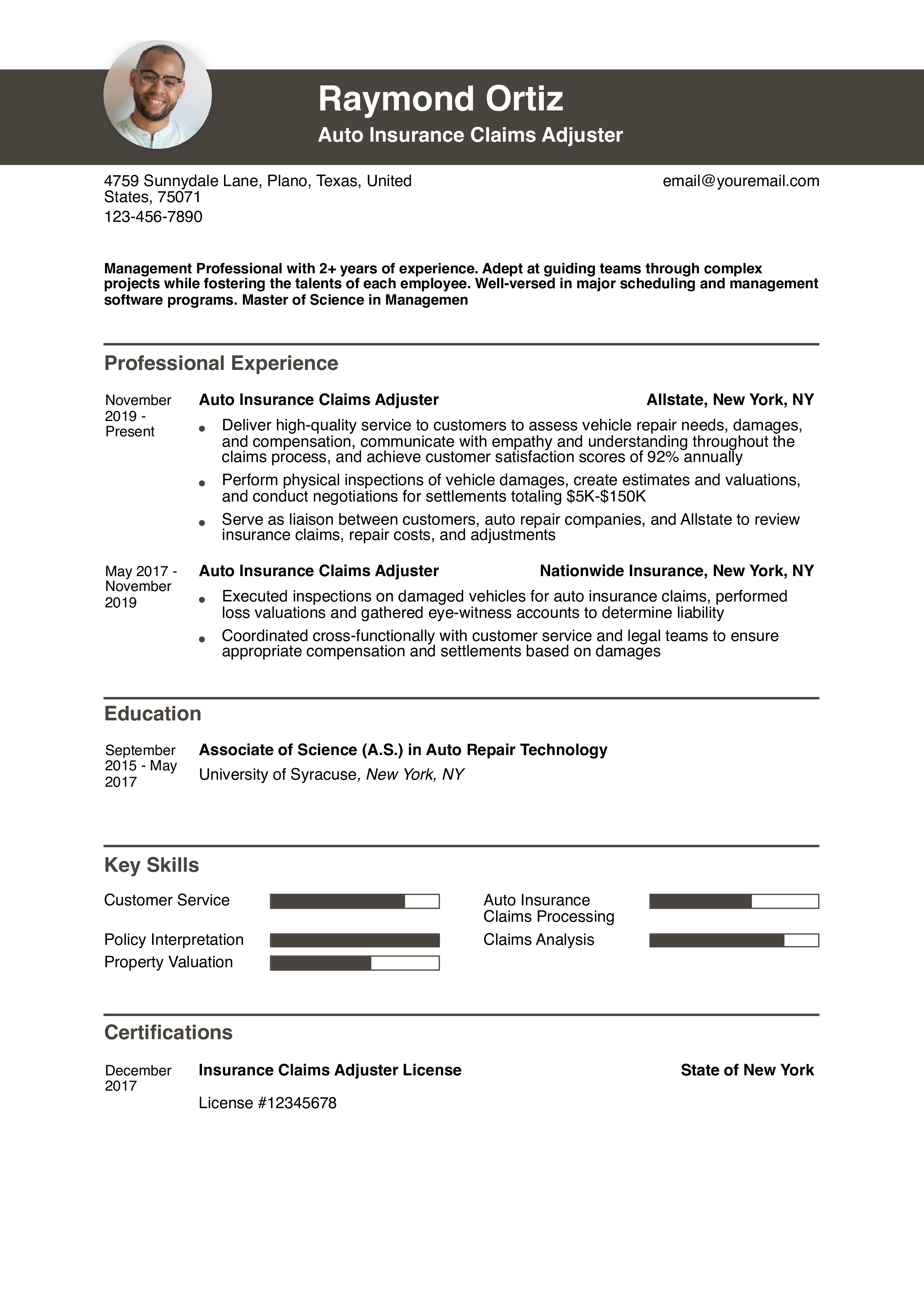

Entry-Level Professional Experience Example

Auto Insurance Claims Adjuster, Allstate, New York, NY

November 2019 – Present

- Deliver high-quality service to customers to assess vehicle repair needs, damages, and compensation, communicate with empathy and understanding throughout the claims process and achieve customer satisfaction scores of 92% annually

- Perform physical inspections of vehicle damages, create estimates and valuations, and conduct negotiations for settlements totaling $5K-$150K

- Serve as liaison between customers, auto repair companies, and Allstate to review insurance claims, repair costs, and adjustments

3. Include education and certifications relevant to auto insurance claims adjusters

College degrees and certifications can help you stand out as a candidate. They also help qualify your experience, ensuring hiring managers are confident in the knowledge and skills you claim to have. A variety of degrees are relevant to work as an auto insurance adjuster. Associate degrees in auto repair, finance, or business all demonstrate experience that may be helpful on the job.

Certifications may be even more specialized and indicate you made an effort to master skills related to estimating damage, handling complex insurance processes, or investigating accidents.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Associate of Science (A.S.) Auto Repair Technology

- University of Syracuse, New York, NY | 2017

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- Universal Claims Certification, Claims and Litigation Management Alliance | 2022

4. List auto insurance claims adjuster-related skills and proficiencies

As you create each section of your resume, consider how you can insert relevant key skills that may catch the eye of hiring managers. This verbiage can also help your resume make it through applicant tracking systems (ATS), which are designed only to pass through resumes with enough relevance.

One of the best ways to load your resume with relevant skills is to include at least one in each bullet point in your professional experience section. For example, “Leveraged knowledge of auto repair technology to support accurate damage assessments” includes two key skills.

| Key Skills and Proficiencies | |

|---|---|

| Auto insurance claims adjustments | Auto insurance claims analysis |

| Auto repair technology | Claims exposure |

| Claims processing | Client relations |

| Communication | Customer service |

| Damage assessment | Denial processes |

| Insurance claims analysis | Insurance claims investigations |

| Liability | Loss valuation |

| Policy interpretation | Property valuation |

| Regulatory compliance | Vehicle inspections |

How To Pick the Best Auto Insurance Claims Adjuster Resume Template

Choose a template with visually appealing elements, such as a standout header with your name and contact information and subheadings that identify each section. Steer away from templates with overly decorative fonts and design elements that might make your page look cluttered.

An auto insurance claims adjuster must be able to communicate complex information in a concise, clear manner. When in doubt, opt for a simple, elegant template that supports your content and qualifications.

Frequently Asked Questions: Auto Insurance Claims Adjuster Resume Examples and Advice

What is the best way to highlight my experience in my Auto Insurance Claims Adjuster CV?-

The best way to highlight your experience in your Auto Insurance Claims Adjuster CV is by emphasizing specific achievements in each role. Use bullet points to make your experience scannable and focus on results-driven accomplishments, such as improving processes or saving costs. Include quantifiable data like percentage increases or revenue growth to reinforce the impact of your work.

What are common action verbs for auto insurance claims adjuster resumes?-

Adding action verbs to your resume makes it more dynamic and easier to read. When you start sentences and bullet points with relevant verbs, you drive straight to the important points, and that helps you pack more punch in just a one-page document.

Consider ways you can use various action verbs to discuss your previous work, such as incorporating words like adjusted, appraised, and estimated into bullet points. When you start with a relevant action verb and end with a positive result, you can impress hiring managers with your proactive approach to challenges.

| Action Verbs | |

|---|---|

| Adjusted | Analyzed |

| Appraised | Assessed |

| Communicated | Compiled |

| Documented | Educated |

| Evaluated | Examined |

| Inspected | Interviewed |

| Investigated | Managed |

| Negotiated | Oversaw |

| Processed | Resolved |

| Reviewed | Supported |

How do you align your resume with a job description?-

The job market for insurance claims adjusters, appraisers, examiners, and investigators is expected to decline by 3% through 2032, according to data published by the Bureau of Labor Statistics (BLS). Fortunately, there are still plenty of organizations across the nation that need auto insurance claims adjusters.

For example, suppose an organization is looking for a candidate with exceptional customer service skills. In that case, you can go further than simply listing this as a skill on your document. Instead, you could highlight your integrity and commitment to driving positive outcomes for customers throughout the claims process. Remember, a resume is more than just a document stuffed with keywords; it’s a summarization of your career on paper. By illustrating your own unique experiences that match the job description, you’ll significantly increase your chances of success during the job search.

What is the best auto insurance claims adjuster resume format?-

For auto insurance claims adjusters, the reverse chronological resume format is typically best. This format places your most recent and relevant work experience towards the top of your document.

This order of presentation lets employers understand the progression of your career. By placing your most recent work on top, the format tends to ensure employers read your most relevant or impressive accomplishments first. This can help you capture the hiring manager's attention, ensuring they read through the rest of your resume.

What’s the ideal length for an auto insurance claims adjuster resume?-

A one-page resume is ideal for most auto insurance claims adjuster positions, especially if you have less than 10 years of experience. For experienced professionals, a two-page resume may be appropriate, but only if it includes valuable, job-relevant content. Focus on showcasing your key achievements, certifications, and skills that align with the job description.

Aim to include work experience from the last 10 to 15 years. Older roles can be summarized or omitted unless they add significant value. Keeping your resume concise and relevant will leave a strong impression on hiring managers.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

A cover letter is another opportunity to tailor your application package to the specific job. Use it to align yourself culturally with an organization, or make sure hiring managers note your most important qualifications.

Instead of writing a single cover letter to slap on every resume, tweak this document for each application. Start with our finance resume cover letter examples for some ideas before writing a cover letter that is uniquely yours.