To advance your career as a tax preparer, you need a stand-out resume that encapsulates the full breadth of your accounting skills and regulatory knowledge. Create an engaging professional document that demonstrates your expertise in preparing returns, managing financial data, and performing analysis to generate positive results for clients. In this guide, we’ll walk you through every step of the resume writing process to help you translate your accounting background into a powerful marketing tool.

Tax Preparer Resume Templates and Examples (Download in App)

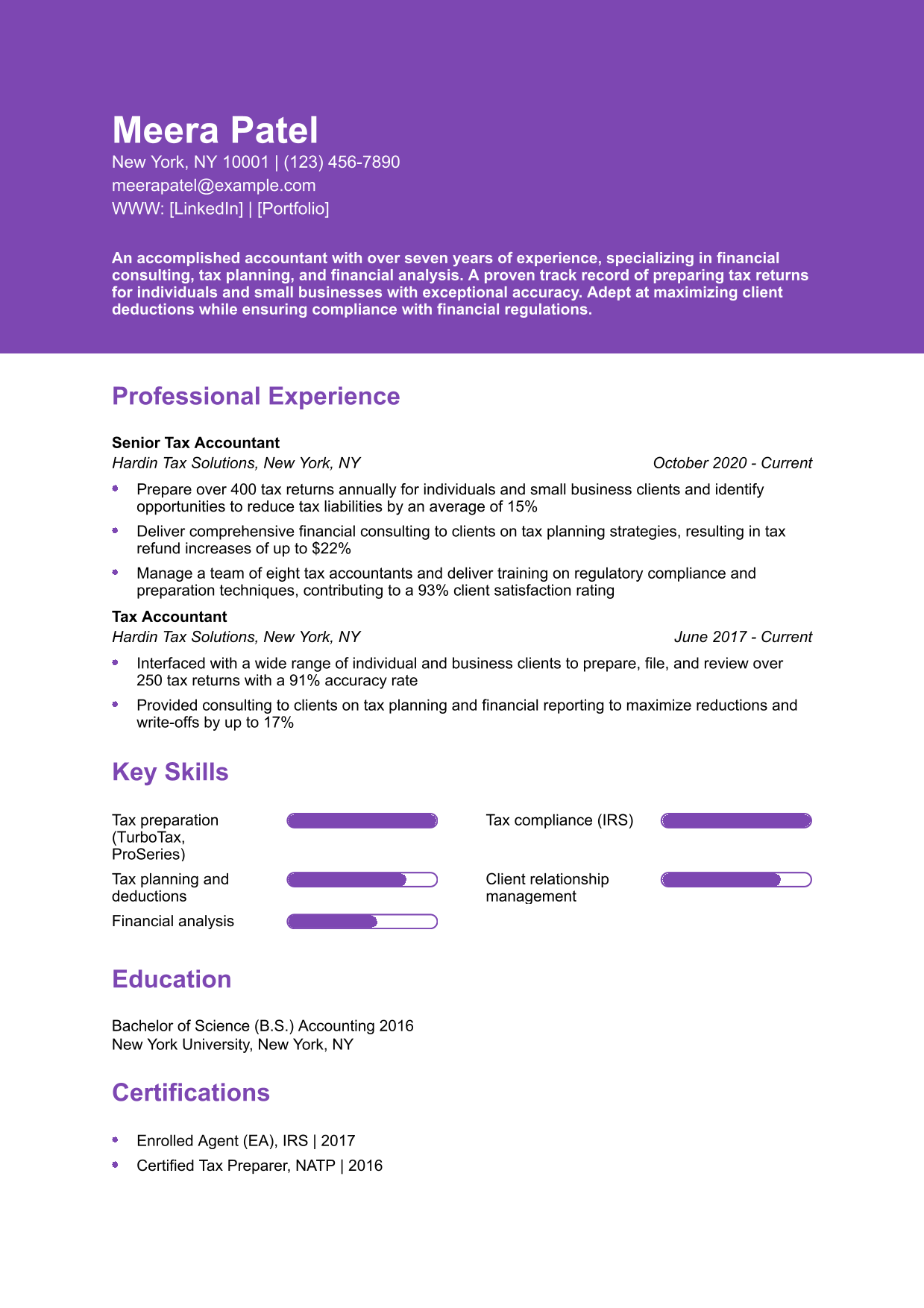

Tax Preparer Resume Example

Why this tax preparer resume example is strong:

This resume showcases significant results in reducing client tax liabilities and increasing refunds while emphasizing strong technical skills in tax preparation software and compliance with IRS regulations.

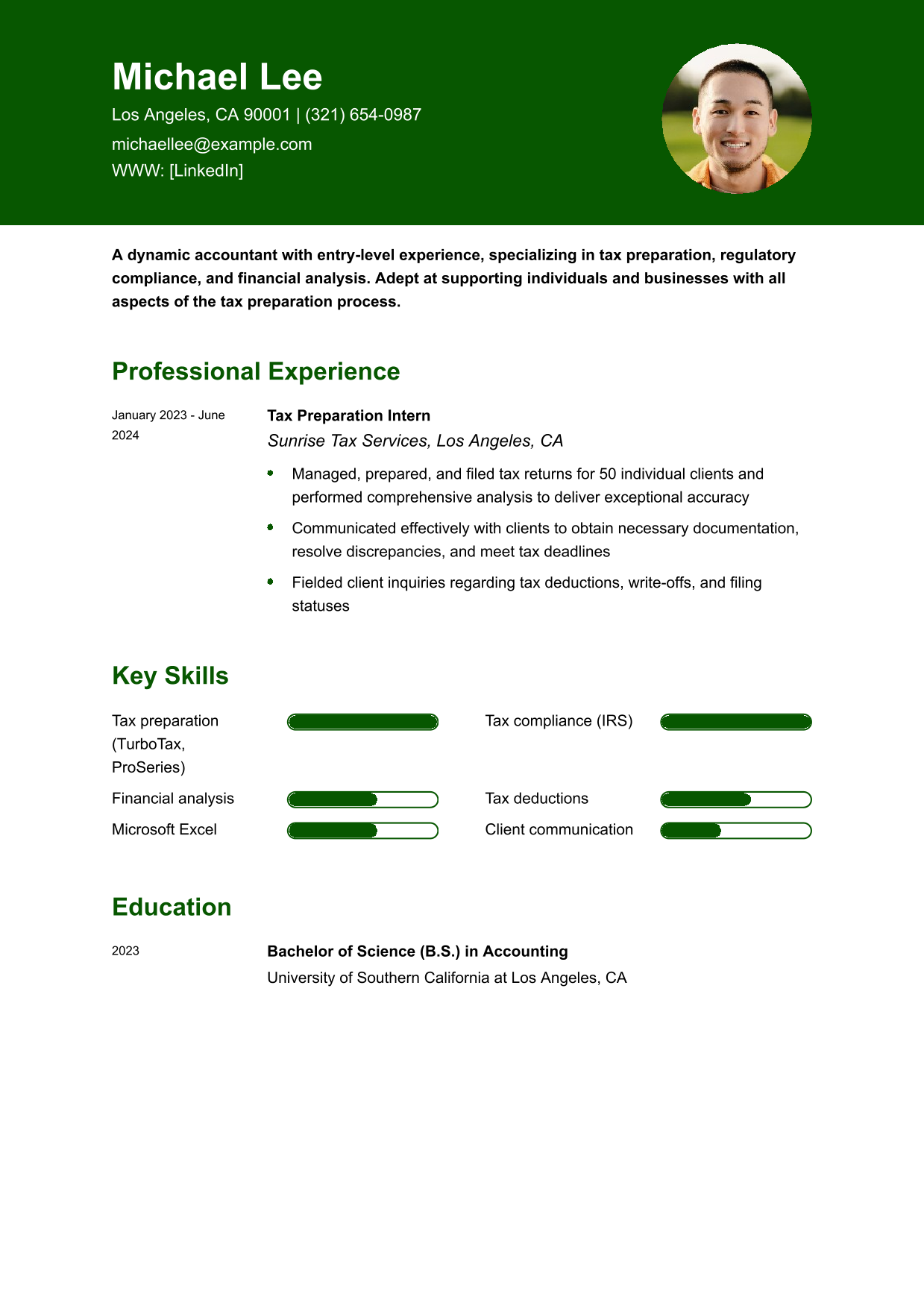

Entry-Level Tax Preparer Resume Example

Why this entry-level tax preparer resume example is strong:

This resume emphasizes relevant skills gained through an internship, showcasing the candidate’s readiness to handle tax preparation duties. It also highlights proficiency in tax software and client communication, critical for an entry-level role.

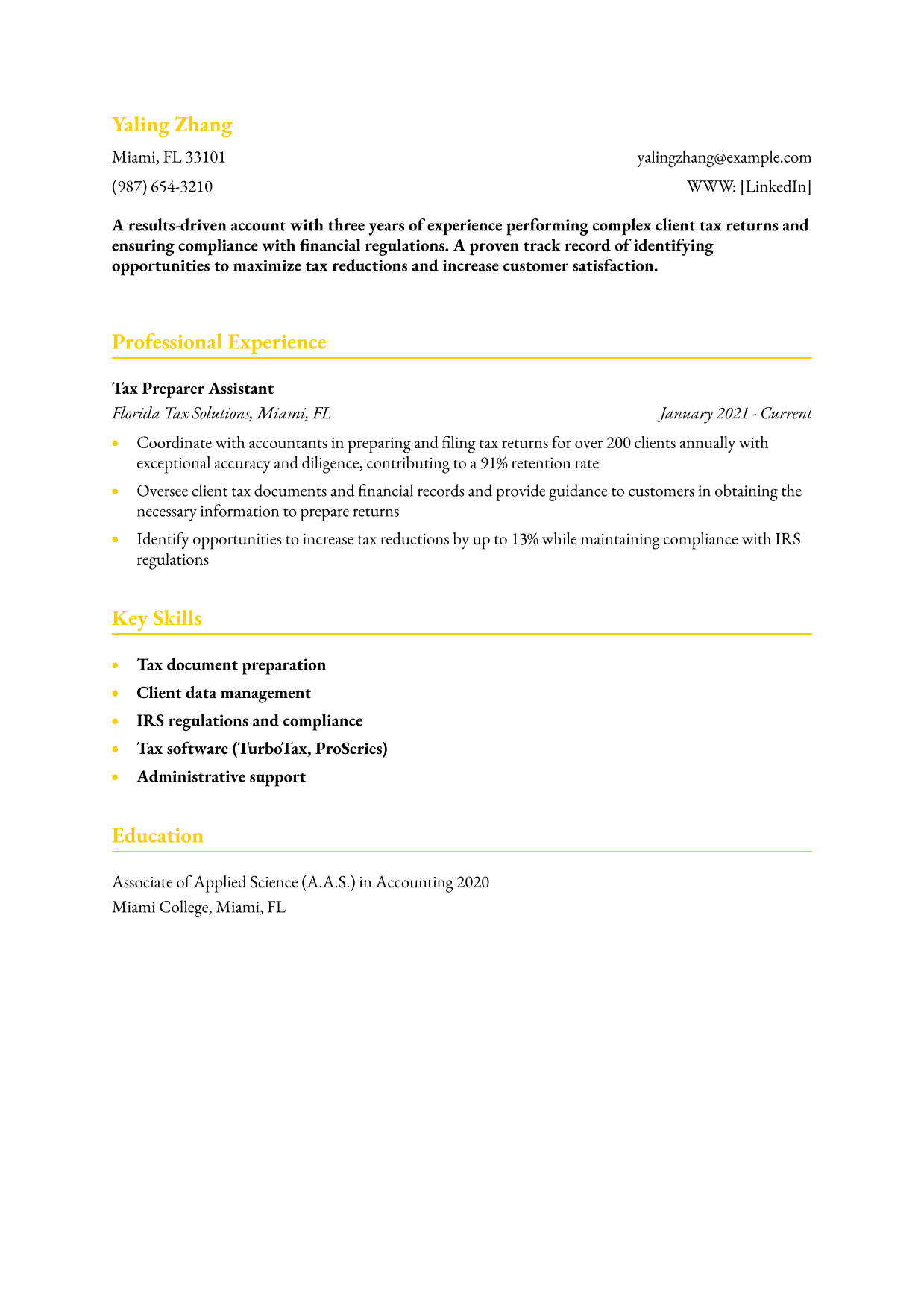

Tax Preparer Assistant Resume Example

Why this tax preparer assistant resume example is strong:

This resume focuses on the candidate’s experience in supporting tax preparers, demonstrating proficiency in document preparation and client communication. The strong focus on accuracy and organization makes it ideal for an assistant role.

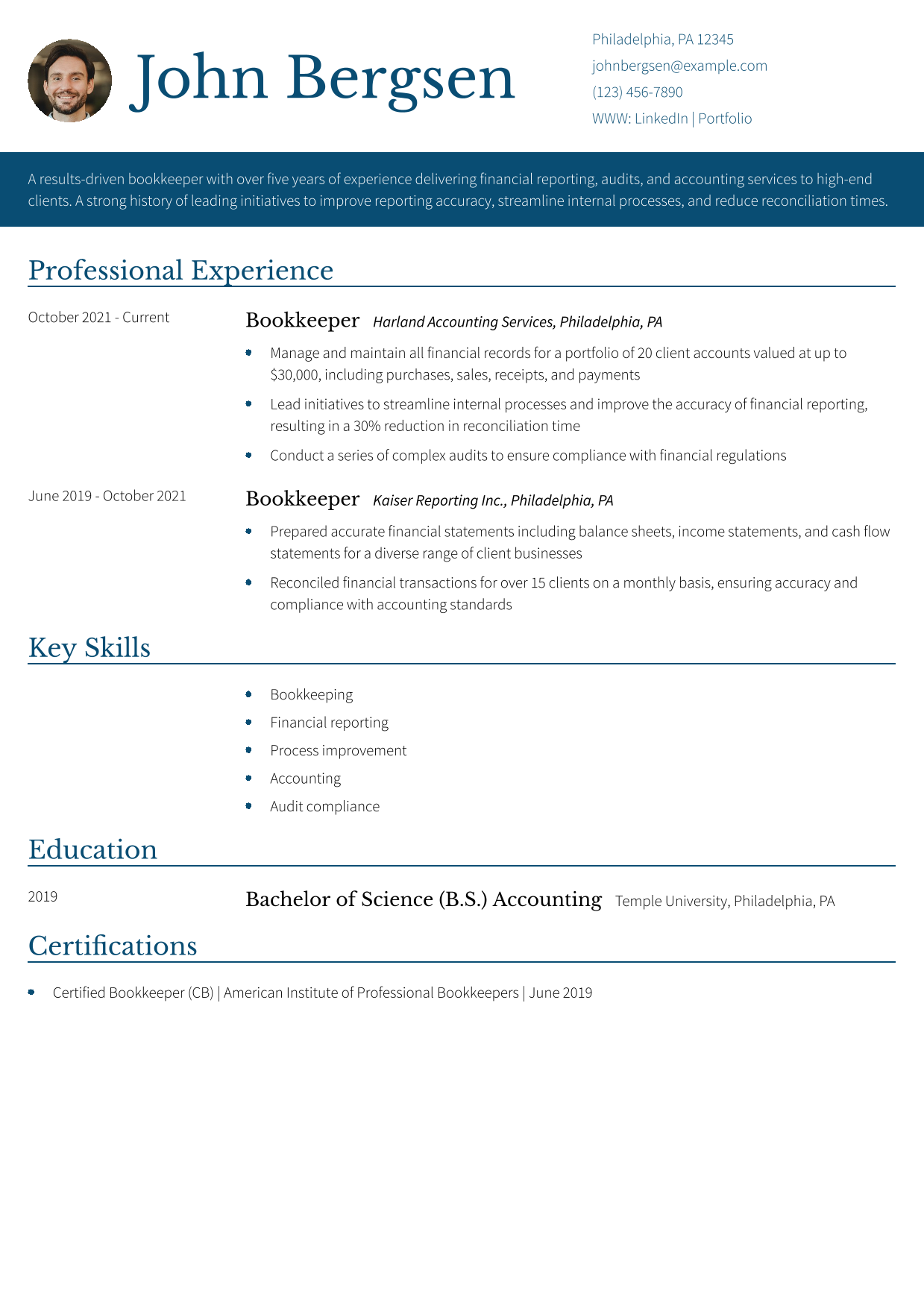

Bookkeeper Resume Example

Why this bookkeeper resume example is strong:

This bookkeeper resume does an exceptional job of highlighting the candidate’s comprehensive background in accounting and financial reporting. The bullet points provide clear and compelling examples that demonstrate the applicant’s ability to streamline internal processes and drive positive business results for clients.

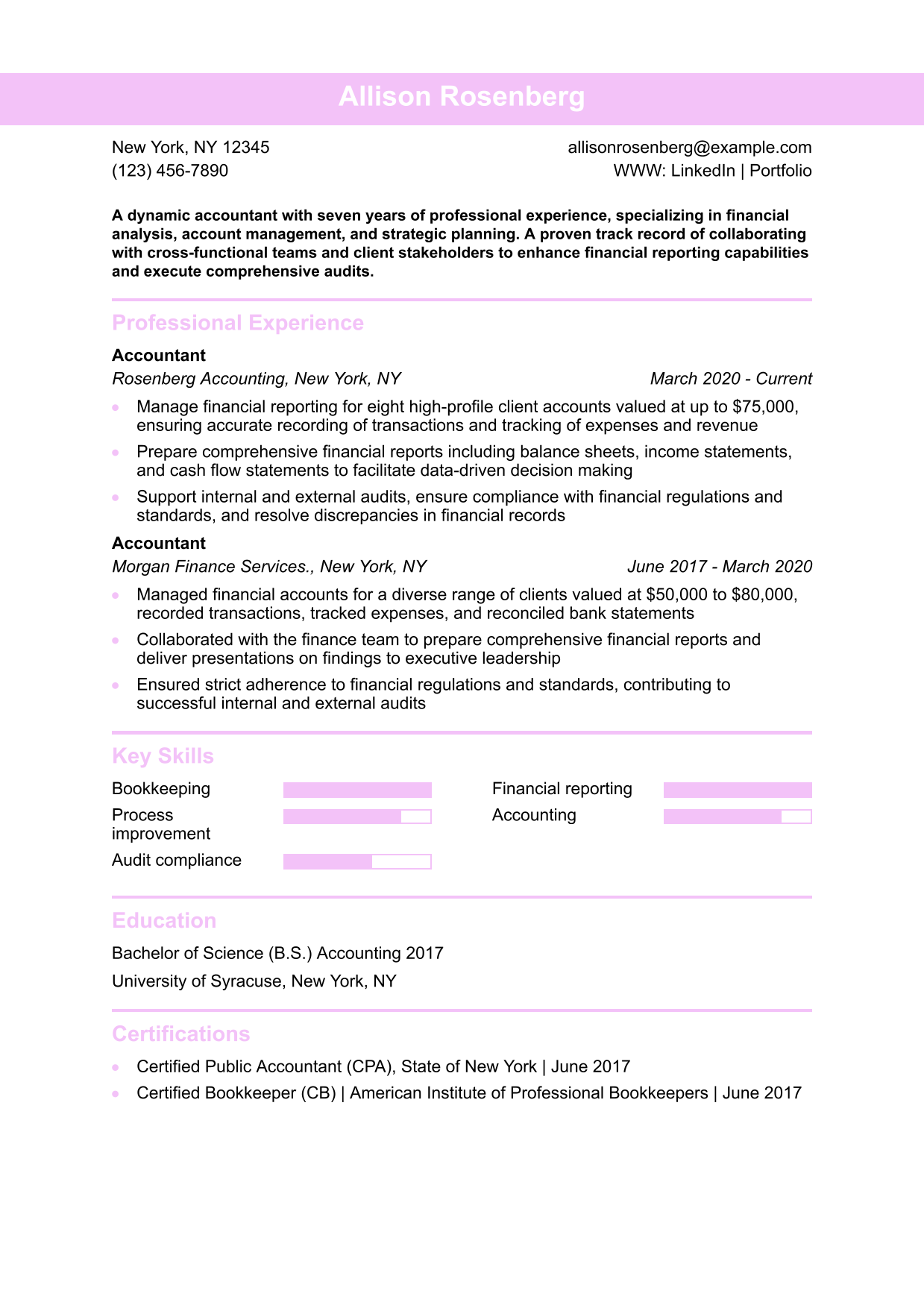

Accountant Resume Example

Why this accountant resume example is strong:

In this resume example, the candidate focuses on painting a clear and impactful picture of their experience as a bookkeeper by highlighting their most impressive achievements. The bullet points emphasize their expertise in both financial reporting and auditing, which is essential for this type of position.

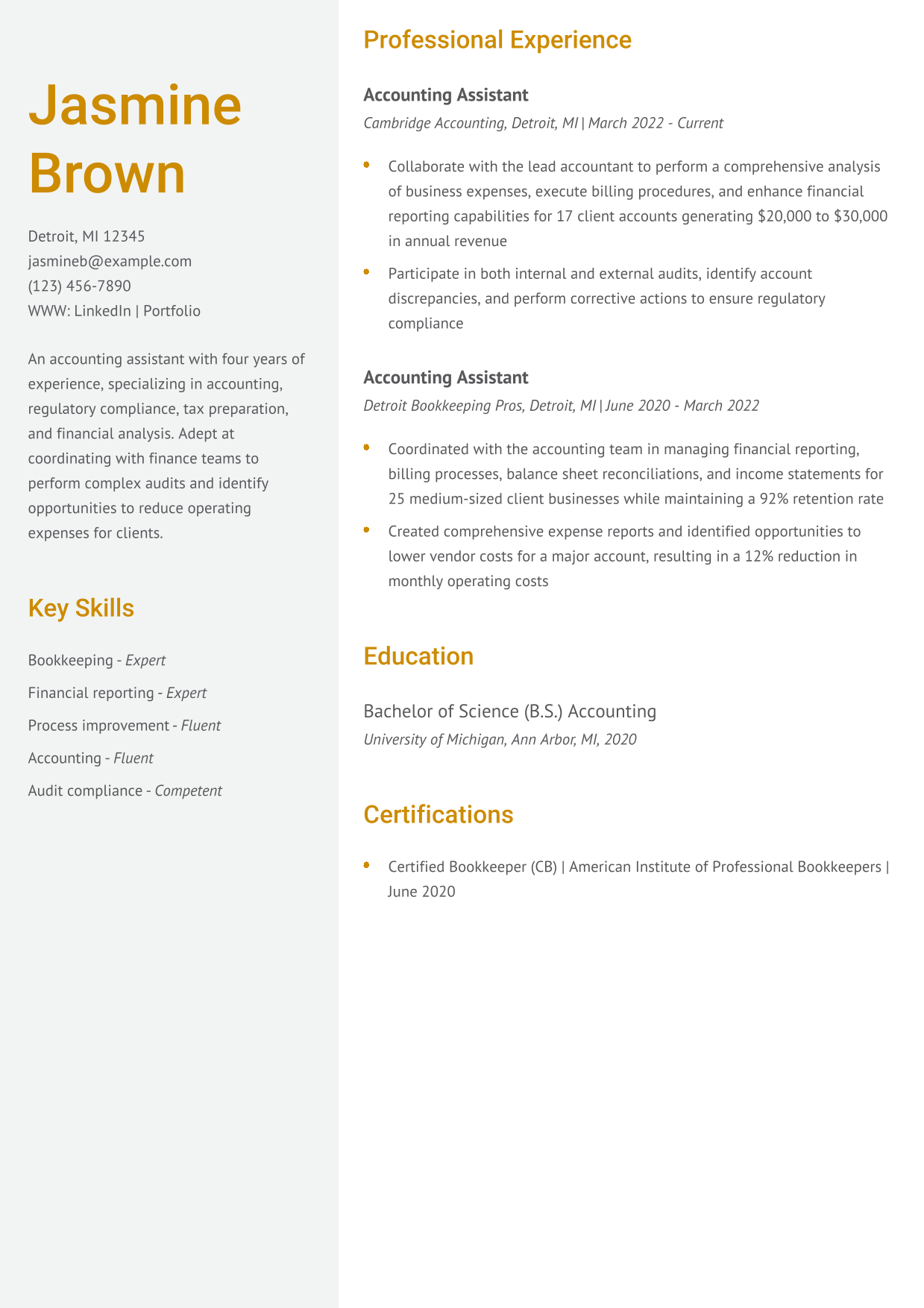

Accounting Assistant Resume Example

Why this accounting assistant resume example is strong:

This assistant bookkeeper resume excels in capturing the most impactful aspects of the candidate’s early career experience. The bullet points leverage monetary figures and metrics effectively, demonstrating the potential value they can bring to future employers.

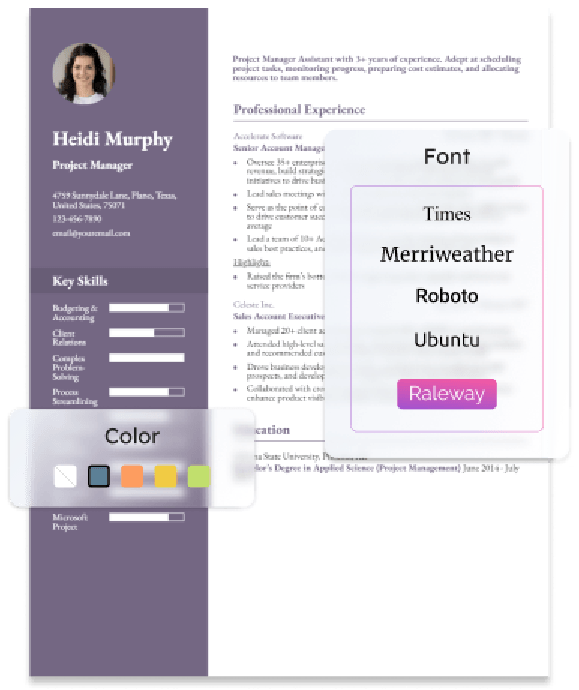

Our templates are crafted by professional resume writers to make creating your resume quick, easy, and effective.

- Professional resume template downloads

- Customized cover letter generation

- AI resume writing support

- Career-building resources and advice

Tax Preparer Text-Only Resume Templates and Examples

How To Write a Tax Preparer Resume

1. Write a dynamic profile summarizing your tax preparer qualifications

Grab the hiring manager’s attention with an engaging summary that captures your most impressive accounting skills and tax knowledge. Start with an opening sentence that lists your title, years of experience, and three to four skills that match the job posting. Emphasize your ability to drive tax reductions for clients while maintaining compliance with tax regulations. Create a snapshot of your career that shows the hiring manager you have the ideal background to succeed in the position.

Strong Profile Example

An accomplished accountant with over seven years of experience, specializing in financial consulting, tax planning, and financial analysis. A proven track record of preparing tax returns for individuals and small businesses with exceptional accuracy. Adept at maximizing client deductions while ensuring compliance with financial regulations.

Weak Profile Example

Tax preparer with experience filing taxes for individuals. Familiar with tax laws and working with different tax forms. Proficient in Microsoft Excel and tax software.

2. Add an accomplishment-driven tax preparer professional experience section

As you build out your professional experience section, prioritize highlighting your career achievements as a tax accounting professional. Create engaging bullet points that showcase how you’ve maximized tax refunds and accuracy during the preparation process. Incorporate hard numbers and eye-catching descriptions to create a sense of scope for the types of clients you’ve worked with and the value you’ve generated for previous employers.

Strong Professional Experience Example

Tax Preparer, ABC Tax Solutions, New York, NY | January 2017 – present

- Prepare over 450 tax returns annually for individuals and small business clients and identify opportunities to reduce tax liabilities by an average of 15%

- Deliver comprehensive financial consulting to clients on tax planning strategies, resulting in tax refund increases of up to $22%

- Manage a team of eight tax accountants and deliver training on regulatory compliance and preparation techniques, contributing to a 93% client satisfaction rating

Weak Professional Experience Example

Tax Preparer, XYZ Accounting, New York, NY | January 2019 – present

- Filed tax returns for clients

- Used tax software to complete forms

- Answered client questions about their taxes

3. Include relevant tax preparer education and certifications

Most employers will require a bachelor’s degree in accounting when considering candidates for tax preparer positions. More importantly, you’ll need to pursue specific certifications before companies will consider you for tax accountant roles. A Certified Public Accountant (CPA) or Certified Tax Preparer designation are both acceptable options for this occupation.

Education

Template

- Degree Name — [Major, Minor], School Name, City, ST or online | [Year]

- [Relevant honors, activities, or coursework]

Example

- Bachelor of Science (B.S.) in Accounting

- New York University, New York, NY | 2016

Certifications

Template

- Certification Name or Title, [Awarding Organization] | [Year]

- [Description]

Example

- Enrolled Agent (EA), IRS | 2017

- Certified Tax Preparer, National Association of Tax Professionals (NATP) | 2016

4. List pertinent tax preparer key skills

To achieve compliance with applicant tracking systems (ATS), provide a mix of keywords that match the needs of the company you’re targeting. Accounting terminology will always take priority, but it’s worthwhile to feature a mix of soft skill sets to show the hiring manager that you’re a versatile candidate who can communicate effectively with client stakeholders. Below, you’ll find a list of key skills to consider featuring on your tax preparer resume:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Business analysis |

| Client relations | Communication |

| Data analysis | Financial analysis |

| Financial consulting | Income tax returns |

| IRS regulations and compliance | Microsoft Excel |

| ProSeries | Tax deductions |

| Tax planning and consulting | Tax preparation |

| TurboTax | |

How To Pick the Best Tax Preparer Resume Template

The best tax preparer resume template should focus on clarity and organization. Ensure that your relevant accomplishments and certifications are easy to find. A simple, clean design helps hiring managers focus on your experience and technical skills, without distractions from unnecessary design elements.

Frequently Asked Questions: Tax Preparer Resume Examples and Advice

How do I optimize my Tax Preparer CV to get noticed by hiring managers?-

To optimize your Tax Preparer CV, begin by showcasing measurable achievements that demonstrate the value you’ve brought to previous employers. Use action verbs and specific examples to highlight your contributions. Incorporating industry-specific keywords, particularly in the skills and professional experience sections, will help your CV stand out, especially with ATS systems.

What are common action verbs for tax preparer resumes?-

Incorporating action verbs into your resume is a great way to help hiring managers visualize your achievements as a tax accountant. That being said, you may use the same verbs repeatedly while building your professional experience section. To diversify your usage of action verbs and keep your content engaging, we’ve compiled a list of verbs to craft impactful bullet points:

| Action Verbs | |

|---|---|

| Analyzed | Calculated |

| Communicated | Conducted |

| Consulted | Delivered |

| Developed | Drove |

| Filed | Identified |

| Led | Managed |

| Organized | Oversaw |

| Performed | Prepared |

| Provided | Reviewed |

| Verified | |

How do you align your resume with a tax preparer job description?-

To align your resume with a tax preparer job description, closely review the skills and qualifications the employer is seeking. Tailor your resume by highlighting your relevant experience, tax preparation expertise, and familiarity with tax software mentioned in the job posting. For example, if the job listing emphasizes IRS compliance and maximizing deductions, include specific examples where you helped clients reduce tax liabilities or ensured compliance with regulations.

What is the best tax preparer resume format?-

The reverse chronological format is ideal for tax preparers. This format highlights your most recent experience first, allowing hiring managers to see your relevant accomplishments and expertise upfront. The ATS also prefers the reverse chronological format, helping ensure your resume passes the initial screening.

Should my tax preparer resume be one or two pages?-

Your tax preparer resume should ideally be one page, especially if you have fewer than 10 years of experience. A two-page resume can be effective for seasoned professionals with a longer track record if it highlights accomplishments and skills directly relevant to the job. Every detail should add value and strengthen your candidacy.

Limit your work experience to the past 10 to 15 years, unless earlier positions are highly relevant. Keeping your resume concise and targeted will make a strong and memorable impression on potential employers.

Including a well-crafted cover letter with your tax preparer resume can significantly boost your chances of landing an interview. A cover letter allows you to explain how your skills and experience align with the employer's needs and show how you can help clients manage their taxes effectively. For more information, visit our account cover letter guide.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!