How To Write a Chief Financial Officer Resume

Within a short document, your executive-level finance resume must convey your achievements in budgeting, managing finances, and more. You must also show how you might fit into a company’s culture, what you can do for a hiring organization, and that you hold requisite credentials. Learn more about creating a chief financial officer (CFO) resume that does all of that below.

- Entry-level

- Mid-career

- Senior-level

1. Write a brief summary of your chief financial qualifications

The resume profile may be your first impression on a hiring committee, so make yours top-notch. Include information you think will be most relevant to the hiring organization, and tweak your profile summary for each CFO job you apply to. Highlight your tenure in leadership, finance, or business positions, and cite one or two of your top achievements to tease the rest of your resume.

Senior-Level Profile Example

CFO with over 15 years of advancement and experience. Draw on broad, deep finance knowledge to make viable budget decisions and set strategies for double-digit growth. Recent highlights include cutting department costs by 18% and financing a $40 million equipment purchase.

Entry-Level Profile Example

Senior executive with over three years of experience managing all financial operations for a fast-growing startup.

2. Showcase your chief financial experience

Companies want CFOs with strong leadership and steady progress toward broad financial and business goals. Show you’ve done that for other organizations — at all levels of your career — with results-driven bullets in your professional experience section. Quantify your achievements with data that helps employers see the difference you can make.

Senior-Level Professional Experience Example

Chief Financial Officer

FFF Solutions, Baltimore, MD | December 2017 to present

- Guide financial interactions between clients, vendors, and company’s over 400 staff members

- Focus on finding and pursuing cost-reduction opportunities to help raise the bottom line

- Oversee financing of large-scale projects

Highlights:

- Streamlined finance operations, reducing yearly expenses by 18% to date

- Coordinated financing of a complex $40 million equipment purchase

Entry-Level Professional Experience Example

Chief Financial Officer

JNR International, New York, NY | July 2019 to present

[Innovative tech startup with 20 employees.]

- Manage all financial accounts and operations

- Research foreign markets, analyze strategic opportunities, and present findings to senior partners

- Set annual financial budgets that include a rolling forecast

Highlight:

- Helped guide the acquisition of four companies in the past three years, taking annual revenue from $2.5 million to $7.3 million

3. Include chief financial-related education and certifications

While the bulk of a CFO resume is typically the experience section, include all your relevant education and certifications in an easy-to-read list. The following templates and examples will help you format these details on your resume.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Master of Business Administration

- The University of California, San Francisco, CA | 2011

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- CPA, New York State Board of Public Accountancy, 2010

4. Make a list of your chief financial-related skills and proficiencies

When hiring executive leadership, organizations tend to look for someone who is a good cultural fit and with the right skills to shore up the existing team. Always check the job listing for the specific position to learn more about the skills required — and if possible, talk to people in your network who might have insider information on the position. When you have skills and knowledge matching the company’s needs, highlight them on your resume using key phrases such as those below.

| Key Skills and Proficiencies | |

|---|---|

| Budget forecasting and management | Building teams |

| Collaboration | Cost management |

| Financial reporting | Financial software |

| Forecasting | Funding |

| Leadership | Management |

| Mergers and acquisitions | Problem-solving |

| Project management | Regulatory compliance |

| Risk assessment | |

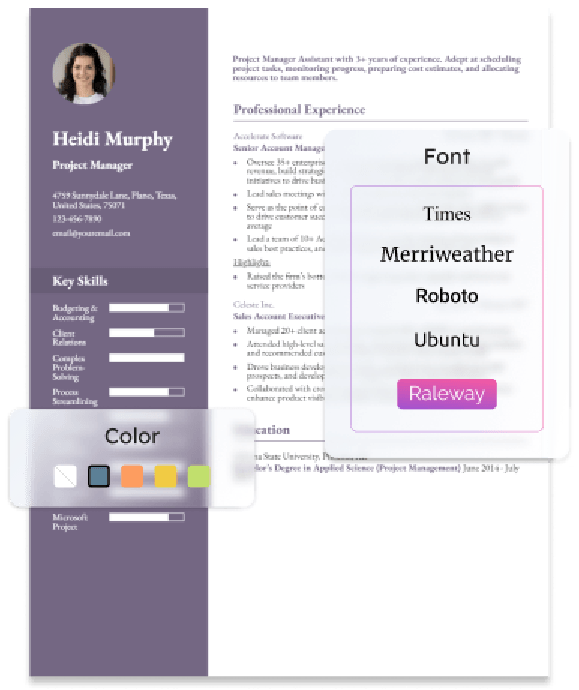

How To Pick the Best Chief Financial Officer Resume Template

When applying for an executive position, your resume must be as polished and professional as possible. Choose a template that matches your career level. While the focus should still be on content about your experience, accomplishments, and skills, a small and tasteful design flourish or two is not out of the question for a high-level resume. Remember that many application tracking systems convert resumes to digital formats, so ensure it’s easy to copy/paste the important elements or that optical character recognition (OCR) software can scan your resume.

Chief Financial Officer Text-Only Resume Templates and Examples

- Entry-level

- Mid-career

- Senior-level

Michael Sanderson

(123) 456-7890 | [email protected] | 789 Third Street, San Francisco, CA 12345

Profile

Award-winning Chief Financial Officer (CFO) with 7+ years of experience in the tech industry. Skilled at driving major top- and bottom-line growth; recent highlights include cutting department costs by $500K and helping acquire 7 small businesses for 178% greater revenue. Career background includes 4 years streamlining complex accounting systems. Work informed by MBA in Finance from the University of California.

Professional Experience

Chief Financial Officer, ABC Incorporated, San Francisco, CA | August 2015 to Present

- Set and execute core financial strategies governing this $14M enterprise

- Work closely with CEO and other executives on all mergers, acquisitions, joint ventures, and other large transactions

- Collaborate with operations manager on yearly financial budgets and rolling forecasts

- Ensure company’s ongoing compliance with state and federal law

- Develop forecasting to help gauge potential business ventures

Highlights:

- Helped guide 7 acquisitions in the past 5 years, translating to 178% revenue growth

- Streamlined finance and operational workflows, cutting annual costs by more than $500K

- Garnered 2 major industry awards for innovation in financial reporting and management

Assistant Financial Officer, LMB Technologies, San Francisco, CA | June 2011 to August 2015

- Executed core financial processes including vendor setup, bank account administration, and account reconciliation

- Analyzed and presented company’s financial reports to senior management

Highlights:

- Introduced accounting system that decreased input errors by 15%

- Refocused marketing spend on more lucrative channels, helping raise sales 120%

Education

The University of California, San Francisco

- Master of Business Administration (MBA) | 2011

- Bachelor of Science (BS) – Accounting | 2009

Key Skills

- Corporate Change Leadership

- Cross-Functional Coordination

- Financial Analysis & Reporting

- Mergers & Acquisitions

- Organizational Development

- Partnerships Development

- Public Speaking & Presentations

- Regulatory Compliance

- Revenue & Profit Growth

- Strategic Business Planning

Frequently Asked Questions: Chief Financial Officer Resume Examples and Advice

What are common action verbs for chief financial officer resumes?-

The CFO of any organization must be a person of action who can consider data and make fast, accurate decisions. They must also be leaders who can delegate tasks and inspire others to follow through on requirements. It can be hard to fully convey that you’re an action-based leader who confidently steps into work, so it’s important to include action verbs throughout your resume.

These verbs help position you as someone who does things — and when combined with your accomplishments, you create a narrative that demonstrates you do things well. Some action verbs you may want to try include:

| Action Verbs | |

|---|---|

| Build | Champion |

| Conduct | Conceive |

| Create | Decrease |

| Develop | Enhance |

| Generate | Forecast |

| Implement | Improve |

| Increase | Launch |

| Lower | Manage |

| Mentor | Raise |

| Reduce | Spearhead |

How do you align your resume with a job posting?-

When putting yourself forward for a leadership position, demonstrate that you’re the right person for the job. Aligning your resume with a job posting helps show how well you fit a hiring organization’s culture, mission, and needs. Look closely at the job posting to find key phrases and skills you have and highlight those on your resume. You can also look at the tone of the hiring organization’s messaging and match that in your resume when appropriate.

The Bureau of Labor Statistics notes that job opportunities for top executives, including CFOs, are growing at an average rate compared to other opportunities, making this a competitive market. Taking these extra steps can help you stand out from other candidates.

What is the best chief financial officer resume format?-

Most CFO candidates find the reverse-chronological format works best. It lets you show your growth in leadership and other critical skills over time and helps employers understand more about your background. Stand out with this format by including a robust professional summary and ensuring your education and certifications are easy to find when someone first scans the document. Because CFO resumes tend to include much experience and data, use bullet points, subheadings, and white space to make the document easier for talent teams to review.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!