How To Write a Certified Public Accountant Resume

Your certified public accountant (CPA) resume adds up to success when it includes credentials and skills matching an employer’s needs, such as tax preparation and compliance work. Ensure your education and certifications are easy to find, and create scannable bullet points highlighting your experience and what you can do for an organization. Get tips for creating a CPA resume below, including how to organize your qualifications and what type of format is best.

- Entry-Level

- Mid-Career

- Senior-Level

1. Summarize your certified public accountant qualifications in a dynamic profile

In the profile section, catch employers’ interest by naming the major reasons you’re the right person for the job. If they only have time to read one section right now, your profile must be strong enough that your resume ends up in the consideration pile. Mention your certifications and highlight one or two of your top accomplishments before ending with some key skills you can bring to the organization.

Senior-Level Profile Example

Proven corporate tax manager with three years of leadership experience and over 10 years as a CPA. Ensured accuracy and outstanding customer service for tax planning, preparation, and compliance work completed by 50 staff members. Highly educated with a Master of Taxation from Thomas Jefferson University and sought-after expertise in risk management and emerging tax software.

Entry-Level Profile Example

Knowledgeable and detail-oriented senior forensic accountant with CPA and Certified Forensic Accountant designations. Skilled at analyzing financial information, creating measurement tools, and maintaining client relationships.

2. Add your certified public accountant experience with compelling examples

Back up your claims in your profile with results-driven bullet points in your professional experience section. List previous accounting jobs with points for each, including specific successes you brought to your team. Show your ability with facts and figures whenever possible by including actual data and metrics. If you don’t have much accounting experience, highlight relevant skills you gained in previous positions, such as managing the budget at a volunteer organization or attending to the books as an office manager.

Senior-Level Professional Experience Example

Senior Corporate Tax Manager

Grant Thornton, Pittsburgh, PA | November 2017 to present

[Local branch of prestigious accounting and consulting firm with over 500 employees]

- Plan, manage, and execute full-circle tax projects in over 15 industries by providing top-quality tax planning, consultation, and compliance expertise

- Manage the corporate tax team within the tax services department, which includes three managers, six senior associates, 12 junior associates, and four interns

- Conduct primary and secondary review of complex income tax returns including corporate, S corporation, partnership, and individual clients

- Work with a team of experts to evaluate innovative tax software and seamlessly implement selection within the corporate tax office

- Remotely assess employee performance for assignments and year-end reviews

Entry-Level Professional Experience Example

Senior Forensic Accountant

J.S. Held, Washington, D.C. | March 2019 to present

[Global consulting firm with over 1,000 employees]

- Oversee and support the work of seven entry-level forensic accountants

- Serve as a back-up expert witness for fraud cases, appearing in four winning cases while supervisor was away

- Audit detailed financial and business data to create a comprehensive analysis that supports investigations and prosecution

- Employ financial forensic skills to analyze each criminal’s methods of money laundering and movements within an organization

3. Include certified public accountant-related education and certifications

Include the details relevant to your CPA and any accounting or finance degrees you might hold. Also, add other relevant training that may help you stand out among similar CPA candidates. For example, if you have credentials such as Certified Financial Analyst or Certified Fraud Examiner, this points to unique skills and knowledge that may be valuable to a hiring organization.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Bachelor of Business Administration in Accounting

- Temple University, Philadelphia, PA | 2017

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- CPA, Association of Certified Public Accountants, 2016

4. Include a list of skills and proficiencies related to certified public accountants

Many businesses use software called applicant tracking systems (ATS) to sort resumes. Resumes that don’t include certain key skills may never be reviewed by a human hiring manager, so feature these relevant skills on your resume if you have them. Focus on your analytic and accounting skills, including general professional skills like time management or collaboration. Some common skills and proficiencies that are required for CPA positions include:

| Key Skills and Proficiencies | |

|---|---|

| Accounting software | Auditing |

| Bookkeeping | Complex problem-solving |

| Critical analysis | Customer service |

| Data analysis | Financial accounting |

| Financial modeling | Forecasting |

| Leadership | Management |

| Math and computation | Microsoft Excel |

| Taxes | |

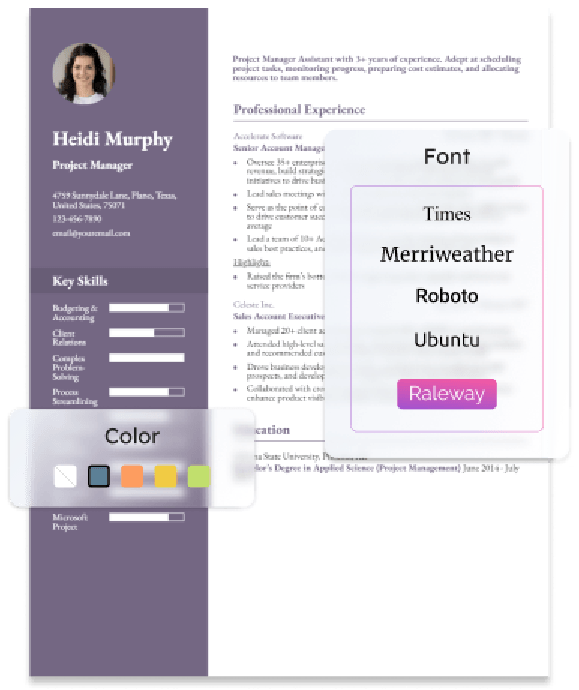

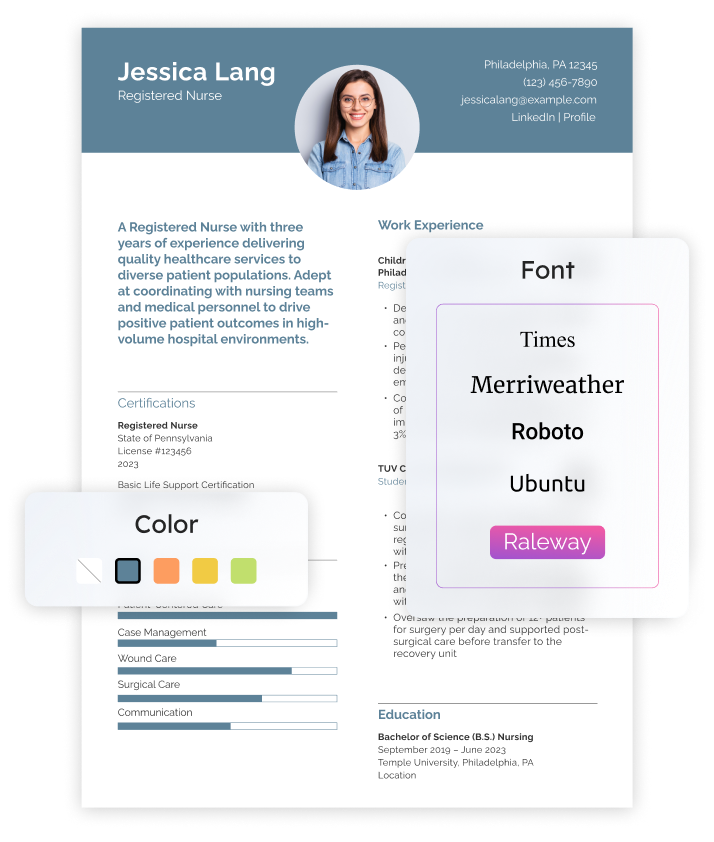

How To Pick the Best Certified Public Accountant Resume Template

Consider a design that balances concision and professionalism with modern visual appeal. Avoid fancy or hard-to-read fonts, and stick with something that puts the focus on your information. When possible, look for templates that align with industry standards or provide areas for things like accounting certifications and education. Choose a template you can easily work with, so if you don’t use word processing programs often, opt for a simple template with basic tabs, spaces, and bullet points.

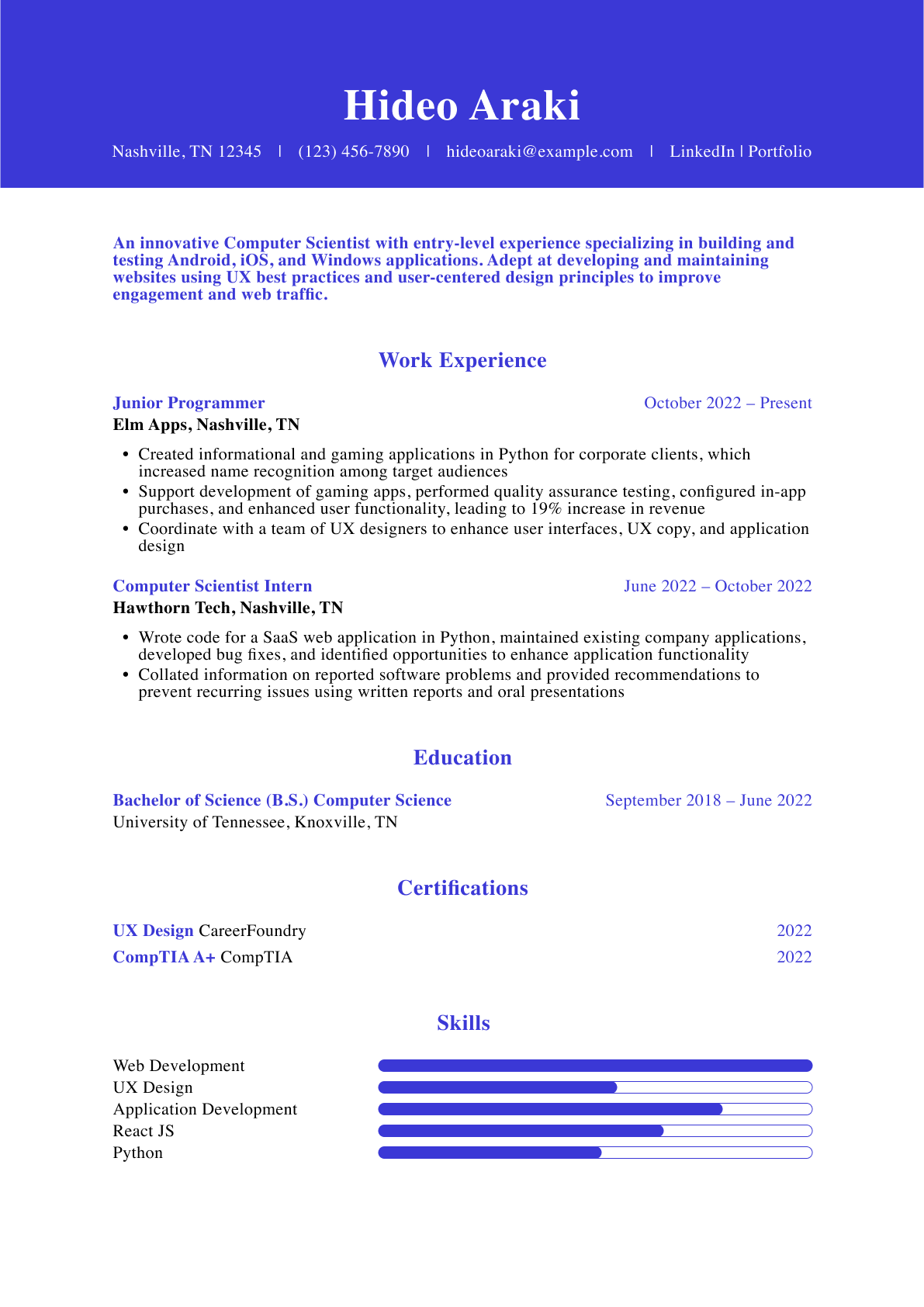

Certified Public Accountant Text-Only Resume Templates and Examples

- Entry-Level

- Mid-Career

- Senior-Level

Keegan Chang

(512) 456-7890 | [email protected] | Denver, CO 12456 | linkedin.com/in/yourname

Profile

Motivated internal auditor and licensed CPA with over six years experience working for two well-known technology brands. Graduate of the number one accounting program in the nation and fluent in Portuguese.

Professional Experience

Internal Audit Lead, Hewlett-Packard, Spring, TX

January 2020 – Present

[$30 billion multinational information technology company]

- Remotely supervise up to 35 employees at a time

- Offer weekly Zoom training sessions for new or struggling auditors, leading to a 20% reduction in the auditor turnover rate

- Assist in enterprise risk assessments and conduct process, financial, regulatory and cyber audits

- Delegate and provide guidance for each audit team’s assigned engagements

- Advise company management on necessary improvements based on audit results

- Conduct post-audit evaluations and ensure improvement plans are implemented in an effective manner

Senior Internal Auditor, Hewlett-Packard, Spring, TX

October 2016 – January 2020

- Traveled to over 20 internal office sites to meet with staff and audit operations

- Executed required quarterly and annual SOX 404 assessments of HP’s control environment, ensuring that there were no compliance violations during full 3+ years in this role

- Audited individual departments to make certain they’re within Minimum Internal Control Standard (MICS)

- Performed audit procedures, including defining issues, developing criteria, and substantiate audit conclusions

Internal Audit Associate, Dell Technologies, Round Rock, TX

July 2014 – September 2016

[Leading computer hardware company with 100,000+ employees]

- Served on a team of over 100 auditors tasked with improving Dell’s control environment and identifying and managing business risks

- Named Associate of the Year for the department in 2015 after outperforming 95% of auditors company-wide

- Developed strong skills in project management, controllership, and presentations

- Applied knowledge of Portuguese language to audit performed working with Dell’s Brazil office

- Gained experience in all phases of the audit engagement, including planning, program development, evaluation of controls, report writing, and follow-up

Education

Bachelor of Business Administration in Accounting

UNIVERSITY OF TEXAS Austin, TX, May 2014

Key Skills/Knowledge Areas

- Critical thinking

- Computer-aided audit tools

- Fluent in Portuguese

- Relationship-building

- SOX compliance

Certifications

- Certified Public Accountant, Association of Certified Public Accountants, 2016

- Certified Internal Auditor, Institute of Internal Auditors, 2018

Frequently Asked Questions: Certified Public Accountant Resume Examples and Advice

What are common action verbs for certified public accountant resumes?-

Action verbs move the reader through your information at a good pace and present you as someone who gets things done. By pairing strong accounting-related action verbs with details from your work experience, you can position yourself as a dynamic and well-rounded finance professional. Some verbs you may want to use on your resume include:

| Action Verbs | |

|---|---|

| Account | Analyze |

| Audit | Balance |

| Budget | Calculate |

| Certify | Create |

| Document | Ensure |

| Evaluate | File |

| Forecast | Perform |

| Prepare | Reconcile |

| Report | Resolve |

| Save | Streamline |

How do you align your resume with a CPA job posting?-

Hiring organizations have specific goals when they publish a job posting. When you align your resume with those goals, you increase your chance of moving forward in the screening process. Review the job posting carefully to see what stands out as the employer’s main needs and preferences. Tailor your resume profile to speak to those needs, and update keywords and phrases in the rest of your resume to match the verbiage used in the job listing. With almost 1.5 million accounting positions nationwide, customizing your resume for the exact job you want can help you get noticed.

What is the best certified public accountant resume format?-

Most CPAs should use the combination (or hybrid) format. True to its name, this format combines two important features of other resume formats: the chronological format’s experience section and the functional format’s profile section.

A combination resume offers the best of both worlds by fusing these two sections. The experience section lets you outline your recent work history – essential information for most employers. At the same time, the profile section lets you display your career highlights at the top, regardless if they’re from that work history or another part of your background. The resulting resume is straightforward yet strategic. It gives hiring managers the clearest possible view of your background and relevant skills, so they can decide to proceed with your candidacy.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!