How To Write a Financial Analyst Resume

As a financial analyst, your resume is a powerful tool that features your unique skills, accomplishments, and aspirations in the finance industry. To stand out as a top candidate, you’ll need to write a resume that meets the needs of employers and aligns with the role you’re applying for. We’re here to help you accomplish just that. This guide will provide real financial analyst resume examples and expert insights to help you write your best resume. You’ll learn how to effectively showcase your unique skills, accomplishments, and aspirations in the financial realm, capturing the attention of hiring managers and recruiters. We’ll guide you through the essential elements and strategies that make a standout financial analyst resume.

- Entry-Level

- Mid-Career

- Senior-Level

1. Craft an outstanding profile with a summary of your financial analyst qualifications

A resume profile should provide a concise snapshot of your professional expertise and highlight your suitability for the position. In 2-3 sentences, introduce yourself and impress potential employers by sharing your years of experience and how your past successes make you the best candidate. Study the job description and pull keywords you can work into this paragraph to show your alignment with the role. Then, speak to your abilities and emphasize your track record of delivering accurate financial insights, conducting comprehensive market research, or providing data-driven recommendations to support business growth. By aligning your profile with the position’s requirements and presenting your unique value proposition, you’ll impress and persuade recruiters to continue reading your resume.

Senior-Level Profile Example

Chartered Financial Analyst with 12+ years’ experience in financial management, supply chain management, and auditing. Highly capable of collaborating with senior-level staff and meeting multiple pressing deadlines. Deeply familiar with best accounting practices and financial management software systems. Proven relationship builder and motivator.

Entry-Level Profile Example

Enthusiastic entry-level financial analyst with two years of experience focused on using data to help businesses increase profits. Reduced waste and expenses for financial services companies and created dashboards for senior management and executive staff. Used MS Access and Excel to improve portfolios by at least 5.5% per year.

2. Add a compelling section featuring your financial analyst experience

Your professional experience section should show potential employers how you leverage your skills to accomplish daily tasks and long-term goals. Demonstrate your impact in previous roles and go beyond simply providing a laundry list of responsibilities. As a financial analyst, you’re all about numbers, so go ahead and quantify your experience. Include specific metrics, such as percentage growth in portfolio value, cost savings achieved, revenue generated, or successful investment recommendations. Providing concrete evidence of your work will help employers visualize the value you could bring to their organization and how you could add to their success. As you assemble these accomplishments in bullet points, use action verbs to make your writing succinct and impactful. Start each bullet point with a verb to make it easy for readers to scan through and capture information.

Senior-Level Professional Experience Example

Financial Analyst, United Companies, New Haven, CT

July 2008 – March 2015

- Developed forecasting tools to analyze revenue variance and industry trends, resulting in the discovery of a $2M revenue opportunity

- Collaborated with accounting department in streamlining key processes, reducing labor overtime costs by 20%

- Executed core financial processes, including administration and reconciliations of bank accounts and operational expenses

- Reduced monthly forecast variance from 25% to 9% by communicating across departments to incorporate the most recent information in the forecasts

Entry-Level Professional Experience Example

Financial Analyst I, Enterprise Financial Headquarters, Miami, FL

January 2019 – Present

- Provide bi-weekly and monthly summary reports for North Florida and South Georgia offices and custom dashboards for executive staff

- Found and eliminated recurring errors and duplications, saving the company 2.7% in annual expenses in North Florida and 1.3% in South Georgia offices

- Built data visualization reports showing ways to increase monthly client spending while expanding profit margins by at least 5%

3. Include financial analyst-related education and certifications

Demonstrating your educational background and showcasing your academic achievements in finance-related subjects is essential. This information reassures employers that you have a solid foundation in the field and can apply theoretical concepts to practical scenarios. Start with your highest level of education and list the degree name, institution, location, and completion date.

Additionally, if you hold certifications such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), be sure to include them on your resume. These credentials provide evidence of your expertise and dedication to professional development, setting you apart from other candidates. Create a separate section formatted similarly, listing the certificate title, issuing organization, and date received.

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- ACCA Certificate in Data Analytics (CertDA), July 2017

- Microsoft Certified Data Analyst Associate, January 2019

Education

Template

- [Degree Name]

- [SCHOOL NAME], [City, State Abbreviation] [Dates Enrolled]

Example

- Bachelor of Science in Finance

- UNIVERSITY OF FLORIDA, Gainesville, FL, August 2015 – December 2018

4. Outline your most useful financial analyst skills and proficiencies

Consider the skills hiring managers are looking for in a financial analyst. The best place to start is the job description for the position you’re interested in. Choose to include the skills that match what the company is looking for to prove you’re qualified for the job. Show that you stay up to date with the latest industry trends and technologies by incorporating relevant software proficiencies like Excel, Python, or Tableau. Here’s a list of examples you could include on your financial analyst resume:

| Key Skills and Proficiencies | |

|---|---|

| Budget Management | Client Relationships |

| Corporate Financing | Data Management |

| Economics | Financial Modeling |

| Financial Planning | Financial Statements |

| Forecasting | Investment Analysis |

| Market Research | Profit and Loss (P&L) Management |

| Quantitative Analysis | Regulatory Compliance |

| Reporting and Documentation | Risk Assessment |

| Strategic Planning | Task Prioritization |

| Team Collaboration | Trend Analysis |

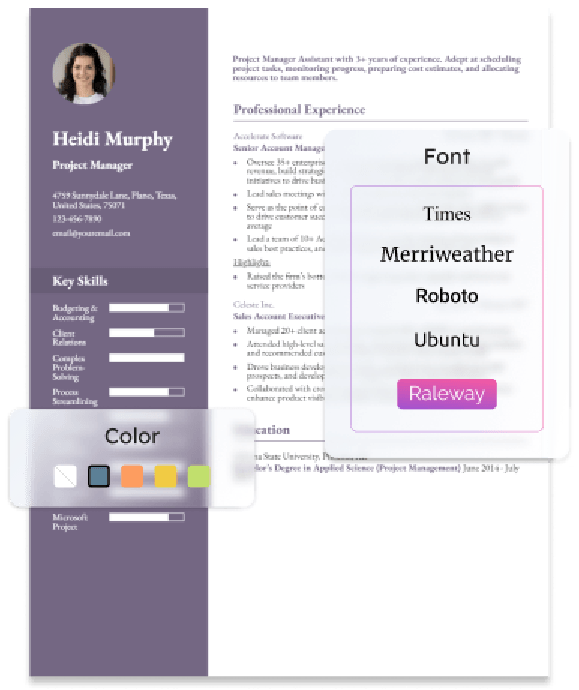

How To Pick the Best Financial Analyst Resume Template

A resume template serves as the foundation for presenting your qualifications and experience. The best template for financial analysts is clean, professional, and visually appealing. Look for a template offering a clear structure with well-defined sections for easy readability. Select a template that aligns with the finance industry’s standards and expectations, emphasizing a modern and sophisticated look. It’s best to avoid overly decorative fonts and bright colors, as they can distract readers and give the wrong impression. Choosing a well-suited template will create a professional and polished resume that effectively showcases your expertise as a financial analyst.

Financial Analyst Text-Only Resume Templates and Examples

- Entry-Level

- Mid-Career

- Senior-Level

Pedro Pennington

(111) 222-3333

[email protected]

123 First Street, New York, NY 10001

Profile

Energetic, detailed-oriented financial analyst who has over eight years of experience. Can lean on accounting background to process large amounts of financial information and investigate the strength of potential investments. Good communicator who is able to create digestible reports and give presentations that assist upper-level decision-makers.

Professional Experience

Financial Analyst, RRR Finances, New York, NY

November 2015 – Present

- Perform risk-assessment analyses on potential and current investments

- Help executive team formulate financial goals, then adjust as necessary each quarter

- Using spreadsheets to present data, report on the performance of current holdings and recommend courses of action

- Identify process improvements that have, to date, resulted in a 9% decrease in overhead costs

- Examine financial documents of businesses seeking funding to determine solvency and potential

Junior Financial Analyst, ACE Bank, New York, NY

July 2012 – November 2015

- Created reports on stock and bond trends

- Prepared technical reports, integrating graphs and charts to show data

- Maintained long-term database on income and expenses from ACE Bank’s 35 real estate property holdings

Education

Master of Finance

Buffalo School Of Finance, Buffalo, NY, September 2010 – June 2012

Bachelor of Science in Accounting

Rochester Business Academy, Rochester, NY, September 2006 – June 2010

Key Skills

- Microsoft Excel

- Interpreting business documents, including business plans and financial statements

- Conducting and contributing to meetings

- Communication through verbal and written means

Certifications

- Certified Financial Analyst, Finance Professionals’ Association of New York, 2020

Frequently Asked Questions: Financial Analyst Resume Examples and Advice

What are common action verbs for Financial Analyst resumes?-

When crafting the professional experience section of your resume, finding the right words to describe your work can be a struggle. It's common to run out of descriptive words that genuinely capture your accomplishments, but we're here to help you over this hurdle. We've compiled a comprehensive list of action verbs that specifically speak to the work of financial analysts. These words will effectively communicate your accomplishments and enhance the impact of your professional experience. Consider using some of these action verbs on your financial analyst resume:

| Action Verbs | |

|---|---|

| Assess | Audit |

| Budget | Communicate |

| Ensure | Evaluate |

| Forecast | Generate |

| Identify | Interpret |

| Invest | Optimize |

| Organize | Present |

| Recommend | Reconcile |

| Research | Review |

| Strategize | Streamline |

How do you align your resume with a job description?-

The Bureau of Labor Statistics predicts employment for financial analysts will increase by 9 percent between 2021 and 2031. This growth will create more than 30,000 new jobs over the decade. Even though the field will see an influx of new opportunities, you'll still need to stand out from other applicants going after the same positions.

Especially when applying for a specific financial analyst job opening, it's crucial to tailor your resume to that position. To do this, review the job description and identify key requirements and responsibilities. Then, align your resume with these points by highlighting relevant experiences, accomplishments, and skills directly related to the role.

What is the best Financial Analyst resume format?-

The most appropriate resume format for financial analysts is typically the chronological format. This style emphasizes a clear and organized timeline of your professional experience, making it easier for employers to assess your career progression and continuity. It lets you showcase your growth, achievements, and increasing responsibilities over time.

However, a combination format can also be effective, allowing you to highlight your relevant skills and accomplishments while still maintaining a clear employment history. It may be more suitable if you have transferable skills or are transitioning between industries. Ultimately, your choice should depend on your specific circumstances and professional goals.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!