How To Write a Personal Banker Resume

To write a strong personal banker resume, you must create an accomplishment-driven document highlighting your banking expertise, sales achievements, and client relations skills.

Emphasize your ability to educate clients on financial products, generate new business, and deliver exceptional customer service. This guide provides expert insights to help you translate your personal banking career into a powerful resume.

- Entry-level

- Mid-career

- Senior-level

1. Craft an outstanding profile with a summary of your personal banker qualifications

Craft a dynamic and engaging profile to make a strong first impression on the hiring manager. Start with an opening sentence with your title, years of banking experience, and three to four specializations matching the job posting. Focus the summary on your ability to create value for customers, team members, and banking institutions.

Include an impressive sales or customer service metric to demonstrate your proven track record of success within the banking industry. Avoid cliche and generic buzzwords such as “problem-solving” or “hard-working,” as these terms won’t help you stand out in a competitive job market.

Senior-Level Profile Example

A senior banking professional with 10 years of experience specializing in portfolio management, business development, consultative sales, and commercial banking. A strong history of building relationships with high-value accounts and managing a multimillion-dollar book of business. Adept at developing and mentoring personal bankers to maximize sales performance.

Entry-Level Profile Example

A personal banker with entry-level experience specializing in retail banking, customer service, relationship building, and account management. A strong history of interfacing with a diverse customer base to recommend appropriate banking products and drive customer success.

2. Create a powerful list of your personal banker experiences

The professional experience section is the most critical piece of your resume. Grab the hiring manager’s attention by showcasing your most compelling accomplishments within the banking industry. Employers are attracted to candidates who can create value for their organizations. The best way to highlight this is by incorporating key metrics and monetary figures from your professional achievements.

For example, if you exceeded monthly sales quotas or improved customer satisfaction scores, be sure to quantify this accomplishment in the form of a percentage. Using hard numbers to your advantage will help you better tell your story and help hiring managers gain a deeper understanding of your experience. Include the types of financial products and services you sold to further emphasize your banking expertise.

Senior-Level Professional Experience Example

Relationship Banker, PNC Financial Services, Boston, MA | May 2016 – present

- Manage a portfolio of over 150 clients with an average net worth of $600,000, build and develop long-term business relationships, and increase client’s deposit average by 70%

- Identify and recommend financial products and banking solutions based on client needs, utilize consultative sales techniques to deliver value-added services, and improve customer retention by over 25%

- Establish small and medium-sized business accounts and collaborate with home lenders and financial advisors to provide support for all customer financial needs

Entry-Level Professional Experience Example

Personal Banker, TD Bank, Cincinnati, OH | May 2021 – present

- Interface with over 50 banking customers per week, manage accounts, identify business opportunities, and upsell retail banking products based on customer needs

- Exceed sales quotas by 120% for fiscal year 2021 by utilizing consultative selling techniques and building long-term client relationships

- Support new customers in opening checking and saving accounts and applying for mortgage loans, including reviewing client financial documentation and transactions

- Provide education to clients on banking products and financial services

3. Include personal banker-related education and certifications

Feature your highest level of education and any relevant certifications to show prospective employers you’re qualified for the position. List the degree, institution, location, and graduation date. Consider pursuing additional certifications to emphasize your commitment to expanding your knowledge and skill sets within the banking industry.

The Certified Personal Banker (CPB) credential is an excellent starting point, as this exam tests your understanding of sales, customer service best practices, and banking products. As you grow in your career, you can pursue more advanced credentials to broaden your prospects, such as a Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) designation.

Education

Template

- [Degree Name]

- [School Name], [City, State Abbreviation] | [Graduation Year]

Example

- Bachelor of Science (B.S.) Finance

- University of Cincinnati, Cincinnati, OH | 2018

Certifications

Template

- [Certification Name], [Awarding Organization], [Completion Year]

Example

- CFP, CFP Board, 2021

- CPB, ABA, 2018

4. List personal banker-related skills and proficiencies

Employers rely on applicant tracking systems (ATS) to screen people based on specific keywords and job requirements. If your resume lacks a certain number of key terms, the ATS may reject your resume before it reaches the hiring manager. Highlight a mix of banking terminology and interpersonal skills to show prospective employers you’re a versatile candidate who excels in multiple areas. Below, you’ll find a list of potential keywords you may encounter while pursuing personal banker jobs:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Banking products |

| Business development | Cash management |

| Client relations | Commercial banking |

| Communication | Consultative sales |

| Cross-functional collaboration | Cross-selling |

| Customer service | Customer success |

| Finance | Financial advising |

| Financial services | Lead generation |

| Lending services | Mortgage loans |

| Personal banking | Personal loans |

| Portfolio management | Retail banking |

| Risk management | Sales |

5. Highlight your leadership and relationship-building skills

Customer-facing positions such as a personal banker require strong communication and team leadership skills. Not only will you be managing relationships with a diverse customer base, but you’ll also be collaborating with internal cross-functional teams to improve the quality of service for clients.

For example, rather than simply mentioning you trained new employees, provide insights into how your coaching and mentorship helped team members grow professionally. Instead of stating you were responsible for customer accounts, include details that offer deeper insights into your relationship-building skills.

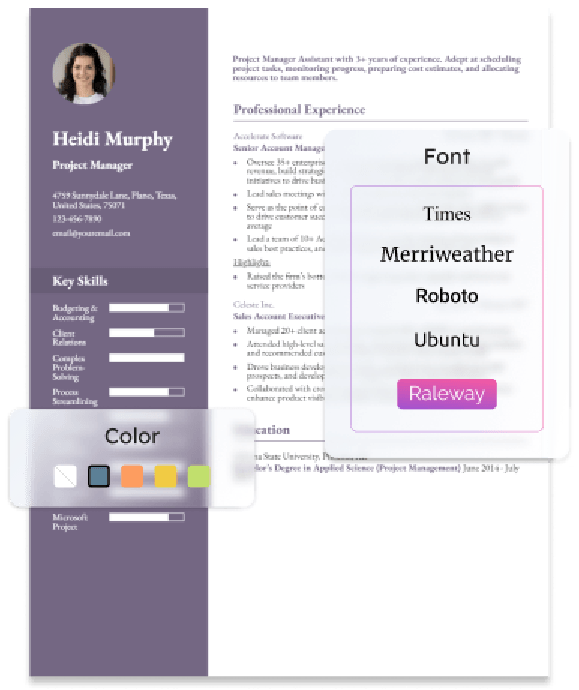

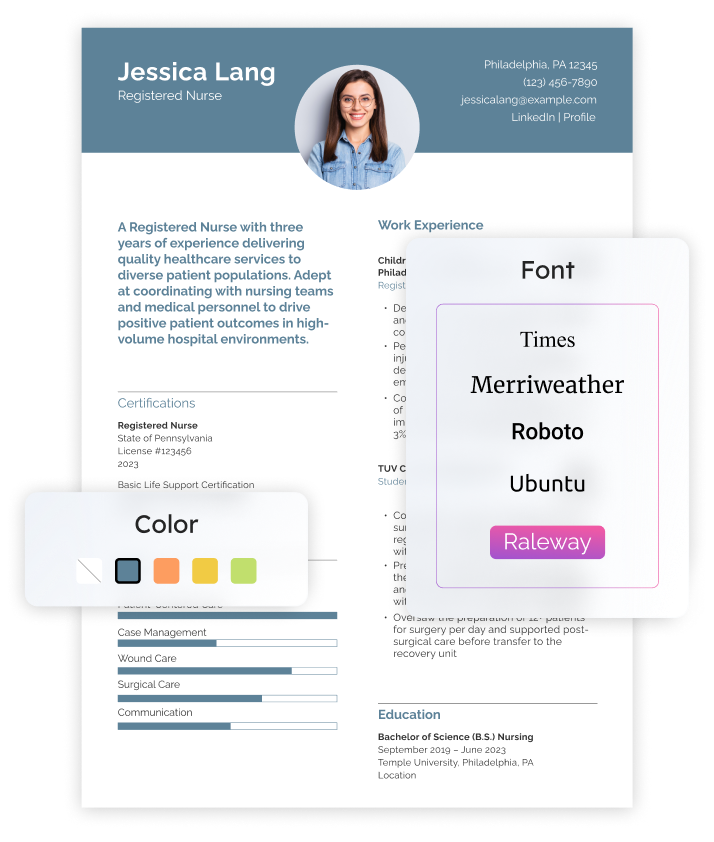

How To Pick the Best Personal Banker Resume Template

When selecting your resume template, it’s often best to choose a simple option that prioritizes structure, organization, and readability over visual appeal. Flashy colors and graphics may look nice, but they can distract the reader from your qualifications and achievements. Select a template that uses a top-down, single-column format to provide a straightforward reading experience. This also allows you to determine what information the hiring manager sees first, rather than scattering multiple sections across the same line of the page.

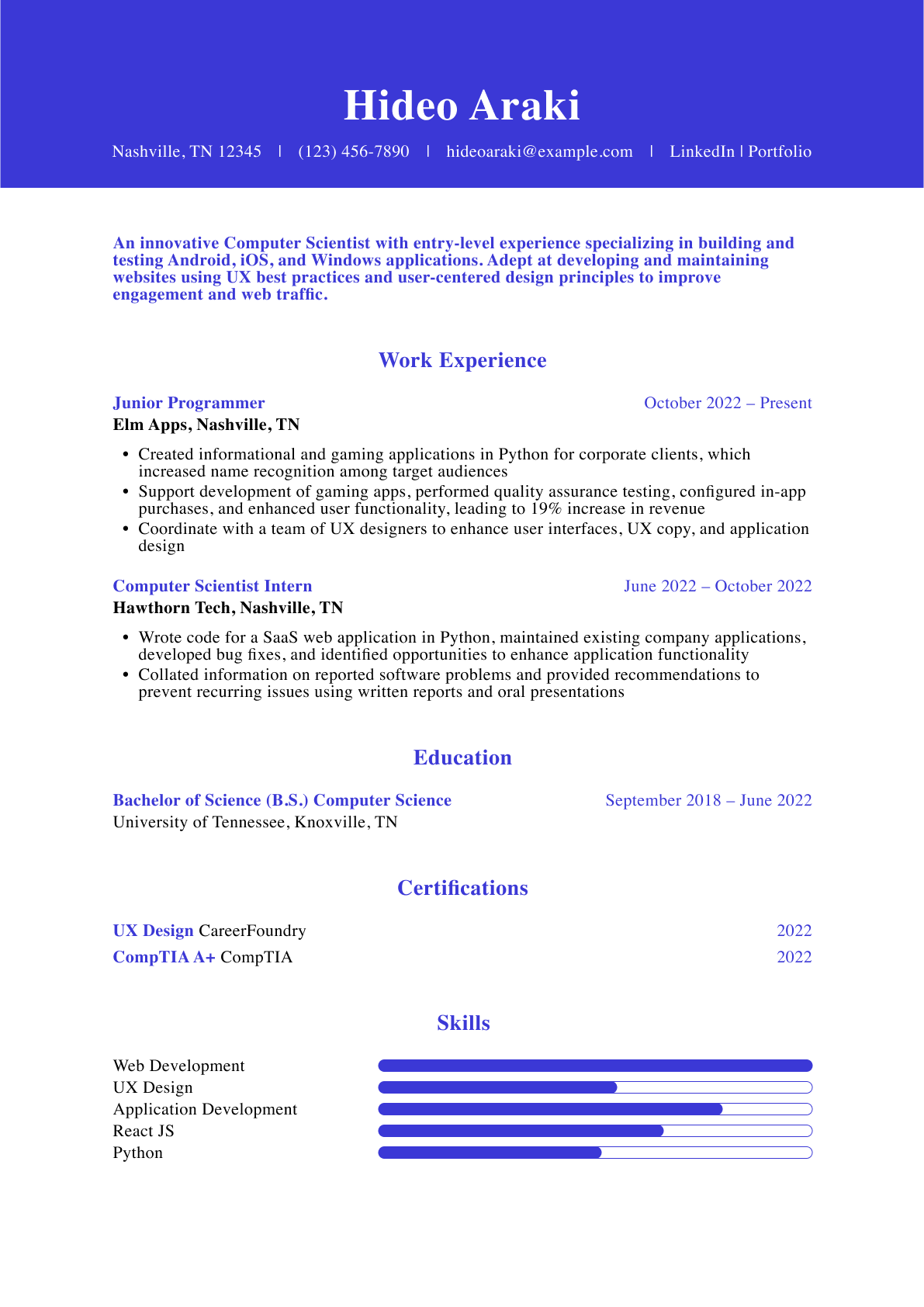

Personal Banker Text-Only Resume Templates and Examples

- Entry-level

- Mid-career

- Senior-level

Emily Lin

(123) 456-7890

[email protected]

123 Your Street, Los Angeles, CA 12345

Profile

A personal banker with five years of experience specializing in customer success, retail banking, cross-selling, and client relations. A proven track record of leveraging consultative sales techniques to identify optimal banking products for customers.

Professional Experience

Personal Banker, Bank of America, Los Angeles, CA

May 2018 – Present

- Manage relationships with 65+ banking customers, analyze client financial needs, identify appropriate financial solutions, and cross-selling banking products to achieve over 130% of monthly sales quota YOY

- Receive recognition with the Banker of the Year Award in 2021 for delivering a high-quality customer experience and achieving client satisfaction scores of 95%

- Develop a mentorship program to train new hires on client relations, cross-selling, and consultative selling, resulting in a 30% sales increase for the banking team

Personal Banker, Wells Fargo, Los Angeles, CA

May 2016 – May 2018

- Led consultative meetings with existing customers and prospects to evaluate banking needs, identify sales opportunities, and provide education on financial solutions, including checking accounts, mortgage loans, savings accounts, and online banking

- Achieved 110%-120% of sales quota month over month and built relationships with customers to ensure alignment with financial needs and goals

- Identified resolution to customer issues regarding overdrafts, fraudulent charges, loan applications, fees, and overdue credit payments

Education

Bachelor of Science (B.S.) Finance

University of California, Los Angeles, CA September 2012 – May 2016

Key Skills

- Personal Banking

- Cross-Selling

- Financial Services

- Customer Education

- Mortgage Loans

Frequently Asked Questions: Personal Banker Resume Examples and Advice

What are common action verbs for personal banker resumes?-

It’s easy to find yourself running short on action verbs while crafting your professional experience section. Often there are a limited number of verbs you can use to accurately convey your career achievements and qualifications. That being said, incorporating a mix of strong action verbs will maximize your bullet points' impact and enhance the hiring manager's reading experience. We’ve compiled a list of action verbs you can use to build your personal banker resume:

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Collaborated | Communicated |

| Conducted | Consulted |

| Coordinated | Created |

| Delivered | Developed |

| Enhanced | Evaluated |

| Examined | Generated |

| Identified | Implemented |

| Led | Managed |

| Maintained | Oversaw |

| Performed | Provided |

| Supported | |

How do you align your resume with a personal banker job description?-

Prospects for banking professionals vary depending on your experience level and career goals. According to the Bureau of Labor Statistics, bank teller occupations are expected to decline by 12% over the next decade, while personal financial advisor positions are projected to grow by 15%. No matter the growth projections, you’ll need to tactically align your resume with the job description to differentiate yourself from the competition during the job search.

For example, if a bank seeks a candidate who excels in selling loan products, provide examples of your consulting customers on personal and mortgage loan options.

If a company is looking for a personal banker with exceptional customer service skills, emphasize your ability to interface with diverse clients and build long-term relationships. By tailoring your resume to the job description, you’ll greatly increase your odds of landing the interview.

What is the best personal banker resume format?-

Personal bankers should opt for a reverse chronological resume format in most situations. This approach allows you to place your most recent and relevant experience towards the top of your document while illustrating your career progression. Functional resumes should be avoided, even at the entry level, as you need to show more than just skills to generate job interviews.

In this situation, emphasize transferable skills from your previous jobs, especially if you’ve worked in a customer service-oriented position. You can also feature academic projects if your degree is centered around finance, business, or economics.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Create a matching cover letter to bolster your personal banker job applications. Be sure to tailor your document to each company you apply to. In the middle paragraphs, mention something specific about the bank’s reputation, mission statement, or culture and why this draws you to apply for the position. For more insights, visit our bank teller cover letter guide.